简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones, S&P 500 Price Outlook: Will Tech Continue the Rally?

Abstract:With the S&P 500 at record highs, will tech continue to carry the index higher or will traders look elsewhere to fuel a continuation rally?

Dow Jones, S&P 500 Price Outlook:

道琼斯,标准普尔500指数价格展望:

The technology sector has climbed considerably in the year to date, dragging US indices higher

技术行业大幅攀升今年迄今为止,拖累美国指数走高

The sectors strength can be seen in the disparity between the Dow Jones and the Nasdaq, with the latter pressing to record highs before the former was able to even test prior levels

道琼斯和纳斯达克之间的差距可以看出行业强势,后者迫切需要在前者能够测试先前水平之前创出历史新高

For traders hoping the rally will continue, healthcare could be a sector ripe for medium-term gains

对于希望反弹将持续的交易者而言,医疗保健可能是中期成熟的行业收益

Dow Jones, S&P 500 Price Outlook: Will Tech Continue the Rally?

道琼斯,标准普尔500指数价格展望:科技将继续拉力赛吗?

With the majority of big-tech earnings for the season behind us, the market has a good grasp on what to expect in the coming quarter. An earnings beat from Apple saw them recapture the $1 trillion mark, while Googles miss saw its market cap fall by $85 billion in a day. Still, tech remains the one sector to stand atop the rest - as it has during much of the decade-long bull run.

由于本季度大部分高科技收益落后于我们,市场对未来一季度的预期有了很好的把握。苹果公司的盈利超过1万亿美元大关,而谷歌小姐的市值每天下跌850亿美元。尽管如此,科技仍然是站在其余部分之上的一个领域 - 正如它在长达十年的大部分时间里所做的那样。

At current valuations, some market participants have begun to call the top. For those on the other side of the argument, will they continue to pile into technology stocks? Or will they venture into other sectors in an attempt to prolong the run?

在目前的估值中,一些市场参与者已经开始致电顶端。对于那些争论另一方的人来说,他们会继续投入科技股?还是会冒险进入其他行业以试图延长股价?

Tech Remains on Top

Tech Remains on顶部

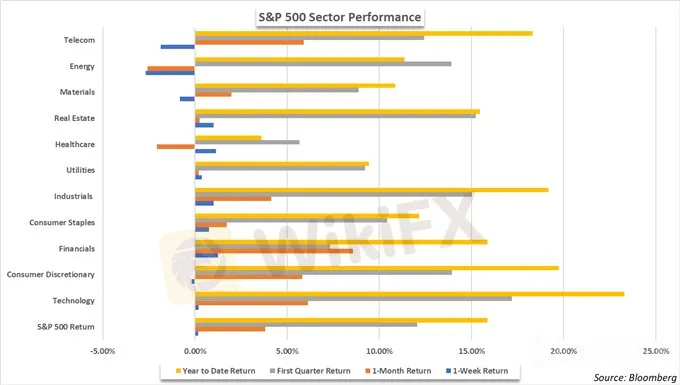

With a year-to-date return of roughly 23%, the tech sector is responsible for a significant portion of the recovery rally from December. Consumer discretionary and industrials are two other notable performers, offering returns of 19% and 18% respectively. On the other hand, sectors that are typically more defensive like utilities, energy, and healthcare unsurprisingly lag the broader S&P 500.

由于年初至今的回报率约为23%,科技板块将在12月份的复苏反弹中占据相当大的一部分。非必需消费品和工业企业是另外两个显着的表现者,分别提供19%和18%的回报。另一方面,通常更具防御性的行业,如公用事业,能源和医疗保健,不足为奇地落后于更广泛的标准普尔500指数。

However, healthcare has offered particularly poor returns – battling calls for free universal healthcare in early and mid April. The discussions in Washington pressured the sector to forfeit most of its progress in the recovery rally. With that in mind, the sector could be ripe for outperformance in the coming weeks. Although the calls for healthcare reform will remain for some time as election season progresses, the initial shock to the sector may have been weathered.

然而,医疗保健已经提供了特别糟糕的回报 - 对抗呼吁4月上旬和中旬免费全民医疗保健。在Washingto的讨论该行业面临压力,在恢复涨势中丧失了大部分进展。考虑到这一点,该部门可能在未来几周内表现优异。虽然随着选举季节的推进,对医疗改革的呼吁将持续一段时间,但对该部门的最初冲击可能已经风化。

{11}

The potential outperformance comes with a caveat - investors must be willing to accept the political risk associated with the sector, a tall task. But as election season unfolds, and frontrunners emerge, the likelihood of reform will likely be easier to forecast – thus influencing price. The Healthcare XLV ETF notched its second largest intraday outflow over the last year on Thursday, suggesting investors were either content to take profit from last weeks recovery – or the risk at the current valuation was too high for investors to stomach.

{11}

Either way, healthcare makes up a sizable portion of the S&P 500. As the second largest sector, healthcare is responsible for 13.76% of the Index – compared to 21.71% for tech and 12.29% for third place financials. If investors are looking for a particular sector to watch if the rally is to continue, healthcare may be one to watch.

无论哪种方式,医疗保健在标准普尔500指数中占相当大的比例。作为第二大行业,医疗保健指数占指数的13.76% - 相比之下,科技指数占21.71%。第三名财务报告为12.29%。如果投资者正在寻找一个特定行业来观察反弹是否会持续,那么医疗保健可能值得关注。

--Written by Peter Hanks, Junior Analyst for DailyFX.com

- 由DailyFX.com的初级分析师Peter Hanks撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Stocks Dip, Bitcoin Surges, Euro Weakens | Daily Market Update

Tech Stocks Under Pressure, Inflation Data Looms

February 23, 2024- US Stocks Hit Record Highs, Tech Sector Fuels Rally

Nvidia Soars, European Markets Gain, and Key Forex Trends

U.S. stock indexes retreated from their record-high levels. The Dow Jones Industrial Average dropped 274 points (-0.71%) to 38,380, the S&P 500 fell 15 points (-0.32%) to 4,942, the Nasdaq 100 was down 29 points (-0.17%) to 17,613.

Nvidia (NVDA) gained 4.79% to $693.32, marking a third consecutive record close. Goldman Sachs raised its price target on the stock to $800. Tesla (TSLA) fell 3.65% to $181.06, the lowest close since May 2023. ON Semiconductor (ON) jumped 9.54% as fourth-quarter results exceeded market expectations.

Navigating Market Peaks: Insights and Strategies for Today's Opportunities

Decoding Market Moves: Unveiling Potential in Recent Record-Highs and Currency Dynamics

WikiFX Broker

Latest News

Forex Inflows Surge by 245.9%, What’s Behind This Staggering Growth?

SaracenMarkets- Safe or Scam?

How to Spot a Fake Forex Broker Before You Lose Money

AUSTRAC Shakes Up Australia’s Crypto and Money Transfer Industries

Is Binance Really for Sale? The Truth Behind the Speculation and Market Shifts

Broker Comparison: XM vs AvaTrade

FCA Flags 9 Unlicensed Financial Website: Warning on Investor Risks

"I can't log in or withdraw funds"- Victim Said

Will SOLANA Survive the Meme Coin Collapse?

Cyprus Police Warn of Rising SMS Scams Targeting Binance Crypto Users

Currency Calculator