简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Commission-free Trading

Abstract:Traditionally, the act of buying or selling stocks and other assets carried with it cost-brokerage fees. These fees have long acted as gatekeepers, limiting access to investment opportunities to those able to afford them. Enter commission-free trading, a development that has torn down these financial barriers. It is a practice offering the ability to trade stocks, ETFs, and other financial instruments without the burden of a brokerage fee. Through this, investing opens the door to investors of all scales and from all walks of life.

What is commission-free trading?

Traditionally, the act of buying or selling stocks and other assets carried with it cost-brokerage fees. These fees have long acted as gatekeepers, limiting access to investment opportunities to those able to afford them.

Enter commission-free trading, a development that has torn down these financial barriers. It is a practice offering the ability to trade stocks, ETFs, and other financial instruments without the burden of a brokerage fee. Through this, investing opens the door to investors of all scales and from all walks of life.

What has truly amplified the impact of commission-free trading is the introduction of fractional shares trading. This feature allows individuals to invest in proportion of a share, bypassing the need for substantial capital outlays that some shares require.

However, the world of commission-free trading is not without its complexities. The old adage “there's no such thing as a free lunch” retains merit, even here. Brokers may take other forms of charging, and new risks will be created by lowering the investment threshold.

In the following sections, we will pull back the veil on commission-free trading. We will look closely at its benefits and potential risks, along with examining how platforms offering such trades generate revenue.

6 Best Brokers for Commission-Free Trading

We, at WikiFX, operate as a regulatory inquiry platform. Our primary focus lies in selecting brokerage firms that adhere to regulatory standards. In addition to regulatory compliance, we also consider the following criteria:

1. The presence of hidden fees;

2. User-friendliness of the trading platform;

3. Availability of demo accounts for user practice;

4. Variety of trading products;

5. Responsiveness of customer service.

Charles Schwab

| Charles Schwab |  |

| Regulation | SFC |

| Minimum Deposit | $2,000 (Margin account) |

| Commissions | $0 |

| Trading Platform | Thinkorswim |

| Demo Account | Yes |

| Trading Assets | Stocks, ETFs, Bonds |

| Customer Support | Phone, Email |

Trading Fees and Commissions of Charles SchwabCharles Schwab offers commission-free trading for listed stocks and ETFs when trading online. For options trading, there's an online base commission along with a fee of $0.65 per contract. When it comes to mutual funds, Charles Schwab provides access to thousands of funds through the Schwab Mutual Fund OneSource platform.

Pros and Cons of Charles Schwab

Pros:

Commission-free trading: Investors can execute trades without incurring additional fees, potentially saving significant costs over time.

Access to Thinkorswim trading platform: The platform offers advanced features and tools, providing a comprehensive trading experience with robust analysis and customization options.

Diverse range of trading assets: Investors have access to a wide variety of assets, including stocks, ETFs, and bonds.

Responsive customer support via phone and email: Fosters a supportive environment for investors, with readily available assistance and guidance when needed.

Regulated by SFC: Being regulated by the Securities and Futures Commission (SFC) instills confidence in investors regarding regulatory compliance and investor protection, enhancing trust in the brokerage.

Cons:

Minimum deposit of $2,000 for a margin account: The requirement of a minimum deposit may deter some investors or pose a barrier to entry for those with limited capital, particularly for those interested in margin trading.

Limited availability of demo account (though available): While a demo account is offered, its limited availability may hinder the ability of investors to thoroughly test trading strategies or familiarize themselves with the platform before committing real funds, potentially impacting the learning curve for new users.

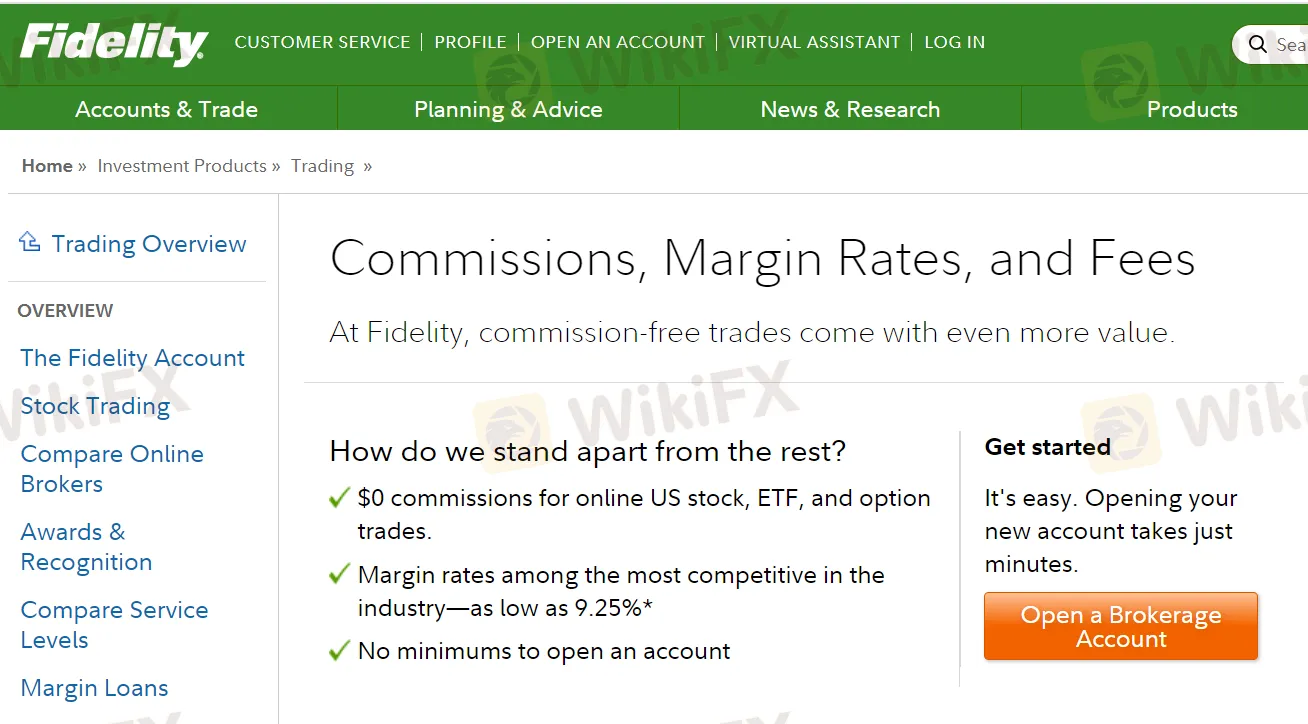

Fidelity

One of the most notable features of Fidelity is its wide range of tradable products. On their official website, users can find up to 15 types of products, including Retirement & IRAs, Spending & Saving, Investing & Trading, Mutual Funds, Crypto, Direct Indexing, Fixed Income, Bonds & CDS, ETFs, Options, Sustainable Investing, Managed Accounts, 529 College Savings, Health Savings Accounts, Annuities, and Life Insurance. Traders have access to these products through three different platforms.

| Fidelity |  |

| Regulation | FSA |

| Minimum Deposit | None |

| Commissions | $0 |

| Trading Platform | Mobile Trading, Active Trader Pro, Trading Dashboard |

| Demo Account | Yes |

| Trading Assets | Investment Trusts (Funds), Stocks, ETFs/ETNs, REITs, NISA |

| Customer Support | Phone: +81 0120-140-460; 0120-405-606 (Weekdays 8:30-17:00); Facebook |

Pros and Cons of Fidelity

Pros:

$0 commissions for online US stock, ETF, and option trades: Offers significant cost savings for investors.

Competitive margin rates of 9.25%: Make it an attractive option for margin trading.

No minimums required to open an account: Provides accessibility to investors of all levels without meeting minimum deposit requirements.

Cons:

Margin trading carries inherent risks: Investors should exercise caution despite Fidelity's competitive rates.

Firstrade

| Firstrade |  |

| Regulation | Unregulated |

| Minimum Deposit | None |

| Commissions | $0 |

| Trading Platform | Customizable platforms through desktop, iPad or mobile phone |

| Demo Account | Yes |

| Trading Assets | Stocks/ETFs, Options, Mutual Funds |

| Customer Support | Phone and E-mail |

Firstrade provides an extensive range of trading options, allowing users to trade stocks listed on major exchanges such as NYSE, AMEX, Nasdaq, and the Over-the-Counter (OTC) markets. Investors can hedge their portfolios with options at no commission and without incurring contract fees. With over 11,000 Mutual Funds available, users can diversify and create professionally managed portfolios tailored to their investment goals.

Firstrade claims to minimize fees, offering $0 commission trades, $0 options contract fees, and no minimum account requirements or inactivity fees. The platform's customizable trading platforms can be access across desktop, iPad, or mobile devices. Serious investors can leverage OptionsWizard, Firstrade's professional-grade options analytics tool, to unlock advanced investing opportunities and improve trading strategies.

Pros and Cons of Firstrade

Pros:

Extensive Range of Trading Options: Firstrade provides users with a wide array of trading options, including stocks listed on major exchanges like NYSE, AMEX, Nasdaq, and the Over-the-Counter (OTC) markets.

Commission-Free Trading and No Contract Fees: Firstrade offers $0 commission trades and charges no fees for options contracts. This fee structure can result in significant cost savings for investors, especially for those who trade frequently or utilize options to hedge their portfolios.

Diversification with Mutual Funds: With over 11,000 Mutual Funds available, Firstrade allows users to diversify their portfolios and create professionally managed investment strategies tailored to their goals.

Minimized Fees: Firstrade aims to minimize fees by offering $0 commission trades, $0 options contract fees, and no minimum account requirements or inactivity fees.

Customizable Trading Platforms: Firstrade's customizable trading platforms are accessible across desktop, iPad, and mobile devices, providing users with flexibility and convenience in managing their accounts and executing trades.

Professional-Grade Options Analytics Tool: Serious investors can leverage OptionsWizard, Firstrade's professional-grade options analytics tool, to unlock advanced investing opportunities and improve trading strategies.

Cons:

Limited Availability of Advanced Features: While Firstrade offers customizable trading platforms and a professional-grade options analytics tool, some advanced features may be limited compared to other brokerage platforms.

Interactive Brokers

| IB |  |

| Regulation | SASIC, FCA,FSA, SFC |

| Minimum Deposit | None |

| Commissions | $0 |

| Trading Platform | IBKR GlobalTrader, Client Portal, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR Event Trader, IMPACT |

| Demo Account | Yes |

| Trading Assets | Stocks, options, futures, forex, bonds, ETFs, CFDs |

| Customer Support | 24/7 phone, email, live chat |

Interactive Brokers (IB) offers a varied commission structure for U.S. market trading.

For Stocks/ETFs, prices range from USD 0.0005 to 0.0035 per share (tiered) or USD 0.005 per share (fixed), with no fees on No Transaction Fee ETFs.

Options range from USD 0.15 to 0.65 per contract (tiered) or a fixed rate of USD 0.65 per contract.

Futures range from USD 0.25 to 0.85 per contract (tiered) or a fixed rate of USD 0.85 per contract for certain types.

Spot Currencies see commissions from 0.08 to 0.20 basis points × Trade Value per order. Bonds are charged at 10 basis points × Face Value per order.

Mutual Funds incur a commission of 3% × Trade Value, capped at $14.95 per transaction, with no fees on No Transaction Fee Funds.

| Product | Tiered Pricing | Fixed Pricing | Notes |

| Stocks/ETFs | USD 0.0005 to 0.0035 per share | USD 0.005 per share | No commission on No Transaction Fee ETFs |

| Options | USD 0.15 to 0.65 per contract | USD 0.65 per contract | |

| Futures | USD 0.25 to 0.85 per contract | USD 0.85 per contract | For US-Future and Future Options |

| Spot Currencies | 0.08 to 0.20 basis points × Trade Value per order | Tight spreads as narrow as 1/10 PIP | |

| Bonds | 10 basis points × Face Value per order | ||

| Mutual Funds | 3% x Trade Value, up to $14.95 per transaction | No commission on No Transaction Fee Funds |

Webull

Webull offers commission-free trades and imposes no minimum deposit requirements. The platform sustains itself through various revenue channels common to brokerage firms, including income generated from stock loans, interest accrued on free credit balances, margin interest, and compensation derived from order flow. Notably, Webull does not rely on commissions as a revenue source.

| Webull |  |

| Regulation | FSA |

| Minimum Deposit | None |

| Commissions | $0 |

| Trading Platform | Webull Desktop, Webull Mobile App, Web Platform |

| Demo Account | Yes |

| Trading Assets | Stocks/ETFs, Options, Mutual Funds |

| Customer Support | Phone: +1(888)828-0618 |

Pros and Cons of Webull

Pros:

Commission-Free Trades: Webull offers commission-free trading, allowing users to execute trades without incurring additional fees.

No Minimum Deposit Requirements: Unlike some other brokerage platforms, Webull does not impose minimum deposit requirements.

Diverse Revenue Streams: Webull sustains itself through various revenue channels beyond commissions. These include income generated from stock loans, interest accrued on free credit balances, margin interest, and compensation derived from order flow.

Not Solely Reliant on Commissions: Unlike traditional brokerage firms that heavily rely on commissions as a primary source of revenue, Webull does not solely depend on commissions.

Cons:

Reliance on Alternative Revenue Channels: While Webull's reliance on alternative revenue streams is a strength, it also poses a potential risk. Income from stock loans, interest on free credit balances, margin interest, and order flow compensation may fluctuate based on market conditions and regulatory changes.

Benefits of Commission-Free Trading

The advent of commission-free trading has substantially transformed this scenario, bringing along a suite of empowering benefits.

Accessibility Unleashed: Traditionally, trading in financial markets was considered an exclusive club, barricaded behind the wall of commission fees. Commission-free trading has dismantled this wall, ushering in a notable democratisation in trading. Now, virtually anyone can dip their toes into the riveting waters of the stock market without fretting over burdensome upfront costs. This means more people harnessing the potential of financial markets, catalysing a wider participation.

Augmented Profit Potential: When trades aren't bogged down with commissions, what you earn is truly what you keep. The absence of brokerage fees improves the net return from every successful trade, amplifying profit potential. This impact is particularly noticeable for frequent traders, whose cumulative commissions can otherwise take a formidable toll on their overall profits.

A Plunge into Fractional Shares: The guilded clubs of high-priced stocks are now no longer inaccessible to the average investor. Commission-free trading platforms have introduced fractional shares, enabling investors to own a segment of a share instead of needing to buy a whole one. This innovative feature means pricy stocks now commandeering triple or quadruple digits become affordable investment ventures, creating a more diversified and resilient investment portfolio.

Room for Experimentation: The learning curve of the stock market is steep and often, expensive. With the commission fees out of the way, beginners have the freedom to explore, learn, and grow their trading skills without constantly losing to commissions. Its risk-taking made affordable, creating a more conducive learn-by-doing environment.

Fostering Regular Investing: The consistent drip-feeding of investments, popularly known as dollar-cost averaging, builds robust portfolios and is statistically proven for better returns. Commission fees were an impediment to this strategy, with every regular investment nibbling away profits. By removing commissions, these platforms encourage regular investments, fostering sound investment habits for long-term wealth creation.

How do Commission-free Brokers Make Money?

Commission-free trading is on the rise in the UK but its still not offered by every broker. Given that, you are right to wonder what allows the stockbrokers who do offer commission-free trading, to do so.

The first big factor is cost.

Stockbrokers come in all shapes, sizes and ages. And, as we see in many other sectors, newer technology-led businesses often run a lower-cost business model than the older players thanks to fewer legacy systems and processes.

The other key aspect is how the broker charges its clients. Its a good idea to understand how a broker or investment platform makes money (and if it makes money, is it an established player?) before you invest with them.

One example of a charging structure is a freemium business model. And just like many other subscription businesses, from music to magazines, there is a certain level of the product or service you don‘t pay for but if you’d like more variety or a different feature then that comes at a cost.

There are quite a few other business models out there, so it‘s important to check how they work and whether it’s in your best interests.

Understanding the Risks of Commission-Free Trading

While commission-free trading may seem to have no direct cost, it does carry some hidden costs. For instance, a platform may widen the bid-ask spread to make a profit, which is naturally a cost to investors. Additionally, some platforms may sell order flow to other brokers, which could impact the execution quality of investors' trades and thereby indirectly affect investment returns.

Other platforms may offset their commission-free operational costs by charging other fees, such as data usage fees, withdrawal fees, etc. Therefore, when choosing a commission-free trading platform, investors need to be aware of and consider these potential hidden costs.

Tips for Successful Commission-Free Trading

-

Understand the Hidden Costs: Be knowledgeable about the various hidden costs that may be associated with commission-free trading. This could include a wider bid-ask spread, or extra fees for data usage and withdrawals. Recognize that 'commission-free' does not equate to 'cost-free'.

Research Thoroughly: Do an in-depth study of the trading platform and your chosen investments. Evaluate the platform for its worthiness, considering all possible costs and not being swayed simply by the allure of commission-free trading.

Use Responsible Trade Practices: Even when trades don't carry a commission, it's crucial not to forget sound risk management strategies. Resist the temptation of making frequent trades just because the commission is non-existent. Each trade carried out should be backed by solid reasoning instead of merely being provoked by its cost-effectiveness.

Leverage Technology: Use technology to your advantage. Many trading platforms offer technical analysis tools that can help you make informed decisions. Tools that can aid in tracking market trends and making market predictions can be invaluable.

Stay Informed: Keep a close eye on market trends and financial news. Staying updated with the current state of the marketplace can help you make timely and sound investment decisions.

Future Trends in Commission-Free Trading

In the future, commission-free trading is set to advance with expanded product offerings, sophisticated trading platforms, and increased automation. Artificial intelligence will play a crucial role in providing personalized trading experiences, while regulatory changes and alternative revenue streams will drive global expansion. Overall, commission-free trading will continue to evolve, shaping the future of the financial industry.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator