简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】The Surge in Gold Prices - Reassessment of the Value of Safe-Haven Assets Amid Economic Uncertainty

Sommario:The strong performance of the gold market in 2024 is not only a response to global economic uncertainty but also a deep understanding of central bank policies and market trends. Gold, as a traditional safe-haven asset, still cannot be ignored in its value and attractiveness in a changing market environment. The rise in prices is not only a reflection of market sentiment but also an expectation of future economic policies and the global economic situation. Investors need to closely monitor the re

Recently, the dramatic fluctuations in the spot gold price have become a focal point in the global financial market. On Friday, the spot gold price touched a historical high of $2,500 per ounce before slightly retreating to around $2,477. This surge not only reflects the market's complex expectations for the US economic outlook but also the close attention to the Federal Reserve's monetary policy.

The gold market has attracted global investors' attention with a series of record high prices. Despite concerns that high gold positions may lead to a price correction, Charlie Morris, founder of ByteTree, believes that the upward trend of gold has just begun, and the market's skepticism is unnecessary. He points out that many macroeconomic experts are skeptical about the upward trend of gold, mainly because they believe that market positions are too high. However, he believes that this skepticism is unfounded. He emphasizes that although most investors have missed the significant rise in gold, central banks have benefited from it, indicating that the rise in gold prices is not without support.

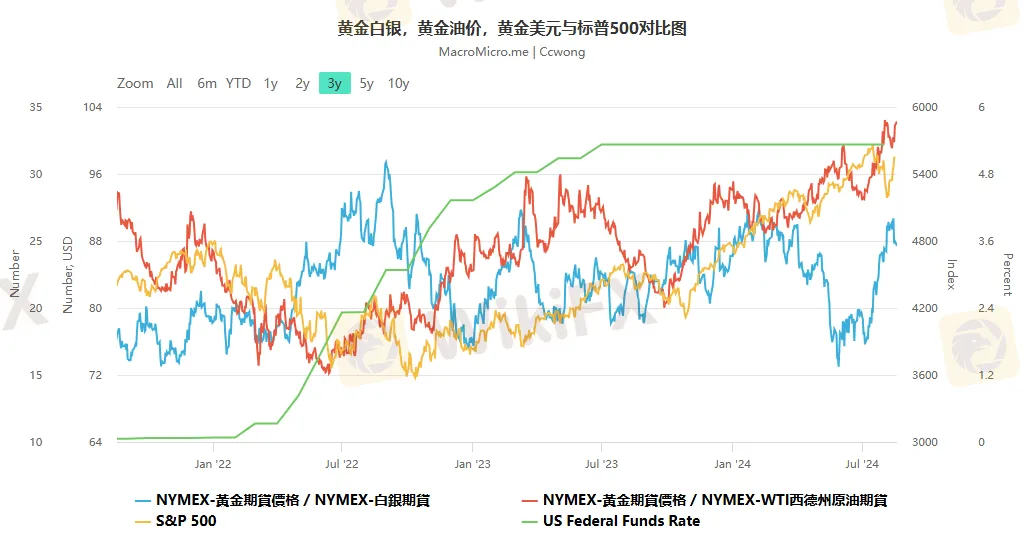

From a technical analysis perspective, it is believed that gold is at a significant historical high. Morris mentioned that since 2006, although gold has lagged behind the S&P 500 index, the gap is not large, highlighting the importance of gold as a diversification tool in investment portfolios. This performance also shows the stability and value of gold in different market environments. Meanwhile, the holdings of gold ETFs are on the rise, but this does not mean that gold trading is already too crowded.

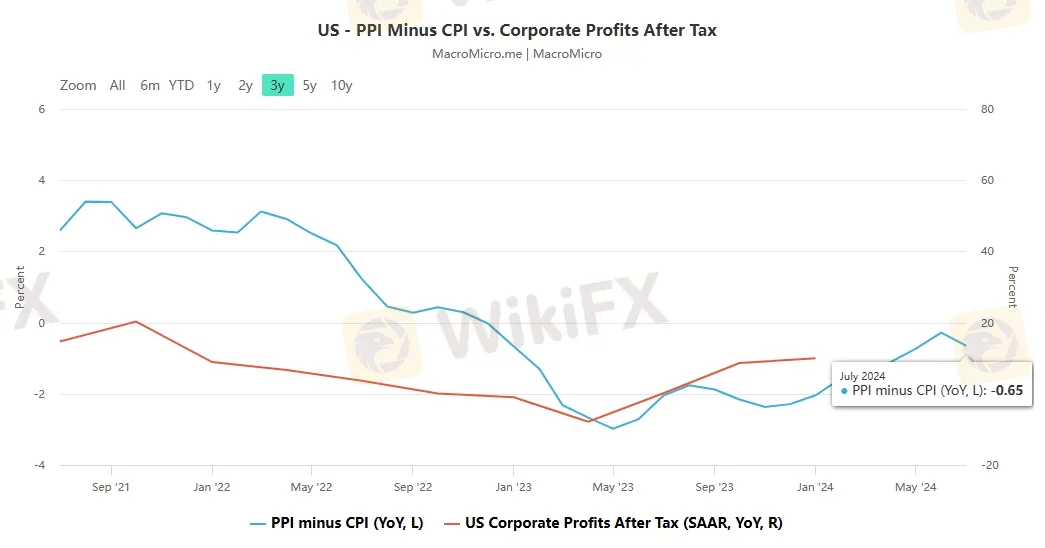

On the other hand, Mark Spitznagel, Chief Investment Officer of Universa Investment Fund, expressed deep concern about the current economic situation. He pointed out that although the market has shown some signs of economic cooling, such as the rise in unemployment rates and cautious consumer behavior, this does not mean the end of the economic recession. Spitznagel predicts that if the United States has not fallen into a recession by the end of this year, he would be surprised. He warned that excessive debt in the global economy and the Federal Reserve's “money printing” behavior may lead to a period of low growth and high inflation, known as stagflation.

Spitznagel is critical of the Federal Reserve's monetary policy. He believes that although the Federal Reserve may take measures such as interest rate cuts, restarting quantitative easing, or launching new stimulus measures to save the economy and the market, these measures may not be sufficient to prevent significant losses for consumers and investors. He pointed out that once money printing and inflation become expected, all money printing will eventually lead to stagflation, and money printing has never created real wealth.

Despite his pessimistic view of the economic outlook, Spitznagel also sees investment opportunities. He believes that after the next epic collapse, gold and commodities will once again become a real trading opportunity. This view echoes that of OANDA market analyst Zain Vawda, who believes that gold prices may need additional catalysts to break through $2,500, but it is unlikely in the short term.

Recently, data has restored confidence that was shaken by the unexpectedly weak employment report earlier this month. The PPI and CPI data released this week have also strengthened optimism about improving inflation. Currently, traders are convinced that the Federal Reserve will cut interest rates at the September meeting, but there is controversy over the extent of the cut. The Federal Reserve Observation Tool of the Chicago Mercantile Exchange Group shows that the probability of a 50 basis point rate cut by the Federal Reserve in September is currently 25%, lower than the previous day's 36%.

Dilin Wu, a research strategist at Pepperstone, is also cautious about the gold market. He believes that unless there is a significant shift in market expectations, gold prices may continue to fluctuate within a roughly range. Wu pointed out that the biggest risk facing gold prices is the US non-farm employment data to be released in early September. If employment growth slows down and the unemployment rate remains high, this data may trigger concerns about an economic recession.

But it seems that Morris's judgment has won the market's approval, and gold broke through the $2,500 mark the next day, which was unexpected by many! We can observe that although the futures market's long positions are high, they are not extremely high, and the short positions show a certain randomness. Obviously, investors have paid too much attention to the futures market data (COT) and have neglected the importance of ETF fund flows. That is to say, although the inflow of investor funds has weakened since 2021, the price of gold has continued to rise.

The more reasonable explanation behind this is the continuous demand for gold by central banks. The demand of central banks is the most important factor affecting the gold price, which has been clearly reflected in the gold price trend in recent months and years. So despite market doubts, the upward trend of gold is still stable, and the demand of central banks will continue to support the rise of gold prices. Therefore, instead of paying too much attention to short-term market fluctuations, it may be a more scientific investment approach to focus more on the long-term value of gold and the dynamics of central bank demand in the coming period.

The strong performance of the gold market in 2024 is not only a response to global economic uncertainty but also a deep understanding of central bank policies and market trends. Gold, as a traditional safe-haven asset, still cannot be ignored in its value and attractiveness in a changing market environment. The rise in prices is not only a reflection of market sentiment but also an expectation of future economic policies and the global economic situation. Investors need to closely monitor the release of economic data and the actions of policymakers to make wise investment decisions. In addition, considering the value of gold and commodities during economic turmoil, investors may need to re-evaluate their investment portfolios to prepare for possible market changes.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Pepperstone

FxPro

Vantage

STARTRADER

Tickmill

FBS

Pepperstone

FxPro

Vantage

STARTRADER

Tickmill

FBS

WikiFX Trader

Pepperstone

FxPro

Vantage

STARTRADER

Tickmill

FBS

Pepperstone

FxPro

Vantage

STARTRADER

Tickmill

FBS

Rate Calc