简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price News and Forecast

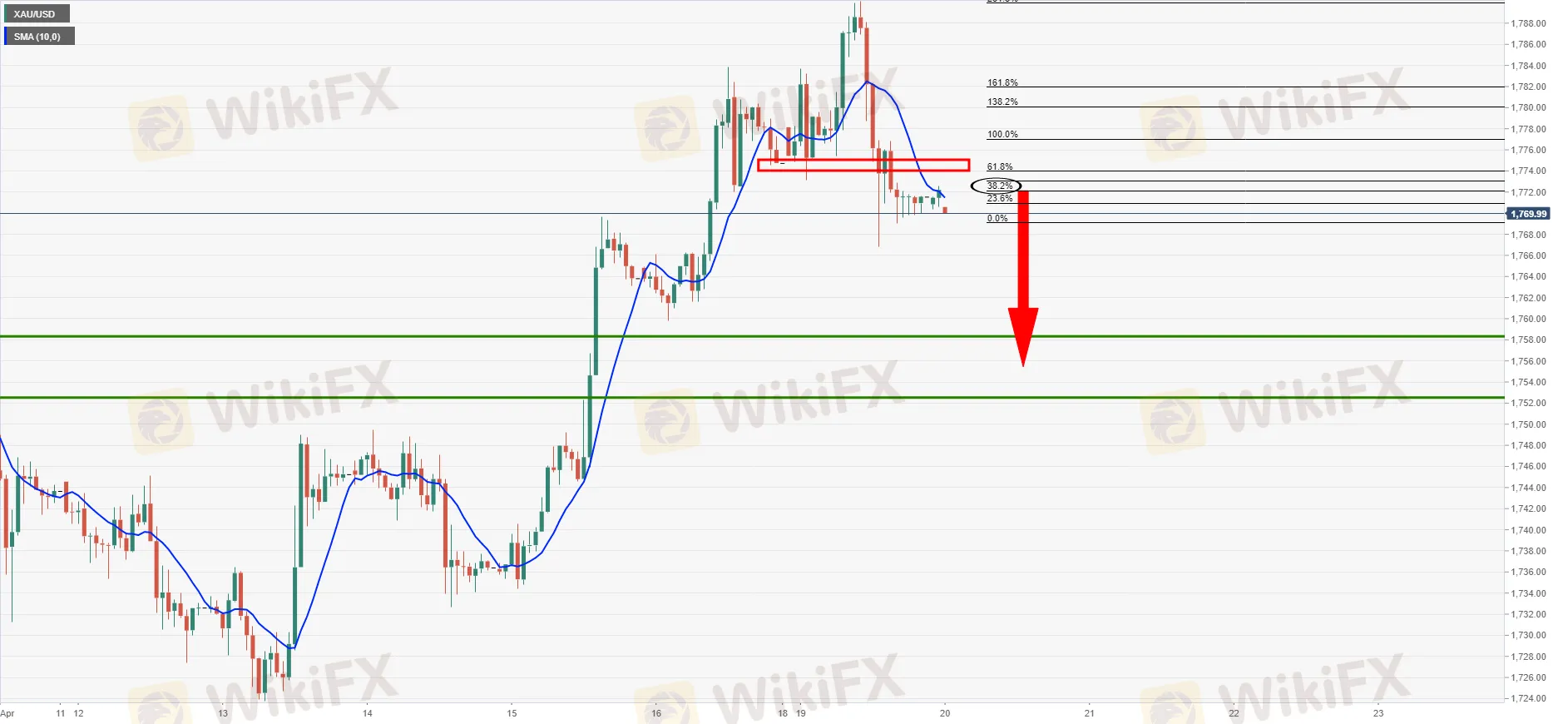

Abstract:XAU/USD looks to retest $1,750 as risk dwindles

The price of gold is on the backfoot despite a weaker US dollar at the start of this week and the prospects are for a significant correction to the downside.

Failures at resistance have so far proven to draw in additional bearish flows and speculative shorts.

TECHNICAL ANALYSIS

Gold, daily chart

The bulls are facing a wall of resistance and the price could be drawn to a restest of the prior support and a 61.8% Fibonacci retracement.

Bears can engage from below hourly resistance.

Gold, hourly chart

Bears are in control below the hourly resistance after making a 38.2% Fibonacci retracement of the latest bearish impulse.

POPULAR GOLD BROKER LIST

AvaTrade

XTB

BDSwiss

OctaFX

FXCM

FP Markets

FXTM

Plus500

Tickmill

Stay tuned as WikiFX will bring you with more Forex news updates!

╔═══════════════════════╗

Website: https://bit.ly/wikifxIN

APP for Android: https://bit.ly/3kyRwgw

APP for iOS: https://bit.ly/wikifxapp-ios

╚═══════════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Effect of Tariffs on Gold and Oil Prices

Tariffs—taxes imposed on imported goods—serve as tools for governments to protect domestic industries, generate revenue, and influence trade balances. However, their impact on commodity markets, particularly gold and oil, is multifaceted and can lead to significant price fluctuations.

Tariff Policies on Metals Drive Spot Gold Prices to New Highs

Gold hits a record $2,926 as Trump’s metal tariffs, inflation fears, and geopolitical risks drive investor demand for safe-haven assets.

How Is UBS Using Blockchain to Simplify Gold Investments?

UBS leverages blockchain to enable direct gold purchases, ensuring privacy, scalability, and interoperability for Swiss clients.

$600B Gold Reserves in Pakistan's Indus River Could Reshape Economy

Breaking: Pakistan uncovers gold deposits worth 600B PKR in the Indus River, sparking hopes for economic revival and sustainable resource development.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

IG 2025 Most Comprehensive Review

Currency Calculator