Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

妙悟岐黄

Hong Kong

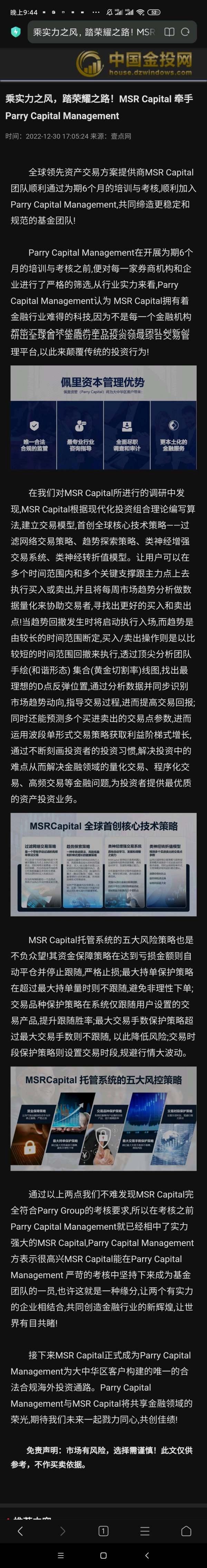

Chancellor Precious Metals and MSR defrauded customers and misappropriated customer funds without withdrawing. They modify the background data, close the settlement channel, harm investors, and refuse to pay out money. The current address is the entrance to the official website of Chancellor Precious Metals. On March 15, MSR changed the deposit address. I went to MSR to find a theory. MSR kept delaying, saying that their executives had been arrested. So can you embezzle client funds? On September 18, MSR shut down the network and ran away, always saying that it would negotiate to withdraw. It’s a scam platform, everyone, keep your eyes peeled. Not allowing withdrawals, they are extremely shameless.

Exposure

2023-11-08

黄先生4154

Hong Kong

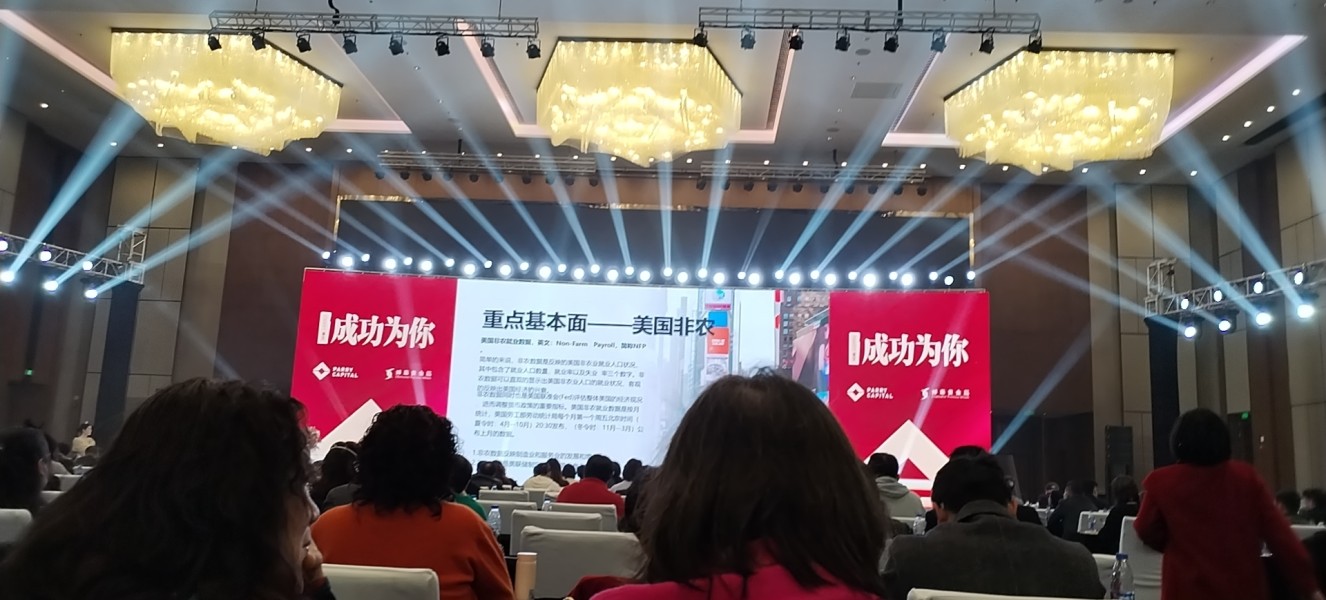

Chancellor Precious Metals, through Parry Capital (the so-called institutions) teamed up to attract mainland investors. I started depositing in USDT from December 11, 2022. There is a Chancellor Precious Metals receipt certificate for the deposit, and the total deposit is nearly 130,000 USDT. In March 2023, Chancellor Precious Metals stopped trading and has not returned my investment funds, and the customer service has not explained in detail. Chancellor Precious Metals, return investment funds ASAP.

Exposure

2023-07-25

忘6734

Hong Kong

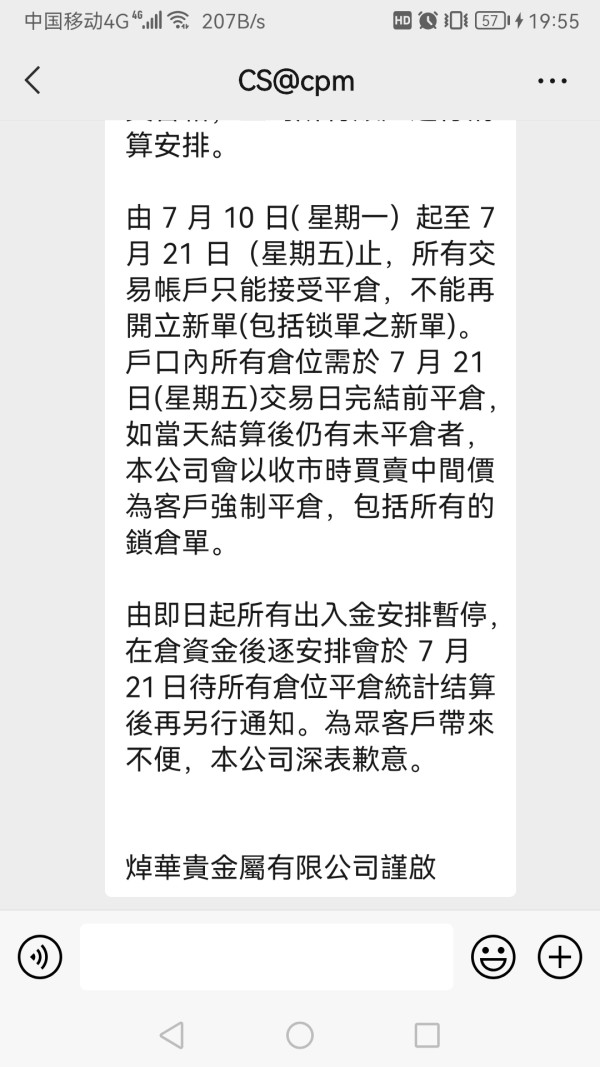

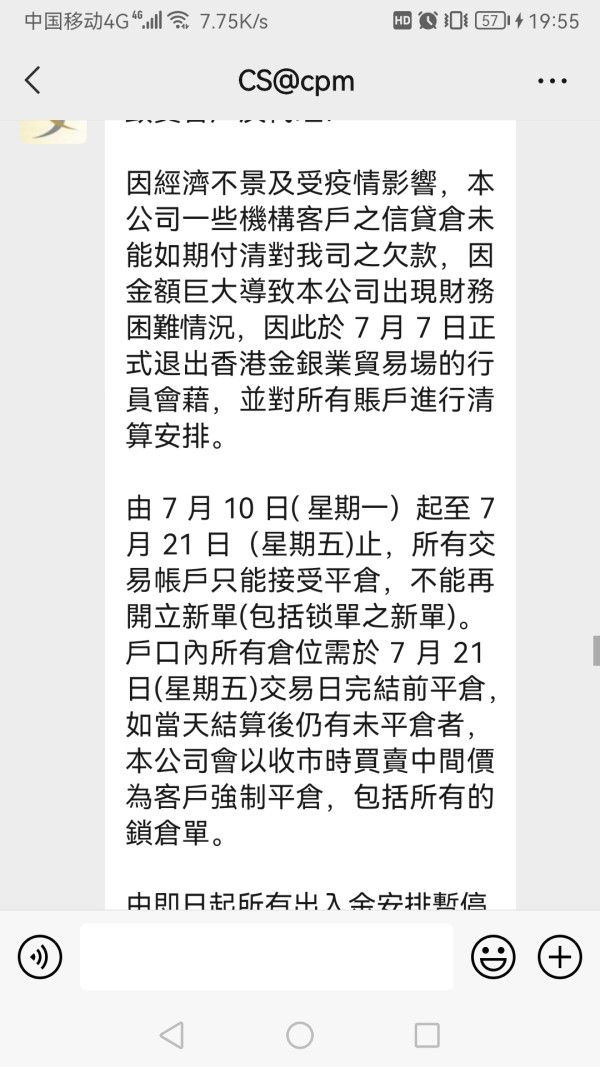

Now I can’t withdraw the funds. On July 10, they issued an announcement saying that the follow-up of the withdrawal would be arranged on the 21st. Until now, I can’t log in to the customer center.

Exposure

2023-07-17

67330

Hong Kong

The customer service of Zhuohua Precious Metal Co., Ltd. is not responding now, and my phone number has been blacked out. Please be careful with the Zhuohua Precious Metal Co., Ltd. platform. To promote established securities firms is to seize our mentality and deceive investors, and stay away from them.

Exposure

2023-06-04

67330

Hong Kong

Zhuohua Precious Metals Co., Ltd., these leaders of Zhuohua publicize the safety of funds and deceive members in mainland China. Now they don’t give us money. Zhuohua is really not a human being. They also advertise that the funds are clerks of the gold and silver industry trade fair. It’s all fake. Please be careful Stay away, beware of being deceived

Exposure

2023-05-21

67330

Hong Kong

Zhuohua Precious Metals Co., Ltd. has no bottom line and no conscience. Everyone must stay away from this platform. It is too inhuman. Now that something happened, the member's background is also closed, and the responsibility is passed on to Perry. It is too shameless

Exposure

2023-05-20

FX3669990871

Hong Kong

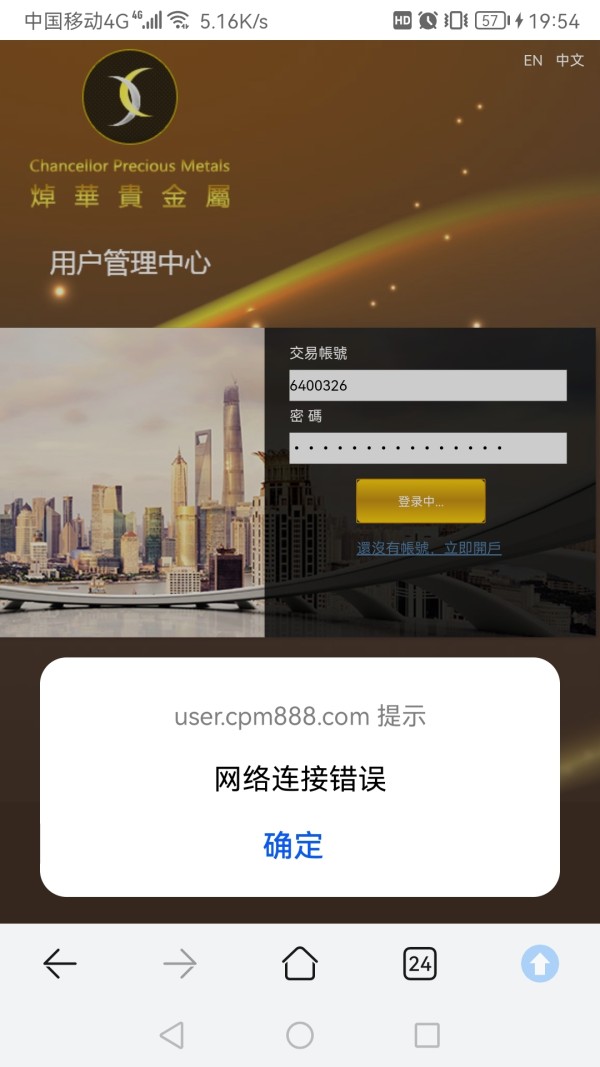

Deposit to ZH MT5 account, but cannot withdraw. Cannot even log in. Delete data from personal account. This platform is so rip-off

Exposure

2023-05-10

FX3879602543

Hong Kong

hongkong Chancellor Precious Metals didn’t the company close all the withdrawal channels of all members in mainland china today, and they are not allowed to withdraw funds, and now they can’t even log in. also known as the 064 member of the hong kong gold and silver trade association

Exposure

2023-05-05

67330

Hong Kong

Zhuohua has no humanity, no bottom line, and ruined the investor's family. It has been more than two months now, and we have not been able to withdraw funds for a long time. It is too wicked. Everyone must remember this company. It is really a rascal, shameful, financial fraud, It's really harmful. I request for withdrawal.

Exposure

2023-05-04

falm

Hong Kong

The platform collaborated with other companies to cheat investors, running away with money. Now it's unable to withdraw money.

Exposure

2023-05-03

FX1295961279

Hong Kong

The following letter is sent to your company to state the following: Since mid-March 2023, we learned that Perry Capital, which is associated with your company, has been investigated by the mainland police, and the relevant personnel and Perry's Malaysian executives have been detained under investigation, and to date, the case has not been concluded. After the incident, you sent a letter to your mainland Chinese investors informing them to stop trading on Blanchard MT5. We are calm and collected in the face of this unexpected incident, and we understand and cooperate with your company's temporary handling. At the same time, we also received a letter from Perry's official back office informing investors of the return of their principal payments, but we have not seen the implementation of this payment commitment since 4.25. In this regard, we urgently contacted your official customer service and requested an immediate and safe refund of the investors' principal, while all the investors contacted your official customer service separately by phone and submitted their personal MT5-related information to the company's email address one after another, requesting a refund. However, to date, we still have not seen any positive and objective reply from your company. In view of the current situation: a statement as follows 1 our investment money is through the company's deposit address to the Blanchard back office MT5 account, open your official website MT5 personal member page, our deposit time, deposit amount, submit the withdrawal and other information elements are clearly visible, for security reasons, we have a complete backup of the MT5 account, personal details have been saved. The fact that we are a one-to-one relationship between the investor and the recipient of the investment has established the fact that the investor and your company are the exact attributes of the relationship between the two parties. All investor payments are on your back office personal account and are clearly traceable. 3 What we have determined is that Perry was merely using your deposit address to engage in and complete the financing of our investors' principal. The company acted as an intermediary. Just as a bank lender and a needy borrower complete a successful match at an intermediary, the bank and the individual then form an independent civil legal act of rights and obligations, and the intermediary no longer acts as a check on both parties. Therefore, your company has a completely independent legal obligation to bear all the responsibilities to the investors, let alone any reason, any excuse to shirk this responsibility. 4 You mentioned Perry, it is certain beyond doubt that we are not aware of this company. We have never, and will never, credit any of our investment funds to any of the management companies, which is a necessary step to ensure the safety of our investors' funds. Moreover, we have never received a deposit from another address in Perry as you mentioned. It has been proven that we, the investors, have not had any material dealings with the so-called Perry. This is because we did not transfer funds to any separate account of Perry. 5 Your customer service said: "The withdrawal of funds will also be transferred from Blanchworth to Perry and then paid to the investor", as investors have never known and fully understood the detailed definition of the agreement on withdrawal of funds in the terms of cooperation between your company and Perry, especially at this time of extraordinary circumstances, we as customers of Blanchworth's investment and financial management, our urgent concern is the principal It is our urgent concern that the principal must be returned to the investors intact and safe, how to deal with it and how to solve it, which are all matters within the scope of your company's responsibility. 2 Our request and your responsibility 1 Perry is currently under investigation by the Chinese police and the case is still pending. 2 Be alert to the fact that the two Malay senior officials of Perry are on bail and have absconded from the country, thus causing a change in the transfer of investors' funds in Perry's account. 3 Perry's regulatory license was changed on April 28, 2023. Please check as soon as possible and make a risk assessment in the interest of the investors and take a decisive and foolproof action. In view of the above and other risks that may not be possible, we would like to remind you and request you not to transfer any funds to Perry at this time. A mainland Chinese investors and Hong Kong Chancellor Precious Metals Limited is the relationship between the investor and the recipient of investment, between us is a de facto legal relationship between A and B, and has nothing to do with Perry Capital, the principal must come in and out of there (the original trading profit transfer path here no comment) B we do not want to see is that in view of the current or any future still may arise B We do not want to see that your company should be held legally responsible for any loss of investor's principal due to any current or possible future reasons! 5 In view of the current situation, your company as a regulated and has been enjoying a good reputation in the industry of financial derivatives Chou Hua precious metals company regardless of any situation, the interests of investors, the safety of funds must be put in the first place, this responsibility is more important than Mount Tai, expect your company everything, from the safety of investors' funds in mainland China, take responsibility for, to prevent risks, review the situation, rapid response, proactive response, all parties to coordinate, measures to be taken. We hope that your company will take responsibility for the safety of investors' funds in mainland China, take responsibility for risk prevention, assess the situation, respond quickly, take the initiative, coordinate with all parties, take precise measures, and finally turn the danger into a success, so that investors can get back their capital safely and completely as soon as possible. As all investors, will still and will continue to be happy to see, and witness your strong strength in the industry, good reputation brilliant performance, cooperation is not a matter of the moment, the crisis to see the true feelings, through the present, the future can be expected! The above letter is hereby informed, Note: This piece is sent to the official customer service mailbox of Hong Kong Chou Hua Precious Metals Co! All investment customers of Hong Kong Chou Hua Precious Metals in mainland China 2023.5.2

Exposure

2023-05-02

FX3879602543

Hong Kong

Zhuohua does not allow users to withdraw, maliciously seizes users' principal. Junk platform, and many people in mainland China are currently victimized

Exposure

2023-04-29

妙悟岐黄

Hong Kong

Zhuo Hua and Perry colluded with each other to provide a platform for many fraudsters, and cooperated with each other. They could not give money, get angry, and play the role of old brokers. They played the role of capital fraud, and acted as the legal cloak. They cooperated with Malaysian National Capital, Dianhao Capital tmd, and msr Perry Capital to cheat the people in Chinese Mainland. a thousand deaths will not atone for one 's crime.

Exposure

2023-04-28

67330

Hong Kong

It's so hateful. Chancellor Precious Metals Co., Ltd. has no bottom line. Chancellor and Perry cheated members in mainland China together

Exposure

2023-04-18

无所畏惧123

Hong Kong

Chancellor Precious Metals used the reason that Perry Financial was under investigation by the police to prohibit investors from submitting their own principal, saying that the principal was in Chancellor's Perry comprehensive account, and only Perry authorized them to have authority.

Exposure

2023-03-27

妙悟岐黄

Hong Kong

Zhuohua, Perry Finance, and Perry Capital worked together to act as a broker, pretending to be a deck for asset management, and unable to withdraw money

Exposure

2023-03-23

妙悟岐黄

Hong Kong

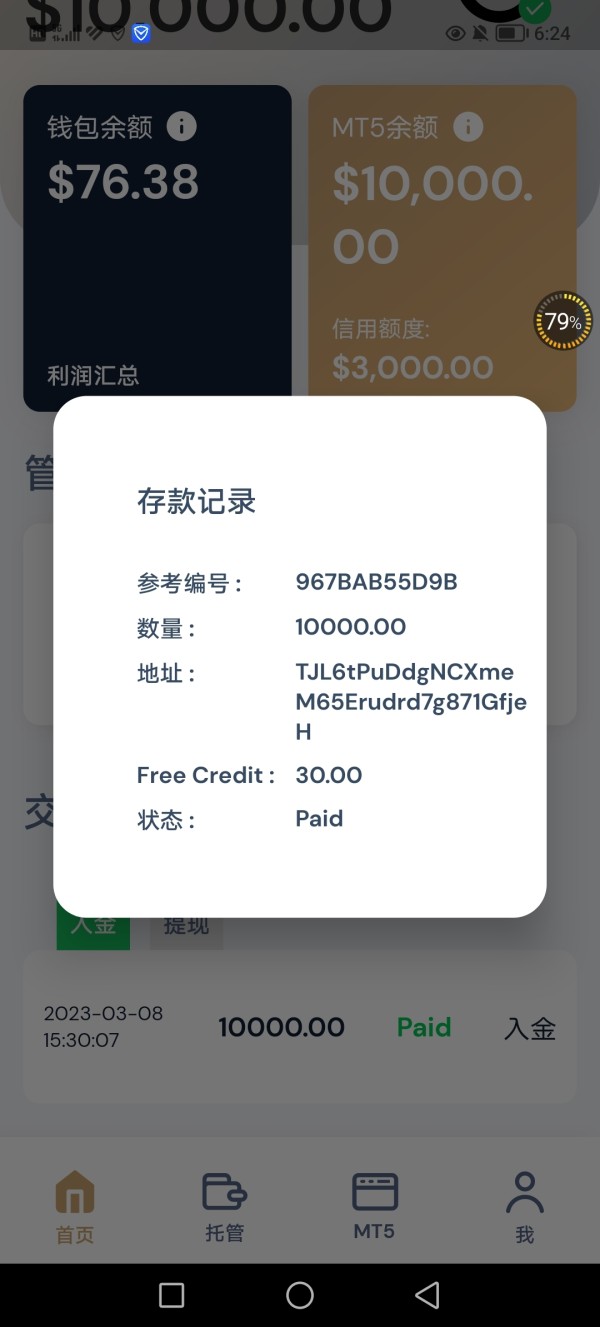

Cooperated with Perry Capital, Perry Finance, and MSR to provide deposit and withdrawal channels, and announced the USDT recharge address of Perry's deposit and deposit on the official website. The deposit was made on March 8, and the withdrawal has not been able to be operated and the account has not yet been received.

Exposure

2023-03-22

汇市9232

Hong Kong

Two months ago, I was invited by a friend to make a deposit and after that, they did not withdraw and suspend trading account. The black fraud specifically targets mainlanders for financial shuffle

Exposure

2022-12-04

falm

Hong Kong

The btoker is a pyramid-pulling pyramid selling model, claiming that the deposit can get a fixed income proportionally, the fund custody is the profit you want, it swallows your principal, and the freedom of deposit and withdrawal is just a foreshadowing before the harvest, when there is no more newcomers, it is the day that you will cry

Exposure

2022-10-08

falm

Hong Kong

The platform is inducing more people to conduct funds custody, illegal fundraising, and about to run away.

Exposure

2022-10-06