简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WeWork presentation has numbers critics say should have been in IPO - Business Insider

Abstract:The presentation also highlighted a break with cofounder Adam Neumann, with new executives planning to focus on large companies as customers.

WeWork on Friday released an investor presentation that shows how its new leaders are trying to make a break with the past. Among other things, the presentation indicates the company plans to focus on working with large companies, a customer group that co-CEO Artie Minson told Business Insider earlier this year is critical for growth.In the document, WeWork for the first time publicly released specific data about location occupancy and other metrics.The company was criticized for not publishing such numbers in its filing to go public, an effort it ultimately cancelled in the face of investor resistance.Read all of Business Insider's WeWork coverage here.WeWork on Friday released an investor presentation that offers new details about its business and turnaround plan.The 49-slide presentation, which dates from mid-October, offers data about its operations that the company didn't include in the filings it made for its now-aborted initial public offering. The turnaround plan it lays out is an early version of one that is still in the works, a source said.The plan laid out in the presentation called for WeWork to cut jobs in its general and administrative groups, at its venture arm, and in “growth-related functions.” Under the plan, it wouldn't cut its community teams, which manage its buildings. In the document, the company's new leadership also outlined plans to sell or dispose of non-core investments, including wave pool company Wavegarden, women-focused coworking company The Wing, and online group organizer Meetup. Since mid-October, WeWork has moved to cut or downsize some of those businesses, initiating layoffs at coding bootcamp Flatiron School on Thursday and at Meetup on Monday and putting the company's private plane up for sale, as Business Insider previously reported.The presentation stated that WeWork plans, as part of its turnaround plan, to focus on working with companies with more than 500 employees, a customer group that co-CEO Artie Minson told Business Insider earlier this year is critical for its future growth.In the document, WeWork, also, for the first time publicly released specific data about occupancy at its various locations and other data.WeWork revealed new occupancy data

WeWork's initial public offering filing included numerous pages of photos of WeWork locations and New Age mottos.

WeWork

Potential investors criticized the company for not publishing such information in its filing to go public, an effort it ultimately abandoned in the face of stiff resistance from the market. Instead, the widely-panned filing opened with a dedication “to the energy of We – greater than any one of us, but inside each of us” and included multiple pages of glossy photos of WeWork locations, customer testimonials, and New Age mottos.As of September, according to the presentation, WeWork had 600 locations, 580,000 membership, and 676,000 desks. By comparison, at the end of June, it had 528 locations and 527,000 memberships. It didn't previously disclose its number of desks.Overall, WeWork's occupancy rate stood at 80% at the end of September, down from 83% at the end of June. By comparison, coworking rival IWG, formerly known as Regus, had an occupancy rate of 69%, according to the company's most recent earnings report in August. WeWork locations that have been opened for more than two years are 89% occupied on average. WeWork also said that it's getting cheaper for it to add more desks. In 2014, it spent $7,300 per desk, compared to $3,700 per desk in the first half of the year. For the first time, the company also spelled out how its business model works on a per-square-foot basis:

WeWork

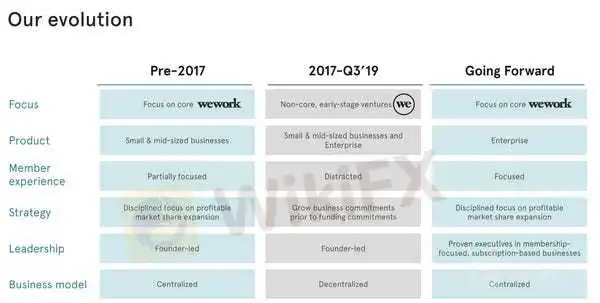

WeWork's new leaders are signaling a break from the pastIn the presentation, WeWork's new leadership team – chairman Marcelo Claure and co-CEOs Artie Minson and Sebastian Gunningham – made clear they were attempting to make a break with the company's recent past.Under cofounder and previous CEO Adam Neumann, WeWork grew from an idea to 528 locations and 12,000 employees in nine years. But the company struggled with governance issues and a web of conflicts of interest, many of which came to light in mid-August with its IPO documents. Investor and media scrutiny of those problems and Neumann's responsibility ultimately led WeWork's board to oust Neumann, name two co-CEOs, and bring in Claure.In one slide, the company compared its past, under cofounder and then-CEO Adam Neumann, with its future:

WeWork

Get in touch! Contact this reporter via encrypted messaging app Signal at +1 (646) 768-1627 using a non-work phone, email at mmorris@businessinsider.com, or Twitter DM at @MeghanEMorris. (PR pitches by email only, please.) You can also contact Business Insider securely via SecureDrop.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WeWork missed its target for enterprise customers by more than 25% - Business Insider

Last year, WeWork added 108,000 desks for companies with over 500 employees, a key customer base. Fourth-quarter leases also dropped steeply.

SoftBank is all over the biggest real-estate tech funding rounds of 2019 - Business Insider

Oyo Hotels is one of four companies on the list as a result of a SoftBank funding round. It is joined by Compass, Opendoor and WeWork.

Venture capitalists reveal the startups that changed everything in the last decade - Business Insider

By leveraging smartphones, online marketplaces, and cheap access to technology, startups like Uber and Shopify became the talk of the town.

Aryeh Bourkoff explains why unprofitable startups will struggle to IPO - Business Insider

LionTree founder Aryeh Bourkoff said 2019's IPO turmoil "is not necessarily a bad thing," and that the public market "always wins."

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The One Fear That’s Costing You More Than Just Profits

Currency Calculator