简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold, Crude Oil Prices at Risk if ECB, US CPI Cool Stimulus Hopes

Abstract:Gold and crude oil prices may be pressured if the ECB underwhelms investors dovish hopes while higher US core inflation cools Fed rate cut expectations.

GOLD & CRUDE OIL TALKING POINTS:

黄金和原油谈话要点:

Gold prices snap four-day losing streak ahead of key event risk

黄金价格在关键事件风险之前实现四天连跌

Crude oil prices drop as distillate build warns of soggy demand

原油价格下跌,因为馏分油建设警告需求潮湿

ECB rate decision, US CPI data might put markets on defense

欧洲央行利率决定,美国消费者物价指数数据可能使市场受到防御

Gold prices tracked higher, breaking a four-day losing streak. The move appeared to reflect corrective flows amid pre-positioning ahead of heavyweight event risk rather than a discrete catalyst. Crude oil prices fell for a second day as distillate inventories unexpectedly rose by the most in two months, warning about weakness in downstream demand. A large drop in crude storage seems to have been priced in already.

黄金价格走高,打破连连四天。此举似乎反映了在重量级事件风险之前预先定位的纠正流程,而不是分散的催化剂。原油价格连续第二天下跌,因馏分油库存意外上升两个月以来的最高水平,警告下游需求疲软。原油储存量的大幅下降似乎已经定价。

GOLD AND CRUDE OIL PRICES AT RISK IF ECB, US CPI DISAPPOINT DOVISH HOPES

如果欧洲央行,美国消费者价格指数令人失望,那么黄金和原油价格将面临风险

{6}

First, markets seem to agree on the likelihood that the ECB will deploy additional stimulus. The priced-in probability of a deposit rate cut is pegged at a commanding 100 percent. Many also seem to think that policymakers will move a step further to set the stage for another round of QE (if not triggering one upfront). Guidance on scope for a lasting easing cycle is also eyed.

首先,市场似乎同意欧洲央行将部署额外刺激的可能性。存款利率下调的定价概率为100%。许多人似乎也认为政策制定者将进一步为另一轮量化宽松政策做好准备(如果不是先触发一个)。关于持久宽松周期范围的指导也被关注。

Such lofty expectations mean it will be hard for President Mario Draghi and company to produce a sentiment-boosting dovish surprise. By contrast, the risk of an underwhelming outcome that sours investors‘ mood appears to be asymmetrically high. An uptick in US core inflation that cools Fed rate cut speculation ahead of next week’s FOMC meeting may compound any risk-off reversal.

这种崇高的期望意味着总统马里奥·德拉吉和公司很难产生情绪激动的鸽派惊喜。相比之下,令投资者情绪低落的令人沮丧的结果的风险似乎是不对称的高。美国核心通胀上升,在下周的联邦公开市场委员会会议之前冷却美联储减息预测可能加剧任何风险如果市场再次发现自己处于守势,那么周期敏感的原油价格似乎容易受到更深层次的损失影响。

{10}

Cycle-sensitive crude oil prices appear vulnerable to deeper losses if markets find themselves on the defensive once again. The implications for gold may not be altogether positive either. While the non-interest-bearing metal tends to rise when haven-seeking capital flows drive down bond yields, it may not manage such a feat when the prospect of higher lending rates is itself the spark for risk aversion.

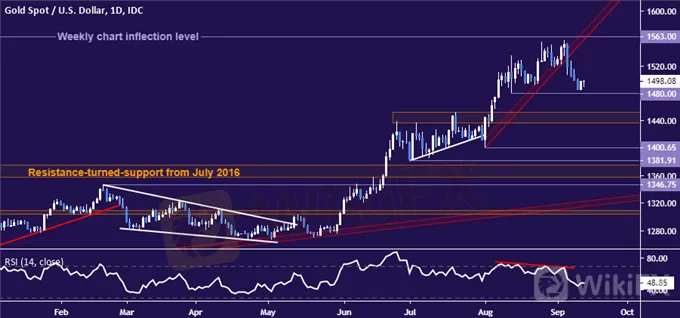

GOLD TECHNICAL ANALYSIS

黄金技术分析

Gold prices found interim support just above the August low at 1480.00. A bounce from here sees its first major hurdle at 1563.00, a weekly chart inflection point. Alternatively, a break downward confirmed on a daily closing basis targets the 1437.70-52.95 area next.

黄金价格发现临时支撑位于8月低点1480.00之上。从这里反弹看到其第一个主要障碍在1563.00,即每周图表拐点。或者,在每日收盘基础上向下确认的下跌目标位于下一个1437.70-52.95区域。

Gold price chart created using TradingView

使用TradingView创建的黄金价格图表

CRUDE OIL TECHNICAL ANALYSIS

原油技术分析

Crude oil prices have pulled back to menace near-term rising trend support set from Augusts swing bottom, now at 54.94. Breaking below that on a daily closing basis exposes a minor hurdle at 52.96 on route to a pivotal barrier near the $50/bbl figure. Immediate resistance is in the 60.04-84 area.

原油价格回落至近期上涨趋势支撑位于8月份触底反弹,目前位于54.94。在每日收盘基础上突破该位置,在50美元/桶的数据附近突破52.96的小障碍。即时阻力位于60.04-84区域。

Crude oil price chart created using TradingView

使用TradingView创建的原油价格图表

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

USDJPY Predicted to Rise on Yen Depreciation

The USD/JPY pair is predicted to increase based on both fundamental and technical analyses. Fundamental factors include a potential easing of aggressive bond buying by the Bank of Japan (BoJ), which could lead to yen depreciation. Technical indicators suggest a continuing uptrend, with the possibility of a correction once the price reaches the 157.7 to 160 range.

Stocks Dip, Bitcoin Surges, Euro Weakens | Daily Market Update

Tech Stocks Under Pressure, Inflation Data Looms

Beginner Tips for Gold Technical Analysis - Forex4you

Are you interested in trading gold? Forex4you will provide you 6 tips for gold technical analysis, which each beginner or novice should know.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator