Score

ZHONGYANG

Hong Kong|5-10 years|

Hong Kong|5-10 years| http://www.zyfgl.com

Website

Rating Index

Influence

Influence

D

Influence index NO.1

India 2.52

India 2.52Surpassed 55.40% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+852 31070731

Other ways of contact

Broker Information

More

中阳金融集团

ZHONGYANG

Hong Kong

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

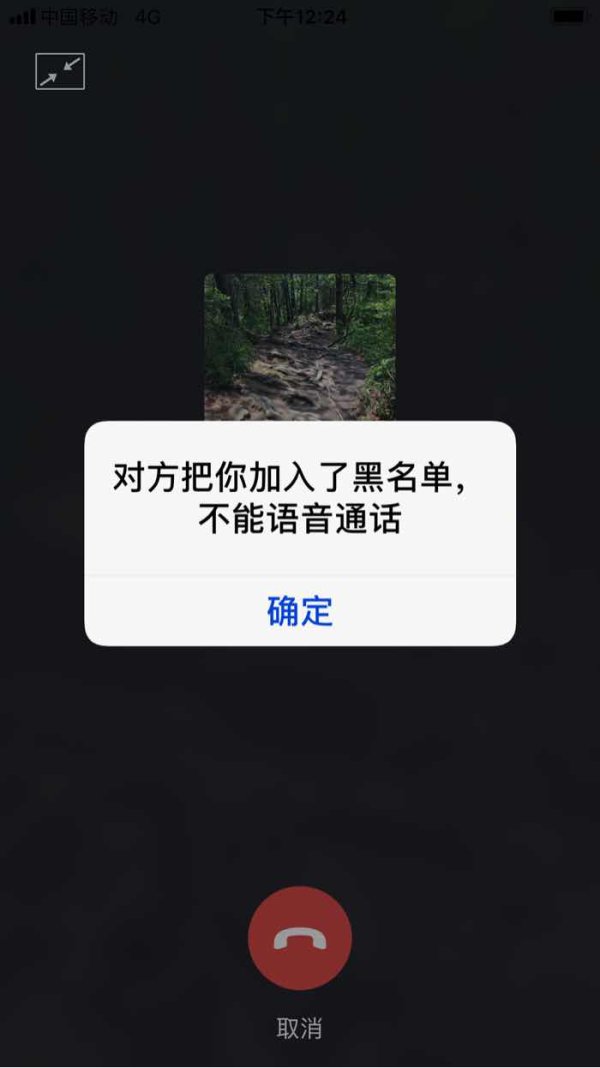

- This broker exceeds the business scope regulated by China Hong Kong SFC(license number: BLG119)SFC-Advising on securities Non-Forex License. Please be aware of the risk!

- The China Hong Kong SFC regulation (license number: BGT529) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

Users who viewed ZHONGYANG also viewed..

XM

Exness

Decode Global

CPT Markets

ZHONGYANG · Company Summary

| Company Name | ZHONGYANG |

| Regulatory Authority | China Hong Kong Securities and Futures Commission (SFC) |

| License Number | BGT529 (Claimed License Number, authenticity uncertain) |

| License Type | Unknown (Regulatory compliance and authenticity questioned) |

| Business Scope | Securities and Futures Brokerage |

| Regulation | SFC |

| Headquarters | Address: Room 1101, 118 Connaught Road West, Hong Kong |

| Services Offered | Securities Trading |

| Futures Trading | |

| Services | Hong Kong Stock Exchange (HKEX) |

| American Stock Exchanges (NYSE, NASDAQ) | |

| Shanghai and Shenzhen Stock Connect | |

| Securities (Hong Kong and American Stocks) | |

| Futures Contracts (Commodities, Currencies, Indices, etc.) | |

| Trading Fees | Hong Kong Stocks: |

| - Commission Fee: 0.1% of trade value | |

| - Minimum Transaction Cost: 80 HKD | |

| - Margin Financing Interest Rate: 8% annually | |

| Shanghai/Shenzhen-Hong Kong Stock Connect: | |

| - Commission Fee: 0.1% of trade value | |

| - Minimum Transaction Cost: 100 CNY | |

| - Margin Financing Interest Rate: 8% annually | |

| U.S. Stocks: | |

| - Commission Fee: 0.05 USD per share (2,000+ shares: 0.01 USD per share) | |

| - Minimum Transaction Cost: 1.99 USD | |

| - Margin Financing Interest Rate: 8% annually | |

| Contact Information | Customer Service Hotline: +852 31070731 |

| Online Consultation: Email - CS@zyzq.com.hk | |

| Fax: (852) 2836 3825 |

Overview

ZHONGYANG, operating under license number BGT529, falls under the regulatory oversight of the China Hong Kong Securities and Futures Commission (SFC). However, concerns have arisen about the authenticity of this license and the company's compliance with regulatory requirements. The company provides securities and futures brokerage services, offering trading options in various markets, including the Hong Kong Stock Exchange (HKEX), American stock exchanges (NYSE, NASDAQ), and the Shanghai and Shenzhen Stock Connect. They offer a range of financial products, including securities and futures contracts, each with its associated trading fees. Given the uncertainty surrounding the authenticity of their license and regulatory compliance, exercising caution and conducting thorough due diligence is advisable when considering any business dealings with ZHONGYANG. It is essential to verify licenses and operations to ensure compliance with industry regulations and protect financial interests.

Regulation

ZHONGYANG is currently operating in a manner that exceeds the permissible business scope as regulated by China Hong Kong Securities and Futures Commission (SFC), under license number BLG119, which authorizes them to engage in Advising on securities Non-Forex activities. It is essential to be aware that the SFC regulation associated with license number BGT529, which ZHONGYANG claims to possess, raises suspicions of being a clone or counterfeit license.

This situation underscores the need for caution when dealing with ZHONGYANG, as they may not be complying with the legal and regulatory framework set forth by the SFC. Engaging with such entities can expose you to heightened risks, including potential financial losses and a lack of legal protection. Therefore, it is crucial to thoroughly investigate and verify the authenticity of the broker's licenses and operations before considering any business dealings with them. Staying informed and vigilant is paramount in safeguarding your financial interests and ensuring compliance with regulatory requirements in the financial industry.

Pros and Cons

ZHONGYANG offers a wide range of financial products, including securities and futures, covering various global markets. Their product offerings encompass Hong Kong stocks, American stocks, and Shanghai/Shenzhen-Hong Kong Stock Connect for securities, as well as an array of commodity, financial, agricultural, and currency futures contracts. It's important to note that ZHONGYANG operates under a license number (BGT529) that raises concerns about its authenticity and regulatory compliance, as it may exceed the permissible business scope regulated by the China Hong Kong Securities and Futures Commission (SFC). Caution is advised when dealing with such entities, as non-compliance with regulatory requirements can pose risks to investors. Additionally, they provide accessible customer support through a hotline, email consultation, and traditional fax services, along with a physical address in Hong Kong for in-person interactions, reflecting their commitment to assisting clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Products

ZHONGYANG offers a diverse range of financial products, including securities and futures, covering various global markets.

Securities:

Securities are financial instruments that represent ownership or debt in a publicly traded company. They are typically bought and sold on stock exchanges. In your list, you've mentioned various securities related to different stock exchanges:

Hong Kong Stocks (HKEX): This category includes the Hang Seng Index (HSI), Mini Hang Seng Index (MHI), H-shares Index (HHI), Mini H-shares Index (MCH), U.S. Dollar Gold (GDU), U.S. Dollar against Renminbi (CUS), and Renminbi against U.S. Dollar (UCN). These securities allow investors to trade in Hong Kong's equities and currency markets.

American Stocks (NYSE, NASDAQ): While not explicitly mentioned in your list, American stocks refer to equities of companies listed on U.S. stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ. These exchanges host a wide range of publicly traded companies from various industries.

Shanghai and Shenzhen Stock Connect : The Shanghai and Shenzhen Stock Connect programs allow international investors to trade certain mainland Chinese stocks listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE).

Futures Contracts:

Futures contracts are financial derivatives that obligate the buyer to purchase and the seller to sell an underlying asset at a predetermined price on a future date. Your list includes various futures contracts from different global futures exchanges:

Commodity Futures (COMEX, NYMEX, ICEU, ICE-NYBOT): These contracts allow trading in commodities such as gold (GC), copper (HG), silver (SI), crude oil (CL), gasoline (RB), natural gas (NG), cocoa (CC), cotton (CT), coffee (KC), sugar (SB), and others.

Financial Futures (CME, EUREX): These futures contracts are related to financial instruments like currencies, stock indices, and bonds. They include contracts on the Euro (EC), Japanese Yen (JY), British Pound (BP), U.S. Dollar Index (DX), German DAX (DAX), and more.

Agricultural Futures (CBOT): The Chicago Board of Trade (CBOT) offers futures contracts on agricultural products such as corn (C), soybeans (S), wheat (W), and more.

Mini Futures (CME): Mini futures contracts are smaller versions of their standard counterparts and are designed for retail traders. These include contracts on stock indices like the E-mini S&P 500 (MES), E-mini NASDAQ 100 (MNQ), and others.

Currency Futures (CME): These contracts cover various currency pairs, including the Australian Dollar (AD), British Pound (BP), Euro (EC), and more.

Interest Rate Futures (CME): These futures contracts are related to various bond products like U.S. Treasuries with different maturities (ZB, ZF, ZT, ZN).

Other International Futures (SGX, NSE): The Singapore Exchange (SGX) offers futures on the FTSE China A50 Index (CN), Nikkei Index (NK), and USD/CNY futures (UC). The National Stock Exchange (NSE) provides futures on the Indian GIN Index (GIN).

Each of these products allows traders and investors to speculate on price movements in different asset classes, providing opportunities for hedging and trading strategies across global financial markets.

Trading fees

The trading fees for different types of securities, including Hong Kong stocks, Shanghai/Shenzhen-Hong Kong Stock Connect, and U.S. stocks, are described as follows:

Hong Kong Stocks:

Commission Fee: 0.1% of the trade value.

Minimum Transaction Cost: 80 Hong Kong Dollars (HKD).

Shanghai/Shenzhen-Hong Kong Stock Connect:

Commission Fee: 0.1% of the trade value.

Minimum Transaction Cost: 100 Chinese Yuan (CNY).

Margin Financing Interest Rate : 8% annually.

U.S. Stocks:

Commission Fee : 0.05 USD per share (For single-day single stock trades of 2,000 shares or more, the fee reduces to 0.01 USD per share).

Minimum Transaction Cost: 1.99 USD.

Margin Financing Interest Rate: 8% annually.

These fees provide an overview of the costs associated with trading in different markets and securities. Investors should be aware of these fees when making trading decisions, as they can impact the overall profitability of their trades. Additionally, it's important to note that brokerage firms may have their own fee structures, so it's advisable to check with the specific brokerage for detailed information on trading fees and any additional charges that may apply.

Customer Support

The customer support services offered by this company are accessible through various channels, providing convenience and assistance to clients. They offer a dedicated customer service hotline at +852 31070731, ensuring direct and immediate access to support personnel. Additionally, clients can seek assistance through online consultation via email atCS@zyzq.com.hk, making it easy to address inquiries and concerns electronically. Furthermore, they offer a fax service at (852) 2836 3825 for traditional communication methods. With a physical address provided at Room 1101, 118 Connaught Road West, Hong Kong, clients also have the option for in-person interactions if needed. Overall, this multi-channel approach demonstrates their commitment to providing comprehensive and accessible customer support.

Summary

ZHONGYANG offers a wide range of financial products, including securities and futures, covering various global markets. Their product offerings encompass Hong Kong stocks, American stocks, and Shanghai/Shenzhen-Hong Kong Stock Connect for securities, as well as an array of commodity, financial, agricultural, and currency futures contracts. It's important to note that ZHONGYANG operates under a license number (BGT529) that raises concerns about its authenticity and regulatory compliance, as it may exceed the permissible business scope regulated by the China Hong Kong Securities and Futures Commission (SFC). Caution is advised when dealing with such entities, as non-compliance with regulatory requirements can pose risks to investors. Additionally, they provide accessible customer support through a hotline, email consultation, and traditional fax services, along with a physical address in Hong Kong for in-person interactions, reflecting their commitment to assisting clients. It's essential to thoroughly research and verify the broker's licenses and operations before engaging in any business dealings to safeguard financial interests and ensure regulatory compliance.

FAQs

Q1: What types of financial products can I trade with ZHONGYANG?

A1: ZHONGYANG offers a diverse range of financial products, including securities like Hong Kong and American stocks, as well as various futures contracts covering commodities, currencies, indices, and more.

Q2: Is ZHONGYANG regulated by the China Hong Kong Securities and Futures Commission (SFC)?

A2: The broker claims to operate under a license number (BGT529), but there are concerns about its authenticity and regulatory compliance. It's advisable to exercise caution when dealing with them.

Q3: What are the trading fees associated with Hong Kong stocks?

A3: For Hong Kong stocks, the commission fee is 0.1% of the trade value, with a minimum transaction cost of 80 Hong Kong Dollars (HKD).

Q4: How can I contact their customer support?

A4: You can reach their customer support through a hotline at +852 31070731, email consultation at CS@zyzq.com.hk, and traditional fax services at (852) 2836 3825.

Q5: Where is their physical address for in-person interactions?

A5: Their physical address is Room 1101, 118 Connaught Road West, Hong Kong, providing clients with the option for face-to-face interactions if needed.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now