简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Trends】 Gold prices consolidate at high levels, market volatility and uncertainty coexist

Sommario:Gold is undoubtedly one of the most watched assets this year. Driven by the expectation of a sharp interest rate cut by the Federal Reserve and the concerns of foreign governments about the weaponizat

Gold is undoubtedly one of the most watched assets this year. Driven by the expectation of a sharp interest rate cut by the Federal Reserve and the concerns of foreign governments about the weaponization of the US dollar, gold prices have hit new highs and have become one of the best performing assets in the first three quarters of this year, even outperforming US stocks. However, the carnival will not last indefinitely. In the past few weeks, gold has been trading sideways.

Analysts point out that the S&P 500 is trading at a dangerously high level, and it doesn't take much to panic the market, creating a liquidity trap that drags gold prices lower. The gold market may still have room to rise in the short term, but one market strategist said that gold is gradually losing buyers, which means that downside risks are increasing.

Carley Garner, co-founder of brokerage firm DeCarley Trading, has long been a gold bull. However, she added that with gold prices rising above $2,600 an ounce, it's time to look at the other side of the trade. "I see gold running into some important resistance levels, and it's hard to justify bullishness at these price levels," she said.

Better-than-expected U.S. economic data led the market to lower expectations for the extent of the Federal Reserve's interest rate cuts, which supported the dollar and put downward pressure on gold prices. Traders now see an 86% chance that the Fed will cut interest rates by only 25 basis points next month. The dollar index is hovering at its highest level in seven weeks, making dollar-denominated gold and silver more expensive for holders of other currencies.

Geopolitics and safe-haven demand

“The stronger dollar is currently a short-term headwind, preventing gold from setting new all-time highs,” said Peter A. Grant, vice president and senior metals strategist at Zaner Metals. But he still sees potential for gold to reach $2,700 in the short term, adding that “the longer-term target of $3,000 remains valid as geopolitical tensions and political uncertainty bring safe-haven demand as the U.S. election approaches.”

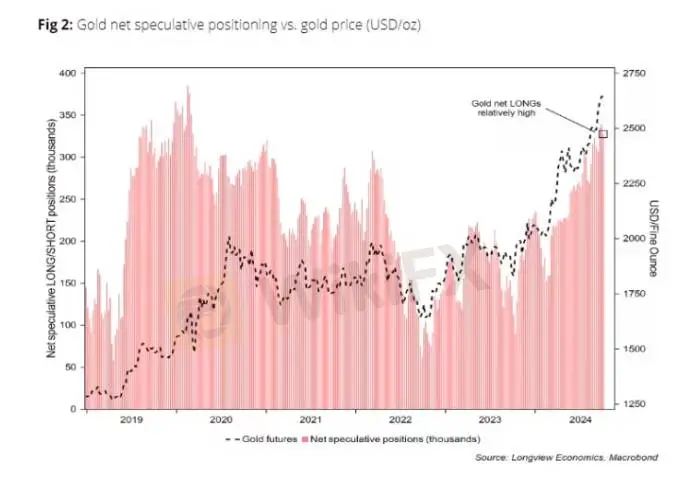

Watling noted that “in addition to the changing outlook for interest rates (and the dollar), gold is vulnerable to downside risk from a positioning, sentiment and technical model perspective.” He noted that speculative positions are crowded, sentiment measures are bullish and technical indicators are at or near sell thresholds.

Data from the Commodity Futures Trading Commission (CFTC) on Friday showed that as of October 1, fund managers have reduced their net long position in gold to a three-week low. Ole Hansen, head of commodity strategy at Saxo Bank, wrote in a report, "Net selling in gold and silver was due to traders taking profits in both precious metals after the recent price gains, which seemed to be lackluster. In gold, it is worth noting that both long and short positions were reduced as recent short sellers worried about tightening geopolitical situations, while long positions held by long-term investors continued to be liquidated."

Garner pointed out that shorting gold at the current level is an extremely contrarian operation, and in order to limit the risk, she prefers to short through option spreads. She mentioned that she made a trading suggestion on September 17 when the gold price was slightly below $2,600 per ounce. In the put option spread, Garner sold a call option with a strike price of $2,900 expiring in February and a put option with a strike price of $2,400 expiring in February, and used the credit line to buy a put option with a strike price of $2,500 expiring in February.

While Garner expects gold prices to fall in October, she also expects a lot of uncertainty and volatility in November around the U.S. presidential election. She suggests that traders should generally start reducing their risk exposure before the election. But in the current complex market environment, the future trend of gold prices is full of uncertainty. Bulls and bears are looking for opportunities, and geopolitical tensions and the upcoming U.S. election may bring more volatility to the market. Traders need to pay close attention to economic data, market sentiment, and position changes to develop corresponding trading strategies and risk management plans.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Tickmill

OANDA

Octa

HFM

GO MARKETS

FOREX.com

Tickmill

OANDA

Octa

HFM

GO MARKETS

FOREX.com

WikiFX Trader

Tickmill

OANDA

Octa

HFM

GO MARKETS

FOREX.com

Tickmill

OANDA

Octa

HFM

GO MARKETS

FOREX.com

Rate Calc