Score

ITCS

Kazakhstan|2-5 years|

Kazakhstan|2-5 years| https://itcs.trade/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Kazakhstan

KazakhstanUsers who viewed ITCS also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

itcs.trade

Server Location

United States

Website Domain Name

itcs.trade

Server IP

63.250.43.11

Company Summary

| ITCS Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Kazakhstan |

| Regulation | No Regulation |

| Market Instruments | 5,000+ CFD instruments, forex, indices, commodities, cryptocurrencies, stocks and ETFs |

| Demo Account | Unavailable |

| Leverage | N/A |

| Spread | From 0.01 pips |

| Trading Platforms | XOH Trader |

| Minimum Deposit | N/A |

| Contact form, chat via WhatsApp | |

| Customer Support | Phone: +34 951 12 72 11 |

| Email: support@itcscapital.com | |

| Address: K. Amanzholov Street 174, Uralsk City, 090000, Kazakhstan | |

What is ITCS?

ITCS, also known as ITCS Capital, is an unregulated trading platform that offers a wide range of financial instruments for traders. Founded in 2019 and based in Kazakhstan, ITCS provides access to over 5000 CFD instruments, including forex, indices, commodities, cryptocurrencies, stocks, and ETFs. The platform offers competitive spreads and charges a nominal commission of 0.03% per position. Traders can utilize the XOH Trader platform for advanced features such as technical analysis tools, real-time market updates, and multiple deposit methods.

Pros & Cons

| Pros | Cons |

| Diverse range of trading options | No Regulation |

| Multiple deposit methods supported | |

| Multiple Customer Support Channels |

Pros:

Diverse range of trading options: ITCS offers over 5000 CFD instruments, including forex, indices, commodities, cryptocurrencies, stocks, and ETFs, providing traders with ample opportunities to diversify their portfolios and explore various financial markets.

Multiple deposit methods supported: ITCS supports a wide range of deposit methods, including Mastercard, Visa, SEPA transfer, MiFinity e-wallet, Trustly via MiFinity, Sofort via MiFinity, Binance Pay, and various cryptocurrencies, offering convenience and flexibility to traders worldwide.

Multiple Customer Support Channels: ITCS provides various customer support channels including phone, email, live chat, and contact form, enhancing accessibility and assistance for clients.

Cons:

No Regulation: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency. There are also reports of being unable to withdraw and scams, adding to the cons of the platform.

Is ITCS Legit or a Scam?

ITCS currently lacks valid regulation, which raises significant concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring that a financial services provider operates within established standards and adheres to specific rules and requirements designed to protect investors and clients. Without proper regulation, there is an increased risk of fraudulent activities, scams, and inadequate consumer protection.

Market Instruments

ITCS boasts an extensive range of over 5000 CFD instruments, covering various financial markets to cater to diverse trading preferences. Traders can access a wide array of forex pairs, indices representing global markets, commodities including precious metals and energy resources, cryptocurrencies such as Bitcoin and Ethereum, as well as stocks and ETFs from leading companies across different sectors.

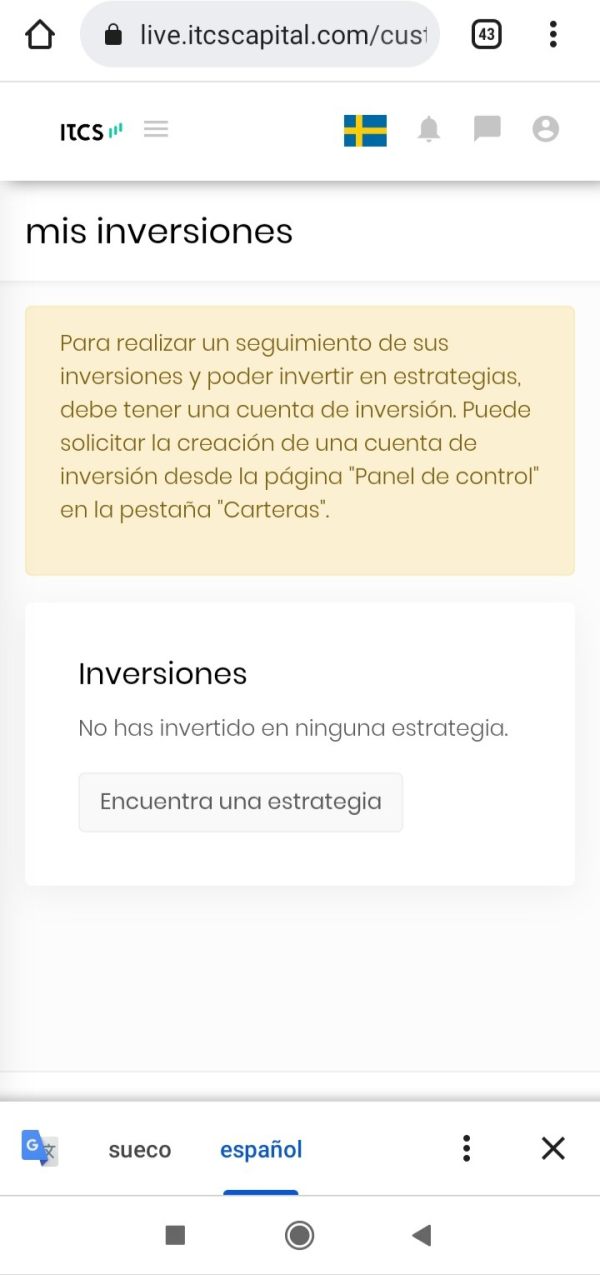

How to Open an Account?

Step 1: Click the button ''Create a free account'' on the homepage.

Step 2: Follow the on-screen instructions to input your personal and contact details.

Step 3: Click on the ''Create account'' option to finalize the creation of your account.

Step 4: An email will typically be sent to your registered email address to verify your account. Ensure to check your inbox and spam folders.

Step 5: Click on the link received in the verification email to activate your account.

Spreads & Commissions

ITCS provides competitive spreads starting from as low as 0.01 pips, ensuring cost-effective trading for its clients. In addition to tight spreads, ITCS charges a nominal commission of 0.03% per position, allowing traders to benefit from transparent and affordable trading conditions. This combination of low spreads and commission fees enables traders to execute their strategies with minimal costs, maximizing their returns.

Trading Platforms

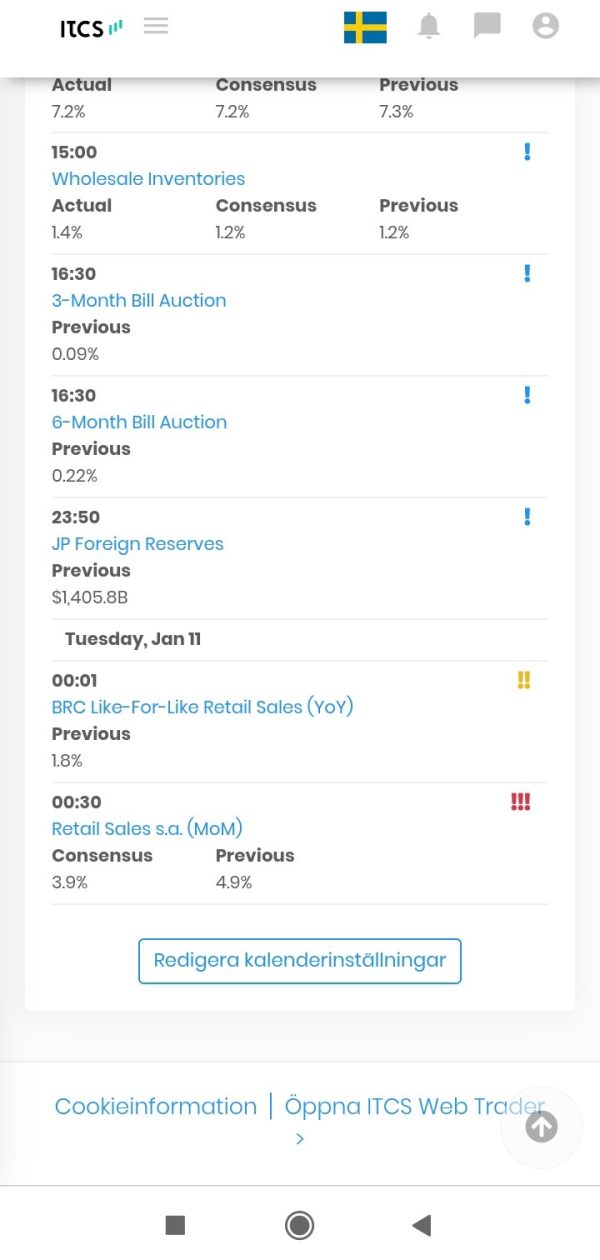

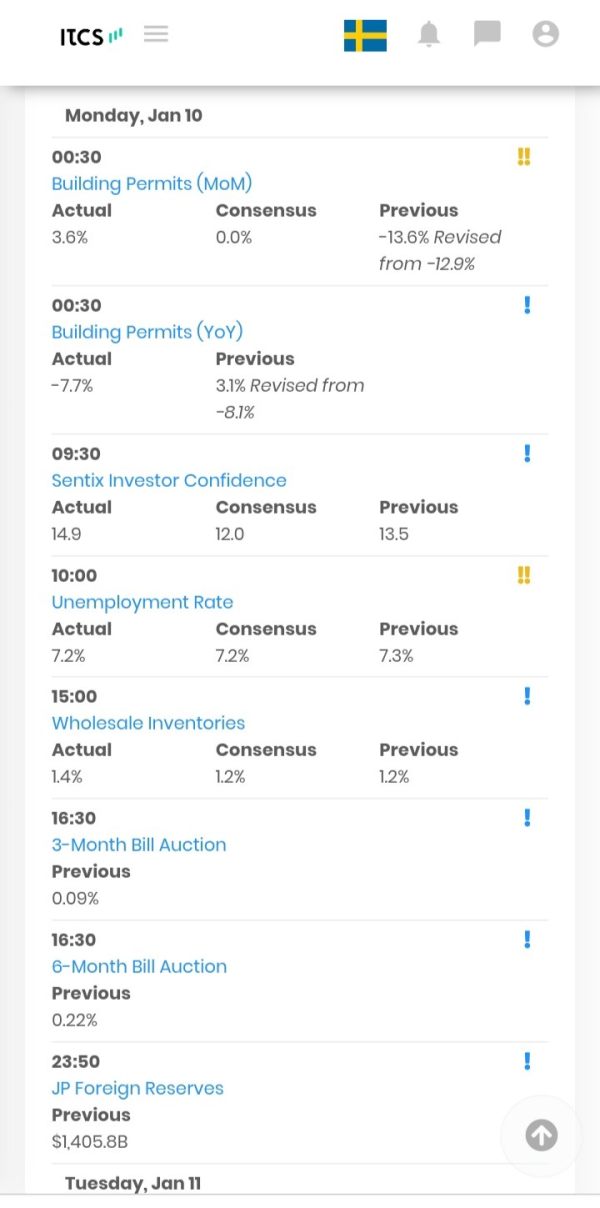

ITCS provides traders with the XOH Trader platform, offering a suite of features for both beginners and seasoned investors. Users can access real-time quotes, execute various trade orders, and track their trading history seamlessly. Advanced functionalities include market sentiments, trending asset indicators, financial news, and an economic calendar, ensuring traders stay informed. The platform also offers robust technical analysis tools, including advanced charts, popular indicators, and multiple timeframes.

Trading Tools

ITCS Trade provides a robust set of trading tools designed to enhance your technical analysis and improve trading outcomes. The platform offers various chart types, including candlestick, bar, and line charts, allowing you to visualize market movements effectively. With over 40 technical indicators available, such as moving averages and oscillators, you can perform in-depth analysis to identify trends and entry and exit points.

ITCS Trade also offers customizable timeframes, drawing tools, and multi-chart functionality, enabling you to tailor your analysis to your unique trading style. Additionally, real-time data and market updates ensure that you have access to the latest information, empowering you to react swiftly to market changes.

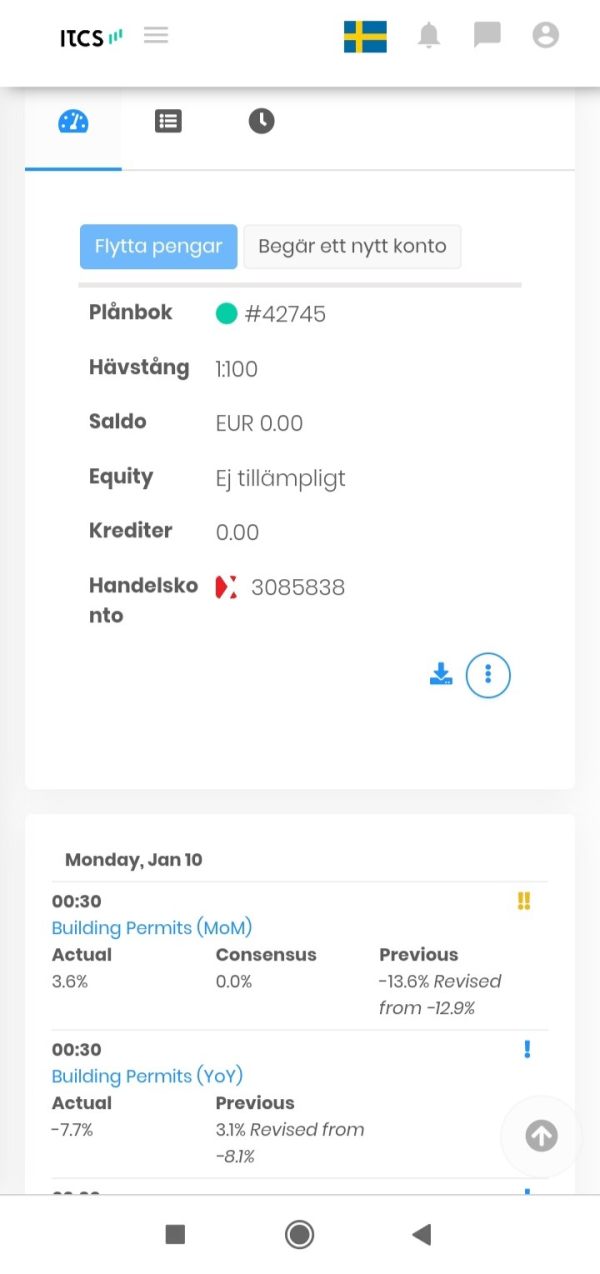

Deposits & Withdrawals

ITCS provides a seamless and convenient deposit process, offering a wide range of payment methods to suit the preferences of its clients. Investors can fund their trading accounts using popular options such as Mastercard, Visa, and SEPA transfer for traditional banking transactions. Additionally, ITCS supports modern digital payment solutions, including MiFinity e-wallet, Trustly via MiFinity, Sofort via MiFinity, Binance Pay, and various cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Tether, and Ripple.

When it comes to withdrawals, ITCS offers a straightforward process to facilitate the transfer of funds from trading accounts back to clients' bank accounts. Withdrawals can be made conveniently via SEPA transfer, providing a reliable and efficient method for transferring funds within the European Union.

You can refer to the screenshot for more information on currency, processing time, and transfer limits.

Customer Service

ITCS provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Contact form, chat via WhatsApp

Phone: +34 951 12 72 11

Email:support@itcscapital.com

Address: K. Amanzholov Street 174, Uralsk City, 090000, Kazakhstan

Conclusion

In conclusion, ITCS offers an extensive range of trading instruments, competitive spreads, multiple trading tools, and a wide range of accepted payment methods, making it an advantageous platform for various investors with varying investment styles and goals. However, the lack of valid regulation raises significant concerns about the safety and trustworthiness of the platform.

Frequently Asked Questions (FAQs)

| Question 1: | Is ITCS regulated? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | Does ITCS offer demo accounts? |

| Answer 2: | No. |

| Question 3: | What financial instruments can I trade with ITCS? |

| Answer 3: | 5000+ CFD instruments, forex, indices, commodities, cryptocurrencies, stocks and ETFs. |

| Question 4: | Does ITCS offer industry-leading MT4 & MT5? |

| Answer 4: | No. Instead, it offers XOH Trader. |

| Question 5: | Is ITCS a good broker for beginners? |

| Answer 5: | No. It is not a good choice for beginners because of its unregulated condition. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now