简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD Technical Analysis: Bullish Momentum Ahead

Abstract:Since the start of this week's trading, the price of the GBP/USD currency pair is in an upward correction path. Its gains reached the resistance level of 1.3298, which is stable around it at the time of writing the analysis and before the announcement of the British inflation figures. Overall, the British pound is looking to regain more ground lost against the euro and dollar in the near term as markets anticipate further interest rate hikes from the Bank of England, and the war in Ukraine offers diminishing returns to the market's "bears."

Since the start of this week's trading, the price of the GBP/USD currency pair is in an upward correction path. Its gains reached the resistance level of 1.3298, which is stable around it at the time of writing the analysis and before the announcement of the British inflation figures. Overall, the British pound is looking to regain more ground lost against the euro and dollar in the near term as markets anticipate further interest rate hikes from the Bank of England, and the war in Ukraine offers diminishing returns to the market's “bears.”

Today is 27 days since the war in Ukraine, and with few new material developments, the markets seem to have fully internalized the implications of the current equilibrium. This balance explains the slow and chaotic progress of Russian forces, the brutal destruction of Ukrainian cities, and indications that most Western market-related sanctions have now been passed against Russia.

This is significant for the British pound which has proven to be one of the biggest underperformers in the forex market since late February when Russia invaded Ukraine and the markets are adjusting accordingly.

Therefore, analysis from Goldman Sachs found that the pound should be supported in the near term if the situation in Ukraine does not deteriorate significantly. “The relatively high cyclical beta of the pound should dominate these factors to some extent, and apart from other escalation risks – GBP/USD could continue to stagnate,” analyst Zack Bundle says in Currency Research Weekly. Getting rid of the risk premium that has been created in recent weeks.

It appears that peace talks between Russia and Ukraine will continue, but comments from the Russian side indicate that there is little scope for a breakthrough in the near term. For his part, Russian presidential spokesman Dmitry Peskov said on Monday that the two sides are still far apart, which lies behind downside risks that threaten risk sentiment and thus the British pound. Accordingly, analysts believe that the degree of progress in the negotiations may not be what is desirable and not what the development of the situation may require for the Ukrainian side.

There were hopes that Ukrainian President Volodymyr Zelensky would soon sit down with Russian President Vladimir Putin, but that does not appear to be a near-term prospect. The other major driver of the sterling exchange rates is the expectations of the future interest rates in the Bank of England, here the sterling regained all its losses after the rate hike from the Bank of England. The bank raised 25 basis points last Thursday, as expected, but the pound fell in the wake of the decision.

Our coverage of the fallout suggests that there is a “truth sell” component to the market reaction, with the currency being further affected by the “cautious” streak of the guidance given by the bank. The bank has taken more caution on the economic outlook, warning the market to expect approximately 120 basis points to raise quoted interest rates for the remainder of 2022. This is because the bank sees high inflation levels as having the potential to negatively impact economic growth, with the resulting deflation About that of course that burns inflation. Asking the market to reassess its low expectations of the number of future rate hikes will inevitably lead to a bearish mechanical move in the British Pound.

The pound's recovery seen over recent days would suggest that the market's initial “sell of truth” reaction has been affected and that investors are in the market to buy again. Indeed, against a large group of G10 central banks, the Bank of England remains one of the most hawkish and even our most pessimistic analysts expect at least two rate hikes.

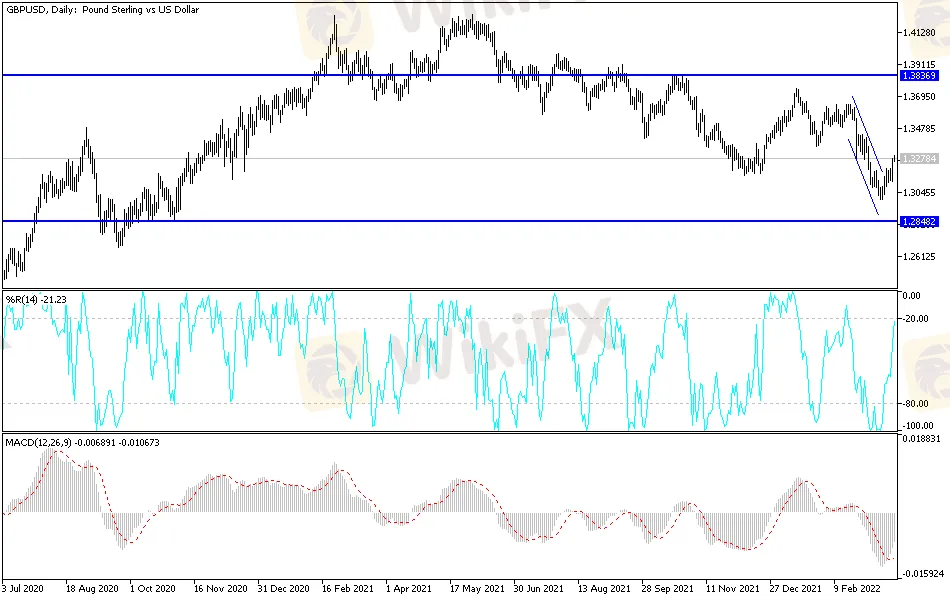

According to the technical analysis of the pair: On the daily chart below, it seems clear that the recent gains of the GBP/USD currency pair were important to break the downtrend and start an opposite ascending channel. On the other hand, the decline of the currency pair towards the support level 1.3120 will be important for the return of the bears' control. The pair's gains may be subject to a rapid collapse if investors' aversion to risk increases and anxiety over the consequences of the Russian war increases.

Today, the sterling dollar currency pair is awaiting the announcement of British inflation figures and from the United States, new US home sales and new statements by US Federal Reserve Governor Jerome Powell.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator