简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Jerome Powell Hawkish Statement Spurs Dollar

Sommario:Market SummaryThe U.S. dollar gained momentum following a hawkish statement from Fed Chair Jerome Powell, signalling that the Federal Reserve is not in a rush to accelerate rate cuts and is likely to

Market Summary

The U.S. dollar gained momentum following a hawkish statement from Fed Chair Jerome Powell, signalling that the Federal Reserve is not in a rush to accelerate rate cuts and is likely to maintain a quarter-point rate reduction in the near term. This boosted the Dollar Index (DXY), which rose over 0.5% in the last session, while Wall Street retreated due to concerns over the Fed's hawkish stance.

Meanwhile, the euro faced downward pressure as inflation data from key Eurozone economies like Germany and Spain pointed to further easing, suggesting that the ECB might consider another rate reduction soon. Similarly, the Japanese yen, which had strengthened following the victory of Japans incoming prime minister, saw its gains ease in the previous session.

In the commodity market, gold struggled against the rising dollar, falling towards its weekly low. Oil prices remained lacklustre, with traders closely watching the escalating tensions between Israel and Lebanon, which could potentially drive prices higher in the near future.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32%) VS -25 bps (68%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index rebounded slightly after Federal Reserve Chair Jerome Powell alleviated concerns about a potential aggressive 50 basis point rate cut. Powell pointed to recent US economic data showing positive signs in both economic growth and personal income, reducing some of the downside risks that the Fed had previously highlighted. As a result, market participants are now pricing a 35% probability of a 50 basis point rate cut in November, down from 53%.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 100.95, 101.80

Support level: 100.25, 99.70

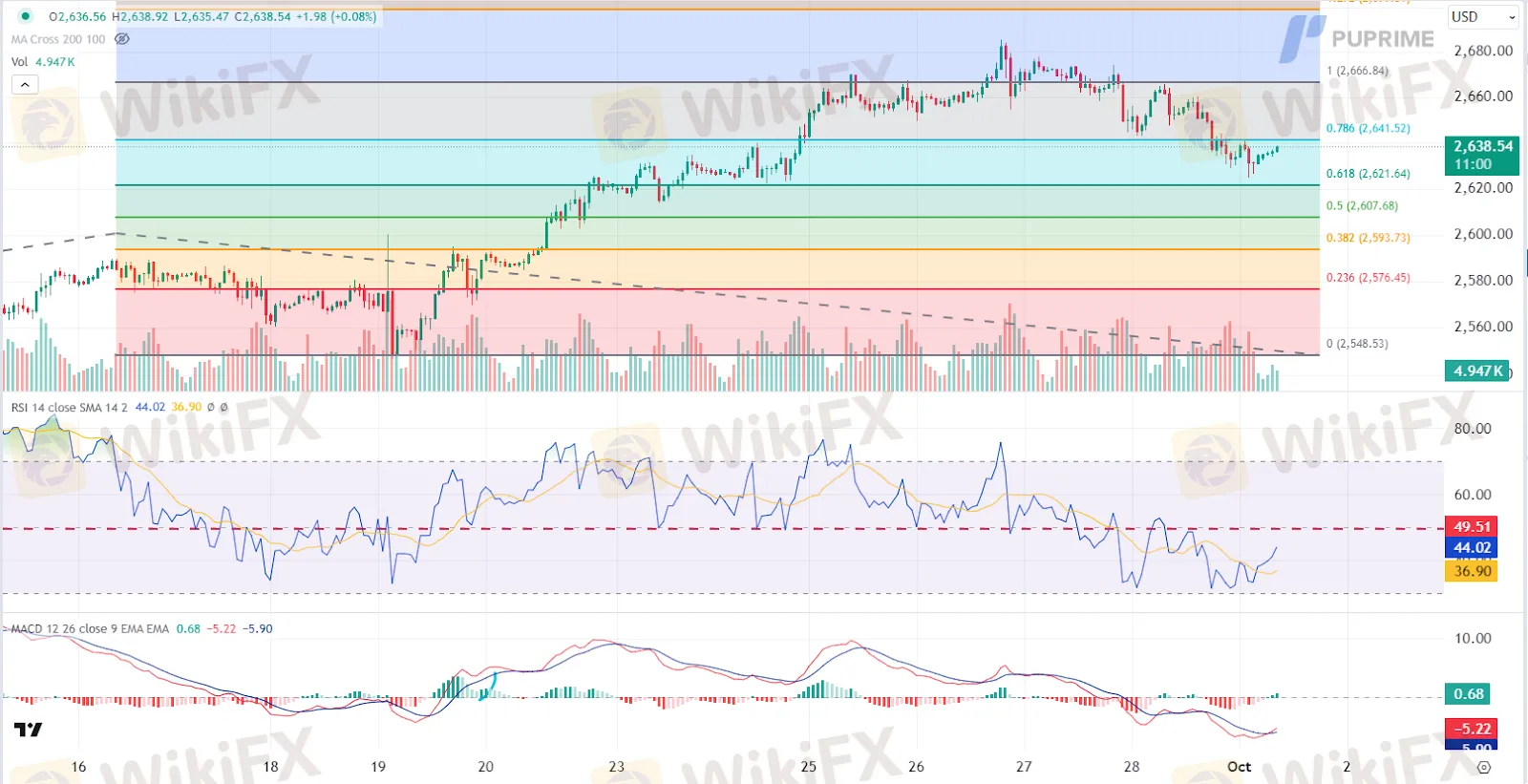

XAU/USD, H4

Gold prices retreated due to profit-taking and strengthening US Dollar, making dollar-denominated gold more expensive and dampening demand. Powell‘s positive remarks on the US economic outlook further fueled the dollar’s rebound, causing gold prices to dip. The reduced likelihood of a 50-basis point rate cut also contributed to the bearish sentiment surrounding gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2640.00, 2665.00

Support level: 2620.00, 2610.00

GBP/USD,H4

The Pound Sterling eased slightly in yesterday's session but continues to hold above its previous fair-value gap, indicating that it remains within its bullish trajectory against the U.S. dollar. The pair faced pressure from the strengthening dollar, which gained support following Jerome Powell's hawkish remarks about the Fed's cautious stance on rate cuts. Despite this, the Pound Sterling managed to offset some of the dollar's strength, as the Bank of England's (BoE) ongoing monetary tightening provided buoyancy for the currency, keeping it relatively firm.

The GBP/USD encountered strong selling pressure at below 1.3425, but the pair was also supported at above its previous fair-value gap at above 1.3350. A break from either side will give a clearer signal for the upcoming trend for the pair. The RSI is easing while the MACD is declining, suggesting the bullish momentum is softening.

Resistance level: 1.3440, 1.3520

Support level:1.3350, 1.3285

EUR/USD,H4

The EUR/USD pair has broken below its uptrend channel, signalling a potential bearish trend. The pair came under pressure from the strengthening U.S. dollar following Fed Chair Jerome Powell's hawkish comments, which reinforced expectations of a slower pace in rate cuts. Additionally, the German and Spanish CPI readings indicated easing inflation, raising concerns that the European Central Bank (ECB) may further ease its monetary policy, which would likely weigh on the euro's strength going forward.

The pair suggests a bearish signal, followed by a break below from the uptrend channel. A break below the critical support level at 1.1120 will be a solid bearish signal for the pair. The RSI has a lower-low pattern, while the MACD is on the brink of breaking below the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 1.1150, 1.1225

Support level: 1.1080, 1.1020

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IC Markets Global

IQ Option

FxPro

GO MARKETS

Pepperstone

STARTRADER

IC Markets Global

IQ Option

FxPro

GO MARKETS

Pepperstone

STARTRADER

WikiFX Trader

IC Markets Global

IQ Option

FxPro

GO MARKETS

Pepperstone

STARTRADER

IC Markets Global

IQ Option

FxPro

GO MARKETS

Pepperstone

STARTRADER

Rate Calc