Overview of FX Corp

FX Corp is an Australia-based company founded in 2020 that specializes in trading services. Although unregulated, it offers a low minimum deposit of $1 and provides competitive leverage of up to 1:400 with spreads starting from zero. The firm offers various trading platforms including the FX Corp APP and a web trade platform, catering to the needs of traders looking to invest in currency pairs, indices, commodities, and CFDs.

Customers can choose between Prime and ECN account types, and there's also an option for a demo account for those wanting to practice their trading skills. For support, they provide phone and email customer services, and transactions can be made through bank transfers or credit/debit cards. Furthermore, FX Corp furnishes its users with educational resources like news and analysis and a financial calendar.

Is FX Corp Legit or a Scam?

FX Corp is unregulated, suggesting it doesn't operate under the oversight or guidance of any notable financial regulatory body. The lack of regulatory supervision implies that while it allows the trading of diverse assets, such as currency pairs, indices, and commodities, it isn't obligated to adhere to any distinct legal or ethical norms typically expected of trading platforms in some regions.

As a result, those considering engaging with FX Corp should exercise heightened caution. Engaging with an unregulated entity necessitates extensive research or consultation with a seasoned financial advisor prior to embarking on any trading endeavors.

The lack of regulatory structure could introduce risks like challenges in resolving disputes, no recourse to compensation mechanisms should the platform become insolvent, and a potential susceptibility to deceptive practices or fraud. This emphasizes the significance of proceeding with caution and thorough investigation.

Pros and Cons

Pros:

Low Minimum Deposit: With a minimum deposit of just $1, FX Corp offers an accessible entry point for traders of all levels.

High Leverage:Offering leverage of up to 1:400 provides traders with the potential for amplified profits.

Versatile Trading Platforms:FX Corp provides its users with multiple trading platforms including the FX Corp APP and a web trade platform, accommodating varied trading preferences.

Wide Range of Tradable Assets:Traders have a plethora of options, from currency pairs to commodities, indices, and CFDs.

Educational Resources:The availability of resources like news & analysis and a financial calendar can be advantageous for both novice and experienced traders.

Cons:

Unregulated:The lack of regulatory oversight can pose risks, making the platform potentially less trustworthy and secure compared to its regulated counterparts.

Potential for Disputes:Without regulation, settling disputes might be more challenging, as there may not be a clear avenue for resolution.

No Compensation Scheme:If FX Corp faces insolvency, traders might not have access to any compensation schemes, leading to potential financial losses.

Fraud Vulnerability:Unregulated platforms can be more susceptible to scams or fraudulent activities, putting traders' funds at risk.

Due Diligence Needed:Traders must exercise heightened caution and undertake thorough research before trading, which can be time-consuming and demanding.

Market Instruments

FX Corp furnishes traders with an intricate trading environment spotlighting a gamut of market instruments. Let's delve deeper into these available instruments:

Currency Pairs:

Variety of Pairs:FX Corp facilitates forex trading, allowing participants to engage with major, minor, and exotic currency pairs. Traders can harness the opportunities presented by the constantly fluctuating foreign exchange market.

Major Pairs:This could include popular currency combinations such as EUR/USD, GBP/USD, and USD/JPY, offering the benefit of high liquidity and potentially tighter spreads.

Exotic Pairs:Constituting currencies from emerging markets paired with majors, they present unique trading prospects albeit with higher volatility.

Indices:

Diverse Global Indices:FX Corp provides a platform for traders to tap into the global stock market indices, reflecting the performance of particular stock markets or sectors.

Major Market Indices:Examples might encompass the S&P 500, FTSE 100, or the ASX 200, allowing traders to gauge and capitalize on the broader market movements.

Commodities:

Broad Spectrum of Commodities:FX Corp offers a gateway to trade in various commodities, ranging from energy products to agricultural goods.

Energy Commodities:Including oil and natural gas, these present traders with the opportunity to speculate on global energy demands and geopolitical events.

Agricultural Commodities:Such as wheat, soybeans, and more, presenting chances to exploit seasonal and weather-driven market dynamics.

CFDs (Contract for Difference):

Versatile Trading Instrument:FX Corp's platform supports CFD trading, allowing traders to speculate on the price movements of various assets without owning the underlying asset, offering flexibility and leverage.

While FX Corp provides a broad palette of market instruments and myriad trading possibilities, it's paramount to recognize that all trading endeavors come intertwined with inherent risks.

Account Types

FX Corp caters to a broad spectrum of traders by offering tailored account types designed to align with the diverse needs and aspirations of its clientele, facilitating an organized and conducive trading landscape.

PRIME Account: Positioned as a premium offering, the PRIME account demands a minimum deposit of 2000 USD. It extends similar leverage options as the FX Corp account, ranging from 1:100 to 1:400. Order execution via market transactions is standard, but it stands out with its 0 floating point difference spread. The strong flat ratio remains consistent at 100%, emphasizing its premium stance.

ECN Account: Tailored for those seeking a direct gateway to the interbank market, the ECN account is geared towards seasoned traders. Though it presumably demands a 2000 USD initial deposit like the PRIME account, it mirrors its leverage and order execution attributes. A notable distinction is its 0 floating point difference spread, similar to the PRIME variant. This account also ensures a 100% strong flat ratio, resonating with its elite orientation.

How to Open an Account?

Here's a step-by-step guide on how to open an account with FX Corp:

1. Visit the Official Website:Begin by navigating to the official FX Corp website. Look for the “Open Account” or “Register” button, typically located at the top right corner or prominently displayed on the homepage.

2. Fill Out the Registration Form:Once you click on the account opening section, you'll be presented with a registration form. Enter all required details, such as your full name, email address, phone number, and any other necessary personal information. Make sure to provide accurate details to ensure a smooth verification process.

3. Submit Verification Documents:For security and compliance reasons, FX Corp may request certain identification documents. This can include a copy of your passport or national ID for identity verification and a recent utility bill or bank statement as proof of address. Upload clear and legible copies of these documents when prompted.

4. Await Account Approval:Once you've submitted all required details and documents, your application will be reviewed. This can take anywhere from a few hours to several days, depending on their verification process. Once approved, you'll receive a confirmation email with your account details and login credentials.

5. Make Your First Deposit:Log into your newly created FX Corp account and navigate to the “Deposit” section. Choose your preferred deposit method (e.g., bank transfer, credit/debit card) and follow the on-screen instructions to fund your account. Remember, the minimum deposit amount varies based on the account type you've chosen.

Leverage

FX Corp offers its traders two distinct account types, each tailored to different trading needs and preferences: the PRIME and the ECN accounts.

For those who opt for the PRIME account, there is a generous provision to start trading without any initial deposit, making it exceedingly accessible for a broad range of traders. Meanwhile, the ECN account is targeted more towards serious or professional traders, demanding an initial deposit of 2000 USD.

When it comes to magnifying trading positions, both account types in FX Corp are equipped with potent leverage options. Traders have the flexibility to choose among three leverage ratios: 1:100, 1:200, and a whopping 1:400. Such high leverage ratios not only enable traders to amplify potential profits but also, conversely, can escalate potential risks.

Spreads & Commissions

Spreads within FX Corp can be as minimal as 0. At FX Corp, traders have the opportunity to leverage competitive spreads, commencing from an enticingly low point of 0. This potentially offers a propitious trading milieu, particularly for those who dabble in frequent trading or operate on slender margins.

The precise breadth of these spreads can oscillate contingent on the specific tradable assets and prevailing market climates. When it comes to commissions, it's paramount for prospective traders to delve into the intricate commission structure elucidated by FX Corp. Platforms like these often harbor a nuanced commission regime that may be influenced by factors such as the chosen account type, trading volume, or the specific trading platform in use.

Grasping these nuances is pivotal for traders. It empowers them to adeptly compute trading costs, allowing them to craft their trading strategies astutely, thereby managing potential hazards and optimizing their anticipated returns.

Trading Platform

FX Corp showcases a cutting-edge array of trading platforms, each embedded with unique attributes and utilities, designed meticulously to resonate with the diverse trading needs and proclivities of its user base.

FX Corp APP:As a product of rigorous in-house development, the FX Corp APP stands as an integrated mobile trading software solution. It amalgamates a myriad of functionalities such as real-time market quotations, comprehensive charting tools, seamless trading capabilities, and efficient account management. Moreover, it simplifies processes like account opening and facilitates effortless deposit and withdrawal functions, all bundled into one cohesive mobile application.

WEB TRADING TERMINAL:Designed for those who favor uncomplicated accessibility, the WEB TRADING TERMINAL allows traders to peruse and trade currency pairs and CFDs without the cumbersome requirement of downloads or installations. Its hallmark lies in its simplicity, speed, and user-friendly interface. Trading is made more efficient with features like one-click order closure, simultaneous order executions in the same direction, and the handy option to close all orders at once. Additionally, its reminder for price changes ensures traders remain abreast of market movements.

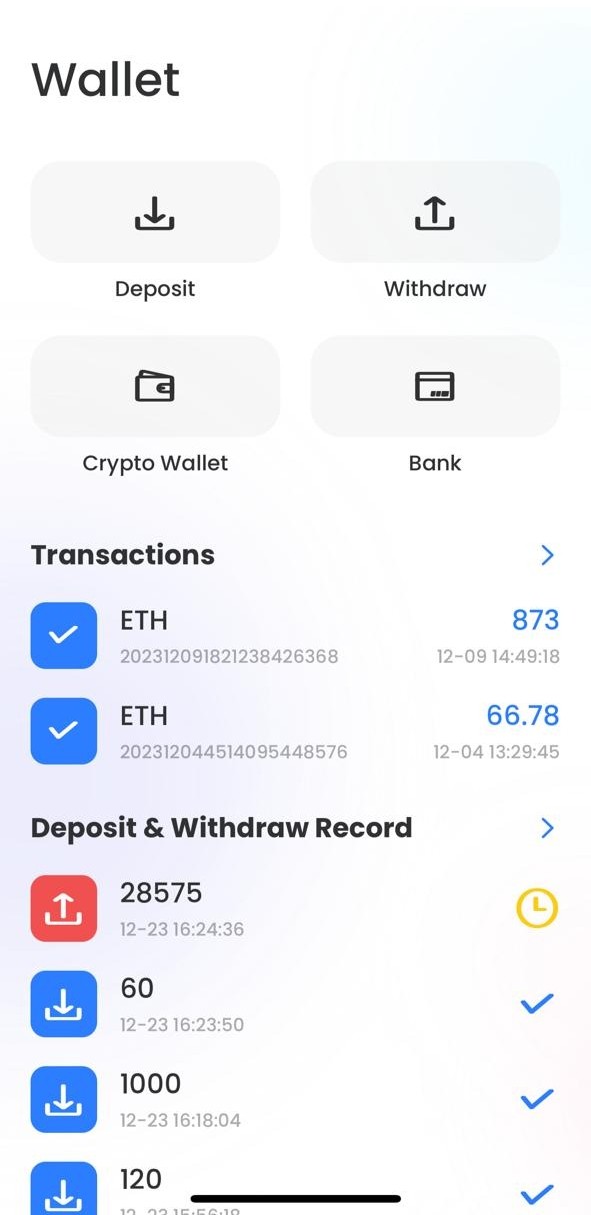

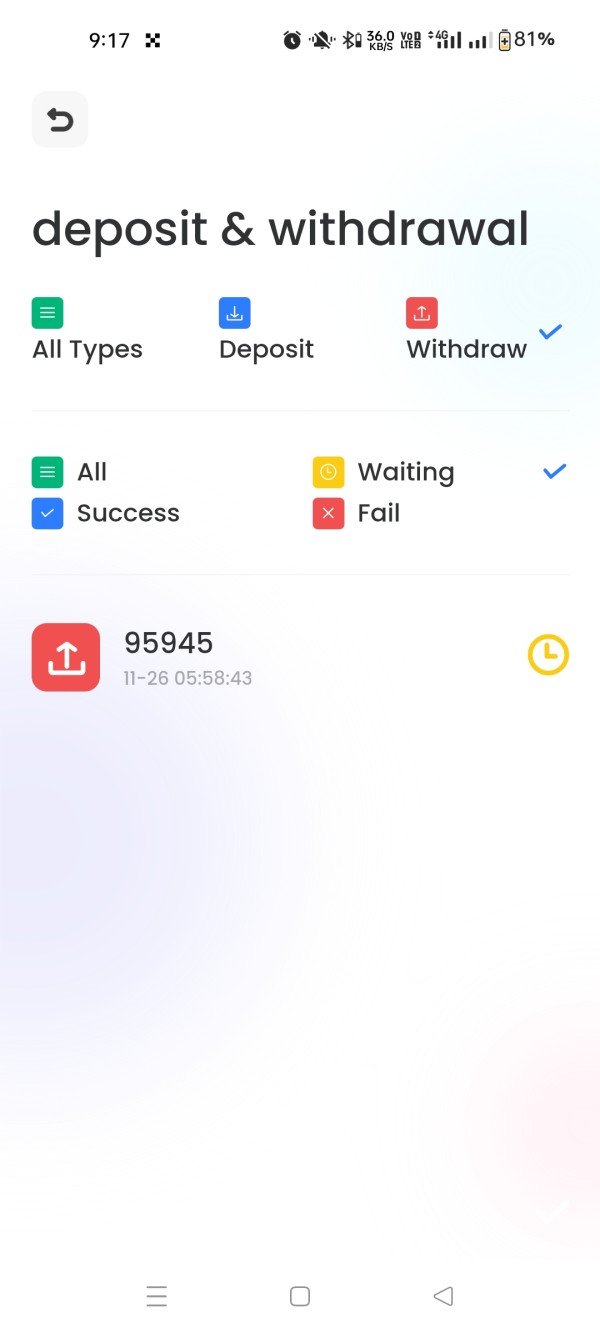

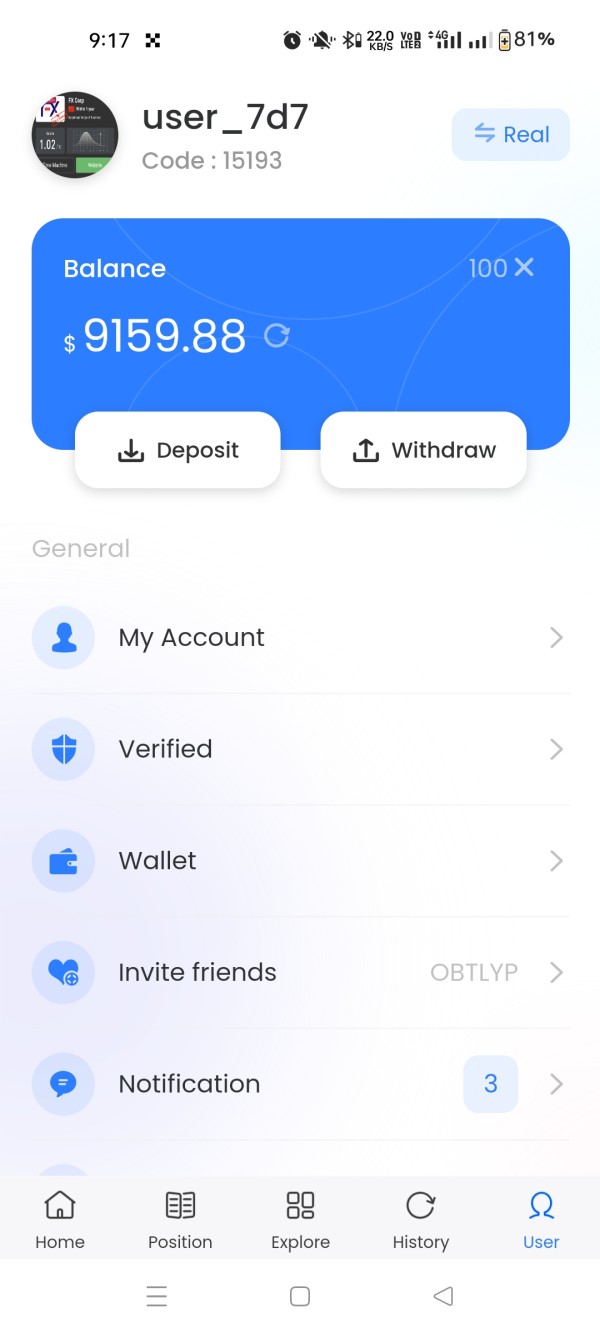

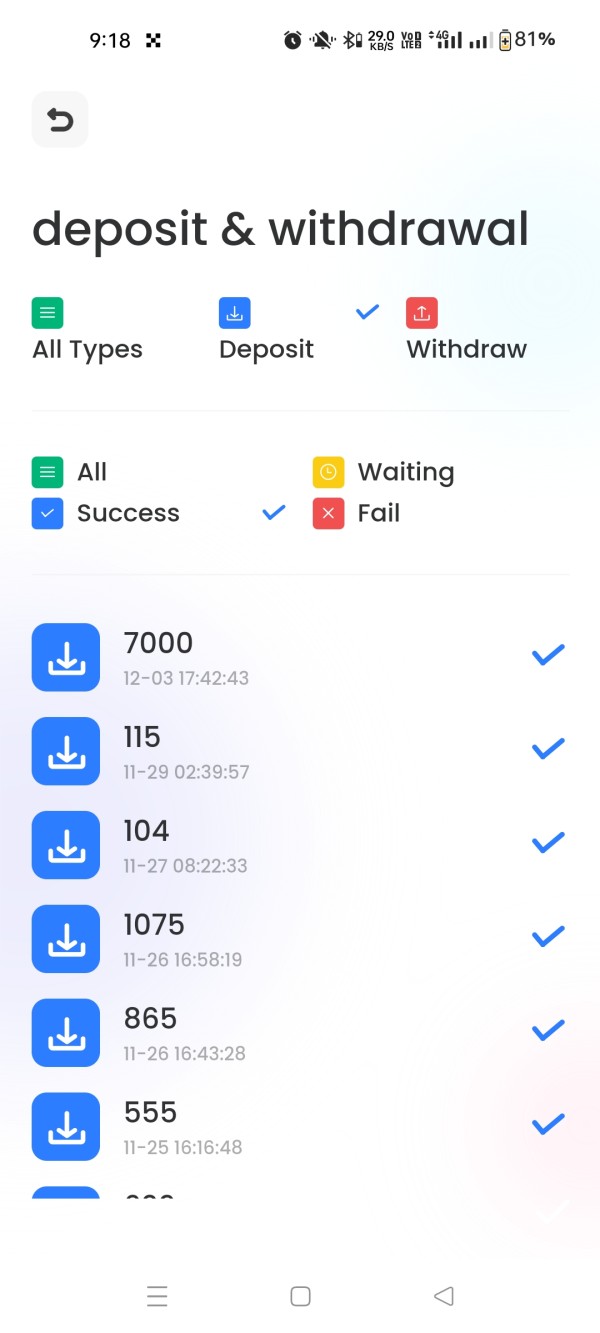

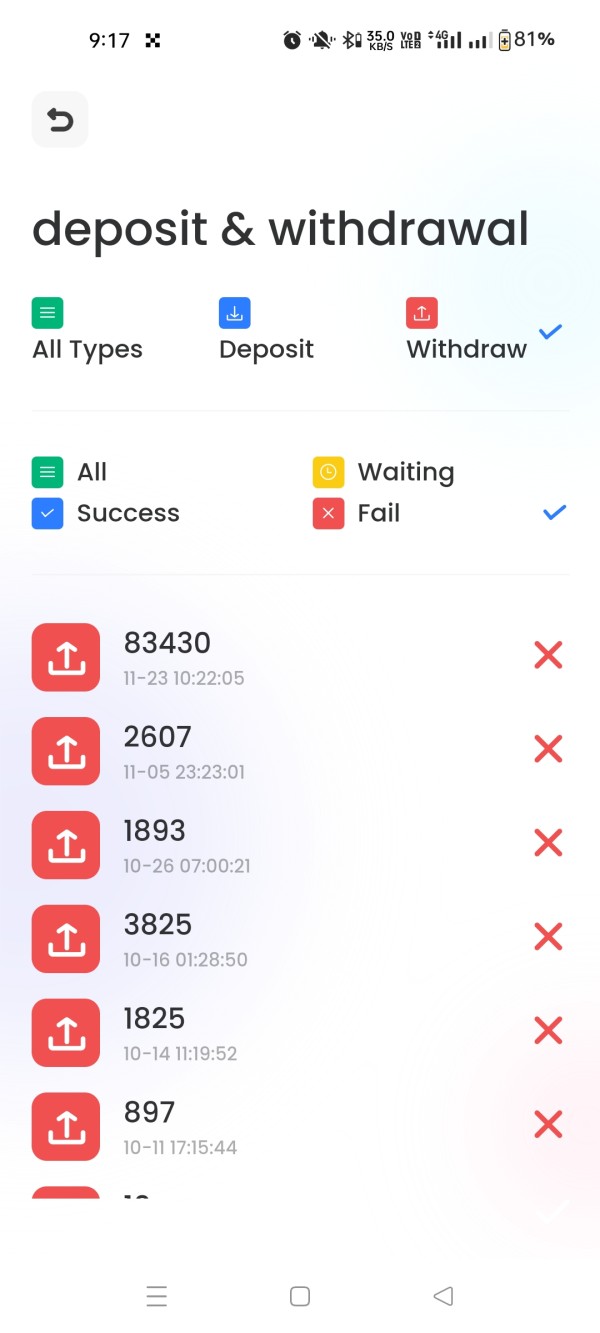

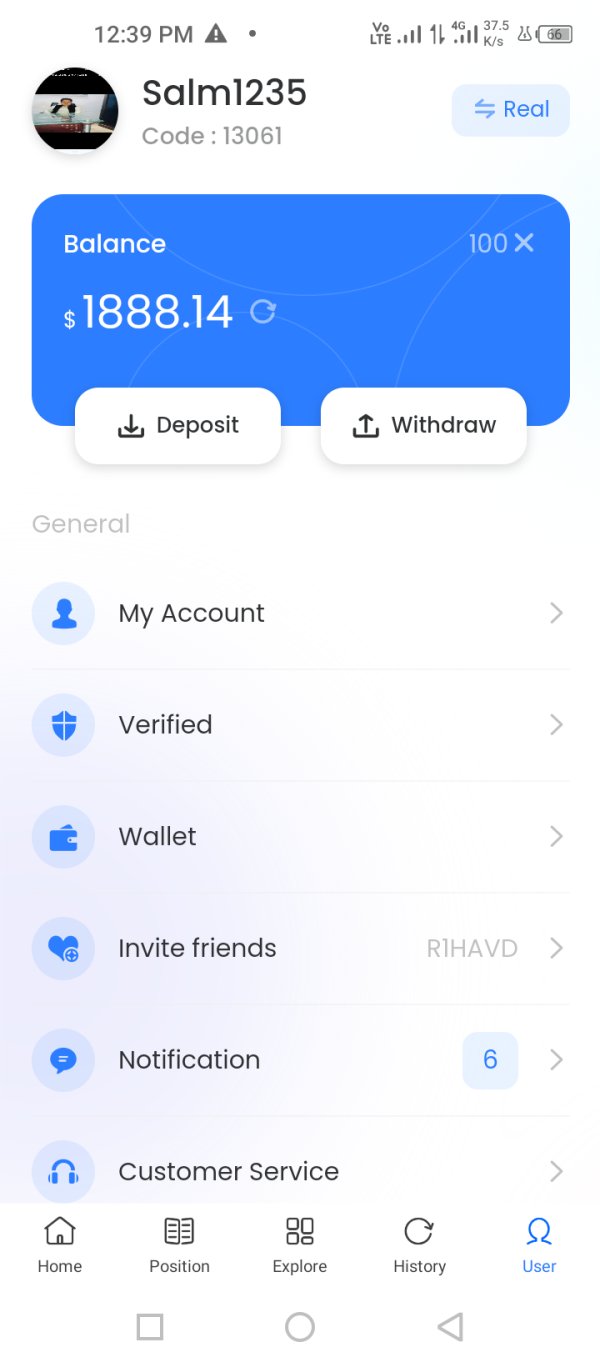

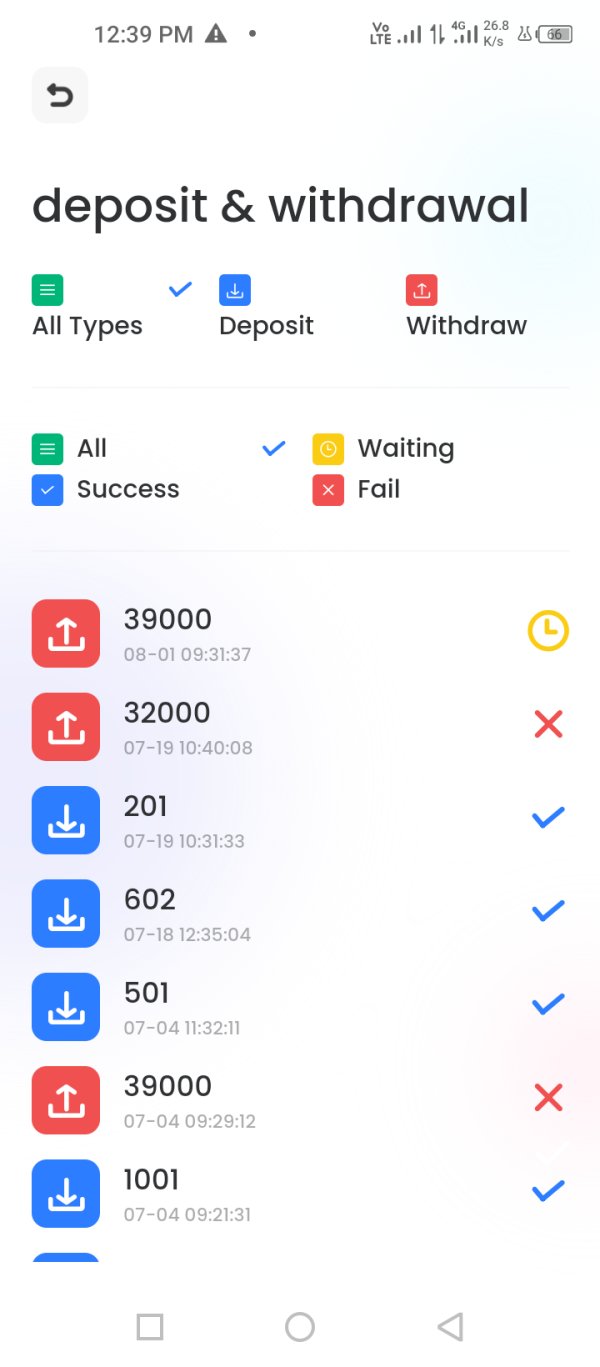

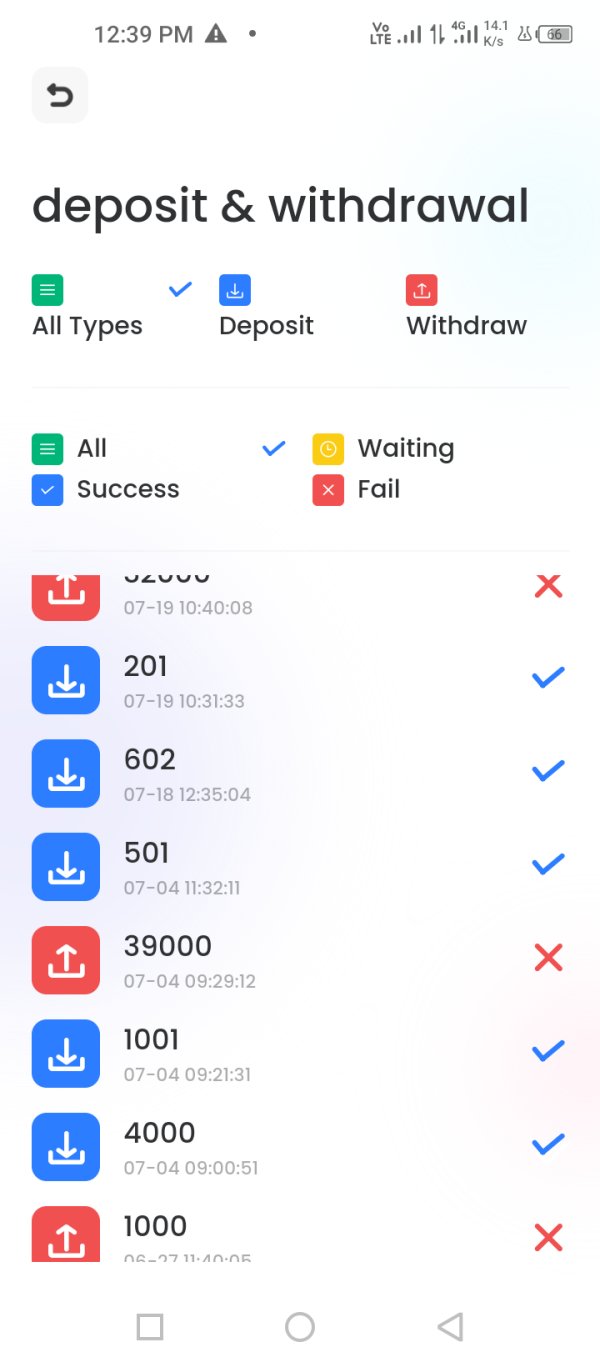

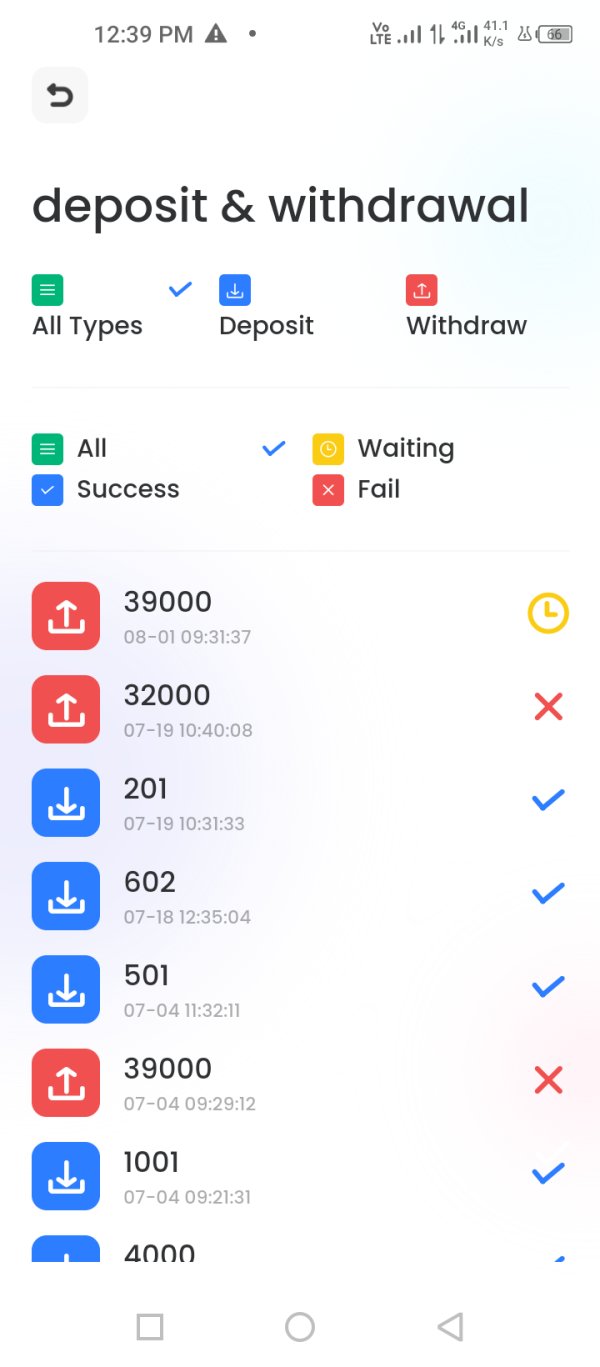

Deposit & Withdrawal

FX Corp provides a comprehensive and flexible deposit and withdrawal framework tailored to accommodate the diverse financial needs of its clientele in the global trading arena. Traders can venture into the vast expanse of currency pairs, indices, commodities, and CFDs, all while benefiting from competitively low point differences starting at 0.

In terms of trading volume, FX Corp offers a commendable entry point, allowing trades as low as 0.01 lot, ensuring even those with modest capital can partake in the global market dynamics. Furthermore, traders can amplify their positions with the platform's robust leverage, capped at an impressive 1:400.

One of the standout features of FX Corp is its exceedingly accessible minimum deposit requirement. At just $1, it encourages a wide gamut of traders, from novices taking their first steps to seasoned professionals, to engage with the platform without the pressure of hefty initial capital.

For an exhaustive understanding of FX Corp's deposit and withdrawal modalities, potential fees, and turnaround times, traders are encouraged to navigate the official FX Corp website or liaise with their customer support.

Customer Support

FX Corp prioritizes efficient and responsive customer support to cater to its diverse clientele. Specifically designed to serve their Chinese customers, they have established a dedicated customer service team that operates between 07:30 to 23:30 (UTC+8) and can be reached via their official email address atsupport@corpfxltd.com.

Additionally, FX Corp has instituted a cooperative customer service platform which, too, can be accessed through the same email. By providing these specialized channels of communication, FX Corp ensures that clients receive timely assistance and that all queries, concerns, or issues are addressed promptly and professionally.

Educational Resource

FX Corp takes pride in fostering an informed and educated trading community. To this end, they have meticulously curated an 'Educational Resource' section, especially helpful for newcomers to the intricate world of Forex:

Beginner's Guide: This is an introductory module explaining the very basics of the currency market. It demystifies terms like 'money to money market' and elaborates on the essence of currency pair trading, highlighting its role in the global over-the-counter market (OTC). Here, traders are introduced to the concept of the “interbank market,” emphasizing its 24/7 operational hours, making currency trading one of the most dynamic financial activities.

Understanding Currency Pairs: This section delves deeper into the heart of Forex trading - currency pairs. With examples like the EURUSD (Euro Dollar), traders are educated on the terminologies of 'base currency' and 'quoted currency'. The module explains the structure of a currency pair, breaking down how they function and how they can be traded efficiently.

Spread and Point Value: An essential component for any trader, understanding spreads, is vital. The resource illustrates the concept using practical examples, showcasing how the buying price and selling price difference determine the spread. It simplifies the calculation for point value, ensuring traders have clarity on how much each pip movement could potentially mean for their trades.

Through these educational resources, FX Corp aims to build a strong foundation for its traders, ensuring they have the necessary knowledge and tools to navigate the complex, yet rewarding world of Forex trading.

Conclusion

FX Corp stands as a dynamic and innovative trading platform in the forex arena, leveraging cutting-edge financial technology to offer its traders an efficient, high-speed trading system. With its user-friendly FX Corp APP, comprehensive web trading terminal, and a spectrum of trading tools, it seamlessly integrates various trading functionalities.

Furthermore, the platform offers commendable flexibility in terms of leverage, low point differences, and a remarkably accessible minimum deposit threshold. Coupled with a robust educational resource system, FX Corp underscores its commitment to fostering a knowledgeable and empowered trading community.

In essence, FX Corp embodies the fusion of technology, flexibility, and education in the ever-evolving world of forex trading.

FAQs

Q: What is the minimum deposit required to trade with FX Corp?

A: FX Corp offers an exceedingly accessible entry with a minimum deposit requirement of just $1, allowing traders of all levels to engage with the platform.

Q: What leverage options are available at FX Corp?

A: FX Corp provides traders with a range of leverage options, reaching up to an impressive 1:400, depending on the account type and traded asset.

Q: Are there any educational resources available for beginners?

A: Yes, FX Corp offers a comprehensive beginner's guide covering topics like currency pair transactions, understanding the money to money market, and detailed insights into how currency pairs function.

Q: How can I contact FX Corp's customer support?

A: FX Corp's customer support can be reached via email atsupport@corpfxltd.com. They offer services from 07:30 - 23:30 (UTC+8) for both Chinese and cooperative customer inquiries.

Q: Does FX Corp offer a mobile trading application?

A: Yes, FX Corp has developed its proprietary FX Corp APP, which integrates market quotations, charts, trading functionalities, account management, deposit and withdrawal features, and more.