简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dovish FOMC Meeting Minutes Hammers Dollar

Sommario:The dollar continued to face downside pressure following the release of the FOMC meeting minutes. Concerns were raised by FOMC members over potential labour market deterioration, with the majority of the members signalling that a September rate cut might be appropriate. This dovish narrative provided buoyancy to the equity market, as all major U.S. indexes gained in the last session.

The dollar faced continued downside pressure after FOMC meeting minutes hinted at a potential September rate cut, boosting U.S. equity markets.

The euro and British pound reached their highest levels in 2024 against the weakening dollar, eyes on todays PMI readings for both regions.

Oil struggled to maintain support at $72.40, pressured by concerns over the U.S. labour market following a downward revision of the March NFP figure.

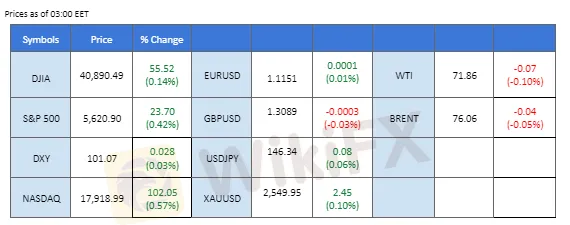

Market Summary

The dollar continued to face downside pressure following the release of the FOMC meeting minutes. Concerns were raised by FOMC members over potential labour market deterioration, with the majority of the members signalling that a September rate cut might be appropriate. This dovish narrative provided buoyancy to the equity market, as all major U.S. indexes gained in the last session.

In the forex market, the euro and the British pound both surged to their highest levels in 2024 against the weakening dollar. Today's PMI readings from both regions are expected to have a direct impact on these currency pairs.

In the commodity market, gold prices were weighed down by heightened profit-taking as the metal surpassed the psychological level of $2,500. Meanwhile, oil prices continued to lack momentum, failing to hold their key support level near $72.40. This decline was exacerbated by the U.S. Bureau of Labor Statistics' revision of the March NFP figure, which suggested that the labor market might not be as strong as previously thought, raising concerns about the broader U.S. economic outlook.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index continues to extend its losses amid growing dovish expectations from the Federal Reserve ahead of the Jackson Hole meeting later this week. The recently released minutes from the Fed's July meeting indicate that the central bank is moving closer to a long-anticipated interest rate reduction, with a higher likelihood of a cut in September. Additionally, the Bureau of Labor Statistics revised down March 2024s employment gains by 818,000 positions earlier in the session, further pressuring the dollar.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 25, suggesting the index might enter oversold territory.

Resistance level: 102.35, 103.35

Support level: 101.10, 99.95

XAU/USD, H4

Gold prices continue to hold above the key psychological level of $2,500 for the third consecutive day, supported by signals from the Fed's meeting minutes that suggest a potential interest rate cut in September. The ongoing weakness in the US dollar, driven by these dovish expectations, continues to bolster dollar-denominated gold. As the week progresses, investors should focus on several crucial economic data releases, including the US Initial Jobless Claims and Fed Chair Jerome Powell's statements at Jackson Hole, to gain further trading insights.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2535.00, 2580.00

Support level: 2495.00, 2465.00

GBP/USD,H4

The British pound continued to trade higher against the U.S. dollar, buoyed by the greenback's ongoing weakness. Yesterday's FOMC meeting minutes revealed a dovish tone, further eroding the dollar's strength. Traders are now turning their attention to the U.K.'s PMI readings, due later today. Expectations of an improvement in the U.K. economy could have a direct impact on the GBP/USD pair, potentially providing additional upward momentum if the data meets or exceeds market expectations.

GBP/USD continues to trade to another high and is poised at its recent high level, suggesting a bullish bias for the pair. The RSI stayed in the overbought zone, while the MACD continued to edge higher, suggesting the pair remains trading with strong bullish momentum.

Resistance level: 1.3140, 1.3220

Support level: 1.2985, 1.2915

EUR/USD,H4

The EUR/USD pair is poised at its highest level in a year, awaiting further catalysts to push higher. The dollar remains weak, pressured by the dovish tone in the FOMC meeting minutes released yesterday. Euro traders are now focusing on today's PMI readings, which could serve as a fresh catalyst for the euro. Positive PMI data may provide the momentum needed for the euro to strengthen further against the dollar, potentially driving the pair to new highs.

EUR/USD remains trading with a higher-high price pattern, suggesting a bullish bias for the pair. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting the pair remains trading with strong bullish momentum.

Resistance level: 1.1180, 1.1230

Support level: 1.1040, 1.0985

USD/JPY, H4

The USD/JPY pair continues to decline after breaking below the critical liquidity zone near the 147.00 level. The pair is pressured by the weakening dollar, which has been hindered by the dovish FOMC meeting minutes. Adding to the potential volatility, the BoJ chief is scheduled to attend a hearing at the Japanese Parliament to answer questions from Lower House lawmakers. The outcome of this hearing could have a direct impact on the yen's strength, as it may influence the direction of the BoJ's upcoming monetary policy decisions. Traders should closely monitor this event, as it could provide further momentum for the pair's movement.

The USD/JPY is forming a lower-low price pattern suggesting the pair is trading in a downtrend trajectory. The RSI is approaching the oversold zone while the MACD has broken below from the zero line suggesting the pair is trading with bearish momentum.

Resistance level: 146.00, 149.20

Support level: 143.45, 141.40

BTC/USD, H4

Bitcoin (BTC) has seen a 3% rally following the release of the FOMC meeting minutes, which had a dovish tone, thereby improving market risk appetite. Despite this upward movement, BTC faces significant selling pressure near the $60,600 liquidity zone. However, the formation of a higher low suggests that the overall selling pressure is diminishing. If BTC breaks through this key liquidity zone, it could signal a strong bullish trend for cryptocurrency.

BTC prices have shown signs of easing from their bearish trend and may have a chance to break above their current strong resistance level at below $61000. The RSI remains at the above 50 level, while the MACD is flowing flat close to the zero line, giving a neutral signal for BTC.

Resistance level: 64860.00, 67540.00

Support level: 57060.00, 52530.00

NASDAQ, H4

The US equity market continues to edge higher, buoyed by the Fed's July meeting minutes, which have bolstered expectations for a rate cut next month. With the vast majority of Fed policymakers signaling that it may be appropriate to begin cutting rates in September, the equity market remains positive. However, risks linger regarding the US economic performance, especially following the Bureau of Labor Statistics' downward revision of the US jobs report, which has heightened concerns about the economy. Investors should closely monitor Fed Chair Jerome Powell's upcoming statements for further trading signals.

Nasdaq is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 20015.00, 20705.00

Support level: 19035.00, 17865.00

CL OIL, H4

The pessimistic global economic outlook continues to weigh heavily on oil prices. Compounding these concerns, the Bureau of Labor Statistics reported that the US jobs figures might have been overstated by 818,000 positions, renewing worries about a slowing economy. Additionally, easing tensions in the Middle East, with Israel agreeing to a preliminary ceasefire deal brokered by the US, has further reduced supply risks and pressured oil prices.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 72.45, 75.20

Support level: 70.40, 67.50

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Tickmill

TMGM

ATFX

STARTRADER

FxPro

HFM

Tickmill

TMGM

ATFX

STARTRADER

FxPro

HFM

WikiFX Trader

Tickmill

TMGM

ATFX

STARTRADER

FxPro

HFM

Tickmill

TMGM

ATFX

STARTRADER

FxPro

HFM

Rate Calc