简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Unable to make a withdrawal? WikiFX investigated the reliability of CLSA Premium

Abstract:What does CLSA Premium look like? “The broker only generated business from its Australian clients.” “CLSA Premium, fraud broker” With the experience of more than 15 years, CLSA Premium has played a significant role in the forex market. However, reports of withdrawal problems have increased recently. Traders are unlikely to feel comfortable if they have continued withdrawal problems. If you want to know whether CLSA Premium is a reliable forex broker or not, please continue to read.

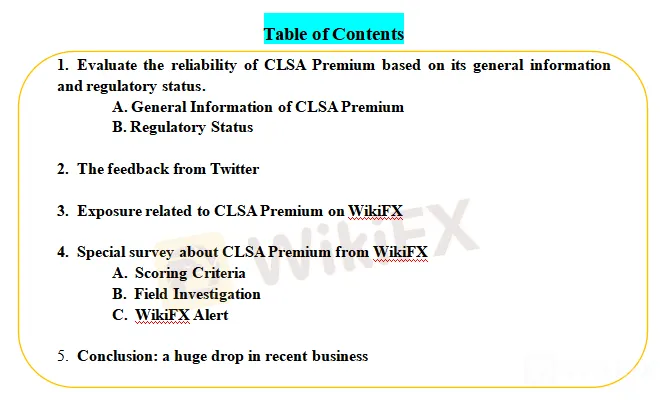

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of CLSA Premium based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether CLSA Premium is a scammer or not, we evaluated CLSA Premium from different aspects, such as regulatory status, exposure, etc.

1.Evaluate the reliability of CLSA Premium based on its general information and regulatory status.

(source: CLSA Premium website)

To understand CLSA Premium better, we explore CLSA Premium by analyzing two main perspectives:

A. General Info of CLSA Premium

B. Regulatory Status

A. General Info of CLSA Premium

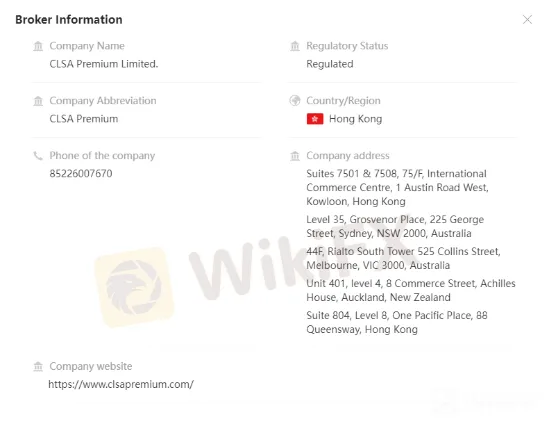

CLSA Premiums general info has been shown below:

General Info (source: WikiFX)

Risk management includes the measurement, assessment, and contingency strategy of risk. As we can see, CLSA Premium seems not to have good risk management, which means it may not have enough capital or good strategies to overcome the sudden risks. As a result, it can cause a huge loss. It may be one of the reasons why CLSA Premium recently has so many complaints from the traders.

(source : WikiFX)

As a HK based company, the website of CLSA Premium supports two languages: English, Chinese(simplified/traditional)

Market Instruments

Financial instruments available on the CLSA Premium platform are Forex trading, Precious Metals , Commodities, share CFD, and Credit Spread CFDs.

Leverage

The maximum leverage of forex products set by the Hong Kong subsidiary is 1:20.

Minimum Deposit

The minimum deposit requirement part is not fully disclosed on CLSA Premium. Most brokers will require a minimum initial deposit of $100 to $200 to start a standard account.

Trading Platform of CLSA Premium

It claims to use the MT5 trading platform. However, according to WikiFX, this broker is currently using non-MT4/MT5 Software.

Deposit & Withdrawal of CLSA Premium

The deposit and withdrawal methods support bank transfers, wire transfers, and deposits will usually reach the traders' trading account within one working day. Bank transfers/wire transfers, intermediary banks, or remittance banks may charge additional transfer fees, and the specific amount depend on the banks, no fees charged by the company.

Trading Hours

24 hours non-stop services from Monday system time 01:01 (GMT+3) to Friday system time 23:50 (GMT+3). Daylight saving hours apply.

(from WikiFX)

B. Regulatory Status

The legitimate license of CLSA Premium

CLSA Premium is a regulated broker. It holds an Australian Financial Services License issued by the Australian Securities and Investments Commission (AFSL No: 226602) to carry on a financial services business in Australia. CLSA Premium has other two entities in Hong Kong and New Zealand respectively: CLSA Premium International (HK) Limited is under the regulation of SFC in Hong Kong, with regulatory license number ALB893, and CLSA PREMIUM NEW ZEALAND LIMITED regulated by FMA in New Zealand, with regulatory license number 1762.

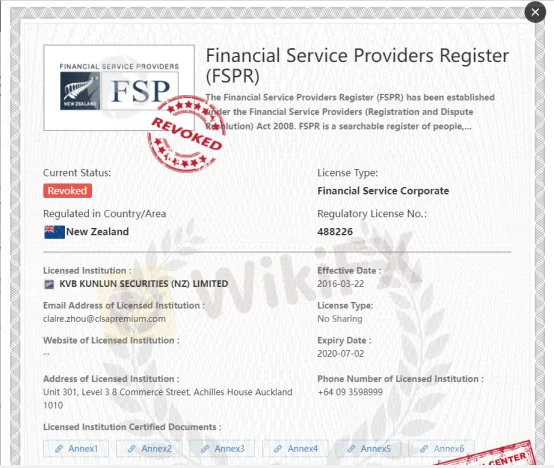

Please note that The regulatory status of New Zealand FSPR (license number: 488226) is abnormal, the official regulatory status is Revoked.

(source: WikiFX)

(source: WikiFX)

(source: WikiFX)

(source: WikiFX)

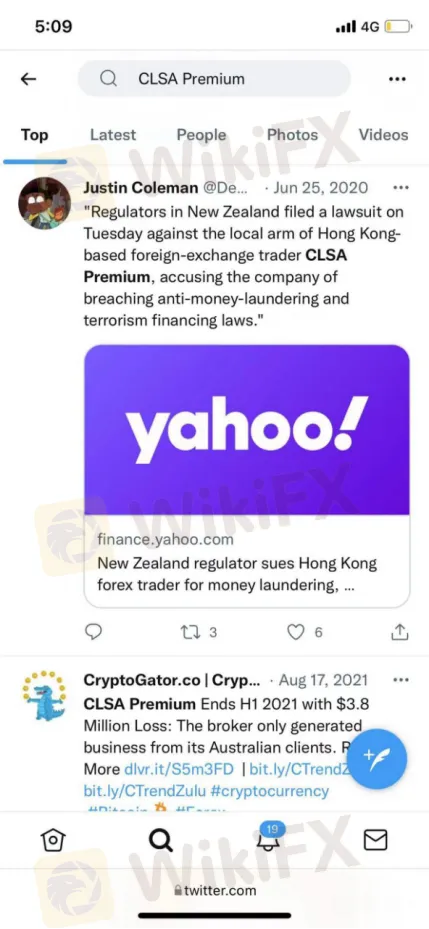

To figure out whether CLSA Premium is a scammer or not, we made a survey about CLSA Premium on Twitter.

(source:Twitter)

CLSA Premium seems to have an account on Twitter. However, this account didnt produce any tweet, and it has 0 follower and 0 following.

Other twitter revealed recently news related CLSA Premium, they are mainly negative. For example, one of twitter claims that CLSA Premium experienced a huge loss in business.

Last year a shareholder of the company floated a business wind-up proposal twice, but it got quashed both times by a majority of shareholders

Its business in New Zealand faced trouble as the New Zealand regulator imposed some strict conditions on its license. It also faced the penalty from the New Zealand Financial Market Authority.

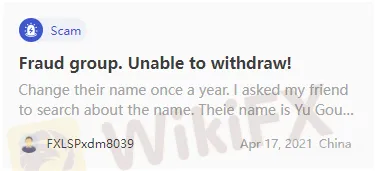

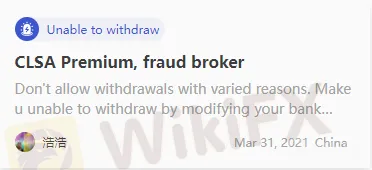

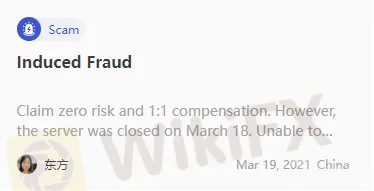

3.Exposure related to CLSA Premium on WikiFX

These complaints depict that CLSA Premium is a scammer. CLSA Premium used the pretty girl as bait to communicate with male traders and persuade them to open an account. They also offered some tempting deals, such as “zero risk”, to the traders in order to let them invest. After that, CLSA Premium is likely to freeze your account and steal your money when you invest. They refuse to withdraw with many excuses.

4.Special survey about CLSA Premium from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform,instruments etc |

| Risk Management index: the degree of asset security |

According to WikiFX, CLSA Premium has been given a decent rating of 7.68/10.

(source:WikiFX)

It seems that CLSA Premium is very poor at risk management. Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events.CLSA Premium seems not to have enough capital and good strategies to secure clients assets in the unstable market. This may be one of the reasons why CLSA Premium makes so many traders angry.

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

As of February 22rd, 2022, WikiFX didnt do a site survey on CLSA Premium.

C. WikiFX Alerts

| The number of complaints received by WikiFX against this broker reached 12 in the past 3 months. |

| The regulatory status of New Zealand FSPR (license number: 488226) is abnormal, the official regulatory status is revoked. |

| This broker exceeds the business scope regulated by New Zealand FSPR(license number: 488226)Financial Service Providers Register Non-Forex License. |

| Current data shows that this broker is using Non-MT4/5 Software |

(source: WikiFX)

5.Conclusion:

CLSA Premium is a regulated broker, and it has a long history in the forex market. However, it seems CLSA Premium suffered a huge loss in recent business. Due to its too many complaints, please do more research and assess the risk before you want to invest in this broker. It is a better option to choose a regulated broker with few complaints. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Exness offers traders seamless experiences with its Exness Terminal and Exness Trade app, providing flexibility, advanced tools, and low-cost trading.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Rupee gains against Euro

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator