简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

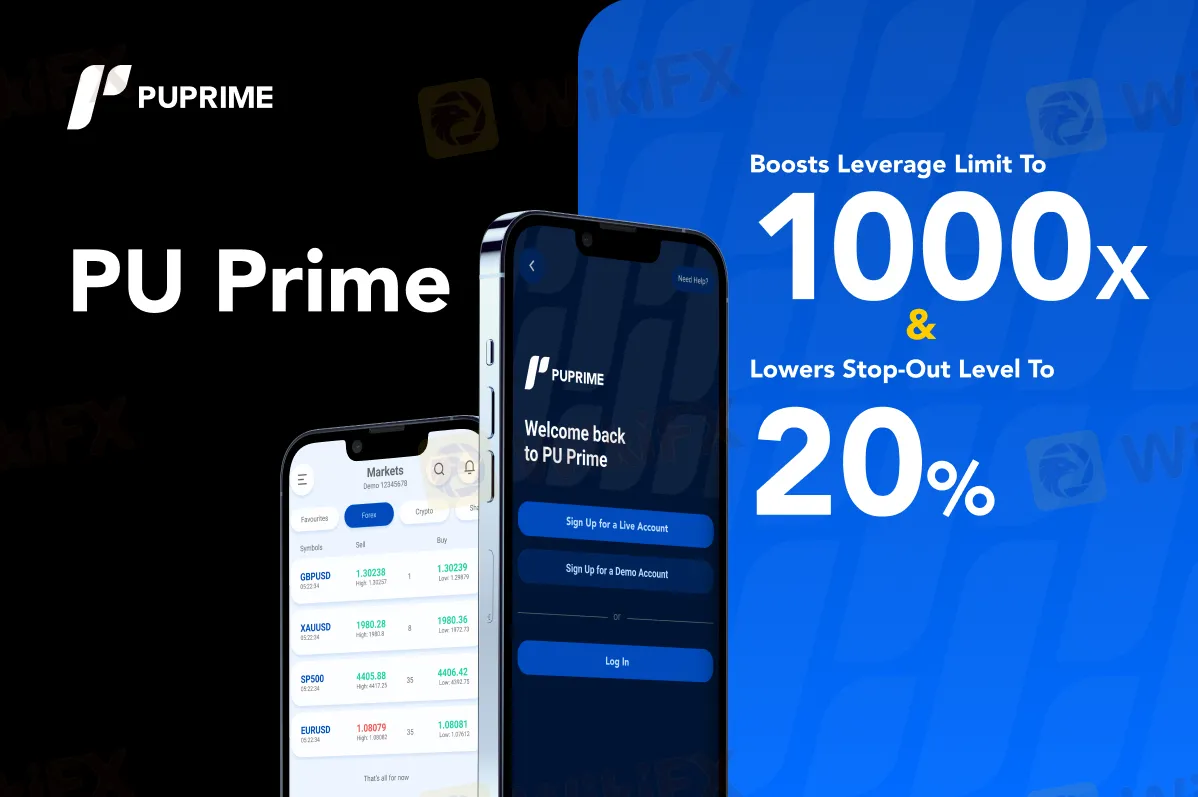

PU Prime Ups Leverage Limit, Downs Stop-out Level

Sommario:Leading broker PU Prime is shaking things up with a dual approach to enhance customer risk management and trading opportunities. Effective June 17th, 2024.

Leading broker PU Prime is shaking things up with a dual approach to enhance customer risk management and trading opportunities. Effective June 17th, 2024, they're:

Raising the maximum leverage to 1:1000:This allows traders to control larger positions with a smaller initial investment, potentially leading to bigger profits. However, remember – greater leverage equals greater risk. Tread cautiously when using such high leverage.

Lowering the stop-out level to 20%:If your account equity falls below 20% of the required margin, your positions will automatically close to limit losses. This safety net encourages responsible risk management and provides greater peace of mind while navigating the market.

PU Prime's bold move to increase the leverage limit while simultaneously reducing the stop-out level significantly alters the forex and CFD trading landscape. It empowers traders to potentially amplify their gains, but emphasizes the importance of meticulous risk management. By offering high leverage and a tighter stop-out, PU Prime aims to equip traders for safe and potentially profitable ventures.

Remember, high rewards come with high risks. Traders should be vigilant and employ smart risk management strategies, such as stop-loss orders, portfolio diversification, and detailed trade records. Utilize PU Prime's new settings thoughtfully to maximize your trading potential while minimizing risks.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FBS

VT Markets

GO MARKETS

TMGM

Tickmill

Octa

FBS

VT Markets

GO MARKETS

TMGM

Tickmill

Octa

WikiFX Trader

FBS

VT Markets

GO MARKETS

TMGM

Tickmill

Octa

FBS

VT Markets

GO MARKETS

TMGM

Tickmill

Octa

Rate Calc