简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead - Top 5 Events: August RBA Meeting Minutes & AUD/USD Rate Forecast

Abstract:The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

August RBA Meeting Minutes Overview:

The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

However, September RBA meeting interest rate cut odds have fallen in recent weeks, so any AUDUSD weakness around the minutes may be short-lived.

Retail traders have remained net-long since July 19 when AUDUSD traded near 0.7012; price has moved 3.2% lower since then (no change over the past week).

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

08/20 TUESDAY| 01:30 GMT | AUD AUGUST RESERVE BANK OF AUSTRALIA MEETING MINUTES

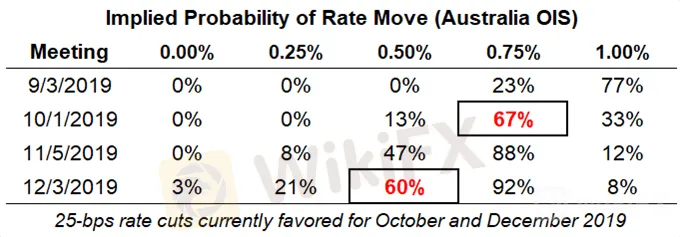

Reserve Bank of Australia Interest Rate Expectations (August 16, 2019) (Table 1)

Now, interest rate markets have eased off those dovish expectations compared to where they were before and immediately after the August RBA meeting. There is a 77% chance of no change in rates at the September RBA meeting.

That said, rates market continue to foresee two 25-bps rate cuts by the end of the year: there is a 67% chance of the first 25-bps rate cut coming in October and a 60% chance of the second 25-bps rate cut coming in December.

Pairs to Watch: AUDJPY, AUDNZD, AUDUSD

AUDUSD Technical Analysis: Daily Timeframe (August 2018 to August 2019) (Chart 1)

In our last AUDUSD technical forecast, it was noted that “until the daily 8-EMA is breached – AUDUSD has closed below it every session since July 23 – there is little reason to look higher.” The daily 8-EMA was breached with a close above it on August 13, even though there has yet to be follow through to the topside. Now, the daily 13-EMA is shoring up resistance; it has not been breached since July 23 on a closing basis either.

While AUDUSD is still below its daily 8-, 13-, and 21-EMA envelope, daily MACD has turned higher (albeit in bullish territory) while Slow Stochastics continue to climb towards neutral. Although the bias may still be for lower AUDUSD prices, traders may want to see how the recent high/low range between 0.6736 and 0.6822 breaks before choosing a direction.

IG Client Sentiment Index: AUDUSD Rate Forecast (August 16, 2019) (Chart 2)

AUDUSD: Retail trader data shows 73.0% of traders are net-long with the ratio of traders long to short at 2.7 to 1. In fact, traders have remained net-long since July 19 when AUDUSD traded near 0.7012; price has moved 3.2% lower since then. The number of traders net-long is 1.0% lower than yesterday and 3.6% lower from last week, while the number of traders net-short is 5.3% lower than yesterday and 1.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUD/USD Eyes Upside on Potential Loan Prime Rate Cut in China

Australian Dollar eyes China’s monthly 1- and 5-year Loan Prime Rate fixing. Traders await news over US/China oil inventory releases and Biden’s Fed pick. AUD/USD downside may continue as bearish SMA crossover nears.

EUR/USD, EUR/JPY Rates Rebound Off Lows after September ECB Meeting

Euro rates have seen volatility around the September ECB meeting as outgoing President Draghi's alter ego “Super Mario” made an appearance.

Gold Price Rise May Extend But Signs of Exhaustion Are Emerging

Gold prices may continue inching upward but technical cues pointing to ebbing momentum are warning of a possible pullback before the broader rise resumes.

FX Week Ahead - Top 5 Events: July US Retail Sales Report & EUR/USD Rate Forecast

The July US retail sales report (retail sales advance) is due out on Thursday, August 15 at 12:30 GMT, and it is due to confirm signs that the US economy is slowing down.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Currency Calculator