简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best Time to Trade Forex in the UK 2025

Abstract:The best time to trade forex in the UK is during the London-New York overlap when liquidity and volatility are at their peak. Avoid low-liquidity periods like late-night hours or weekends to minimize risks. By aligning your schedule with these optimal times, using tools like an economic calendar, and trading with a reliable broker.

It is acknowledged that the forex market operates 24 hours a day, 5 days a week, but not all hours are created equal. Volatility, liquidity, and market overlaps dictate price movements, creating opportunities that can amplify profits or magnify risks. For traders in the UK, understanding these rhythms is especially critical. London, the worlds largest forex hub, handles about 35% of global forex volume, anchoring a network of financial activity that ripples across time zones from Tokyo to New York.

Understanding the Forex Market Hours

4 Forex Trading Sessions (UK Time-GMT/BST)

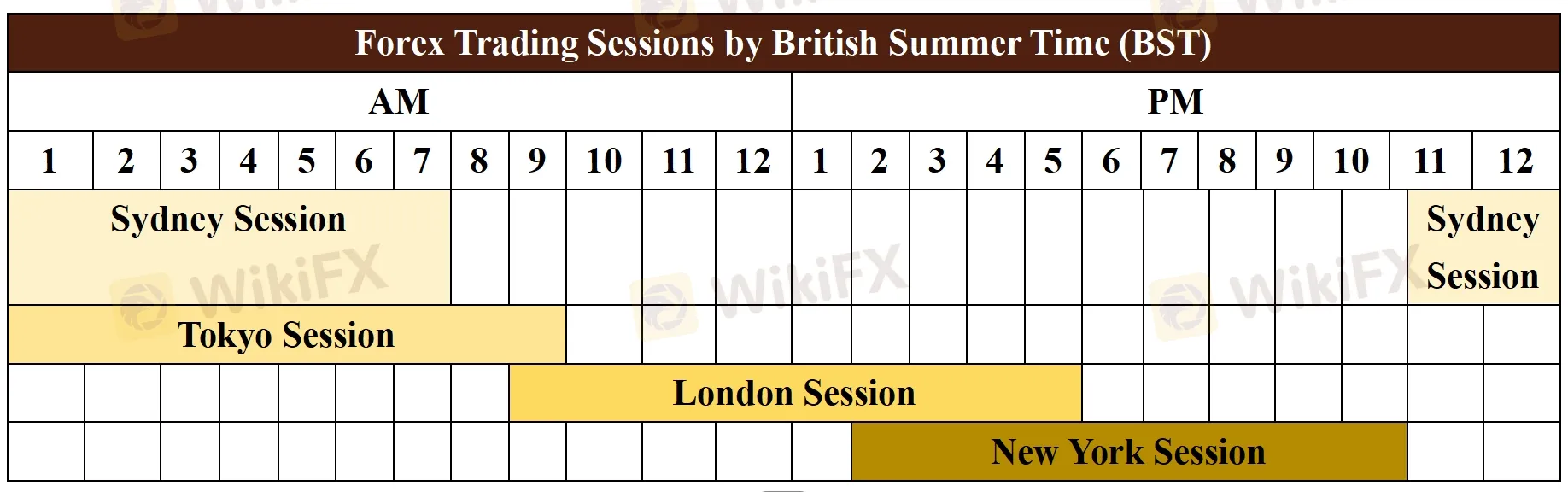

As we have mentioned before, forex markets operate 24/5, but activity peaks during specific sessions. There are four forex trading sessions, Sydney Session, Toyko Session, London Session, and New York Session.

The London Session (8:00 AM – 5:00 PM GMT/9:00 AM - 6:00 PM BST) is the most active session for UK traders, contributing to about 35% of global forex volume. Major currency pairs like EUR/USD and GBP/USD see significant price movements during this period.

| Session | GMT (Winter) | BST (GMT+1, Summer) | Volatility | Best Currency Pairs | |

| Sydney | 10:00 PM - 7:00 AM | 11:00 PM - 8:00 AM | Low - Moderate | AUD, NZD, JPY (AUD/USD, NZD/JPY) |

| Tokyo | 12:00 AM - 9:00 AM | 1:00 AM - 10:00 AM | Moderate | JPY, AUD, SGD (USD/JPY, AUD/JPY) |

| London⭐ | 8:00 AM - 5:00 PM | 9:00 AM - 6:00 PM | Very High | GBP, EUR, USD (GBP/USD, EUR/USD) |

| New York | 1:00 PM - 10:00 PM | 2:00 PM - 11:00 PM | High | USD, CAD, MXN (USD/CAD, EUR/USD) |

Note: UK switches to BST from 30 March to 26 October 2025.

3 Key Overlap Periods (UK Time-GMT/BST)

Based on the understanding of 4 forex trading sessions, you can learn about the 3 overlap sessions better. The most significant opportunities arise during overlap periods when two major trading sessions are open simultaneously. These overlaps create heightened liquidity and volatility.

The London-New York overlap (1:00 PM - 5:00 PM GMT/2:00 PM - 6:00 PM BST) is the most active and profitable period, offering high liquidity and volatility.

Major currency pairs like EUR/USD, GBP/USD, and USD/CAD experience rapid price movements. High trading volume ensures tight spreads and better execution, making it ideal for scalpers, day traders, and those using short-term strategies.

This overlap accounts for the majority of daily trading volume, offering the best opportunities for profit. Economic news releases from both Europe and the U.S. can further amplify volatility.

| Overlap | GMT (Winter) | BST (GMT+1, Summer) | Volatility | Best Currency Pairs |

| Sydney-Tokyo | 12:00 AM – 7:00 AM | 1:00 AM – 8:00 AM | Low - Moderate | AUD/JPY, NZD/JPY, AUD/USD |

| London-Toyko | 8:00 AM - 9:00 AM | 9:00 AM - 10:00 AM | Moderate | EUR/JPY, GBP/JPY, AUD/JPY |

| London-New York⭐ | 1:00 PM – 5:00 PM | 2:00 PM – 6:00 PM | Very high | EUR/USD, GBP/USD, USD/CAD |

Best Time to Trade Forex in the UK

Understanding the optimal times to trade forex is essential for maximizing opportunities and minimizing risks. For traders in the UK, aligning your trading activities with the most active market hours can significantly enhance profitability, while avoiding low-liquidity periods can help reduce costs and slippage.

The best time to trade you cannot miss must be the London-New York Overlap (1:00 PM – 5:00 PM GMT/2:00 PM - 6:00 PM BST). It is the most active and liquid period of the day. Institutional traders and banks are highly active, leading to rapid price movements and excellent trading opportunities. You can consider trading EUR/USD, GBP/USD, or USD/CAD.

Worst Times to Trade Forex in the UK

However, certain periods in the forex market are characterized by low liquidity, wider spreads, and increased slippage. Trading during these times can lead to unfavorable execution and higher costs. If you do not want to lose your money, please avoid the following times!

- Late Night Hours: 10:00 PM – 12:00 AM GMT/11:00 PM - 1:00 AM BST.

- Weekends and Off-Hours: Avoid holding positions over weekends due to price gaps.

- Low-Liquidity Gaps: Avoid trading during the gap between sessions, especially after the New York close.

Factors Influencing the “Best” Time to Trade

The “best” time to trade forex depends on a combination of market conditions and personal preferences. Factors such as volatility, liquidity, economic news releases, currency pairs, and risk tolerance all play a crucial role in determining when to enter the market. Understanding these elements can help you align your trading strategy with the most favorable conditions for success.

Market Volatility: High volatility = Bigger price moves, more opportunities but higher risks. Peaks during session overlaps and after major news events.

Liquidity: High liquidity = Tighter spreads, better trade execution. Best during active sessions (London, New York) and overlaps.

Economic News Releases: Major events (e.g., NFP, BoE decisions) cause sharp price movements. Use an economic calendar to plan or avoid high-impact times.

Currency Pairs Traded: EUR/USD, GBP/USD: Active in London/New York sessions. USD/JPY, AUD/JPY: Active in Tokyo session. Trade pairs that align with the session youre active in.

Risk Tolerance: High-risk traders: Focus on volatile periods like overlaps. Low-risk traders: Stick to steady, low-volatility sessions (e.g., Tokyo).

Practical Tips for UK Traders

To make the most of your trading sessions, its important to adapt to factors like avoiding periods of low liquidity and staying ahead of market-moving news. These practical tips will help you refine your approach, manage risks, and align your strategy with the realities of the forex market.

- Avoid Low-Liquidity Periods: Late New York session (after 8:00 PM GMT/9:00 PM BST) and Asian midday often see reduced activity.

- Use Economic Calendars: Track UK-specific events (e.g., GBP volatility around Brexit updates in 2025).

- Focus on Major Pairs: Prioritize EUR/USD and GBP/USD during London hours for tighter spreads.

- Use Stop-Loss Orders: Essential during volatile overlaps to manage risk.

Some Reliable Forex Brokers Optimized for UK Trading Hours

For UK traders, choosing a forex broker that aligns with local trading hours and offers optimal trading conditions is essential for success. The right broker not only provides access to the global forex market during key sessions—such as the London session and the London-New York overlap—but also ensures competitive spreads, fast execution, and reliable customer support.

To help you make an informed decision, weve curated a list of some of the most trusted brokers optimized for UK trading hours: IG, XTB, City Index, and eToro. These brokers are all regulated by reputable authorities like the Financial Conduct Authority (FCA), ensuring security and transparency while catering to the unique needs of UK traders.

| Broker |  |  |  |  |

| IG | XTB | City Index | eToro | |

| Year Established | 1974 | 2002 | 1983 | 2007 |

| Regulation | FCA, ASIC, FSA, FMA, MAS, DFSA⭐ | FCA, CySEC | FCA | FCA, ASIC, CySEC |

| Negative Balance Protection | ✔ | ✔ | - | - |

| Segregated Account | - | ✔ | - | - |

| Minimum Deposit | $0⭐ | £0⭐ | $0⭐ | $10 |

| Demo Account | ✅ ($20,000 virtual funds) | ✅ | ✅ (£10,000 in virtual funds for 12 weeks) | ✅ ($100,000 in virtual funds) |

| Maximum Leverage | 1:400 | 1:500 | 1:500 | 1:400 |

| Average EUR/USD Spread | 0.6 pips⭐ | 0.9 pips | 1.3 pips | 1 pip |

| Trading Platform | L2 dealer, ProRealTime, MT4, TradingView | xStation5 | Mobile trading app, WebTrader, TradingView, MT4 | eToro proprietary platform, MT4 |

| Copy/Social Trading | ✔ | - | - | ✔ |

| Deposit & Withdrawal Method | Credit/debit card, bank transfer | MasterCard, Maestro, Visa, Bank Transfer | Visa, MasterCard, Maestro and Electron, Bank transfer⭐ | Bank transfers, cards |

| Inactivity Fee | - | £10 monthly if no purchase or sale transaction within 365 days | £12 if inactive for 12 months or more | $10 monthly if no logins in the previous 12 months |

| Live Chat Support | ✔ | ✔ | ❌ | ❌ |

Conclusion

The best time to trade forex in the UK is during the London-New York overlap when liquidity and volatility are at their peak. Avoid low-liquidity periods like late-night hours or weekends to minimize risks. By aligning your schedule with these optimal times, using tools like an economic calendar, and trading with a reliable broker such as IG, XTB, City Index, or eToro, you can maximize opportunities and reduce costs. Success in forex trading comes down to preparation, discipline, and leveraging the right timing to suit your goals.

FAQs about Forex Trading Times in the UK

What time does the UK forex market open and close?

Forex trading begins at 10:00 GMT/11:00 PM BST on Sunday and closes at 10:00 GMT/11:00 PM BST on Friday.

Can I trade forex on weekends in the UK?

No, the forex market is closed on weekends.

What is the best time to trade forex in the UK?

The best time is during the London-New York Overlap (2:00 PM - 6:00 PM BST) when liquidity and volatility are highest.

Why is the London session important for UK traders?

The London session accounts for about 35% of global forex trading volume, offering high liquidity, tight spreads, and significant price movements, making it ideal for trading major currency pairs.

Which currency pairs are most active during London hours?

Major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY are most active during the London session due to overlapping trading activity in Europe and the UK.

How do I avoid slippage during high volatility?

To avoid slippage, trade during high-liquidity periods (e.g., London-New York overlap), use limit orders instead of market orders and avoid trading immediately after major news releases.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator