简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Post-Fed Rate Cut, Gold Prices Persist in Rallying While Market Divergence Deepens

Sommario:Following the Federal Reserves rate cut, international gold prices have continued to shatter historical highs. On the 23rd, the New York COMEX gold benchmark contract peaked above $2,656 per ounce, on

Following the Federal Reserve's rate cut, international gold prices have continued to shatter historical highs. On the 23rd, the New York COMEX gold benchmark contract peaked above $2,656 per ounce, only to experience a significant retreat, causing market apprehension. Is the lofty gold price unsustainable? In reality, the bull conviction remains unshaken, with capital actively pouring into the market, increasing their stakes in gold-related products.

Gold Futures and Spot Price Spread at a Premium.On September 23, after reaching an all-time high, international gold prices plummeted abruptly. As of the time of this writing, the London spot gold price is hovering around $2,616 per ounce, while the New York Comex gold futures December contract is hovering around $2641 per ounce, with the spread between London spot gold and the Comex gold benchmark contract— that is, the difference between futures and spot prices (Spread)— reaching as high as $25 per ounce.The spread between futures and spot prices is a crucial indicator of investment enthusiasm. At the end of July this year, this spread approached $50 per ounce, setting a new high since March 2020. Now, this spread has yet to narrow, and net long positions in the gold market continue to climb.

Gold ETFs Regain Favor with Capital Inflows.In the second half of the year, capital seems to have rediscovered its preference for gold ETFs. Global gold ETF products achieved an inflow of $2.1 billion in August, and with the rise in gold prices, the overall size of global gold ETFs reached a new high at the end of August, hitting $257 billion.

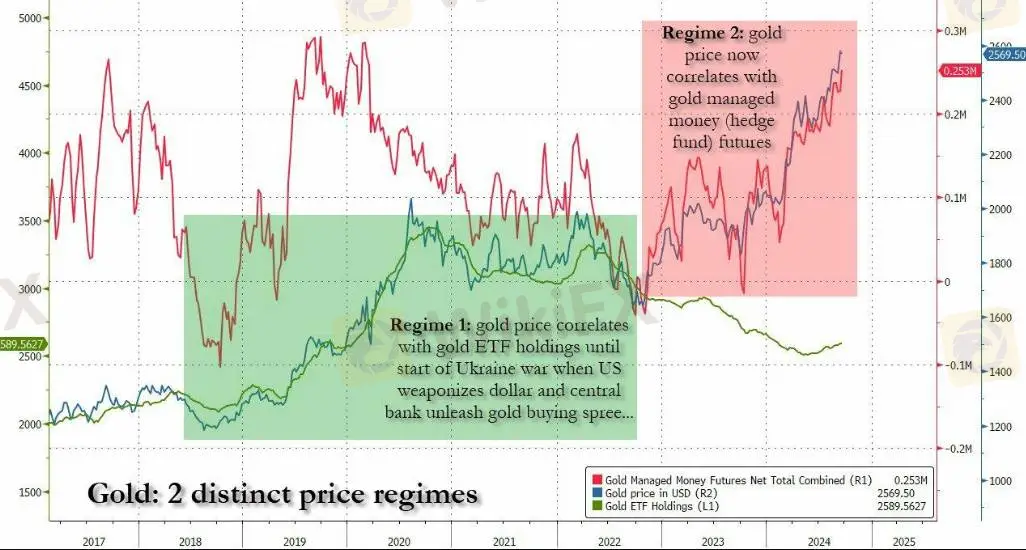

At present, the behemoth gold ETF with a scale close to $70 billion—SPDR Gold ETF (GLD)— has seen capital inflows for three consecutive months. Notably, in August, global gold ETF holdings increased by 28.5 tons of gold, with North American funds adding 17.2 tons.Goldman Sachs team pointed out a striking phenomenon in the gold market: for several years prior to the Russia-Ukraine conflict, the correlation between gold prices and gold ETF holdings was indeed very close, but since then, the gold price has completely lost its correlation with ETF holdings, instead becoming closely related to another data series: the net value of managed funds (i.e., hedge funds) futures.

Hedge funds— perhaps due to their ability to collect and trade “non-public” central bank information— have become a barometer and real-time indicator of central bank purchasing behavior. Therefore, the current spot gold price is directly related to the net gold management futures (CFCDUMMN).As ETF capital flows have also turned positive, coupled with continuous buying by central banks, record gold imports by India, and unprecedented demand for physical gold in the U.S., it's no wonder that gold is setting new historical highs day after day. But this is just the beginning. Another reason for the anticipated surge in gold is the Federal Reserve's recent “recalibration,” where Powell initiated an easing cycle with significant rate cuts, which gold apparently deems unnecessary, hence the surge in prices. Benjamin Picton of Rabobank stated:

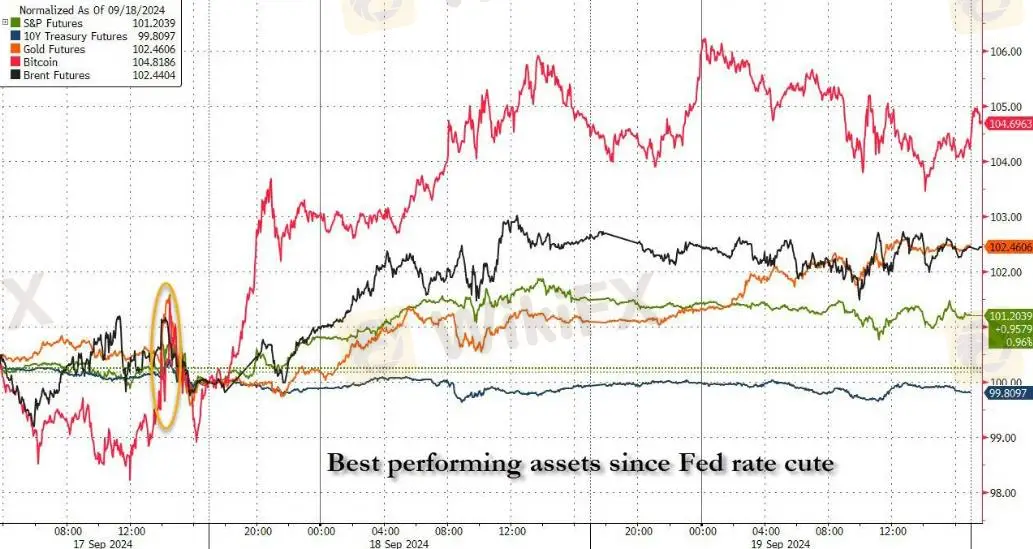

Last Friday, gold prices reached an all-time high, closing well above the $2,600 per ounce threshold. At this juncture, the upward momentum of gold seems unstoppable, and it has become commonplace for it to revisit historical highs. Given that the Federal Reserve has initiated an easing cycle with ultra-large scale rate cuts while economic growth remains robust, inflation is above target, and the federal deficit is at a staggering level, this might not be surprising.Since the Fed's rate cut last week, gold has been the second-best performing asset, just behind Bitcoin. Silver is also on the move. Goldman trader Robert Quinn noted that as gold ETFs finally began to rise, the managed money long positions in silver (which have been a major driving force for gold prices over the past two years) are also surging.

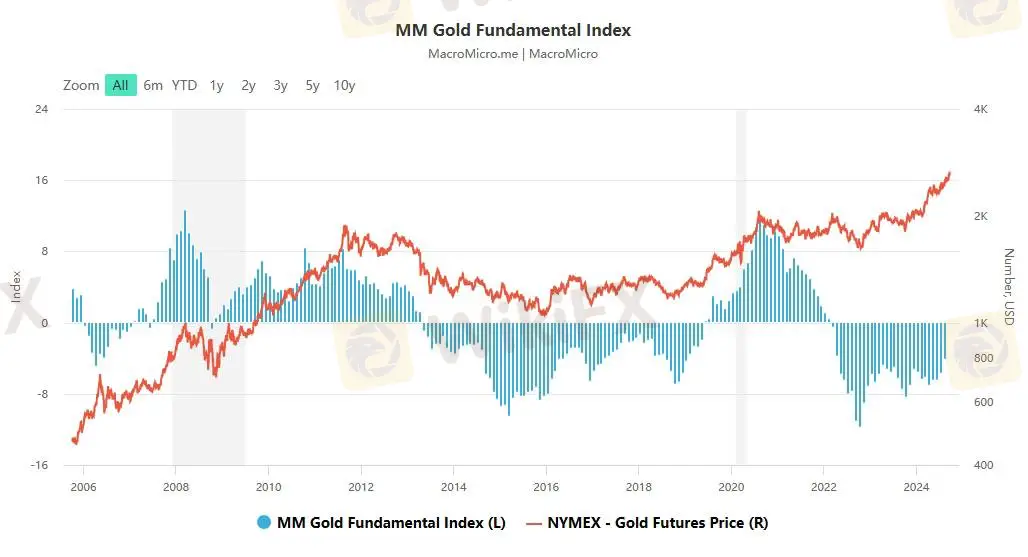

Goldman's commodity team emphasizes that the surge in gold ETF buying is just beginning and reiterates its recommendation to go long on gold, setting a price target of $2,700 per ounce by early 2025, for three main reasons:

1.Goldman believes that since mid-2022, due to concerns about U.S. financial sanctions and U.S. sovereign debt, the volume of gold purchases by central banks has tripled, a structural trend that will continue regardless of reporting.

2.The Fed's rate cuts are expected to bring Western capital back to gold ETFs, which have been largely absent during the significant rebound in gold prices over the past two years. As ETF holdings will only gradually increase with the Fed's rate cuts, this upward trend has not been fully priced in.

3.Gold provides significant hedging value for portfolios against geopolitical shocks, including tariffs, Fed-related risks, debt concerns, and recession risks. Goldman's analysis indicates that if financial sanctions rise to levels seen since 2021, gold prices could have an additional 15% upside; similarly, if U.S. CDS spreads widen by one standard deviation (13 basis points) amid heightened debt concerns, gold prices could see comparable gains.

In light of the above technical and liquidity issues, Goldman believes that the gold trend has just begun.Precious Metals Remain Attractive for Allocation.Currently, investment banks such as UBS and Goldman Sachs have set a target price of $2,700 for gold, with more domestic and international hedge funds predicting that surpassing the $3,000 mark is only a matter of time.

Securities analysts believe that the sell-off before the rate cut was a preemptive reaction to domestic investors' concerns about gold price declines under the expectation of a rate cut. However, the performance of gold prices since the rate cut on September 18, along with the underlying logic, supports the continuation of high gold prices. The performance of gold prices after the rate cut and the preemptive decline in gold stock prices show a significant expectation gap, with stock prices expected to rise to correct valuations.

Some analysts, from a macro allocation perspective, believe that precious metals are still worth more allocation to hedge against currency credit risks. The gold price maintains a ladder-like upward trend, and the transition from volatility to rapid upward movement requires event-driven catalysts, still advising to buy more on dips. The current anchor for precious metals is not the real interest rates under the global quantitative easing system, but the currency credit risks that the global quantitative easing system can no longer sustain; thus, the fundamental driver for the rise remains unchanged. Historically, rate cuts have often been beneficial for precious metals, but the impact on other assets still needs further observation.

Reviewing the rate cut cycles since 1980, it is found that gold prices are likely to continue rising in the early stages of the rate cut cycle, while the longer-term gold price trend depends on the economic environment at the time. The current valuation level of gold stocks is much lower than the historical level for the same cycle. With the Fed starting its rate cut cycle, domestic policy space is expected to open up in tandem, and market risk appetite may gradually improve. The combination of “low valuation” and “rising market risk appetite” makes the cost-effectiveness of domestic gold stock allocation still prominent.

For precious metal investment, whether in gold or silver, it seems that we are standing at a new starting point. As global economic uncertainty increases and monetary policies become more accommodating, the safe-haven attributes of precious metals are once again being emphasized. Investors should pay attention not only to short-term price fluctuations but also to the long-term allocation value.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

XM

Tickmill

FXTM

EC Markets

IC Markets Global

ATFX

XM

Tickmill

FXTM

EC Markets

IC Markets Global

ATFX

WikiFX Trader

XM

Tickmill

FXTM

EC Markets

IC Markets Global

ATFX

XM

Tickmill

FXTM

EC Markets

IC Markets Global

ATFX

Rate Calc