简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUDUSD Outlook: US-China Trade War Nearing the End

Abstract:AUDUSD Outlook: US-China Trade War Nearing the End

AUD Price Analysis and Talking Points:

US-China Trade Deal Possible in Near-Term

Chinese GDP to Add to AUD Downside Risks.

See our quarterly AUD forecast to learn what will drive prices through mid-year!

US-China Trade Deal Possible in Near-Term

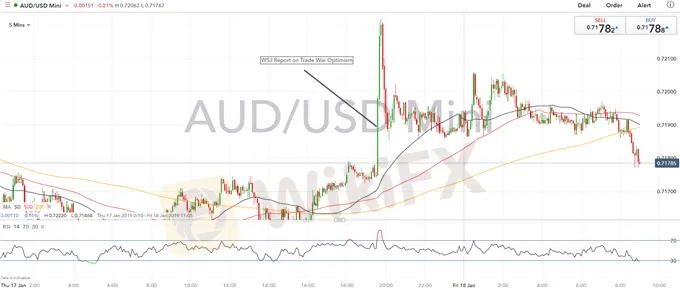

Overnight, equity markets and high beta currencies (AUD, NZD) initially rose on the back of reports from WSJ, which stated that US Treasury Secretary Mnuchin had suggested lifting import tariffs on China and potentially offering a tariff rollback in the upcoming trade discussions on January 30th. However, the treasury department had been quick to deny these rumors, while the WSJ report also highlighted that US Trade Representative Lighthizer (China hawk) had resisted this idea. Although, while these rumors may have been dismissed almost immediately, this does embolden the view that a US-China trade deal may be on the way in the near-term. As such, positive headlines in the run up to the January 30th meeting could increase the prospects of a deal.

AUDUSD PRICE CHART: 5-Minute Time-Frame (Jan 17-18th 2019)

Chart by IG

The initial spike higher in the Aussie had been quickly retraced. While trade war optimism can provide a undercurrent of support for the Australian Dollar, headwinds remain, most notably the slowdown in the Chinese economy. China will release their Q4 GDP figures next week, which is expected to dip to the lowest level since the financial crisis at 6.4%. Consequently, this will add to the woes that the Australian economy faces, thus keeping AUD upside limited and downside risks to 0.7000.

AUD TRADING RESOURCES:

See our quarterly AUD forecast to learn what will drive prices through mid-year!

Just getting started? See our beginners‘ guide for FX traders

Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australian Dollar Eyes Chinese Economic Data, Will AUD/USD React

Australian Dollar is in focus with Chinese economic data on tap to kick off APAC trading. Japan’s Q3 GDP crossed the wires at -3.0% q/q, missing analysts’ expectations of -0.7%. AUD/USD looks to move higher after a Bullish Engulfing candlestick pattern forms

Australian Dollar Battered Amid Market Turmoil Faces RBA and GDP

The Australian Dollar has got two huge economic data points on the schedule this week, but they may have to stray far from expectations to loosen overall risk appetites grip.

Australian Dollar Bears Rule But May Not Turn Up Heat This Week

The Australian Dollar remains close to notable lows against its US counterpart and the market is still betting on aggressive rate cuts from the RBA

Australian Dollar Outlook Grim on Yield Curve as Jobs Data Looms

The Australian Dollar outlook is grim on rising fears of a US recession, yield curve inversion. AUD/USD may shrug off rosy jobs data ahead on fears of slowing global growth.

WikiFX Broker

Latest News

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Lawmakers Push New Crypto ATM Rules to Fight Fraud

2025 WikiFX Forex Rights Protection Day Preview

PH Senator Probes Love Scams Tied to POGOs

Currency Calculator