General Information

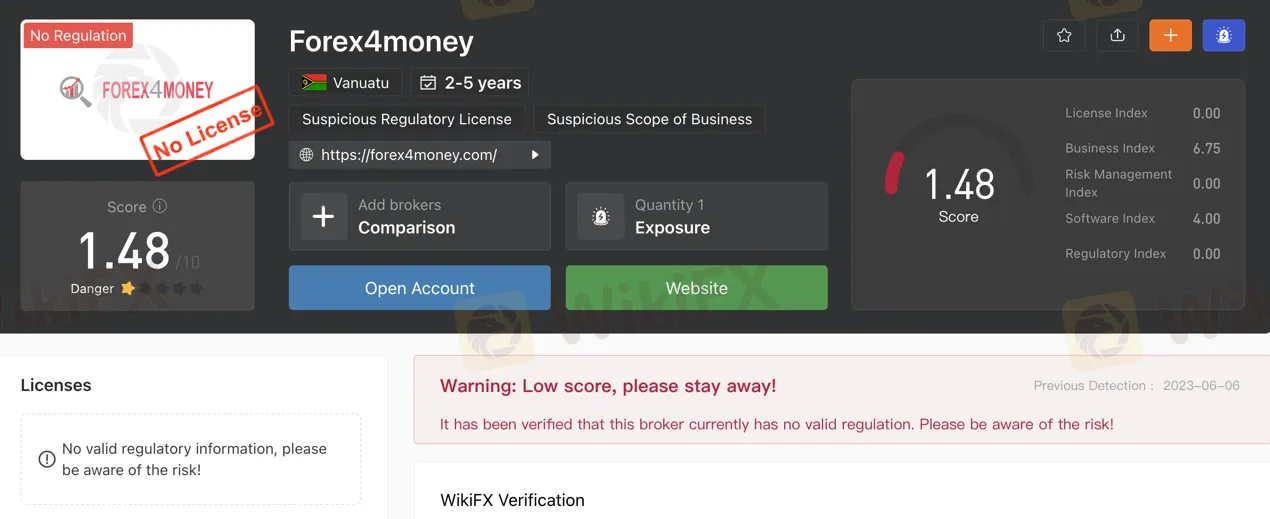

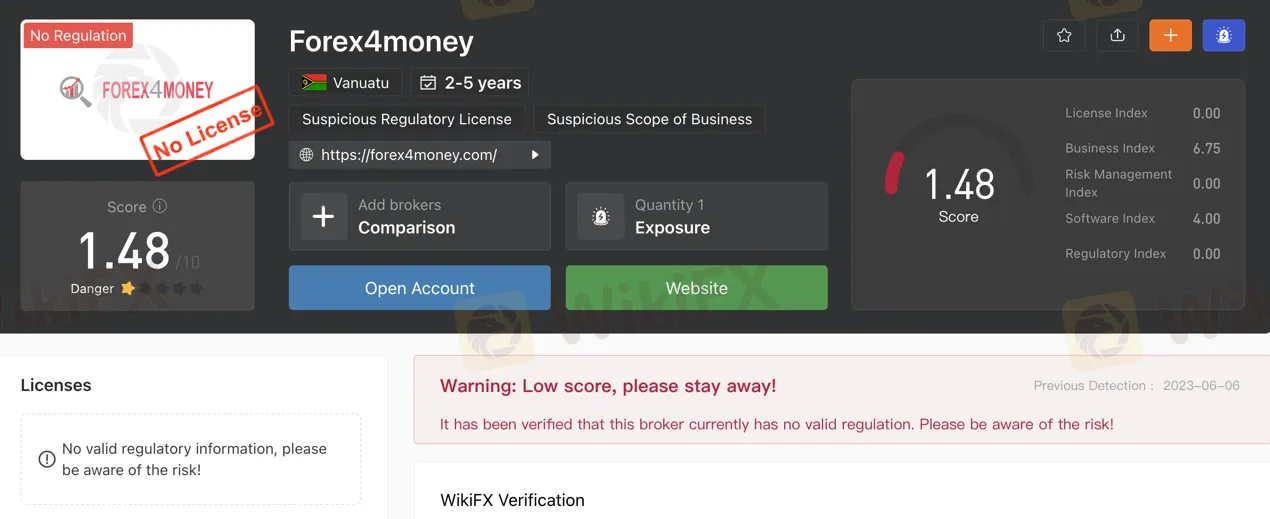

Forex4money is a forex broker operating in the financial market, providing access to various market instruments such as commodities, indices, currency trading, and cryptocurrencies. However Forex4money is not a regulated broker. Regulation in the financial industry ensures certain standards of operation and client protection, so the lack of regulation raises concerns about the safety and transparency of the broker's practices.

Forex4money offers three live trading account types: Mini, Standard, and Premium. The Mini account is the entry-level option, while the Standard and Premium accounts require higher minimum initial deposits and offer additional benefits.

The broker provides leverage of up to 1:400, allowing traders to control larger positions in the market with a relatively smaller amount of capital. However, higher leverage also increases the risk of losses, so traders should exercise caution.

Forex4money offers different trading platforms to cater to traders' preferences, including a mobile trading platform, the FXnet platform, and a web-based platform. These platforms provide real-time market rates, advanced tools and features.

The broker offers a range of trading tools such as Daily Market Review, Financial Calendar, Real-Time Charts, Signals, and Live Market Rates to assist traders in making informed trading decisions. Educational resources are also available, including training programs and courses for beginners.

Forex4money provides customer support through various channels, including phone, email, and online messaging. However, it is important to note that as of my knowledge cutoff, Forex4money was not a regulated broker, which may impact the level of trust and reliability for potential traders.

Pros and Cons

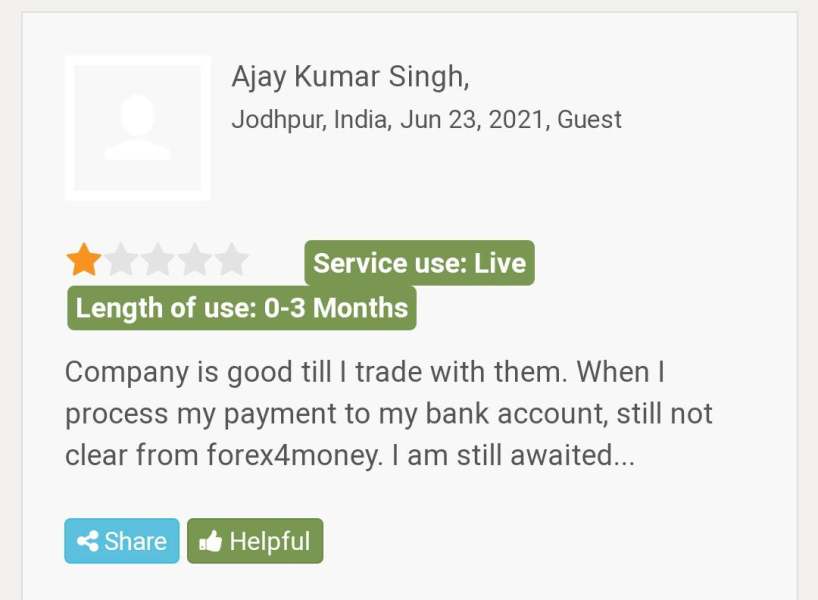

Forex4money offers several advantages, including multiple account types and high maximum leverage, providing flexibility for traders. The platform supports various payment options and ensures timely processing of withdrawal requests. It offers versatile trading platforms accessible through mobile, FXnet, and web-based interfaces. Additionally, Forex4money provides valuable resources such as daily market reviews, financial calendars, and training programs. However, potential drawbacks include the lack of regulation and transparency regarding spreads and payment methods. There might be delays in withdrawals, and personalization options may be limited. Dependence on signals for trading decisions and associated costs for educational resources are other considerations. While customer support is available through multiple channels, the quality and responsiveness may vary.

Is Forex4money Legit?

Forex4money is not a regulated broker. This means that the company does not have the necessary authorization or oversight from any recognized regulatory body.

Regulation in the financial industry is crucial as it provides a level of protection to traders and investors. Regulated brokers are subject to certain rules and regulations designed to ensure fair and transparent trading practices, client fund protection, and adherence to strict operational standards. They are typically monitored and supervised by regulatory authorities that enforce compliance with these regulations.

Market Instruments

Commodities: Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, silver, oil, natural gas, wheat, corn, etc. Trading commodities allows investors to diversify their portfolios and take advantage of price fluctuations in these physical assets.

Indices: Indices represent a basket of stocks from a specific market or sector and provide a snapshot of the overall performance of that market or sector. Traders can speculate on the price movement of an index rather than individual stocks, offering exposure to a broader market.

Currency Trading: Also known as forex or foreign exchange trading, currency trading involves buying and selling currencies in the global foreign exchange market. Traders aim to profit from fluctuations in exchange rates between different currency pairs.

Cryptocurrency: Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin, Ethereum, and Litecoin are examples of cryptocurrencies. Trading cryptocurrencies allows investors to speculate on their price movements and potentially generate profits.

Account Types

There are three live trading accounts offered by Forex4money, apart from demo accounts, namely Mini, Standard and Premium. Opening a Mini account requires the minimum initial deposit amount of $100, while the other two account types with the much higher minimum initial capital requirements of $2,000 and $5,000 respectively.

MINI ACCOUNT

The Mini account is the entry-level option, requiring a minimum initial deposit of $100. It offers a spread of 4 pips, which refers to the difference between the buying and selling price of a currency pair. However, it does not provide trading signals or professional assistance. The Mini account does come with access to a support team, which can assist with any account-related queries or concerns.

STANDARD ACCOUNT

The Standard account, on the other hand, requires a higher minimum initial deposit of $2,000. It offers a spread of 3 pips compared to the Mini account. The Standard account provides trading signals, which can be beneficial for traders seeking market insights. However, it does not include professional assistance. Similar to the Mini account, the Standard account also grants access to a team for support.

PREMIUM ACCOUNT

The Premium account is the highest-tier option, requiring a minimum initial deposit of $5,000 or above. It offers the spread of 2 pips among the account types, providing a potentially more favorable trading environment. The Premium account includes trading signals for market analysis. Furthermore, it offers professional assistance, which can be advantageous for traders who require expert guidance. Like the other account types, the Premium account provides access to a team for personalized assistance.

How to Open an Account?

To open an account with Forex4money, follow these steps:

Step 1: Fill in the application form Click on the “Register” option located in the top right corner of the screen or choose the “Sign-Up” option. Fill in the required information in the application form accurately and ensure that it

is up to date.

Step 2: Submit verification documents Provide your personal information as requested in the form. Pay attention to accuracy and make sure the details match your identity proof. This step is part of the Know Your Customer (KYC) process. Choose a username and password for your account.

Step 3: Receive login information Check your email for a confirmation link after entering your username and password. If the email does not appear in your inbox, check your spam folder. Your verification process will only be complete after confirming your email address.

Step 4: Make your first deposit Once the verification process is complete, you will need to make your first deposit. Choose the type of account you prefer and deposit the initial amount. The account details will include information such as the account number, account type (real or demo), chosen currency (Euro or USD), leverage, and account balance.

Step 5: Start trading After completing all the registration processes, you can start trading worldwide.

Leverage

Forex4money offers a maximum leverage ratio of 1:400, which is significantly higher than what many other brokers provide. It's important to understand that leverage allows traders to control larger positions in the market with a relatively smaller amount of capital. While higher leverage can potentially amplify profits, it also increases the risk of losses.

Spreads

Forex4money offers different account types with varying spreads. The Mini account has spreads starting from 4 pips, the Standard account starts from 3 pips, and the Premium account starts from 2 pips.

Trading Platform Available

Forex4money offers three trading platforms to cater to different trading styles and preferences: the Forex4money mobile trading platform, the FXnet platform, and a web-based platform.

Forex4money Mobile Trading Platform:

The Forex4money mobile trading platform allows traders to engage in trading activities from anywhere and at any time through compatible mobile devices. This platform provides real-time market rates, ensuring that traders stay up to date with the latest market movements. With advanced technology, traders can experience the thrill of the market in the palm of their hands.

FXnet Platform:

The FXnet platform is a downloadable trading platform designed to cater to traders with various levels of experience. This platform offers a comprehensive set of tools and features, providing all the necessary information on the screen for easy usability. Traders using the FXnet platform may execute one-click deals and place limit orders. The platform also allows personalization to meet individual preferences, enhancing the trading experience.

Web-Based Platform:

Forex4money's web-based platform is an ideal choice for traders who travel frequently or have security systems installed on their computers. This platform eliminates the need for downloading and installation, allowing traders to access a range of features directly from their personal computers. Traders can perform tasks such as opening and closing positions, depositing and withdrawing funds, and viewing account history without any hassle. The web-based platform provides instant accessibility from anywhere.

Deposit & Withdrawal

Forex4money offers several payment methods for deposits and withdrawals. According to the logos displayed on their official website's homepage, it appears that the broker accepts payments through PayPal, credit/debit cards such as Visa, MasterCard, American Express, Asia Pay, and JCB. However, it is important to note that the availability of these payment methods may vary, and it is advisable to verify their current options directly with the broker.

When it comes to withdrawal processing, Forex4money typically takes up to three working days to process a withdrawal request. It is worth mentioning that in certain cases, this timeframe might be extended due to technical issues or other unforeseen circumstances. However, the broker claims to keep clients informed about the progress of their withdrawal transactions.

Trading Tools

Forex4money offers a range of trading tools to assist its clients in making informed trading decisions and staying updated with market trends. These tools include Daily Market Review, Financial Calendar, Real Time Charts, Signals, Platforms, Live Market Rates, and an Education Package.

The Daily Market Review provided by Forex4money offers a comprehensive analysis of the financial markets. It includes expert insights, market trends, and potential trading opportunities. This tool can be beneficial for traders seeking to stay informed about the latest developments in the market.

The Financial Calendar is another useful tool provided by Forex4money. It displays upcoming economic events, such as interest rate decisions, GDP releases, and employment data. Traders can use this calendar to plan their trades and adjust their strategies based on anticipated market volatility.

Real-Time Charts are essential for technical analysis. Forex4money offers real-time price charts that provide traders with detailed information about currency pairs, commodities, and other financial instruments. These charts help traders analyze price movements, identify trends, and make informed trading decisions.

The Signals feature of Forex4money provides trading recommendations based on market analysis. Traders can receive signals that indicate potential entry and exit points for various currency pairs. These signals can be helpful for traders who prefer to follow predefined strategies or seek guidance from experienced analysts.

Forex4money offers different trading platforms to cater to the diverse needs of traders. These platforms provide access to the financial markets, order execution, and various trading tools. The specific platforms offered by Forex4money may vary, but they commonly include well-known options such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Live Market Rates are crucial for traders as they provide real-time pricing information for various financial instruments. Forex4money ensures that traders have access to accurate and up-to-date market rates, allowing them to make informed trading decisions.

Educational Resources

Forex4money offers various educational resources to assist beginners in building a successful career in Forex trading. These resources include:

EAP Training Program: This program requires a minimum investment of $300 (or 19,577 INR). It provides accelerated training through training videos, online tutorials, and PDF guides.

Advanced Pattern Mastery Course: Priced at $500 (or 34,000 INR), this course offers in-depth knowledge on advanced trading patterns.

Free Training/Email List: Forex4money also provides a free option for email updates and training materials, which costs $100.

The platform aims to make Forex trading accessible to everyone, regardless of their level of experience. Beginners can start with a demo account with a minimal budget of up to $100. This allows them to practice trading techniques and gain confidence before investing real money.

Customer Support

Forex4money offers customer support through various channels to assist their clients. They can be contacted via phone at +17274519982 or through email at info@forex4money.com. Additionally, clients can send messages online to reach out to the customer support team. The broker also maintains a presence on social media platforms such as Facebook, Twitter, Instagram, LinkedIn, Telegram, and YouTube.

For those seeking assistance, Forex4money provides a physical address at 133 Santina Parde Ellluk, Vantu House, Port Vila Efate, Vanuatu. The company offers a help center where clients can access technical assistance and customer support services. These services are available 24 hours a day, five days a week, to cater to the needs of traders.

Forex International Gain LTD is associated with Forex4money and operates from the same address mentioned above.

Conclusion

In conclusion, Forex4money is a forex broker that offers a variety of market instruments and trading account types. However, there are several disadvantages to consider. Firstly, Forex4money is not a regulated broker, which means it lacks the necessary oversight and protection provided by recognized regulatory bodies. This raises concerns about the safety of funds and fair trading practices. Additionally, the lack of professional assistance and limited account types for certain accounts may not meet the needs of all traders. On the other hand, Forex4money does offer potential advantages such as diversification, market exposure, and opportunities in cryptocurrency trading. The availability of multiple payment options and timely processing of withdrawal requests are also positive aspects. Overall, it is crucial for individuals considering Forex4money to carefully weigh the risks and advantages before engaging in trading activities with the broker.

FAQs

Q: Is Forex4money a regulated broker?

A: As of September 2021, Forex4money is not regulated. It does not have authorization or oversight from any recognized regulatory body.

Q: What market instruments can I trade with Forex4money?

A: Forex4money offers a variety of market instruments, including commodities (such as gold, silver, oil, etc.), indices, currency trading (forex), and cryptocurrencies.

Q: What are the pros and cons of trading with Forex4money?

A: Pros include diversification, potential for profit, market exposure, and cryptocurrency opportunities. Cons include high risk, lack of regulation, and limited account types.

Q: What are the different account types offered by Forex4money?

A: Forex4money offers three live trading account types: Mini, Standard, and Premium. Each account type has its own features and requirements.

Q: What is the maximum leverage offered by Forex4money?

A: Forex4money offers a maximum leverage ratio of 1:400, allowing traders to control larger positions in the market with a relatively smaller amount of capital.

Q: What are the spreads offered by Forex4money?

A: The spreads vary depending on the account type. The Mini account has spreads starting from 4 pips, the Standard account starts from 3 pips, and the Premium account starts from 2 pips.

Q: What payment methods are accepted for deposits and withdrawals?

A: Forex4money accepts payments through PayPal, credit/debit cards (Visa, MasterCard, American Express, Asia Pay, JCB). However, availability may vary, so it's advisable to verify the current options directly with the broker.

Q: What trading platforms does Forex4money offer?

A: Forex4money offers three trading platforms: the Forex4money mobile trading platform, the FXnet platform (downloadable), and a web-based platform.

Q: What trading tools are provided by Forex4money?

A: Forex4money offers trading tools such as Daily Market Review, Financial Calendar, Real-Time Charts, Signals, Platforms (e.g., MetaTrader 4 or 5), Live Market Rates, and an Education Package.

Q: What educational resources are available for beginners?

A: Forex4money offers an EAP Training Program, Advanced Pattern Mastery Course, and free training/email list to assist beginners in learning Forex trading.

Q: How can I contact Forex4money's customer support?

A: You can contact Forex4money's customer support through phone at +17274519982, email at info@forex4money.com, or online messaging. They also have a physical address and a help center for technical assistance and support.