简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

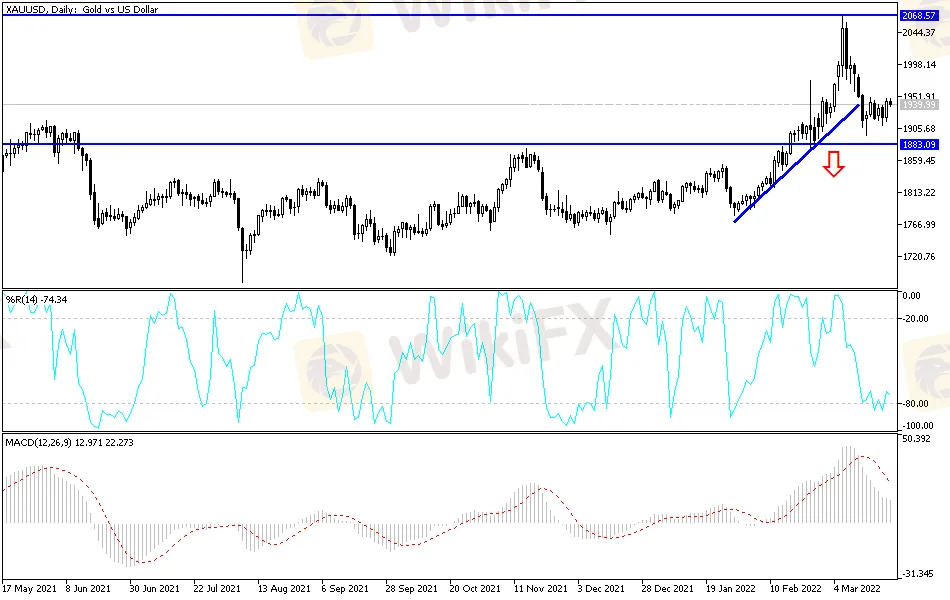

Gold Technical Analysis: Maintaining Bullish Trend

Abstract:Despite the strength of the US dollar, gold prices rose to the resistance level of 1945 dollars an ounce and is stable around it at the time of writing the analysis. The recent selling of gold did not exceed the support level of $ 1911 an ounce, and gold gains came as weakness in global markets amid concerns about the Ukraine war and inflation increased demand for the safe-haven commodity. Earlier this week, Federal Reserve Chairman Jerome Powell suggested in a speech to the National Association of Business Economists that larger increases in US interest rates may be needed if inflation does not subside.

Despite the strength of the US dollar, gold prices rose to the resistance level of 1945 dollars an ounce and is stable around it at the time of writing the analysis. The recent selling of gold did not exceed the support level of $ 1911 an ounce, and gold gains came as weakness in global markets amid concerns about the Ukraine war and inflation increased demand for the safe-haven commodity. Earlier this week, Federal Reserve Chairman Jerome Powell suggested in a speech to the National Association of Business Economists that larger increases in US interest rates may be needed if inflation does not subside.

US President Joe Biden is expected to impose more sanctions on Russia during his trip to Europe this week. Biden is set to meet with other NATO allies in Brussels on Thursday to lay out a road map for a diplomatic solution to the ongoing massacre of Ukrainians by Russia. Biden is also scheduled to meet with European Union leaders to discuss the Russian oil embargo by EU members.

Data from the Commerce Department showed a steady decline in US new home sales in February. The report showed that new home sales fell 2% to an annual rate of 772,000 in February after falling 8.4% to an average of 788,000 in January. The continued decline surprised economists, who expected new home sales to rise 1.1% to a rate of 810,000 from 801,000 originally reported for the previous month.

Yesterday, US stocks fell as Treasury bonds recovered from unprecedented losses before tightening monetary policy to curb inflation. According to the performance, the S&P 500 index fell by 0.820 percent, led by losses in financial stocks, while the benchmark 10-year Treasury yield fell to 2.32 percent after rising to levels not seen since mid-2019.

Bonds are bearing the brunt of the US central bank's calls for tougher measures to control inflation as investors hold stocks as a hedge against inflation, spurring a rally that saw the S&P 500 recover half of its decline from January over just six sessions.

Overall, investors fled bonds as Federal Reserve officials indicated they were willing to aggressively raise US interest rates to tame inflation, and the war on Ukraine has sent commodity prices up 26 percent this year.

According to the technical analysis of gold: As the Russian war continues and is prolonged, any decline in the price of gold will remain an opportunity to think about buying again. Despite the recent performance, the price of gold still can rise if it is stable around and above the $1900 resistance. This supports the bulls in further progress, which may happen strongly if investors aversion to risk increases, with the increase in fears of a prolonged Russian-Ukrainian war. Currently the closest targets to the bulls are 1935 and 1960 dollars, respectively.

On the other hand, the support level of 1880 dollars will be important for the bears to control the trend, and from it and from below it is the best idea for the return of buying gold. The gold market will be affected today by the price of the US dollar and the extent of investors appetite for risk or not, as well as the reaction from the announcement of the readings of the manufacturing and services purchasing managers index from the euro area, Britain, and the United States, and the last of the durable goods orders and weekly jobless claims.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator