简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GemForex - weekly analysis

Abstract:Consolidation for the week ahead: US inflation report to cast light on the Fed’s trajectory

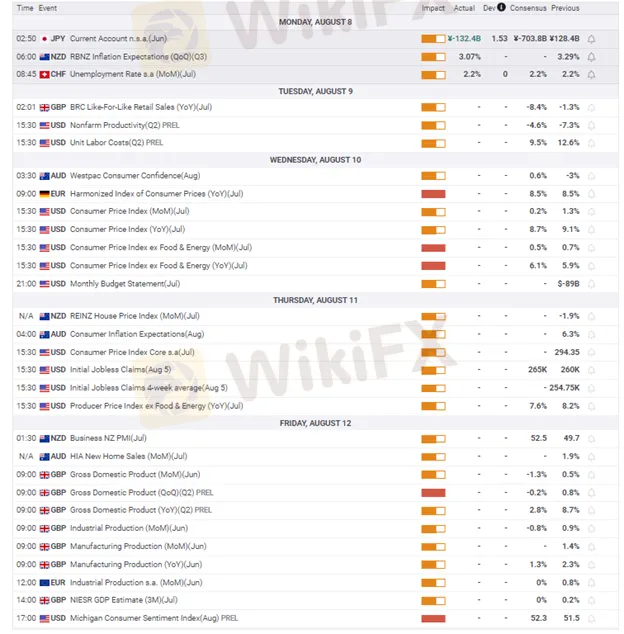

After a turbulent but interesting July and the first week of August, we are heading towards another decisive week for global markets. The main event will be the latest CPI report from the United States, which will reveal whether inflation has finally started to cool off. The economic sentiment is more mixed than expected, even after the US released stronger-than-expected employment numbers last Friday, casting doubt on the incoming recession panic.

Nevertheless, lets see what is on the shelf for the week ahead.

During the first 2 days of the week, we get employment data from Switzerland, which is expected to stay strong at 2.2%, as Switzerland reversed its dovish tune proactively before inflation worries even started and kept the Swiss economy relatively strong compared to its neighbors.

On a similar note from Europe, on Friday we get Industrial production data for the Eurozone, which after 5 months of sanctions against Russia and a significant energy shortage across major European economies, is expected to decrease ahead of the autumn season. Until Friday though, the Euro will follow and adapt to the strength of the Dollar, which if falls below the support of 1.01, could send it back to parity. A bullish breakout would put the currency back on track towards 1.290, the next important level to watch out for, something which may happen if the incoming US data will be less satisfactory than expected.

From the other side of the Atlantic, in the middle of the week, we will anticipate the CPI numbers for the US, and on Thursday the Initial Jobless claims for the month. Against the expected sentiment, the US rebounded last week due to strong employment numbers, and this week we will find out if the recessionary trend of the US economy is due to a halt or will accelerate.

On Friday, we expected the new GDP numbers from across the English Channel. Last week, the BoE measured its monetary policy and tightened the interest rate in the biggest rate hike of the last 40 years, all of that amid rapid inflation and an expected UK recession. And while inflation has already taken its toll and a looming energy crisis is around the corner, it only remains to be seen how the pound will recover, but the road ahead seems bumpy.

Despite the rate increase, the sterling suffered in the aftermath because the BoEs overall message was quite gloomy. The economic forecasts were apocalyptic, pointing to five consecutive quarters of negative GDP growth starting in the fourth quarter of this year.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator