Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

XEROMARKETS, a trading name of Xero Capital Markets Ltd, is an online Forex and CFD broker founded in 2017 and registered in St. Vincent and the Grenadines.

Zerodha is an Indian financial service company, member of NSE, BSE, MCX, MCX-SX that offers retail and institutional broking, currencies and commodities trading, mutual funds, and bonds. Founded in 2010, it is known for its discount pricing model and innovative use of technology. The company claims to be “India's first discount brokerage” having debuted the “discount broking” model in India that is popular in developed markets.

Here is the home page of this brokers official site:

Regulatory Information:

Xero Markets operates under Xero Capital Markets Ltd. However, the specific regulatory body overseeing their operations is not explicitly mentioned on the website. It's important to note that Xero Capital Markets does not offer its services to residents of certain jurisdictions such as Afghanistan, Cote dIvoire, Cuba, Iran, Libya, Myanmar, North Korea, Sudan, Puerto Rico, USA, Australia, Syria, Japan, and Ecuador.

Introduction of Pros and Cons:

XeroMarkets offers a variety of appealing features. They offer a wide range of trading instruments, including Forex, Indices, Commodities, and Cryptocurrencies. But, it is important to consider some drawbacks, such as the lack of specific educational resources and bonus offers.

Market Instruments

XEROMARKETS offers investors access to more than 77 tradable instruments across multiple asset classes, including forex, metals and energy.

Account Types

Apart from demo accounts, there are 3 live trading accounts available on the XEROMARKETS platform, namely XERO ECN, XERO REGULAR, and XERO XL, with minimum deposit requirements of $100, $10 and $10 respectively. Different accounts have different trading conditions.

Account Opening Process:

To open an account, visit the registration page at XeroMarkets, choose the type of account you want to open, select your country from the dropdown list, enter your phone number, read and confirm that you have understood and agree with all Terms & Conditions by checking the box, and click on the “REGISTER” button to submit your registration.

You can open real account to trade and open demo account to learn how to trade.

Leverage

The maximum leverage offered by XeroMarkets is 1:3000. Leverage in forex trading is a powerful financial tool thatallows traders to increase their market exposure beyond the initial investment. For instance, with a leverage of 1:3000, as offered by XeroMarkets, a trader can control a position worth $30,000 with an initial deposit of just $10. This gives traders the ability to potentially generate substantial profits from relatively small price movements. However, it's worth noting that leverage can also amplify losses if the market moves against the trader's position.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you. Unregulated brokers tend to offer high trading leverage to attract new traders.

Spreads & Commissions

The XeroMarkets brokerage firm provides three different types of trading accounts: XERO ECN, XERO REGULAR, and XERO XL. Each account type offers distinct features, including variations in spreads and commissions. Here are the details about the differences between these three accounts:

XERO ECN Account:

Spreads: The XERO ECN account offers spreads starting from 0.0 pips. This means that the difference between the bid and ask prices can be as low as zero pips for certain trading instruments.

Commission: With the XERO ECN account, there is a commission fee of $7 per lot traded. The commission is charged separately from the spreads.

Execution: This account type utilizes an Electronic Communication Network (ECN) execution model, which allows for direct access to liquidity providers and potentially tighter spreads.

XERO REGULAR Account:

Spreads: The XERO REGULAR account provides spreads starting from 1.3 pips. This means that the difference between the bid and ask prices can be as low as 1.3 pips for certain trading instruments.

Commission: The XERO REGULAR account does not charge any commission fees. Traders using this account type only pay the spreads.

Execution: This account type likely employs a market maker or straight-through processing (STP) execution model, where the broker acts as the counterparty to clients' trades.

XERO XL Account:

Spreads: The XERO XL account also offers spreads starting from 0.0 pips, similar to the XERO ECN account.

Commission: However, with the XERO XL account, there is a reduced commission fee of $5 per lot traded, which is lower compared to the XERO ECN account.

Execution: Like the XERO ECN account, the XERO XL account likely operates under an ECN execution model, providing direct access to liquidity providers and potentially tighter spreads.

Trading Platform

XEROMARKETS offers traders the most popular MT4 trading platform available today. MT4 is the preferred choice of 80% of forex traders worldwide, with powerful charting tools, and a large number of custom technical indicators. The MT4 platform has an intuitive interface, and well-designed charting tools, featuring options to run automated trading sessions via EA trading, which traders can easily make changes and can even be compiled on a specially designed editor.

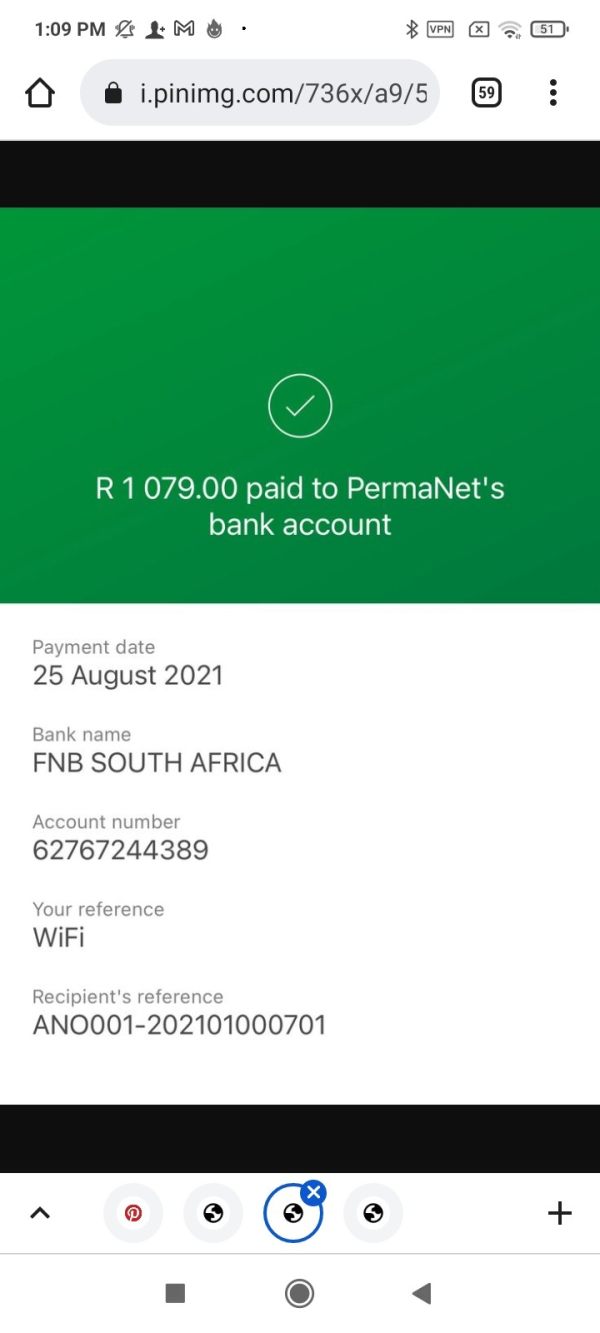

Deposit & Withdrawal

XEROMARKETS supports traders to access their accounts via Help2Pay, PayPal, Direct Bank Transfer, Visa, MasterCard, Maybank, Fasapay, Tether, Bitcoin, Local Depositor, and Bank Wire Transfer.

The minimum funding amount for card payments is $10. If your account is inactive for 6 months, an inactivity fee will apply.

Customer Support

XEROMARKETS customer support can be reached by telephone: +44 20 8123 5544, email: support@xeromarkets.com, or live chat. You can also follow this broker on social networks such as Twitter, Facebook, Instagram, YouTube, TikTok and LinkedIn.

User Experience and Additional Features:

In terms of user feedback, reviews are mixed. One user mentioned that XeroMarkets has the fast spread compared to other brokers but experienced problems with the dashboard system. Another user expressed concern about the withdrawal process, stating that they felt scammed because their withdrawal request was not approved and their communications were not answered.

However, please note that these are just two reviews, and user experiences can vary widely. I was not able to find a significant number of reviews to provide a more comprehensive view of user experiences with XeroMarkets. Furthermore, the platform's additional features beyond what I've already mentioned could not be determined within the time frame. I recommend conducting further research and perhaps trying out their demo account to see if their services align with your trading needs.

Frequently Asked Questions (FAQs)