Score

AKINDRED

Australia|10-15 years|

Australia|10-15 years| http://www.adffx.com/index.html?lang=en-us

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:AKINDRED PTY LTD

License No.:446375

Single Core

1G

40G

1M*ADSL

- The AustraliaASIC (Regulatory number: 446375) Institution Forex License (STP) held by belongs to the scope of institutional business, excluding retail business. It cannot open accounts for individual investors. Be aware of the risks!

Basic information

Australia

AustraliaUsers who viewed AKINDRED also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

Website

adffx.com

Server Location

China

Website Domain Name

adffx.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2005-09-07

Server IP

45.248.86.147

Company Summary

| Aspect | Information |

| Company Name | AKINDRED |

| Registered Country/Area | Australia |

| Founded Year | 2014 |

| Regulation | ASIC |

| Minimum Deposit | $1,000 |

| Products | Forex,commodities,indices,cypto currencies,CFDs,ETFs |

| Commissions | Spreads:0 to 0.6 pips;Commissions:from 3% to 15% |

| Trading Platforms | Meta Trader 4,Meta Trader 5 |

| Demo Account | Available |

| Customer Support | Phone:+442081230997;Email:nfo@adffx.com,service@adffx.com |

| Deposit & Withdrawal | Bank transfer,credit/debit card,third-party payment |

Overview of AKINDRED

AKINDRED, established in 2014 in Australia, operates under the regulation of the Australian Securities and Investments Commission (ASIC).

With a minimum deposit requirement of $1,000, the company offers a broad spectrum of financial products including Forex, commodities, indices, cryptocurrencies, CFDs, and ETFs. AKINDRED's pricing structure features spreads ranging from 0 to 0.6 pips and commissions between 3% to 15%.

Clients have access to popular trading platforms Meta Trader 4 and Meta Trader 5, along with a demo account for practice trading. Customer support is provided via phone at +442081230997 and emails to nfo@adffx.com or service@adffx.com.

For deposit and withdrawal, the company accepts methods like bank transfers, credit/debit cards, and third-party payments, accommodating a wide range of client preferences.

Is AKINDRED Legit or a Scam?

AKINDRED is regulated by the Australia Securities & Investment Commission (ASIC), holding an Institution Forex License (STP) with the license number 446375.

This regulatory status ensures that AKINDRED operates in compliance with Australian financial standards and practices, providing a secure and regulated environment for its clients.

The STP (Straight Through Processing) license indicates that the company processes client trades directly in the financial markets without intervention, further emphasizing its commitment to transparent and efficient trading services.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | High Minimum Deposit |

| Various Financial Products | Commission Structure |

| Advanced Trading Platforms | Spread Range |

| Demo Account Availability | Limited Regulatory Information |

| Multiple Customer Support Channels | Deposit & Withdrawal Methods |

Pros:

Regulated by ASIC: AKINDRED is regulated by the Australian Securities & Investment Commission, ensuring compliance with strict financial standards and offering a secure trading environment.

Various Financial Products: Offering a range of products like Forex, commodities, indices, cryptocurrencies, CFDs, and ETFs allows traders to diversify their portfolios.

Advanced Trading Platforms: Access to popular platforms like Meta Trader 4 and Meta Trader 5 attract both novice and experienced traders, providing advanced tools and features.

Demo Account Availability: The availability of a demo account is beneficial for new traders to practice and hone their trading strategies without financial risk.

Multiple Customer Support Channels: Offering customer support through phone and email provides clients with various options for assistance and inquiries.

Cons:

High Minimum Deposit: A minimum deposit of $1,000 is a barrier for entry-level traders or those with limited capital.

Commission Structure: Commissions ranging from 3% to 15% could be relatively high, especially for frequent traders or those trading in small amounts.

Spread Range: While the spread starts at 0 pips, it can go up to 0.6 pips, which is not be the most competitive in the market.

Limited Regulatory Information: Limited public disclosure about regulatory compliance details may concern some traders seeking transparency.

Deposit & Withdrawal Methods: While they offer standard methods like bank transfer and credit/debit cards, the effectiveness and efficiency of third-party payment systems may vary, potentially affecting transaction convenience.

Products

KINDRED offers a Various range of financial products for trading, meet various investment preferences and strategies. Their product lineup includes:

Forex: Allows trading in the foreign exchange market, providing opportunities to trade major, minor, and exotic currency pairs.

Commodities: Offers trading in different commodities, which may include precious metals, energy products, and agricultural goods.

Indices: Traders can invest in a variety of global indices, representing different segments of financial markets and economies.

Cryptocurrencies: Provides a platform for trading various cryptocurrencies, a sector known for its high volatility and potential growth.

CFDs (Contracts for Difference): Enables traders to speculate on the rising or falling prices of fast-moving global financial markets, including stocks, commodities, and indices.

ETFs (Exchange-Traded Funds): Allows trading in ETFs, which are investment funds traded on stock exchanges, much like stocks.

How to Open an Account?

Opening an account with AKINDRED can be done in four straightforward steps:

Registration:

Visit the AKINDRED website and click on the “Open an Account” or “Sign Up” button. You will be directed to the registration page. Provide your personal information, including your name, contact details, and any required identification documents.

Account Type Selection:

Choose the type of trading account that suits your needs. AKINDRED may offer various account types, such as standard, premium, or demo accounts. Select the one that aligns with your trading preferences and goals.

Verification:

Complete the identity verification process. This typically involves providing valid identification documents, proof of address, and any additional documents requested by AKINDRED to comply with regulatory requirements. This step is crucial for security and regulatory purposes.

Fund Your Account:

Once your account is verified and approved, you can fund it. AKINDRED supports various deposit methods, such as bank transfers, credit/debit cards, and third-party payment systems. Choose the preferred method and transfer the necessary funds to your trading account.

Spreads & Commissions

AKINDRED offers a pricing structure with spreads and commissions as follows:

Spreads: The spreads offered by AKINDRED can vary depending on the financial instrument being traded. Typically, they range from 0 pips to 0.6 pips.Lower spreads can be advantageous for traders as they reduce the cost of entering and exiting positions.

Commissions: AKINDRED charges commissions on trading activities, and the commission rates can range from 3% to 15%. The specific commission rate may depend on factors such as the type of account you have, the financial instruments you trade, and your trading volume.

Trading Platform

AKINDRED provides access to two popular trading platforms for its clients:

MetaTrader 4 (MT4): MetaTrader 4 is a widely used and highly regarded trading platform in the financial industry. It offers a user-friendly interface and a comprehensive set of tools for traders of all experience levels.

MetaTrader 5 (MT5): MetaTrader 5 is the successor to MT4 and offers even more advanced features and capabilities. MT5 provides access to a broader range of financial instruments, including more markets and asset classes.

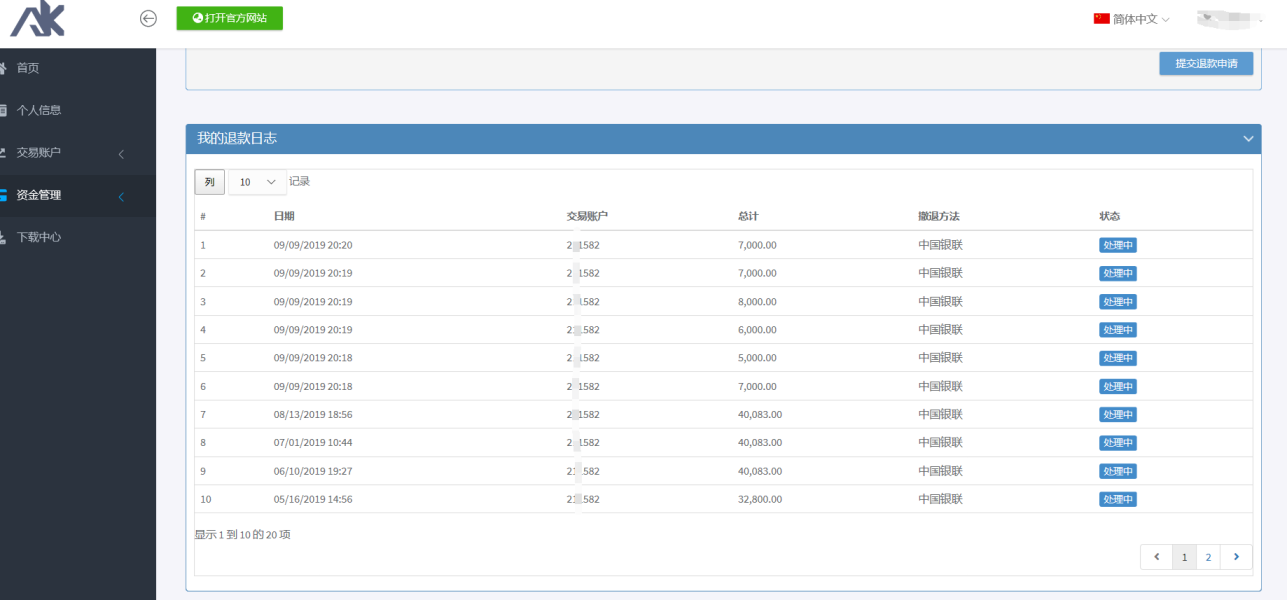

Deposit & Withdrawal

AKINDRED offers various deposit and withdrawal methods to accommodate the needs and preferences of its clients. Here are some of the common deposit and withdrawal options:

Payment Methods:

Bank Transfer: Clients can deposit funds into their AKINDRED trading accounts via bank transfer. This method typically involves transferring money from your bank account to the company's designated bank account. Bank transfers are known for their reliability and security.

Credit/Debit Cards: AKINDRED often accepts major credit and debit cards, such as Visa and Mastercard, for depositing funds. This method offers convenience, and transactions are usually processed quickly.

Third-Party Payment Systems: Depending on the region and client preferences, AKINDRED may support various third-party payment systems, such as e-wallets or online payment platforms like PayPal or Skrill. These options can provide a convenient and secure way to deposit funds.

Customer Support

AKINDRED provides accessible customer support through phone and email channels. Clients can reach out to their support team by calling +442081230997 or sending inquiries to nfo@adffx.com and service@adffx.com.

This multi-channel approach ensures that clients have various means to seek assistance, whether they have questions, need help with technical issues, or require general support related to their trading activities.

Conclusion

In conclusion, AKINDRED is an Australian-based financial company established in 2014 and regulated by the Australian Securities & Investment Commission (ASIC). Offering a Various range of financial products, including Forex, commodities, indices, cryptocurrencies, CFDs, and ETFs, AKINDRED meets a wide array of trading preferences.

Their pricing structure features spreads ranging from 0 to 0.6 pips and commissions from 3% to 15%. Clients have access to popular trading platforms Meta Trader 4 and Meta Trader 5, along with a demo account for practice.

With multiple customer support channels and various deposit and withdrawal methods, AKINDRED strives to provide a comprehensive trading experience for its clients, though potential concerns include the higher minimum deposit requirement and varying commission rates.

FAQs

Q: What regulatory authority oversees AKINDRED?

A: AKINDRED is regulated by the Australian Securities & Investment Commission (ASIC) and holds an Institution Forex License (STP) with license number 446375.

Q: What financial products can I trade with AKINDRED?

A: AKINDRED offers a wide range of products, including Forex, commodities, indices, cryptocurrencies, CFDs, and ETFs.

Q: What are the commission rates at AKINDRED?

A: AKINDRED's commission rates can vary, ranging from 3% to 15%. The specific rate may depend on factors such as the type of account, trading instruments, and trading volume.

Q: Which trading platforms are available at AKINDRED?

A: AKINDRED provides access to Meta Trader 4 and Meta Trader 5, two popular and versatile trading platforms.

Q: Does AKINDRED offer a demo account for practice trading?

A: Yes, AKINDRED provides a demo account for clients to practice and test their trading strategies without risking real capital.

Keywords

- 10-15 years

- Regulated in Australia

- Institution Forex License (STP)

- Suspicious Scope of Business

- Medium potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now