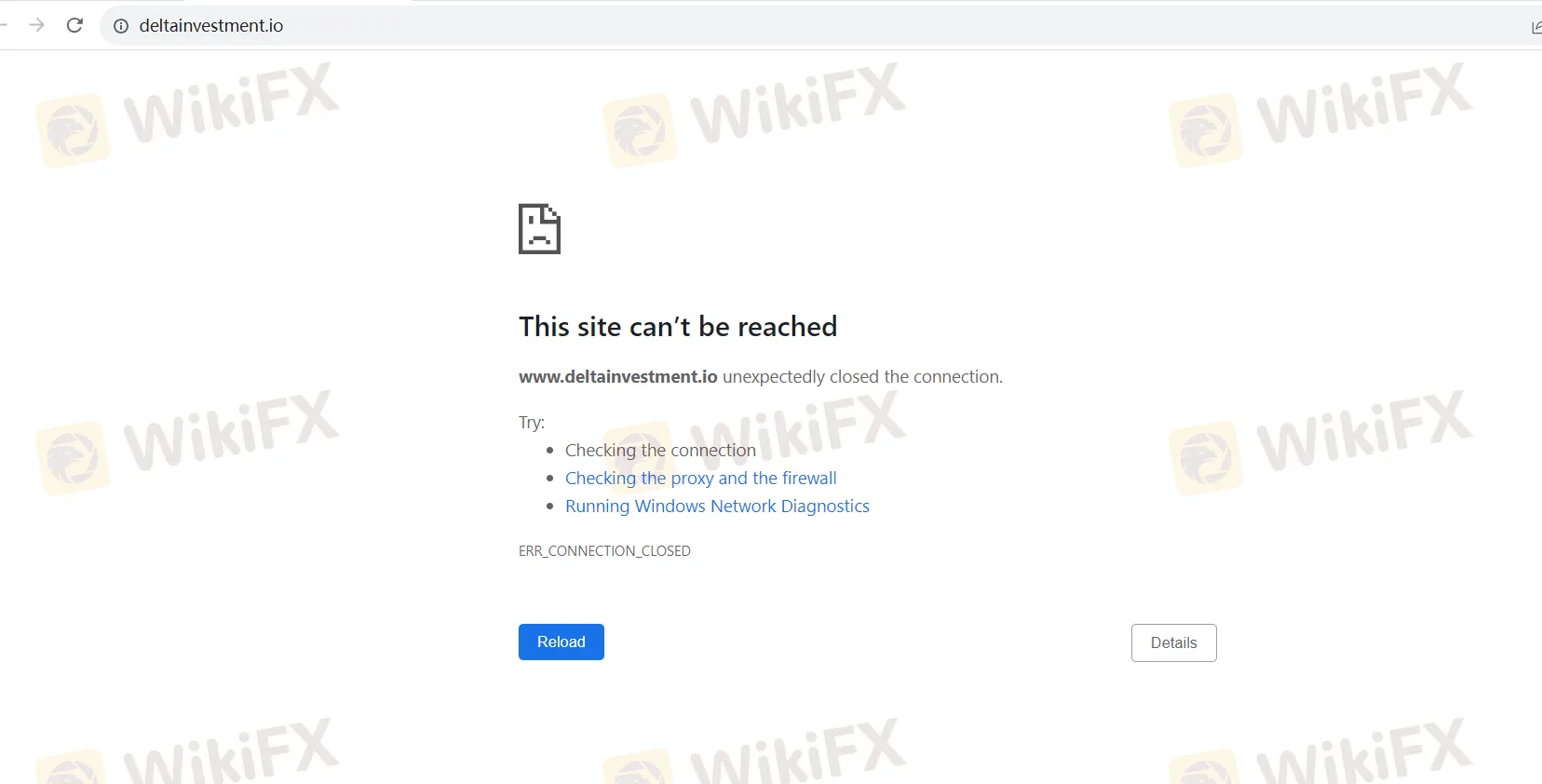

Score

Delta Invest

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.deltainvestment.io

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed Delta Invest also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

deltainvestment.io

Server Location

Lithuania

Website Domain Name

deltainvestment.io

Server IP

5.199.174.240

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Company Name | Delta Invest |

| Regulation | Not regulated |

| Maximum Leverage | Up to 1:1000 |

| Spreads | EUR/USD: 1.2 pips, GBP/JPY: 2.5 pips, Bitcoin (BTC/USD): $1.5, S&P 500 Index: 0.5 points |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Currencies (Forex), ETFs, Indices, Cryptocurrencies |

| Account Types | Live, Demo |

| Demo Account | Available |

| Customer Support | Email support (info@deltainvestment.io), negative tone regarding transparency and accessibility |

| Payment Methods | Bank Wire Transfer, Credit Card, Cryptocurrency (Deposits and withdrawals) |

| Educational Tools | None |

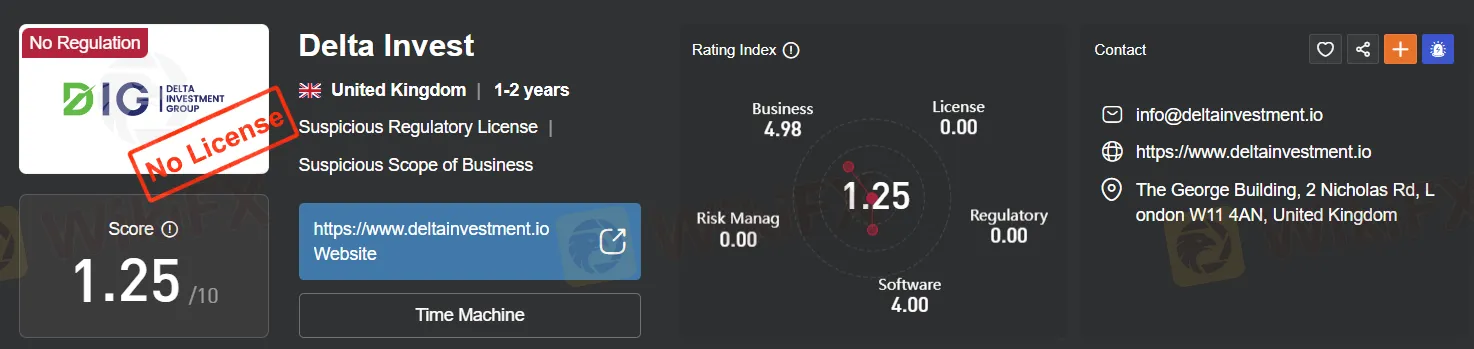

| Website Status | Website downtime reported |

| Reputation (Scam or Not) | Concerns raised due to lack of regulation and negative user feedback |

Overview

Delta Invest, an unregulated brokerage based in the United Kingdom, presents a concerning profile for potential investors. While it offers access to a variety of tradable assets, including currencies, ETFs, indices, and cryptocurrencies, its lack of regulation is a significant red flag for those seeking a secure trading environment. With a maximum leverage of up to 1:1000 and spreads, the broker may attract traders looking for higher returns, but this comes with increased risk. The absence of educational resources limits traders' ability to enhance their skills. Furthermore, negative user feedback and concerns about difficulties in withdrawing funds contribute to a less-than-stellar reputation. Additionally, the reported website downtime raises questions about accessibility and reliability. All these factors should give investors pause and encourage them to explore more reputable and regulated alternatives.

Regulation

Delta Invest is not regulated by any recognized financial authority, which raises concerns about its credibility and safety. Regulated brokers are subject to oversight and adhere to strict standards, providing investor protection.

The absence of regulation in the case of Delta Invest makes it untrustworthy, as it lacks the supervision and safeguards of regulated entities. Negative user reviews, particularly regarding difficulties in withdrawing funds, further highlight the potential risks associated with this broker.

In summary, Delta Invest's lack of regulation and negative user feedback make it an unwise choice for investors. When considering financial institutions, prioritize those with proper regulation to ensure the safety of your funds. Share negative experiences to protect fellow investors from potential harm.

Pros and Cons

Delta Invest, as a brokerage service, has both strengths and weaknesses that traders should consider before engaging with the platform. On the positive side, Delta Invest offers a diverse range of market instruments, enabling traders to access various asset classes. Additionally, the high leverage of up to 1:1000 can attract traders looking for potential higher returns. However, the absence of regulation raises significant concerns about safety and credibility. Negative user feedback, particularly regarding difficulties in withdrawing funds, further underscores these risks. The lack of educational resources is also a notable drawback for traders seeking to expand their skills. Overall, potential investors should exercise caution and explore alternatives that prioritize regulatory compliance and investor education.

| Pros | Cons |

|

|

|

|

|

|

|

Market Instruments

Delta Invest offers a range of market instruments for traders to engage in financial markets. These instruments cover various asset classes, providing traders with opportunities to diversify their portfolios and speculate on price movements across different markets. Here is a description of the market instruments typically offered by brokers like Delta Invest:

Currencies (Forex): Delta Invest offers access to the foreign exchange market, allowing traders to participate in forex trading. This involves the exchange of one currency for another, with traders speculating on currency pair movements, such as EUR/USD, GBP/JPY, or USD/JPY. The forex market is known for its high liquidity and 24-hour availability.

Exchange-Traded Funds (ETFs): ETFs are investment funds that Delta Invest provides, enabling traders to invest in a diversified portfolio of assets, including stocks, bonds, commodities, and more. ETFs offer flexibility and diversification, making them a popular choice for investors seeking exposure to specific sectors or markets.

Indices: Delta Invest offers trading opportunities in stock market indices, such as the S&P 500, Dow Jones, or NASDAQ. Traders can use Index CFDs to speculate on the overall performance of these indices, taking long or short positions to profit from market movements.

Cryptocurrencies: Delta Invest caters to the growing demand for cryptocurrency trading by offering various cryptocurrency pairs. Traders can engage in the price movements of digital currencies like Bitcoin, Ethereum, Litecoin, and more. Cryptocurrency trading provides opportunities for both short-term and long-term strategies.

Delta Invest provides access to these market instruments through its trading platform, offering traders the tools and resources needed to analyze markets, execute trades, and manage their portfolios effectively. It's important for traders to thoroughly understand the specific instruments, leverage, spreads, and associated fees offered by Delta Invest before engaging in trading activities. Additionally, staying informed about market conditions and conducting proper research is crucial for successful trading in these diverse markets.

Account Types

Delta Invest offers two main types of trading accounts: Live and Demo.

Live Account:

Real money trading in actual financial markets.

Involves risk and potential rewards.

Access to the full range of trading instruments.

Live customer support.

Withdraw and deposit real funds.

Demo Account:

Practice trading with virtual funds.

Simulates real market conditions.

An educational tool for learning and testing strategies.

No financial risk as no real money is involved.

Time-limited access, typically for practice purposes.

Both account types serve specific purposes, with live accounts for real trading and demo accounts for practice and skill-building. Delta Invest offers flexibility for traders to switch between these accounts.

Leverage

Delta Invest offers a maximum trading leverage of up to 1:1000. Leverage in trading allows traders to control a larger position size with a relatively smaller amount of capital. While high leverage can amplify potential profits, it also increases the risk of significant losses, making it important for traders to use leverage judiciously and employ proper risk management strategies.

Spreads and Commissions

Delta Invest offers a variety of spreads and commission structures to cater to the needs of different traders:

Spreads:

EUR/USD: The spread for the EUR/USD currency pair is 1.2 pips. This represents the difference between the buying (ask) price and selling (bid) price when trading the Euro against the US Dollar.

GBP/JPY: For the GBP/JPY currency pair, the spread is 2.5 pips. This indicates the cost associated with entering trades involving the British Pound and the Japanese Yen.

Bitcoin (BTC/USD): When trading Bitcoin against the US Dollar (BTC/USD), the spread is $1.5. This is the price difference between buying and selling Bitcoin in US Dollars.

S&P 500 Index: The spread for the S&P 500 Index is 0.5 points. This spread represents the difference between the buying and selling prices for contracts based on the performance of the S&P 500 stock index.

Spreads are essential considerations for traders, as they influence the cost of entering and exiting positions in various financial instruments. The specific spreads mentioned above can vary depending on market conditions, trading platform, and the broker's policies.

Commissions:

Forex pairs: Delta Invest offers commission-free trading for forex pairs. Traders can engage in forex trading without incurring additional commission charges beyond the spreads.

Cryptocurrencies: When trading cryptocurrencies, such as Bitcoin, Delta Invest charges a commission of 0.2% per trade. This commission is calculated based on the trade's transaction value and is applied to both buying and selling.

Stock CFDs: For trading Stock Contracts for Difference (CFDs), there is a commission of $0.10 per share. This commission is levied for each share traded as part of the CFD contracts.

ETFs: Delta Invest provides commission-free trading for ETFs. Traders can access Exchange-Traded Funds without paying additional commissions.

Indices: Similar to ETFs, trading indices through Delta Invest is commission-free, allowing traders to speculate on index movements without commission charges.

These spreads and commission structures are illustrative examples and may not reflect the actual costs offered by Delta Invest or any specific broker. It's crucial for traders to thoroughly review the broker's fee schedule and terms and conditions to understand the exact costs associated with their trading activities. Additionally, brokers may offer various account types with different fee structures, so traders should choose an account that aligns with their preferences and trading strategies.

Deposit & Withdrawal

Deposit Methods:

Bank Wire Transfer: Transfer funds securely from your bank account to your trading account.

Credit Card: Use Visa or Mastercard for quick and easy deposits.

Cryptocurrency: Deposit with Bitcoin, Ethereum, and other supported cryptocurrencies.

Withdrawal Methods:

Bank Wire Transfer: Safely withdraw your trading profits to your bank account.

Credit Card: In some cases, withdraw funds back to your credit card.

Cryptocurrency: Withdraw funds in the same cryptocurrency you used for deposits.

Specific fees, processing times, and policies may apply, so traders should refer to Delta Invest's official website and contact customer support for precise details.

Trading Platforms

Delta Invest provides traders with the MetaTrader 4 (MT4) trading platform, a powerful and user-friendly tool for executing trades and conducting technical analysis. With MT4, traders have access to a customizable workspace that offers a range of charting tools, including multiple timeframes and a diverse set of technical indicators. The platform enables the execution of various order types, from market orders to pending orders, facilitating precise trade entries and exits. Additionally, MT4's user-friendly interface makes it suitable for traders of all experience levels, while its flexibility allows for efficient customization to meet individual trading preferences.

Customer Support

Delta Invest's customer support, as reflected by their provided email address (info@deltainvestment.io), is disappointingly lacking in transparency and accessibility. The use of a generic email address suggests a lack of dedicated customer service channels and raises concerns about the responsiveness and reliability of their support team. In today's digital age, traders expect brokers to provide multiple avenues for reaching customer support, such as live chat, phone support, or a dedicated customer service portal. The absence of these communication channels may leave traders feeling unsupported and frustrated, especially in urgent situations where prompt assistance is crucial. Overall, Delta Invest's customer support, as indicated by their email address, falls short of industry standards and may deter traders seeking efficient and responsive assistance.

Educational Resources

Delta Invest's lack of educational resources is a notable drawback for traders seeking to enhance their knowledge and skills in the financial markets. Without comprehensive educational materials, traders may struggle to understand market dynamics, develop effective trading strategies, or make informed decisions. Many reputable brokers offer a range of educational resources, including webinars, tutorials, articles, and market analysis, to support their clients in achieving trading success. Delta Invest's absence of such resources can leave traders feeling ill-equipped and potentially hinder their trading progress. In a competitive market, a broker's commitment to trader education is often seen as a valuable aspect of their service, and the absence of these resources may deter traders seeking to expand their trading expertise.

Summary

Delta Invest presents significant concerns for potential investors due to a lack of regulation, negative user feedback, and an absence of educational resources. The absence of regulatory oversight raises doubts about the credibility and safety of this broker, while unfavorable user reviews, especially related to difficulties in withdrawing funds, underscore potential risks. Additionally, the lack of educational resources hinders traders' ability to enhance their skills and make informed decisions. Furthermore, the perpetual downtime of its website raises questions about the broker's reliability. Overall, Delta Invest's overall offering falls short of industry standards, and investors are urged to exercise caution and consider safer alternatives.

FAQs

Q1: Is Delta Invest a regulated broker?

A1: No, Delta Invest is not regulated by any recognized financial authority, which raises concerns about its credibility and safety. Regulated brokers are subject to oversight and adhere to strict standards, providing investor protection.

Q2: What is the maximum leverage offered by Delta Invest?

A2: Delta Invest offers a maximum trading leverage of up to 1:1000. Leverage allows traders to control larger positions with a smaller amount of capital but also entails higher risk.

Q3: Are there educational resources available for traders at Delta Invest?

A3: No, Delta Invest lacks comprehensive educational resources, which can be a drawback for traders looking to enhance their knowledge and skills in financial markets.

Q4: What are the deposit and withdrawal methods supported by Delta Invest?

A4: Delta Invest supports various deposit methods, including bank wire transfer, credit cards, and cryptocurrencies. Withdrawals can also be made through bank wire transfer, credit cards, or cryptocurrencies.

Q5: How can I contact Delta Invest's customer support?A5: Delta Invest provides a generic email address (info@deltainvestment.io) for customer support, but it lacks transparency and accessibility. Traders may find it challenging to reach out for assistance via this channel.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now