Overview of Indosukses Futures

Indosukses Futures is a well-established brokerage based in Indonesia, founded in 2003. Regulated by BAPPEBTI and JFX, the company adheres to stringent standards, providing a reliable trading environment. With a minimum deposit requirement of $100, the brokerage offers a competitive maximum leverage of 1:200, allowing traders flexibility in managing their positions. Traders can access the financial markets through the widely used MetaTrader 4 and MetaTrader 5 platforms.

Indosukses Futures facilitates trading in a diverse range of assets, including Forex, CFDs on indices, metals, and energies. The broker offers various account types such as Standard, ECN, and Syariah, satisfying different trading preferences. A demo account is available for users to practice and refine their strategies. Customer support is accessible 24/5 through live chat, email, and phone. Deposit and withdrawal processes are convenient, with multiple options such as bank transfers, credit/debit cards, and e-wallets, ensuring a financial experience for traders.

Pros and Cons

Pros:

Well-Established Brokerage: Indosukses Futures is a long-standing brokerage with a foundation dating back to 2003, suggesting a level of stability and experience in the financial industry.

Regulated by BAPPEBTI and JFX: The brokerage is regulated by two prominent authorities in Indonesia, namely the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) and the Jakarta Futures Exchange (JFX). This regulatory oversight signifies adherence to industry standards, ensuring a more secure trading environment for clients.

Competitive Maximum Leverage (1:200): Indosukses Futures offers a competitive maximum leverage of 1:200, providing traders with flexibility in managing their positions and potentially amplifying their trading capacity.

Diverse Range of Tradable Assets: The platform facilitates trading in a diverse range of financial instruments, including Forex, CFDs on indices, metals, and energies. This diversity allows traders to explore various markets and implement different investment strategies.

Comprehensive Customer Support (24/5, Email, Phone): Indosukses Futures prioritizes customer support by offering multiple channels for assistance, including 24/5 live chat, email support through dedicated addresses, and direct phone contact. This ensures accessibility and timely resolution of queries.

Cons:

Allegations of Involvement in a Ponzi Scheme: Recent information suggests that Indosukses Futures is allegedly involved in fraudulent activities and has been labeled as a Ponzi Scheme. Such schemes pose a significant risk of funds misappropriation, and caution is strongly advised.

Detected to be Operating Illegally and Listed as a Scam Broker: The broker has been detected as operating illegally, with expired licenses, and has been listed in WikiFX's Scam Brokers list. This raises serious concerns about the legitimacy and trustworthiness of the platform.

Risk of Funds Misappropriation due to Ponzi Scheme Allegations: Involvement in a Ponzi Scheme suggests a potential risk of funds misappropriation, as these schemes often rely on new investors' funds to pay existing ones, leading to financial instability and potential losses for participants.

Limited Information on Trading Conditions and Execution Speed: The information provided lacks details on trading conditions, execution speed, and other critical factors that traders typically consider when choosing a brokerage. This lack of transparency can be a concern for potential clients looking for comprehensive details about the trading environment.

Regulatory Status

Indosukses Futures is subject to regulatory oversight by two prominent regulatory bodies in Indonesia, ensuring a secure and compliant trading environment. The first regulatory authority is the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) under the Ministry of Trade. The company holds a Retail Forex License issued by BAPPEBTI, with the license number 69/BAPPEBTI/SI/XII/2000. This license signifies that Indosukses Futures is authorized to operate in the retail forex market in Indonesia and is obligated to adhere to regulatory standards and safeguards.

The second regulatory authority overseeing Indosukses Futures is the Jakarta Futures Exchange (JFX). The company holds a Retail Forex License from JFX, with the license number SPAB - 032/BBJ/10/00. Being regulated by JFX further underscores the broker's commitment to compliance and adherence to industry regulations.

Market Instruments

Indosukses Futures offers a diverse range of products tailored to meet the needs of investors seeking exposure to various financial markets. Among their offerings are currency pairs, allowing traders to participate in the dynamic Foreign Exchange Market (Forex). In Forex trading, individuals can speculate on the value of one currency relative to another, such as the USD/JPY or USD/EUR pairs, leveraging the fluctuations in exchange rates to potentially generate profits.

Additionally, the company provides opportunities for investors interested in precious metals, particularly gold and silver. These metals are recognized globally as 'safe-haven' assets, often sought after during times of economic uncertainty or high inflation. Indosukses Futures enables clients to engage in trading these precious metals, allowing them to benefit from potential price appreciation driven by increased demand in such conditions.

Moreover, the platform offers futures contracts linked to stock indices, providing investors exposure to the performance of broader equity markets. These stock index futures allow traders to speculate on the direction of major indices, such as the S&P 500 or Dow Jones Industrial Average, without directly owning the underlying stocks.

Furthermore, Indosukses Futures facilitates trading in crude oil futures, acknowledging the importance of energy commodities in the global economy. Crude oil, the primary raw material for various petroleum products, serves as a vital energy source worldwide. Through instruments like West Texas Intermediate (WTI) futures contracts, which are based on the benchmark grade of crude oil, investors can capitalize on price movements in this critical commodity.

Account Types

Indosukses Futures recognizes the diverse needs of investors and offers three distinct account types to accommodate varying trading styles and risk tolerances.

The Standard Account is tailored for beginners or those seeking a straightforward trading experience. With a lower minimum deposit of $100, this account is designed to be accessible, making it an ideal choice for individuals starting their trading journey or testing new strategies. The account features variable spreads, typically wider than other types, and operates on a commission-free trading structure, providing a cost-effective option for novice traders.

For more experienced traders seeking tighter spreads and direct access to the interbank market, the ECN Account is the preferred choice. With a higher minimum deposit of $2,000, this account offers significantly tighter spreads compared to the Standard Account. The ECN Account operates on a commission-based structure, with fees charged per trade. This structure is well-suited for active traders who prioritize precise execution and control over bid/ask prices, providing a more advanced and cost-efficient option for seasoned investors.

Indosukses Futures also satisfies investors adhering to Islamic principles with the Syariah Account. This account type aligns with Sharia law by following compliant financial practices, avoiding riba (interest), and steering clear of prohibited activities such as gambling. The Syariah Account features a profit-sharing model instead of commissions, maintaining a minimum deposit and spread structure similar to the Standard Account. This account provides a faith-compliant trading option for Muslim investors, ensuring that their financial activities adhere to their religious beliefs.

How to Open an Account?

Opening an account with Indosukses Futures takes several steps:

Visit the Indosukses Futures website: Navigate to the Indosukses Futures website and click on the “Open Account” button.

Fill out the online application form: Enter your personal information, including your name, email address, phone number, and date of birth.

Choose your account type: Select the account type that best suits your needs and trading style. Indosukses Futures offers three account types: Standard, ECN, and Syariah.

Verify your identity: Upload the required documents to verify your identity and proof of address. This typically includes a government-issued ID and a utility bill or bank statement.

Fund your account: Deposit the minimum required amount to activate your account. The minimum deposit amount varies depending on the account type you choose.

Download and install the trading platform: Choose your preferred trading platform (MetaTrader 4 or MetaTrader 5) and download it to your computer or mobile device.

Start trading: Once your account is funded and verified, you can start trading your chosen instruments.

Leverage

Indosukses Futures offers a range of maximum leverage options across its different account types, satisfying the diverse needs and preferences of traders.

The Standard Account provides a maximum leverage of 1:200, making it suitable for those who are relatively new to trading or prefer a more conservative approach to risk. The ECN Account, geared towards experienced traders, features a slightly lower maximum leverage of 1:100. This account type is designed for individuals seeking tighter spreads and direct access to the interbank market, aligning with a more advanced and potentially risk-tolerant trading strategy. Similarly, the Syariah Account, adhering to Islamic principles, also offers a maximum leverage of 1:100, providing a faith-compliant option for Muslim investors.

Trading Platform

Indosukses Futures offers traders access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. MT4, known for its user-friendly interface and extensive charting tools, suits both novice and experienced traders, enabling analysis, customization, and automated trading via Expert Advisors (EAs) with a mobile app for on-the-go management. MT5, positioned as a next-gen platform, offers advanced market depth, a wider range of order types, enhanced charting capabilities, and backward compatibility with MT4 EAs, providing deeper insights and increased flexibility for trading strategies.

Deposit & Withdrawal

Indosukses Futures facilitates deposits and withdrawals through a variety of payment methods, recognizing the diverse preferences of investors.

For deposits, the brokerage offers several options. Bank transfers, the most common method, are generally free of charge for deposits from Indonesian bank accounts. However, international transfers incur fees from the user's bank. Credit/debit cards provide a convenient option with instant processing, but Indosukses Futures charge a processing fee, typically ranging from 1-2%. E-wallets such as GoPay and OVO are popular choices, often with minimal or no fees. Virtual Account Numbers (VANs), unique identifiers for secure deposits, involve fees depending on the chosen provider.

Withdrawals can be conducted primarily through bank transfers, the primary method that is typically free for withdrawals to Indonesian bank accounts. Similar to deposits, international transfers incur fees from the user's bank. E-wallet options for withdrawals vary, and fees could apply depending on the chosen e-wallet.

Customer Support

Indosukses Futures, located at Sona Topas Tower, 12th Floor Suite 12-04, Jl. Jend. Sudirman No.26 RT.4/RW.2 Kuningan, Karet, Kec. Setiabudi, Jakarta Selatan - 12920, offers customer support services during their operating hours from 10:00 to 17:00.

For general inquiries and assistance, customers can contact them via phone at 021-252-8844 (hunting) or reach out via email at info@indosuksesfutures.com.

If customers have complaints or need to address any issues, they can contact the dedicated customer complaints department at 021-252-6850 (hunting) or send an email to compliance@indosuksesfutures.com. Additionally, customers can utilize the online platform pengaduan.bappebti.go.id for lodging complaints.

Risk Alerts

Caution is strongly advised with Indosukses Futures, as recent information suggests that the platform is allegedly involved in fraudulent activities and has been identified as a Ponzi Scheme. As of the latest detection on February 3, 2024, it has been revealed that the broker is operating illegally, with expired licenses, and has been listed in WikiFX's Scam Brokers list.

The Ponzi Scheme involves the deceptive circulation of funds, using new members' money to pay existing ones, resembling a pyramid scheme. Fraudsters exploit people's desire for financial gain, raising funds clandestinely. Typically, such platforms tend to disappear within a few years after accumulating funds. Due to these alarming findings, it is strongly recommended to avoid engaging with PT Indosukses Futures to mitigate the associated risks.

Conclusion

In conclusion, while Indosukses Futures presents itself as a well-established brokerage in Indonesia with competitive leverage and a diverse range of tradable assets, serious concerns arise from recent information indicating alleged involvement in a Ponzi Scheme, illegal operations with expired licenses, and being listed as a scam broker. These significant disadvantages, including potential funds misappropriation and lack of regulatory compliance, outweigh the advantages. Traders are strongly cautioned against engaging with Indosukses Futures due to the associated risks and uncertainties surrounding the platform's legitimacy and financial practices.

FAQs

Q: Is Indosukses Futures a regulated broker?

A: Yes, Indosukses Futures is licensed and regulated by BAPPEBTI, Indonesia's Commodity Futures Trading Regulatory Agency. However, it's essential to remember that regulations outside Indonesia might not apply.

Q: What types of accounts does Indosukses Futures offer?

A: They have three main account types: Standard (beginner-friendly), ECN (tighter spreads, commission-based), and Syariah (compliant with Islamic financial principles).

Q: What is the minimum deposit amount?

A: The minimum deposit depends on the account type you choose. It starts at $100 for Standard and Syariah accounts, while the ECN account requires a minimum of $2,000.

Q: What trading platforms can I use?

A: Indosukses Futures utilizes two popular platforms: MetaTrader 4 and MetaTrader 5. Both offer user-friendly interfaces, charting tools, and mobile apps.

Q: How do I deposit and withdraw funds?

A: They offer various methods like bank transfers, credit/debit cards, e-wallets, and Virtual Account Numbers. Fees and processing times vary depending on the chosen method.

Q: Does Indosukses Futures offer a demo account?

A: They provide demo accounts with virtual funds for you to practice and familiarize yourself with the platform and trading before risking real capital.

FX9039822991

Hong Kong

The international business of this company is abbreviated as IDS. Now I can’t withdraw. My positions has been locked for a year.

Exposure

2020-10-15

FX1435256417

Hong Kong

Hope you avoid being cheated. Indosukses Futures gives no access to withdrawal, inveigling clients to add fund into MT5. The trading om MT4 is unavailable.

Exposure

2020-03-30

云歌(clouds)

Hong Kong

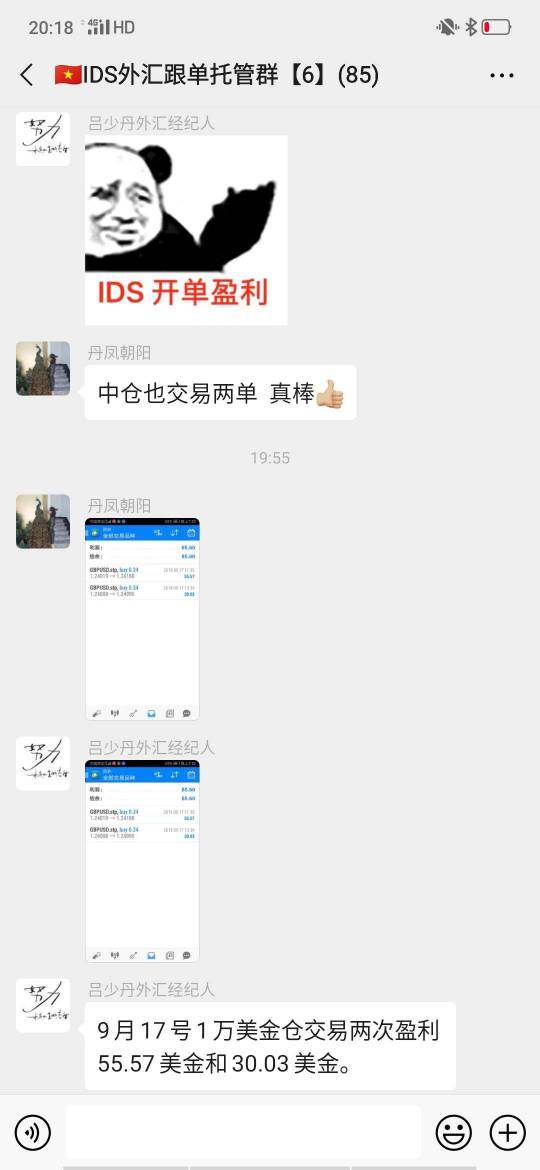

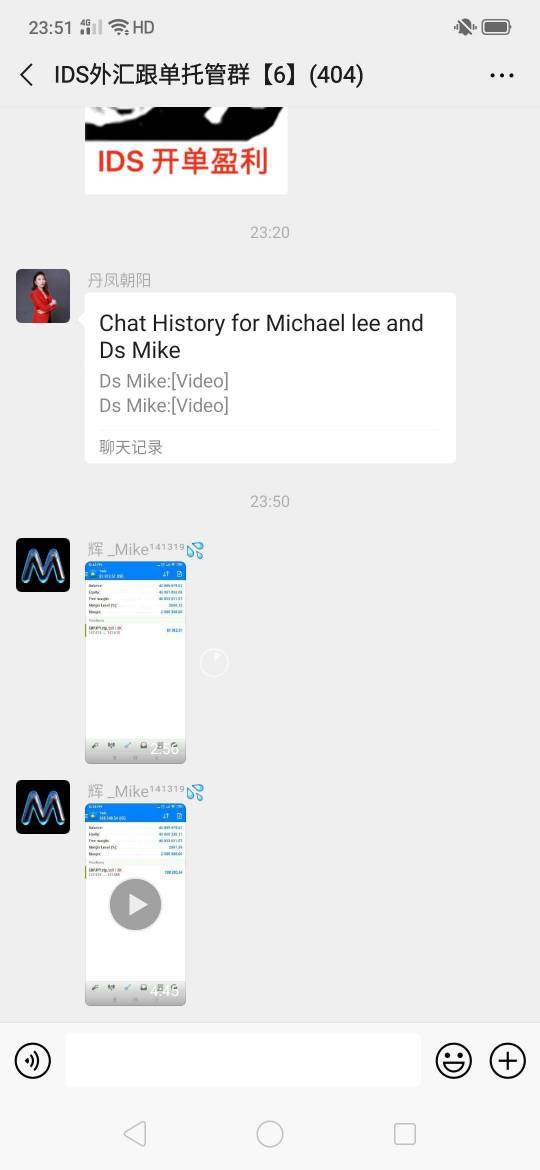

The platform keeps holding off to avoid the withdrawal applied in last December. The phone of the institution which granted the broker license is blank. The leader of Chinese zone residents in Changchun mainly. The Malaysian person whose nicknamed Hui_Mike is the consultant. Lv is the referrer who used to be the staff of PTFX. Lv and his superior “Danfengchaoyang” are engaged in forex scam and have invited more than dozens of person in. They stipulate that members mustn’t add each other or they would be kicked off. The boss of 11 comes form Singapore and the MT4 is located in USA. With the excuse of establishing Derui business school, they induced clients to make a field survey, asking money to pay for the visa, hotel, air tickets and banquets, which is simply a romance scam! They have hoarded 100 million RMB or so by scamming such person as ordinary retired elderly, retired college staff and senior engineers in state-owned enterprises and even universities, with 17 million or so involved.

Exposure

2020-03-22

王蘅(王博)

Hong Kong

The withdrawal is unavailable for 2 months, which should be received within 3 days. Is IDS a scam?

Exposure

2020-03-02

达摩祖师

Hong Kong

Indosukses Futures didn’t give access to withdrawal as expected. I suspected that it is a scam platform and many victims have been deceived. There are more than one broker linked with IDS, which one is true?

Exposure

2020-01-25

走向成功

Hong Kong

My first withdrawal request was refused. The second withdrawal is unavailable for 10 days.

Exposure

2020-01-10

rtyu

Hong Kong

Unable to withdraw in scam Indosukses Futures .

Exposure

2019-12-29

交易

Hong Kong

Why the withdrawal in 111 is unavailable? Please give us an explanation and justice.

Exposure

2019-12-27

laterage

Hong Kong

My fund was in isolated account instead of PTFX. Why you lock my fund?

Exposure

2019-12-27

开心每一天86714

Hong Kong

Dose ISD have relationship with you? ISD is scamming clients’ fund under your name.Dose ISD have relationship with you? ISD is scamming clients’ fund under your name.

Exposure

2019-12-19

FX1628434985

Hong Kong

Indosukses Futures’s license is the same with others. So ridiculous.

Exposure

2019-12-08

金红牛

Hong Kong

There was a lowdown on the 2 companies.IDS was said to be a broker set up in Indonesia in 2019, while it was licensed in Europe.Which one is right?Did it clone others?

Exposure

2019-12-03

FX9209582214

Hong Kong

What’s the relation between IDS and this company?Why the company’s MT4 and backstage belongs to IDS? It is a scam platform.

Exposure

2019-11-23

风格86450

Hong Kong

They have the same login page with the IDS!

Exposure

2019-11-12

A胡宇衡

Hong Kong

Indosukses Futures said that they belong to an Indonesia company while their MT4 is fake.Who can tell me?

Exposure

2019-11-09

smooth

Malaysia

Let me tell you what kind of this broker is and you will see why I strongly advise against Indosukses Futures. This company is operating illegally and has a history of scamming traders. Several of my friends have fallen victim to their schemes, and I'm grateful that I didn't open an account or deposit any money with them. Stay away from this broker and protect yourself from potential fraud."

Neutral

2023-03-27