简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

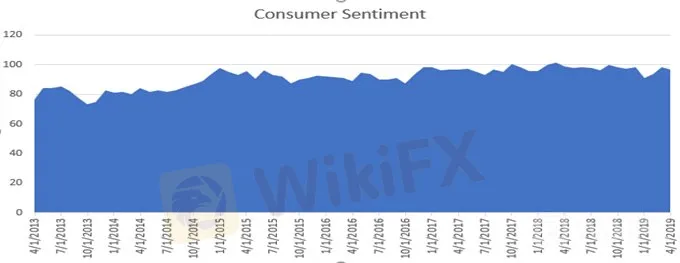

University of Michigan Consumer Sentiment Index Misses Estimates

Abstract:The University of Michigan consumer sentiment reading missed estimates this morning as consumers feel the economy can be cooling off.

UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT - TALKING POINTS:

UofM Consumer sentiment misses estimates coming in at 96.9 vs estimates of 98.2

The index is still well off its 2 year low in January

Consumer sentiment remains at historically high levels compared to previous decades

The University of Michigan preliminary reading on consumer sentiment came in at 96.9 this morning, missing estimates of 98.2. The miss on estimates is largely insignificant as the index remains near historically high levels following years of economic expansion resulting in a healthy environment for American consumers.

The Michigan data saw consumers seeing less of an impact from last years tax cuts which could be indicating that its impact on the economy did not flow down into households as well as some thought. Consumers are also still concerned with home prices which could continue to predict trouble for the home market as home sales have seen some hiccups early this year.

The market largely shrugged off the miss with the S&P 500 up over half a percent, thanks to a strong start to earnings season with JP Morgan posting record profits and revenue. However, with consumer spending making up over 70% of the American economy, investors will continue to closely follow this metric, as the economy nears a point many consider to be the peak, or near the peak, of this economic expansion cycle.

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EURUSD May Have Volatile Spikes: Thinner Liquidity on US Holiday

EURUSD may experience volatile spikes as US markets close for the July Independence Day holiday, leaving markets thinner and exposing the pair to potentially violent swings.

Trump to Pause Government Shutdown, Stocks and USD in Disbelief

President Trump caves on border funding demand after furloughed employee protest put pressure on politicians to reach bipartisan stopgap agreement.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator