简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead - Top 5 Events: July US Retail Sales Report & EUR/USD Rate Forecast

Abstract:The July US retail sales report (retail sales advance) is due out on Thursday, August 15 at 12:30 GMT, and it is due to confirm signs that the US economy is slowing down.

July US Retail Sales Report Overview:

7月美国零售销售报告概述:

The July US retail sales report (retail sales advance) is due out on Thursday, August 15 at 12:30 GMT, and it is due to confirm signs that the US economy is slowing down.

7月美国零售销售报告(零售额)预计将于8月15日星期四格林尼治标准时间12:30公布,这是由于确认美国经济正在放缓的迹象。

The US Dollar (via the DXY Index) has seen a great deal of volatility in recent weeks, but EURUSD will come into focus in particular as the largest component of the DXY Index has broken its downtrend from the June and July swing highs.

美元(通过DXY指数)近几周出现大幅波动,但尤其是欧元兑美元将成为焦点,因为DXY指数的最大部分已从6月和7月的摆动高点突破其下行趋势。 / p>

Retail traders have remained net-long since July 1 when EURUSD traded near 1.1373; price has moved 1.5% lower since then.

零售交易商自7月1日以来一直保持净多头,当时欧元兑美元交易于1.1373附近;此后价格已下跌1.5%。

08/15 THURSDAY | 12:30 GMT | USD RETAIL SALES ADVANCE (JUL)

08/15周四| 12:30 GMT |美元零售销售增长(7月)

Consumption is the most important part of the US economy, generating around 70% of the headline GDP figure. The best monthly insight we have into consumption trends in the US might arguably be the Advance Retail Sales report. In July, according to a Bloomberg News survey, consumption slumped with the headline Advance Retail Sales due in at 0.3% from 0.4% (m/m). Similarly, the Retail Sales Control Group, the input used to calculate GDP, is due in at 0.4% from 0.7% (m/m).

消费是美国经济中最重要的部分,占总体GDP数据的70%左右。我们对美国消费趋势的最佳月度见解可能可以说是Advance Retail Sales报告。根据彭博社的一项调查显示,7月消费下滑,预售零售销售额从0.4%(月比)下降0.3%。同样,零售销售控制组(用于计算GDP的投入)应从0.7%(m / m)下降0.4%。

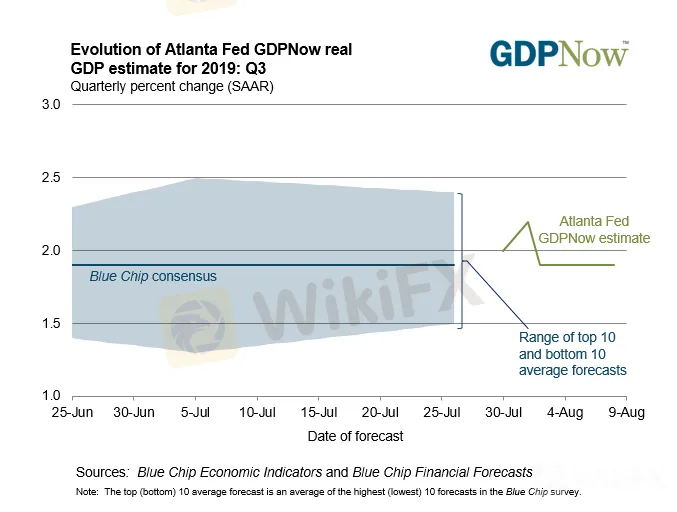

Atlanta Fed GDPNow: Q319 Growth Estimate (Chart 1)

亚特兰大联储GDPNow:Q3'19增长估算(图1)

Growth expectations may only be mildly supported coming out of the data, and the Atlanta Fed GDPNow Q319 growth estimate should remain below 2%. In turn, Fed rate cut odds may not recede further, offering little support for the US Dollar.

增长预期可能只是从数据中得到温和支持,以及亚特兰大联储GDPNow Q3'19增长预估应保持在2%以下。反过来,美联储降息的可能性可能不会进一步下降,对美元的支撑不大。

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

需要观察的对象:DXY指数,EURUSD,USDJPY,黄金

EURUSD Technical Analysis: Daily Timeframe (June 2016 to August 2019) (Chart 2)

p> EURUSD技术分析:每日时间表(2016年6月至2019年8月)(图2)

Several bottoming efforts in recent months have failed to produce a meaningful turn in EURUSD: the bullish falling wedge entering 2019; the bullish falling wedge between January and May; and the rising channel between May and July. Despite EURUSD hitting a fresh yearly low on August 1, it now appears that the pair is attempting yet another bottoming effort as it has now broken the downtrend from the June and July swing highs.

最近几个月的几次底部努力都失败了在欧元兑美元产生有意义的转折:进入2019年的看涨下跌楔形; 1月至5月间看涨的楔形;和5月到7月之间的上升通道。尽管欧元兑美元在8月1日触及新的年度低点,但现在看来该货币对正在尝试再次触底,因为它现在已经从6月和7月的摆动高位突破了下行趋势。

EURUSD price action has had trouble establishing a topside move, despite four consecutive closes above the June and July downtrend, price has yet to close through the July 9/July 17 swing lows around 1.1203. To provide some credit for a bullish turn, price is holding above the daily 8-, 13-, and 21-EMA envelope. Similarly, Slow Stochastics have extended their advance above the neutral line towards overbought condition. Daily MACD remains in bearish territory, but it has been trending higher for four consecutive days.

欧元兑美元的价格走势难以确立上行走势,尽管连续四个收盘高于6月和7月的下行趋势,价格尚未收于7月9日/ 7月17日的低点1.1203附近。为了看涨转向,价格保持在每日8,13和21-EMA信封之上。类似地,慢速随机指标已经将其推进超过中性线向超买状态延伸。每日MACD仍处于看跌区域,但连续四天一直走高。

IG Client Sentiment Index: EURUSD Rate Forecast (August 9, 2019) (Chart 3)

IG客户情绪指数:EURUSD利率预测(2019年8月9日)(图3)

EURUSD: Retail trader data shows 53.2% of traders are net-long with the ratio of traders long to short at 1.14 to 1. In fact, traders have remained net-long since July 1 when EURUSD traded near 1.1373; price has moved 1.5% lower since then. The number of traders net-long is 8.1% lower than yesterday and 28.9% lower from last week, while the number of traders net-short is 3.1% higher than yesterday and 35.4% higher from last week.

欧元兑美元:零售交易者数据显示,53.2%的交易者为净多头,交易者多头与空头的比率为1.14比1。事实上,自7月1日欧元兑美元交易于1.1373附近以来,交易商一直保持净多头;此后价格已下跌1.5%。交易商净多头比昨天减少8.1%,比上周减少28.9%,而交易商净空头数比昨天增加3.1%,比上周增加35.4%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse higher despite the fact traders remain net-long.

我们通常采取反向诉讼为了挤出市场情绪,交易商净多头表明欧元兑美元的价格可能继续下跌。然而,与上周相比,交易商净持续时间较短。近期情绪变化警告称,尽管交易商保持净多头,但目前的欧元兑美元价格走势可能很快反转走高。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

EUR/USD, EUR/JPY Rates Rebound Off Lows after September ECB Meeting

Euro rates have seen volatility around the September ECB meeting as outgoing President Draghi's alter ego “Super Mario” made an appearance.

FX Week Ahead - Top 5 Events: August RBA Meeting Minutes & AUD/USD Rate Forecast

The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

Gold Price Rise May Extend But Signs of Exhaustion Are Emerging

Gold prices may continue inching upward but technical cues pointing to ebbing momentum are warning of a possible pullback before the broader rise resumes.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator