Fidelity Information

Fidelity Brokerage Services LLC is an online broker offering financial services to individual investors, employers, institutions, charitable donors and innovators. Fidelity manages employee benefit programs for over 22,000 businesses, and supports more than 13,500 financial institutions with investment and technology solutions to grow their businesses. Headquartered in Boston, Fidelity serves customers through 12 regional sites across the globe and more than 200 Investor Centers.

Pros and Cons

Fidelity offers a wide array of financial services and investment products, making it a versatile choice for investors. Its comprehensive range of account types, commission-free trading options, and innovative zero expense ratio index funds are significant advantages.

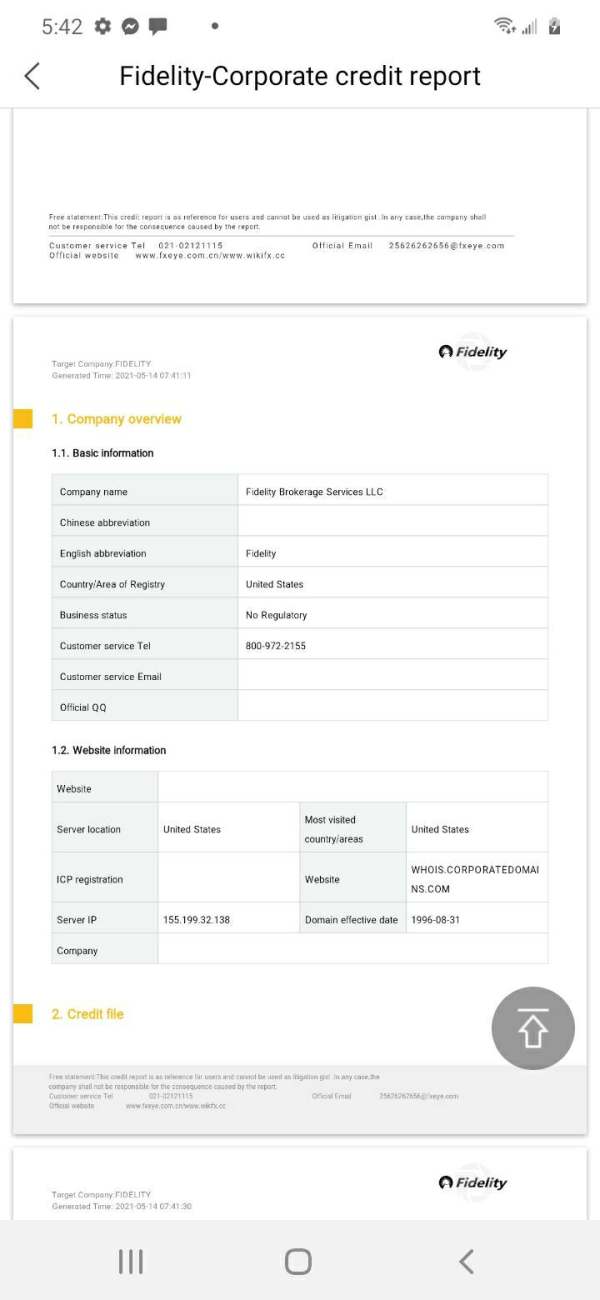

However, Fidelity's lack of regulatory oversight is a notable concern, as it raises questions about the safety and transparency of the platform. It's essential for potential investors to carefully weigh these pros and cons to determine if Fidelity aligns with their specific financial goals and risk tolerance.

Is Fidelity Legit?

Fidelity is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Fidelity carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

What Can I Trade on Fidelity?

Fidelity offers trading in mutual funds, ETFs, fixed income, bonds, CDs, options, stocks, and cryptos.

Account Types

Fidelity offers a comprehensive selection of account types to meet the diverse financial needs of its clients. Here's a structured overview of the various account types offered by Fidelity:

How to Open an Account?

Opening an account with Fidelity is a straightforward process:

Step 1: Visit the Fidelity website. Look for the “OPEN AN ACCOUNT” button on the homepage and click on it.

Step 2: Online Application: Visit Fidelity's official website and fill out the online application form with your personal information and desired account type.

Step 3: Choose Account Type: Select the specific type of account you want to open, such as an individual brokerage account or retirement account.

Step 4: Provide Documentation: Submit required documents for identity verification, like a government-issued ID and proof of your Social Security number.

Step 5: Fund Your Account: Once approved, fund your account using various options, including electronic transfers, checks, or asset transfers.

Step 6: Start Investing: Access Fidelity's platform to invest in stocks, bonds, mutual funds, ETFs, and more.

Step 7: Consider Fidelity Go: If you prefer a managed portfolio, explore Fidelity Go, their robo-advisor service.

Commissions & Fees

There are $0 commissions for online US stock, ETF, and option trades.

Commission-Free Trades: Fidelity offers commission-free online trading for U.S. stocks, ETFs, and options. Clients can execute online U.S. stock, ETF, and option trades with a commission of $0.01 per trade, along with an additional $0.65 per contract on options.

Zero Expense Ratio Index Funds: Fidelity introduced the industry's first zero expense ratio index mutual funds directly available to investors. These funds include the Fidelity® ZERO Total Market Index Fund, Fidelity® ZERO International Index Fund, Fidelity® ZERO Extended Market Index Fund, and Fidelity® ZERO Large Cap Index Fund.

Industry-Leading Value: Fidelity prides itself on offering industry-leading value to its clients. There are no account fees and no minimums required to open a retail brokerage account, including IRAs, making it accessible to a wide range of investors.

Trading Fees for Other Assets: Fidelity's fee structure includes $0 trading fees for all ETFs. For secondary trading of bonds and CDs, there is a fee of $1 per bond or CD, with U.S. Treasuries traded online being free. This fee structure provides potential savings, averaging around $15 per bond.

Zero Minimums for Fidelity Mutual Funds: Fidelity offers clients the opportunity to invest in Fidelity mutual funds with no minimum investment requirements. Additionally, clients can access hundreds of other funds with no transaction fees.

Trading Platforms

Fidelity offers a variety of trading platforms to meet the needs of different investors. These platforms include:

- Fidelity.com: Fidelity.com is Fidelity's web-based trading platform. It is easy to use and offers a variety of features, including real-time quotes, charting tools, and news and research.

- Active Trader Pro: Active Trader Pro is Fidelity's desktop trading platform. It is designed for active traders and offers a variety of features, including advanced charting tools, order management tools, and streaming news and research.

- Fidelity Mobile: Fidelity Mobile is Fidelity's mobile trading app. It is easy to use and offers a variety of features, including real-time quotes, charting tools, and the ability to place trades.

Deposit & Withdrawal

There are several ways to deposit money to a Fidelity account:

Send money to or from a bank account with an electronic funds transfer (EFT);

Wire money from a bank or third party account;

Deposit a check via mobile upload or mail a paper check;

Transfer money from one Fidelity account to another;

Transfer money via a third-party payment app like Venmo® or PayPal®.

Educational Resources

Fidelity offers a variety of educational resources to help investors learn about the markets and how to invest. These resources include:

- Learning Center: The Learning Center is a comprehensive resource for investors of all levels of experience. It offers articles, videos, and interactive tools on a variety of topics, including investing basics, technical analysis, and fundamental analysis.

- Webinars: Fidelity offers regular webinars on a variety of topics, including market updates, investment strategies, and retirement planning. Webinars are a great way to learn from experts and get your questions answered in real time.

- Online courses: Fidelity offers a variety of online courses on a variety of topics, including investing basics, technical analysis, and fundamental analysis. Online courses are a great way to learn at your own pace and in your own time.

ttim

Taiwan

I listened to what netizens said before, and when I wanted to withdraw money after investing, I had to go through a bunch of procedures, including paying taxes and upgrading to a premium membership. It all cost money. After I paid the money and tried to withdraw money, I changed my fund password wrong. Changing the fund password also cost me a lot of money. I can’t get my NT$280,000 back. I have no choice but to call the police. I want to know if Fidelity Coin has this APP. I checked the website before. It was completely down and it came out again after a few months.

Exposure

2023-11-29

FX9595829302

United States

I have deposited big money and made it more than double but for no reason trading company doesn’t allow me to withdraw and Has suspended my account

Exposure

2021-05-22

FX2783420143

United States

I mean it's horrible for a person to drive with out all of his credentials so what's the difference

Exposure

2021-05-14

Hohokam

Singapore

New-age brokers tend to hide pertinent information or not be transparent about their trading conditions and costs. I prefer Fidelity because from the inception I knew what I should expect from a cost point of view. After all, all the information is easy to find on their website and my account manager is always addressing ways to help me cut costs and essentially be more profitable.

Positive

2023-03-16