简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold, Crude Oil Prices at Risk if US Jobs Data Cools Rate Cut Bets

Abstract:Gold and crude oil prices may be pressured if upbeat US employment figures cool Fed interest rate cut prospects, souring sentiment across markets pining for stimulus.

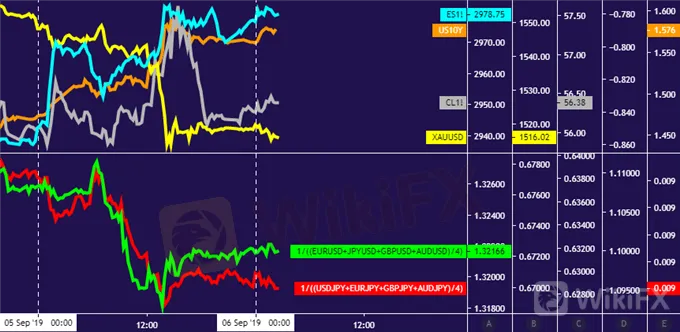

Crude oil, gold price performance chart created using TradingView

GOLD & CRUDE OIL TALKING POINTS:

Gold prices tumble through support as US data cools Fed rate cut bets

Crude oil prices fail to capitalize despite broadly supportive news flow

Commodities may fall if US employment report tops baseline forecasts

Gold prices fell as upbeat US economic data cooled Fed rate cut bets, driving bond yields higher and undermining the appeal of non-interest-bearing assets epitomized by the metal (as expected). A private sector estimate of jobs growth from ADP topped forecasts, factory orders rose by the most in 11 months and ISM survey data showed the service sector unexpectedly grew at the fastest rate since May.

The report showed US stockpiles shed 4.77 million barrels last week, dwarfing the 2.57-million-barrel draw expected and the surprise rise telegraphed in analogous API statistics. Larger-than-expected outflows from refined-product storage were also recorded. Nevertheless, prices turned down after touching a one-month high, erasing nearly all of their intraday advance before the closing bell.

GOLD, CRUDE OIL PRICES AT RISK IF US JOBS DATA COOLS FED RATE CUT BETS

Looking ahead, August‘s US jobs data is firmly in focus. It is expected to show that the economy added 160k jobs, marking a broadly on-trend outcome. The unemployment rate is seen holding steady at 3.7 percent, a hair above 50-year lows, while wage growth moderates a bit to print at a still-firm 3 percent on-year. US data’s recent improvement relative to forecasts hints a rosier report may well be in the cards.

A risk-off tilt seems likely to drive crude oil prices downward. Gold might have capitalized if the defensive were to produce the usual downward pressure on bond yields, but scope for such a thing seems limited when the prospect of higher-than-hoped-for lending rates is itself the catalyst for weakness. Against this backdrop, a relatively flat result might be the most that the anti-fiat benchmark can hope for.

Get our free guide to help build confidence in your gold and crude oil trading strategy!

GOLD TECHNICAL ANALYSIS

Gold prices marked a near-term top below resistance at 1563.00 – a weekly chart inflection level – as expected. A breach of support guiding gains over the past month sets the stage to challenge Augusts low at 1480.00. Breaking below that on a daily closing basis targets the 1437.70-52.95 zone next.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices put in a Shooting Star candlestick at resistance set from late April, hinting at a downturn in the works. Negative RSI divergence bolsters the bearish argument. Breaking below the August 26 low at 52.96 eyes support near $50/bbl next. Alternatively, a close above resistance exposes the 60.04-84 area.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Gold Price Forecast

Bears waiting to target $1,700.

Gold Price Update

Gold Down, Investors Await Further Inflation Data

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Currency Calculator