简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD WEEKLY FORECAST FOR MAY 24-28: DOLLAR SET TO CONTINUE DOWNWARD SPIRAL

Abstract:Following speculation that the US Federal Reserve has to tighten its loose monetary policy sooner than expected, the dollar fell this past week, with the EURUSD pair trading above 1.2200. Fed Reserve boss Jerome Powell has stressed repeatedly that the existing policy will remain until they see considerable progress towards the Reserve Bank’s goal of price stability and full employment.

● As Central Bankers grapple between economic progress and increasing levels of uncertainty.

● Growth should trigger inflationary concerns, further hurting the dollar.

● Bullish potential for EURUSD remains high as market forces eye the year high of 1.2349

Following speculation that the US Federal Reserve has to tighten its loose monetary policy sooner than expected, the dollar fell this past week, with the EURUSD pair trading above 1.2200. Fed Reserve boss Jerome Powell has stressed repeatedly that the existing policy will remain until they see considerable progress towards the Reserve Banks goal of price stability and full employment.

EURUSD TECHNICAL OUTLOOK

The EURUSD pair posted a higher high this past week, reaching the 1.2245 mark. Back in February, the pair reached a high of 1.2242, the monthly high. In theory, that price zone could become a double top. However, given that there is a lack of interest in the greenback, that scenario seems increasingly unlikely.

From the technical analysis point of view, the market perception tilts towards the upside. On the weekly chart, the pair has advanced above the 20 Small Moving Average (although still flat). Technical indicators remain within positive levels though, although they still possess limited directional strength.

According to the charts, the bulls still remain in control — at least thus far. The pair has risen beyond the bullish 20 SMA, which has advanced beyond the longer Moving Averages, providing support (albeit dynamic) around the 1.2110 levels. Technical indicators have eased around positive levels but are firmly above the mid lines.

EURUSD Weekly Chart for May 17-21 [Photo Credit: FX Street]

On the flip side, it can be observed that the EURUSD pair bottomed out around 1.2160 — which is a key support level — quite a number of times this past week, followed by 1.2110. Below the 1.2110 level, the pair could approach the 1.2000 level. The major resistance level is the 1.2245 level, with any break above it meaning a ray towards 1.2349, the years high.

EUR/USD Sentiment Poll

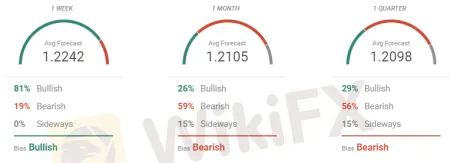

According to Forecast Polls, the dollars weakness is likely to continue in the near future. Afterwards, it is expected to recede. At the moment, bulls represent 81% of the polled experts, leading to an average target of 1.2242 for the coming week. However, in the monthly and quarterly outlook, the bears are more popular, leading to an average target 1.2105 and 1.2098 respectively.

The overall indication over the coming week is that the dollar will continue to lack self-strength. In the weekly, monthly, and quarterly timeframes, the moving averages maintain their bullish outlook. In the monthly time frame, there is an accumulation of targets below the present level, although the pair is not likely to go below the 1.1800 price zone.

EURUSD Sentiment Poll [Photo Credit: FX Street]

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Forex Strategies

New to forex trading and looking for simple and effective trading strategies? We got you covered! In this quick guide, we'll explain some of the key forex strategies which are easy to digest. So, let's start!

Fundamental vs Technical Analysis

Fundamental and technical analysis play some of the most influential and critical roles in making trading decisions amongst traders today. They are widely accepted by stock, foreign exchange, indices and cryptocurrency traders worldwide. Traders use either or both of the methods to make key trading decisions in their respective markets.

Going Short of JPY Is Boosted by Yellen’s Remark on Interest-Rate Hikes Again

When interviewed by Bloomberg, Yellen, the U.S. Treasury Secretary, indicated that the USD 4-trillion budget released by Biden would be beneficial to America even if it may increase inflation and interest rates.

Brent oil is predicted of bullish repricing by Goldman Sach

According to Goldman Sachs' head of energy research, a nuclear deal between the U.S. and Iran could send energy prices higher - even if it means more supply in the oil markets. Talks are ongoing in Vienna between Iran and the six world powers - the U.S., China, Russia, France, U.K., and Germany - trying to salvage the 2015 landmark deal. Officials say there's been progress, but the conclusion of the negotiations remains unclear and oil prices have been soaring as a result.

WikiFX Broker

Latest News

Why Do You Keep Blowing Accounts or Making Losses?

eToro Adds ADX Stocks to Platform for Global Investors

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

It is Not True Love | Tips on Avoiding Romance Scams

XTB Secures Chilean License, Expands Latin America Footprint

Currency Calculator