简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NFP Shocks Market, Triggers Dollar Surge

Sommario:Last Friday's U.S. Nonfarm Payroll (NFP) report rattled financial markets with a significantly higher-than-expected reading, far surpassing both market expectations and the previous month's figures. The robust job data dashed hopes for an early rate hike from the Federal Reserve, as a tight labour market could potentially spur higher inflation, prompting a more hawkish approach from the Fed regarding monetary policy.

NFP came at 272k last Friday, Spurred the dollar and hammered gold.

The euro is hindered by political uncertainty and is traded at a one-month low.

Japanese GDP came short and exerted further downside pressure on the Yen.

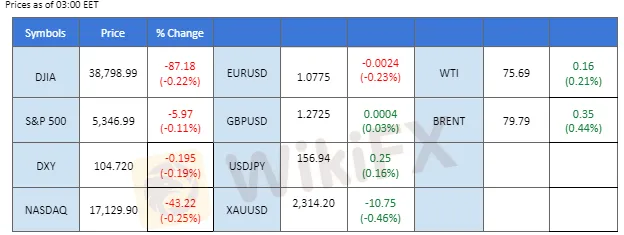

Market Summary

Last Friday's U.S. Nonfarm Payroll (NFP) report rattled financial markets with a significantly higher-than-expected reading, far surpassing both market expectations and the previous month's figures. The robust job data dashed hopes for an early rate hike from the Federal Reserve, as a tight labour market could potentially spur higher inflation, prompting a more hawkish approach from the Fed regarding monetary policy. In response, the dollar index surged nearly 1% immediately after the NFP release, while all three major U.S. equity markets retreated.

In the commodity market, the stronger dollar pressured gold prices to their lowest level in a month. Oil prices, meanwhile, remained steady after rebounding from a three-month low, as traders await Tuesday‘s OPEC monthly report and Wednesday’s Fed monetary policy statement.

In the forex market, the recently released Japanese GDP data fell short of expectations, putting additional downward pressure on the Japanese yen. Pound Sterling traders are also closely monitoring Tuesdays UK job data to gauge the currency's strength.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.9%) VS -25 bps (1.1%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which measures the greenback against a basket of six major currencies, rebounded aggressively following a much better-than-expected US jobs report, complicating the US economic outlook. Despite recent pessimistic economic data, the Nonfarm Payrolls report significantly exceeded market expectations, boosting dollar demand. According to the US Bureau of Labor Statistics, Nonfarm Payrolls surged from 165K to 272K, well above the expected 182K. Additionally, US Average Hourly Earnings rose from 0.20% to 0.40%, surpassing the forecast of 0.30%. However, the unemployment rate edged up to 4% from 3.9%, breaking a 27-month streak.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 105.15, 105.55

Support level: 104.65, 104.10

XAU/USD, H4

Gold prices tumbled sharply, pressured by a substantial rebound in the US Dollar. The unexpectedly strong US jobs report bolstered the dollar, causing a decline in dollar-denominated gold prices. Additionally, the People's Bank of China (PBOC), a major gold buyer for years, ended its 18-month streak of continuous gold purchases in May, following record-high prices in April and May, which also further dragged down the gold price, according to Bloomberg.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 2320.00, 2350.00

Support level: 2285.00, 2260.00

GBP/USD,H4

The GBP/USD pair declined sharply in the last session, primarily due to the strengthening of the U.S. dollar following robust job data. Last Friday's upbeat Nonfarm Payroll (NFP) reading fueled upside momentum for the dollar, raising expectations of a more hawkish approach from the Federal Reserve. Meanwhile, the Pound Sterling remains resilient against other currencies. Pound traders are now eyeing tomorrow's U.K. job data to assess the strength of the Pound and its potential to recover against the dollar.

The GBP/USD pair declined sharply but has found support above the previous low level. The RSI edged lower, while the MACD broke below the zero line, suggesting that bearish momentum may be forming.

Resistance level: 1.2760, 1.2850

Support level:1.2660, 1.2540

EUR/USD,H4

The EUR/USD pair slid last Friday as the strengthening U.S. dollar rejected the pair's attempt to break above its resistance level. Strong U.S. job data fueled expectations of a more hawkish monetary policy from the Federal Reserve, providing upside momentum for the dollar. Additionally, political uncertainty in Europe weighed on the euro. French President Emmanuel Macron's unexpected call for a snap legislative ballot after his party's defeat in the European Parliament election stirred uncertainty in European governance, pushing the euro lower in Monday's session.

EUR/USD has dropped to its one-month low level with strong bearish momentum intact with the pair. The RSI has fallen into the overbought zone while the MACD has dropped below the zero line and is diverging suggest the bearish momentum is gaining.

Resistance level: 1.0805, 1.0864

Support level: 1.0730, 1.0630

AUD/USD,H4

The Australian dollar dropped drastically against the U.S. dollar following the release of robust U.S. job data last Friday. However, the pair has found support at a crucial level that has been providing buoyancy since May. Looking ahead, the Chinese CPI reading due on Wednesday and the Australian job data expected on Thursday are anticipated to impact the Aussie dollar and influence the pair's movement. Traders will be closely monitoring these reports for further direction.

The pair recorded its biggest decline in a month but is currently supported at the 0.6570 level. The RSI has dropped to the above-oversold zone, while the MACD has broken below the zero line, suggesting that bearish momentum is gaining.

Resistance level: 0.6640, 0.6680

Support level: 0.6540, 0.6500

USD/JPY, H4

The Japanese yen extended its losses, pressured by a downbeat Japan GDP report and the stronger-than-expected US jobs data, which widened the US-Japan yield gap. According to the Cabinet Office, Japan's Gross Domestic Product (GDP) for the first quarter contracted by 0.50%, in line with market expectations. This significant decline has raised concerns about Japans economic outlook, prompting the USD/JPY pair to surge aggressively.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 157.10, 158.45

Support level: 156.15, 155.20

BTC/USD, H4

Bitcoin (BTC) has been consolidating following a sharp decline over the past weekend. Data suggests that profit-taking sentiment has eased, and BTC whales have started accumulating cryptocurrency. Additionally, open interest for BTC contracts has shown signs of picking up, indicating that BTC prices have found support at current levels. However, BTC prices are also being hindered by the robust U.S. job market, which may lead to a more hawkish monetary policy from the Federal Reserve. This potential for tighter monetary policy is creating headwinds for BTC.

BTC declined from its recent high above $71000 and has formed a double-top price pattern. The RSI is currently flowing below the 50 level, while the MACD has crossed below the zero line, suggesting that the downside pressure remains with BTC.

Resistance level: 70900.00, 73660.00

Support level: 67540.00, 64860.00

CL OIL, H4

Crude oil prices continued to consolidate within a range as mixed economic sentiments created uncertainty about the oil market's prospects. On the positive side, some market participants and economists expect that major global central banks might consider easing monetary policies and potentially cutting rates, which could support oil prices. However, gains remain limited due to ongoing economic uncertainties and rising oil production. Investors should continue to monitor developments for further trading signals.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 55, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 76.15, 79.80

Support level: 72.90, 69.00

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

WikiFX Trader

Rate Calc