Score

GW

Cyprus|5-10 years|

Cyprus|5-10 years| https://www.globiawealth.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:Globia Wealth Ltd

License No. 318/17

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Cyprus

CyprusUsers who viewed GW also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- Global Business

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

globiawealth.com

Server Location

United States

Website Domain Name

globiawealth.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2016-07-22

Server IP

154.93.237.102

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Company Name | GW |

| Regulation | Unregulated |

| Minimum Deposit | $100 (Basic Account), $10,000 (Premium Account), $50,000 (VIP Account) |

| Maximum Leverage | Up to 1:100 |

| Spreads | Vary by account type (e.g., starting from 2 pips for Basic Account) |

| Trading Platforms | MetaTrader 4 (MT4), proprietary Webtrader platform (presumed) |

| Tradable Assets | Forex, Commodities, Stock Indices, Individual Stocks, Cryptocurrencies (may vary) |

| Account Types | Basic, Premium, VIP |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | Phone: +357 22 28 38 58, Email: info@globiawealth.com (unresponsive) |

| Payment Methods | Wire Transfers, Cryptocurrencies, unclear Credit/Debit card deposits |

| Educational Tools | Not provided |

| Website Status | Reported as down, with allegations of being a 'scam' broker |

Overview

GW, an unregulated brokerage platform, operates with a concerning lack of oversight. It offers a range of account types with varying minimum deposit requirements but fails to provide clear information about several crucial aspects. The unresponsiveness of its customer support, marked by an inactive website and vague communication via email, adds to its drawbacks. Furthermore, the absence of educational resources limits traders' access to valuable training. Notably, there are alarming reports and allegations labeling GW as a 'scam' broker, raising significant doubts about its legitimacy and trustworthiness. Traders should approach GW with extreme caution and consider alternative options that offer more transparency and reliability.

Regulation

GW, a brokerage platform, has sparked concerns due to its unregulated status in the financial industry. The absence of regulatory oversight is a cause for worry as it means investors might face heightened risks when conducting financial transactions on this platform. Regulated brokers are bound by stringent rules and regulations crafted to safeguard the interests of traders, including ensuring the security of funds and promoting fair trading practices. Conversely, unregulated brokers like GW might not be subject to the same stringent standards, potentially exposing clients to greater risk, including the possibility of encountering fraudulent activities or insufficient customer protection measures. Therefore, it is crucial for individuals contemplating GW or any unregulated broker to exercise caution, engage in comprehensive research, and carefully consider the potential risks before committing their capital.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

GW offers a diverse range of trading instruments and multiple account types, providing flexibility to traders. It also presents various leverage options to suit different risk tolerances. However, its unregulated status raises safety concerns, and the customer support is marked by inadequacy and unresponsiveness. Additionally, the unclear deposit and withdrawal processes, coupled with the lack of educational resources, leave much to be desired. Troubling reports labeling GW as a 'scam' broker and limited transparency cast doubt on its reliability. Traders should exercise extreme caution and conduct thorough research before considering GW as their broker of choice.

Market Instruments

GW provides a diverse selection of trading instruments across various asset classes, catering to traders with different strategies and preferences. Here's an organized breakdown of their offerings:

Forex Trading:

Clients can access major currency pairs, including EUR/USD, GBP/USD, USD/JPY, and AUD/USD. These represent some of the most widely traded currencies globally.

For traders with specialized interests, GW offers minor currency pairs like EUR/GBP, GBP/JPY, AUD/CAD, and NZD/JPY. These involve currencies from economies with less global influence.

Commodities Trading:

GW extends its offerings to commodities such as gold, silver, crude oil, and natural gas. These are popular choices among traders seeking diversification.

Stock Indices:

Traders can participate in the movement of popular stock indices like the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. These indices represent the performance of various segments of the stock market.

Individual Stocks:

GW allows access to individual stocks from renowned companies like Apple Inc., Google, Microsoft, and Amazon. Traders can engage directly with these well-known stocks.

Cryptocurrency Trading:

Additionally, the broker may offer trading instruments related to cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. These digital assets have gained popularity in recent years.

Account Types

GW caters to traders of diverse experience levels by offering three distinct tiers of trading accounts:

Basic Account:

Tailored for novice traders, the Basic Account requires a minimum deposit of $100.

It grants access to essential platform features and offers leverage of up to 1:20.

Spreads start from 2 pips.

Inclusions: Major currency pairs, limited options for trading commodities and indices, basic customer support, access to the MetaTrader 4 platform, and fundamental educational resources.

Premium Account:

Designed for experienced traders, the Premium Account mandates a minimum deposit of $10,000.

Traders enjoy a broader range of trading instruments with leverage of up to 1:50.

Spreads start from 1 pip.

Inclusions: Major and minor currency pairs, an expanded selection of commodities, indices, select individual stocks, a dedicated account manager, advanced charting tools, market analysis, priority customer support, and access to premium educational resources and webinars.

VIP Account:

Tailored for high-net-worth individuals and seasoned traders, the VIP Account necessitates a minimum deposit of $50,000.

It offers a comprehensive range of trading instruments across multiple asset classes with leverage of up to 1:100.

Spreads start from 0.1 pips.

Inclusions: A personalized VIP account manager, exclusive research reports, custom trading strategies, invitations to VIP events, premium customer support, and access to advanced trading tools and signals.

These tiered account options provide flexibility and cater to traders with varying levels of expertise, ensuring that traders can select the account that aligns best with their trading objectives and experience.

Leverage

GW extends leverage options of up to 1:100 to traders, enabling them to magnify their trading positions. However, it's imperative for traders to approach higher leverage ratios with caution, as they entail elevated risk levels. Prudent consideration of factors such as risk tolerance, trading strategy, and the current state of the market is essential when harnessing leverage. For precise information regarding available leverage options and their specific requirements, we recommend referring to GW's official website or reaching out to their customer support for clarification.

Spreads and Commissions

Spread Structures at GW:

GW offers traders various spread structures through its account offerings, providing flexibility based on individual preferences and trading styles. These spread options are designed to suit the diverse needs of traders:

In the Basic Account, traders will find a straightforward trading environment where no additional commissions are imposed on trades. This account is an excellent choice for those who prefer simplicity and transparency in their trading conditions.

On the other hand, the Premium Account presents a balance between competitive spreads and moderate commission fees. Traders opting for this account will be subject to a $5 commission per standard lot traded. This structure may be appealing to a specific segment of traders looking for a competitive edge while keeping commission costs manageable.

For those who prioritize highly competitive spreads while benefiting from reduced commission charges, the VIP Account is the ideal choice. This account offers a lower commission rate of $3 per standard lot traded. Traders seeking to maximize their profit potential while maintaining cost efficiency may find this option attractive.

Commission Structures at GW:

In addition to spread structures, GW's account offerings also come with varying commission structures that can significantly influence a trader's overall trading costs:

The Basic Account maintains a straightforward approach by not imposing additional commissions on trades. This account is tailored to traders who prefer a transparent and commission-free trading experience.

In contrast, the Premium Account introduces a $5 commission per standard lot traded. This commission structure strikes a balance between competitive spreads and moderate commission fees, catering to specific trader preferences.

The VIP Account further enhances the cost-efficiency aspect with a lower commission rate of $3 per standard lot traded. Traders who value highly competitive spreads while enjoying reduced commission charges may find this option well-suited to their trading objectives.

These distinct spread and commission structures offered by GW empower traders to select an account type that precisely aligns with their individual trading preferences, risk tolerance, and overall trading strategies.

Deposit & Withdrawal

GW provides multiple deposit methods, encompassing Wire Transfers and cryptocurrencies. However, there are noteworthy aspects to consider regarding these processes:

Deposits:

While GW offers a range of deposit methods, there are concerns regarding the minimum deposit requirement and the handling of Credit/Debit card deposits. The minimum deposit requirement lacks clarity, potentially leaving traders uncertain about the initial funding amount. Additionally, the mention of Credit/Debit card deposits may be misleading, as clients are often required to first purchase cryptocurrencies before transferring them, introducing complexity to the process. These issues raise concerns and potential risks for traders, especially those seeking a straightforward deposit experience.

Withdrawals:

The withdrawal process at GW lacks transparency, with critical details obscured. This lack of transparency can lead to confusion and potential delays or rejections when traders attempt to withdraw their funds. It is imperative for traders to exercise extreme caution when considering GW as their chosen platform due to these issues surrounding deposits and withdrawals. Clarity and transparency in these processes are crucial for ensuring a smooth and reliable trading experience.

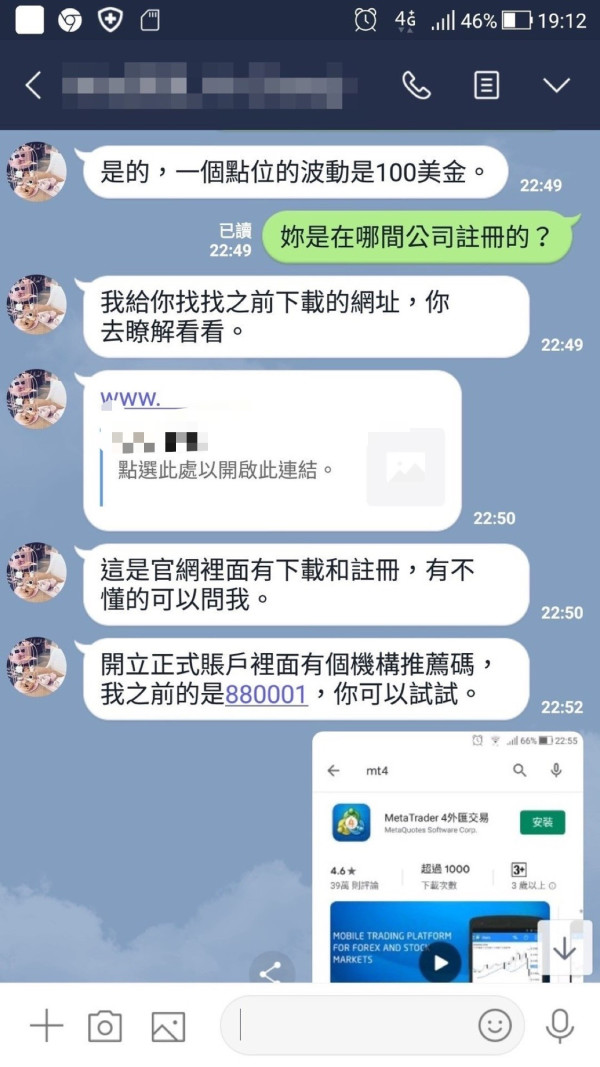

Trading Platforms

GW provides traders with flexibility by offering multiple trading platforms. While specific details about available platforms are not explicitly mentioned, it is presumed that they include the widely recognized MetaTrader 4 (MT4) and a proprietary Webtrader platform.

MT4 boasts comprehensive tools and features, including real-time market data, trade execution, chart analysis, and support for Expert Advisors (EAs). This familiarity benefits experienced traders.

The proprietary Webtrader platform offers convenience, accessible via web browsers, allowing traders to monitor markets and manage accounts from any device with internet access.

Customer Support

GW's customer support, which can be reached at +357 22 28 38 58 for English inquiries, and through email at info@globiawealth.com, unfortunately, falls far short of the expected standard. Contacting them via both phone and email can be a frustrating experience, with their responsiveness being disappointingly slow and their communication often lacking clarity. Traders and clients seeking assistance or resolution to issues are often left in a state of prolonged uncertainty and dissatisfaction. The lack of efficiency and professionalism in their customer support, whether through phone or email, is a significant drawback for those relying on timely and effective assistance.

Educational Resources

GW's absence of educational resources to aid traders in skill enhancement presents a significant limitation, depriving potential clients of access to valuable training and informational materials. Traders with a thirst for educational content should consider exploring alternative brokers that provide a more comprehensive and robust selection of learning materials.

Summary

GW, an unregulated brokerage platform, raises concerns due to the absence of regulatory oversight, potentially exposing investors to increased risks. While it offers a diverse range of trading instruments and multiple account types, the lack of clarity regarding minimum deposits, opaque withdrawal processes, and the reported unresponsiveness of its customer support undermine its reliability. Furthermore, the absence of educational resources limits traders' access to valuable training. Adding to these concerns, reports labeling GW as a 'scam' broker and the reported unavailability of its website cast significant doubts on its trustworthiness and legitimacy. Traders should exercise extreme caution when considering GW as their broker of choice.

FAQs

Q1: Is GW a regulated brokerage platform?

A1: No, GW operates as an unregulated brokerage platform, which can pose increased risks for traders due to the lack of regulatory oversight.

Q2: What account types does GW offer?

A2: GW caters to traders with three account types: Basic, Premium, and VIP, designed to suit different experience levels and preferences.

Q3: What is the minimum deposit for GW's Basic Account?

A3: The Basic Account requires a minimum deposit of $100, making it accessible to novice traders.

Q4: Does GW offer educational resources for traders?

A4: No, GW does not provide educational resources, limiting traders' access to training and information materials.

Q5: Is GW's website currently operational?

A5: No, GW's website is reported as being down, and there are reports labeling it as a 'scam' broker, raising significant concerns about its legitimacy.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Cyprus Straight Through Processing (STP) Revoked

- High potential risk

Comment 11

Content you want to comment

Please enter...

Comment 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

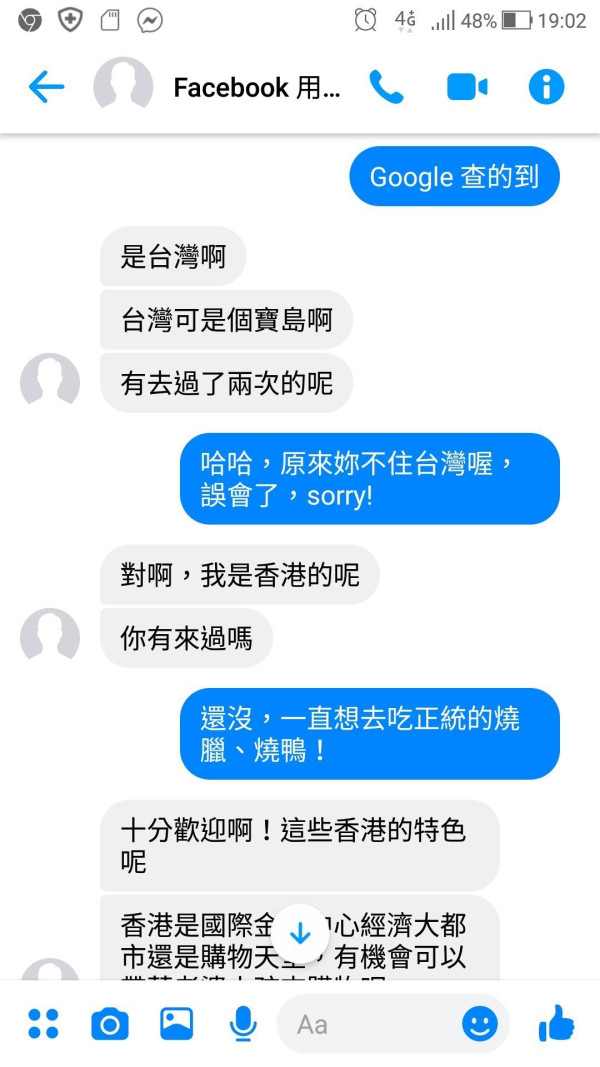

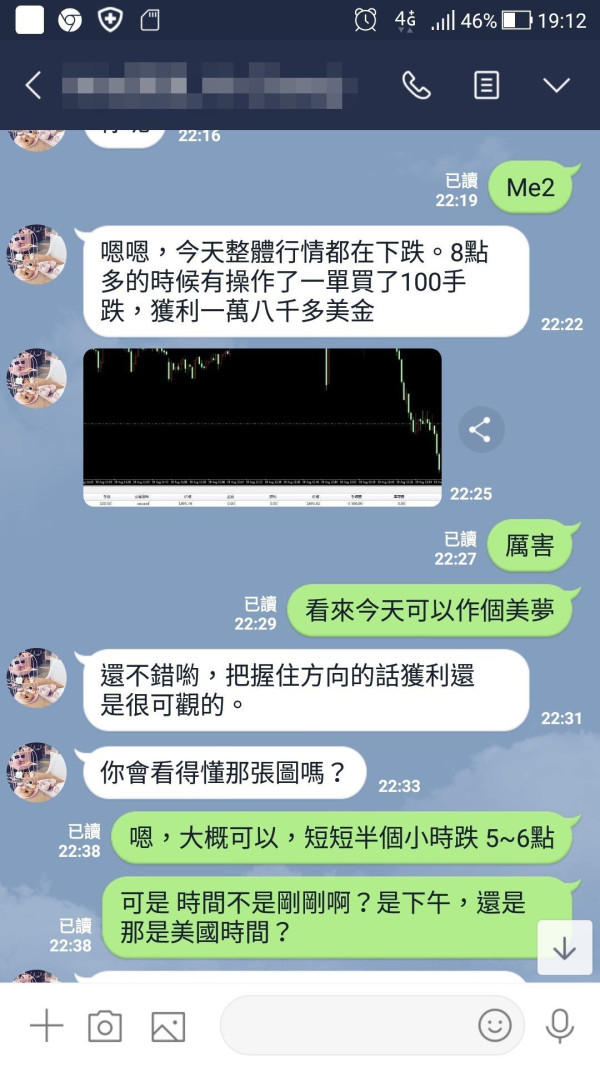

FX3004834243

Taiwan

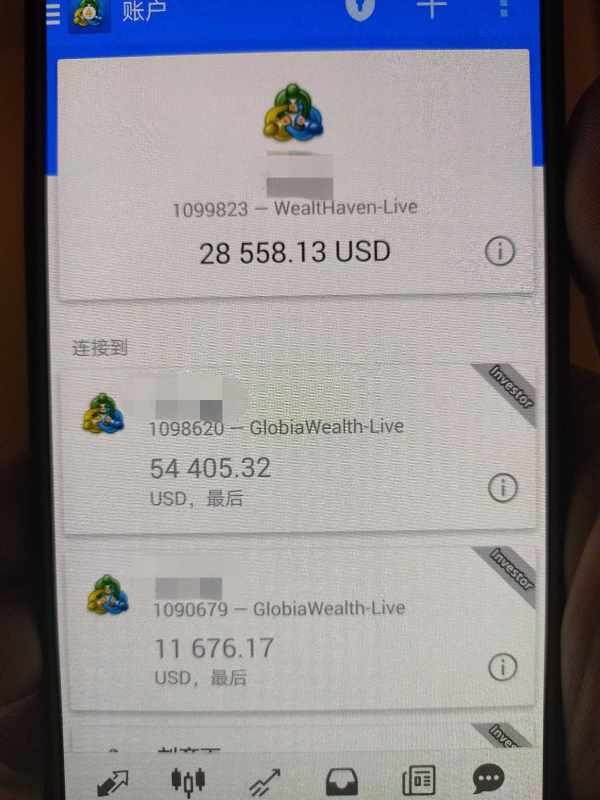

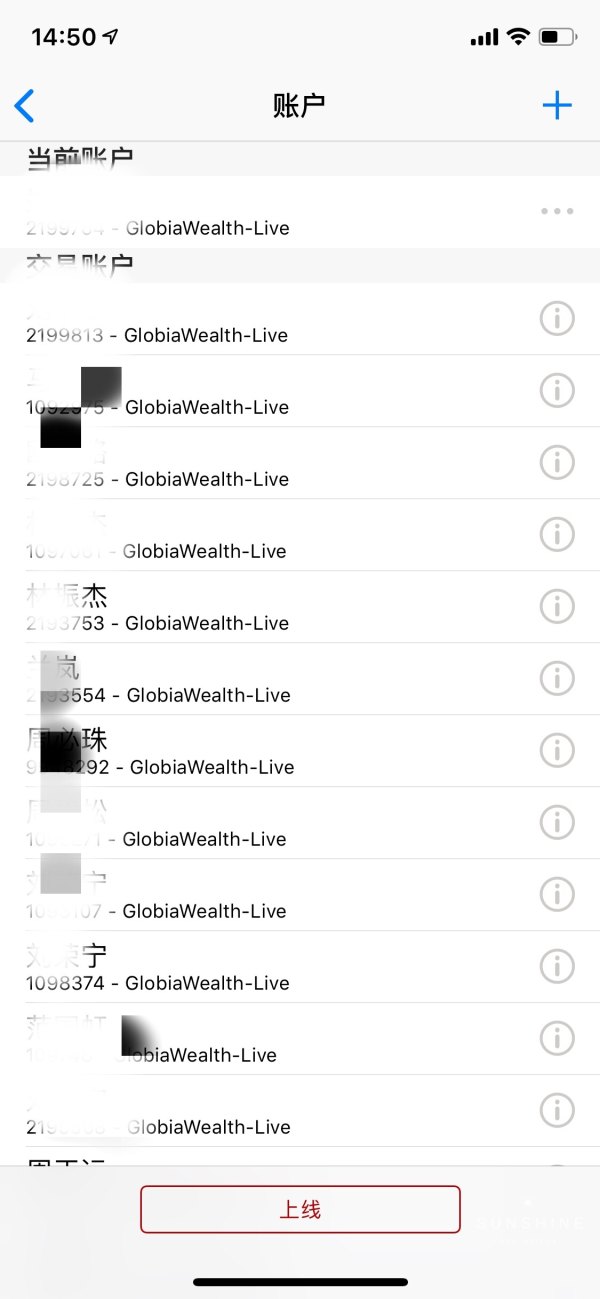

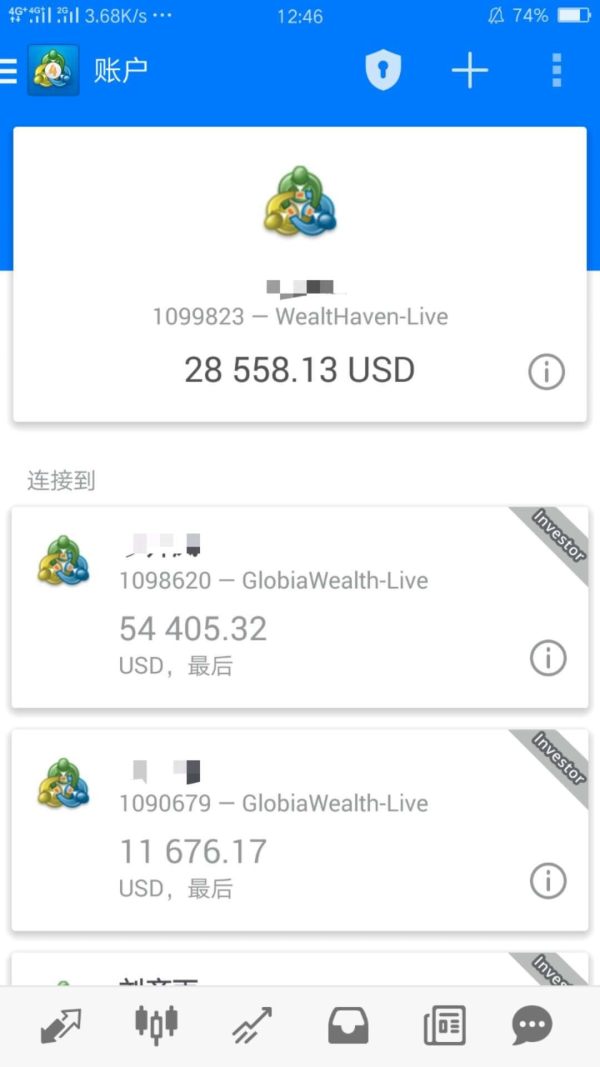

I knew a girl on the Internet and she chatted with me frequently. She led me to deposit but then disappeared.

Exposure

2021-11-04

大悲天龙

Hong Kong

Globia Wealth has offered no access to withdraw money since December 2018, and delays clients’ requests with various reasons. Now even the server can not be found

Exposure

2019-05-15

Vivian。

Hong Kong

I applied for a withdrawal on December 19th 2018 but it hasn’t arrived yet. Their service is missing.

Exposure

2019-05-10

大悲天龙

Hong Kong

Ever since 2018 December 19th, I can’t withdraw on it. They kept finding themselves excuses. Now I can’t even find their information on MT4.

Exposure

2019-05-10

FX5429501750

Hong Kong

The platform has been closed since December 19, 2018, leaving the company empty and its boss missing

Exposure

2019-02-15

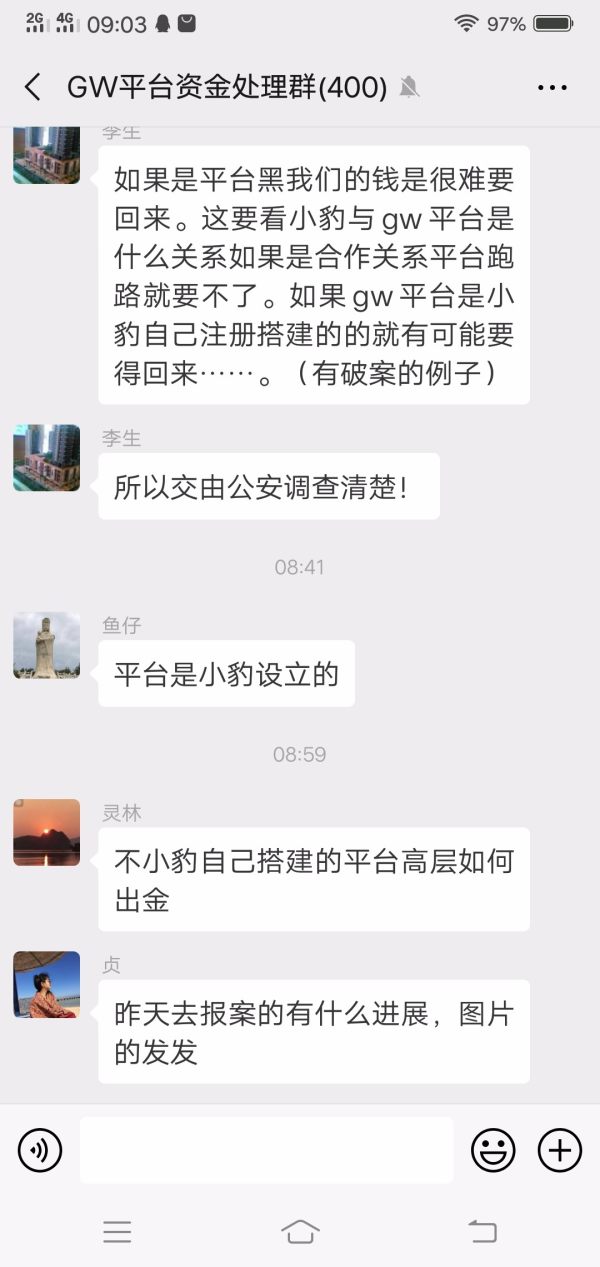

zhuqixing

Hong Kong

Gw platform may be a black platform, Chinese platform run, and is not with small leopard company intelligent trading partner

Exposure

2019-02-10

杰哥

Hong Kong

Application for gold issuance on February 1, 2019, the trading platform has been showing is withdrawing, please review

Exposure

2019-02-06

非云莫属

Hong Kong

Their Chinese website sent an announcement, saying their fund has been frozen by their regulatory authority. I can’t withdraw for a month.

Exposure

2019-01-25

WLP

Hong Kong

I visited the English website, where there used to be a announcement that the original platform Brisk Liquidity pretended to be GW. But the GWChinese website on the FXEYES is indeed this! I can't withdraw money now! How long should I wait?

Exposure

2019-01-21

zhuqixing

Hong Kong

Cyprus WG318/17 platform involves illegal operations. Perhaps the boss has absconded. The company has been frozen by the regulatory, since it do harm to others. Please stay away

Exposure

2019-01-20

zhuqixing

Hong Kong

The agency has been suspended from trading, and the funds have been frozen, how can it be unfrozen

Exposure

2019-01-19