简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Busy Week Kicks Off With RBA And OPEC Meetings

Abstract:Busy Week Kicks Off With RBA And OPEC Meetings

Equity and currency markets generally quiet with US and UK on holiday

It's a packed week though – RBA and OPEC get the show rolling

Overall, investors seem awfully comfortable with prospect of Fed taper

Taper blues not enough to dent sentiment

The Fed's leadership recently opened the door for discussing when cheap money policies should start being withdrawn, and yet global markets don't seem bothered at all. The major US stock indices are hovering near record highs, the dollar remains under pressure, bond yields are trapped in a range, and gold keeps cruising higher.

It is almost like investors don't believe the Fed will execute. Or perhaps it comes down to hopes that other factors will dampen the impact of less monetary juice.With President Biden announcing an astronomical $6 trillion budget plan, it seems that fiscal policy will continue to do the heavy lifting.

Additionally, the serenity in the markets may reflect expectations that the Fed isn't the only player with the ability and willingness to buy bonds in force. Prominent strategists suggest that any QE tapering announcement later this year could be paired with a lifting of the asset ban on Wells Fargo (NYSE:WFC).

The ban has been in place since 2018 and has prevented Wells Fargo from expanding its balance sheet. If it's removed, then a massive player that is thirsty for long-duration assets would be unleashed upon bond markets, absorbing some of the demand the Fed would be leaving behind and allowing for a smoother exit from QE programs. Will monetary policy and financial regulation finally complement each other?

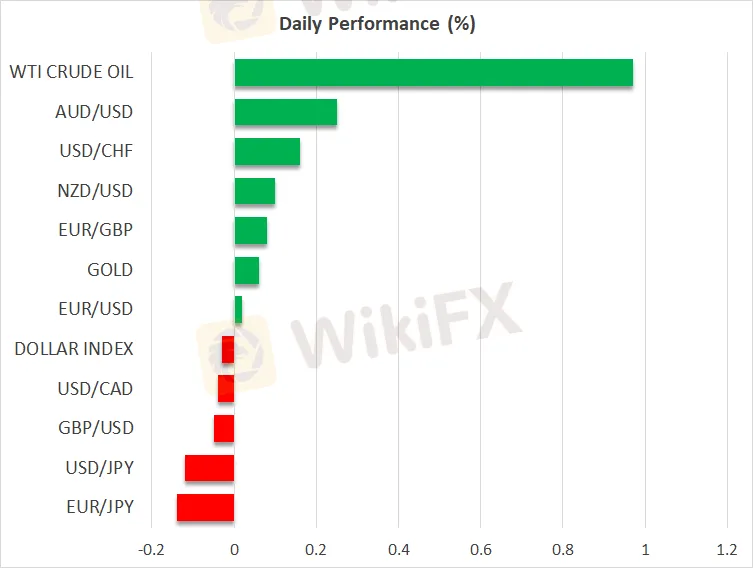

Markets calm ahead of OPEC

It is a quiet start to a busy week, with market holidays in America and Britain keeping liquidity conditions thin today. Still, caution is warranted in such an environment. If any major piece of news hits the wires with two of the biggest trading hubs being closed, any market reaction could be bigger than usual.

In the meantime, traders will keep their eyes on the OPEC+ meeting that will begin today on a 'technical level'. While the official meeting between energy ministers isn't until tomorrow, it is common to hear remarks ahead of time about the mood surrounding the talks, which can move oil prices as traders position for the actual event.

Not much is expected from OPEC. The consensus is that the cartel and its allies will stick to the slow increases in crude production they outlined previously, enabled by a strengthening demand outlook. Of course, the elephant in the room will be Iran, which is in negotiations with America about lifting economic sanctions. That could ultimately flood the markets in crude, though any such breakthrough is still several months off.

RBA unlikely to follow New Zealand's hawkish turn

Over in Australia, the Reserve Bank will wrap up its policy meeting early on Tuesday. But in contrast to the RBNZ meeting last week, the RBA is unlikely to deliver any fireworks. Policymakers have signaled that any major policy decisions will wait until July, so this meeting is likely to serve as a stepping stone.

While the Australian economy is doing well, the RBA has been careful not to appear too optimistic throughout this crisis, and that won't change this week considering the latest mini-lockdown in Melbourne and the slow vaccination rollout. The aussie's fate hangs mostly on global risk sentiment and commodity prices.

Finally, the euro might also attract some attention today when Germany's preliminary inflation print for May is released. The rest of the week includes PMI releases from America and the all-important nonfarm payrolls report on Friday.

Stay tuned on WikiFX, more news coming soon!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Why Do You Keep Blowing Accounts or Making Losses?

eToro Adds ADX Stocks to Platform for Global Investors

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

It is Not True Love | Tips on Avoiding Romance Scams

XTB Secures Chilean License, Expands Latin America Footprint

Currency Calculator