简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD is King in Low Currency Volatility Environment, Gold Drops Below Support - US Market Open

Abstract:USD is King in Low Currency Volatility Environment, Gold Drops Below Support - US Market Open

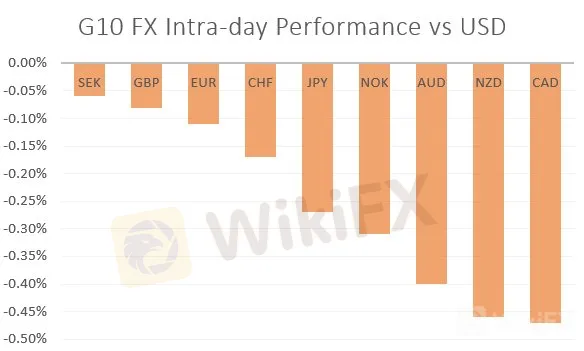

MARKET DEVELOPMENT – USD is King in Low Currency Volatility Environment, Gold Drops Below Support

USD: Despite the risk events throughout the week, FX volatility has been very subdued and continues to do so, with the most traded currency, EURUSD, seeing implied volatility hovering around record lows (1-month vols). Consequently, in this period of low volatility USD remains firm given the attractiveness that carry trades provide, while the fundamental backdrop for the US economy is notably stronger than the Eurozone. With little on the docket, eyes will turn to the Fed speak later today.

GBP: Given that an extension had largely been priced in and the outlook remains unchanged, GBP subsequently failed to find a renewed bid after the announcement. As a reminder, speculative positioning had been relatively neutral, according to the latest COT update, which in turn suggested that a short squeeze would be unlikely. However, while an extension may help GBPUSD hold support at 1.30, uncertainty will persist with a wide range of outcomes still possible (general election, second referendum, Theresa May resignation).

Risk Currencies (AUD, NZD, CAD): Risk sensitive currencies are the notable underperformers this morning against the greenback with the Canadian Dollar feeling the pressure from the pullback in oil prices. In turn, USDCAD is back to familiar resistance at 1.3385-1.34.

Gold: As the USD stabilises around the 97.00 handle, gold prices have taken a slight knock with the precious metal dropping back below the 1300 level. Demand for the precious metal has also been dampened by the mild support for equity markets.

Source: Thomson Reuters, DailyFX

{6}

DailyFX Economic Calendar: – North American Releases

{6}

IG Client Sentiment

{8}

How to use IG Client Sentiment to Improve Your Trading

{8}

WHATS DRIVING MARKETS TODAY

“GBPUSD Price Shrugs Off Brexit Extension, Sterlings Bid Remains” by Nick Cawley, Market Analyst

“Gold Price Outlook Still Positive as Global Slowdown Fears Persist” by Martin Essex, MSTA , Analyst and Editor

“S&P 500 Outlook: Investors on Edge Ahead of Earning Season” by Justin McQueen, Market Analyst

“FTSE Technical Outlook Following Brexit Agreement; GBP Correlation a Factor Again” by Paul Robinson, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

{15}

--- Written by Justin McQueen, Market Analyst

{15}

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Eye on Today’s U.S. GDP

Nvidia's highly anticipated earnings report was released yesterday, but despite the numbers beating market consensus, the performance lacked a "wow" factor for investors. As a result, the market seemed to have already priced in the earnings, leading to a decline in all three major indexes on Wall Street. Despite yesterday's technical correction, Nvidia's strong earnings suggest that the tech industry remains robust, with ongoing demand for Nvidia's chips potentially driving future gains

Gold Price Tops $2500 For the First Time

Gold prices soared above the $2,500 mark for the first time, driven by expectations of potential interest rate cuts, which have weakened the dollar to its recent low levels. Market participants are now focused on Wednesday’s FOMC meeting minutes for insights into the Fed’s next monetary policy moves.

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator