Score

CMBC

Hong Kong|10-15 years|

Hong Kong|10-15 years| https://www.cmbccap.com/

Website

Rating Index

Contact

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by China Hong Kong SFC(license number: BIY679)SFC-Dealing in securities Non-Forex License. Please be aware of the risk!

Basic Information

Hong Kong

Hong KongUsers who viewed CMBC also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

cmbccap.com

Server Location

China

Website Domain Name

cmbccap.com

Website

WHOIS.NO-IP.COM

Company

VITALWERKS INTERNET SOLUTIONS LLC DBA NO-IP

Domain Effective Date

2017-05-29

Server IP

8.210.194.125

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Company Name | CMBC Capital |

| Registered Country/Area | Hong Kong |

| Regulation | Regulated by the SFC of Hong Kong |

| Market Instruments | Securities brokerage, investment banking, structured finance, futures, options, stocks, bonds, notes, funds, alternative investments |

| Fees | Detailed fee structure for various financial instruments (stocks, futures, bonds, etc.) |

| Trading Platforms | SP Trader for stocks, futures, and options trading |

| Customer Support | China hotline at 400 0038 000 and the Hong Kong hotline at (852) 3728-8066 or (852) 3728-8000. Fax number is (852) 3753 3668. Eemail at legal_compliance@cmbcint.com. |

| Deposit & Withdrawal | Bank transfers only |

| Educational Resources | Video tutorials and research reports provided |

Overview of CMBC

CMBC, headquartered in Hong Kong, stands as a financial institution offering a diverse range of trading assets, including securities brokerage, investment banking, and structured finance.

Regulated by the Securities and Futures Commission (SFC) of Hong Kong, CMBC ensures a secure trading environment. The platform boasts a comprehensive trading platform, the SP Trader, with over two decades of experience, providing users with a globally certified solution for stocks, futures, and options trading.

While the platform's exclusive reliance on bank transfers for fund deposits and its perceived complex fee structure are notable drawbacks, its regulated status and broad array of financial services contribute to its standing in the financial landscape.

Is CMBC legit or a scam?

CMBC is regulated by the Securities and Futures Commission (SFC) of Hong Kong, holding a license for dealing in futures contracts with License No. AVG428.

This regulatory oversight signifies adherence to established standards, providing traders on the platform with a secure and monitored trading environment. The SFC, as a reputable regulatory agency, imposes guidelines to ensure fair and transparent trading practices. With a regulated status, CMBC establishes trust among traders, assuring them that the platform operates within the bounds of regulatory compliance. This oversight not only contributes to the platform's credibility but also emphasizes its commitment to maintaining a trustworthy trading ecosystem for all users.

On the other hand, CMBC has exceeded regulatory standards in dealing with securities, holding a license for such activities with License No. BIY679 under the supervision of the Securities and Futures Commission (SFC) of Hong Kong. This “exceeded” status underscores the platform's commitment to surpassing regulatory requirements, potentially providing an extra layer of assurance for traders engaged in securities transactions.

Pros and Cons

| Pros | Cons |

| Regulated by the SFC of Hong Kong | Complex Fee Structure |

| A wide range of financial services, including securities brokerage, investment banking, and structured finance | Exclusive Bank Transfers Only Deposit Method |

| Comprehensive Trading Platforms: the SP Trader platform | Potential Perception of Costliness |

| Video tutorials and research report provided | |

| Accessible Customer Support |

Pros:

Regulated by the SFC of Hong Kong:

CMBC is under the regulatory oversight of the Securities and Futures Commission (SFC) of Hong Kong. This ensures that the platform operates within established standards, providing a secure and monitored trading environment.

2. A wide range of financial services:

CMBC Capital offers comprehensive financial services, covering securities brokerage, investment banking, and structured finance. This diversity allows users to engage in various financial activities through a single platform.

3. Comprehensive Trading Platforms: the SP Trader platform:

The SP Trader platform, with over 20 years of experience, offers a versatile and globally certified trading solution. It supports various financial instruments, including stocks, futures, and options, providing users with a comprehensive and advanced trading experience.

4. Video tutorials and research reports provided:

CMBC Securities enriches the trading experience by providing users with educational resources, including video tutorials and research reports. These resources aim to empower users with knowledge on trading processes and market insights.

5. Accessible Customer Support:

CMBC Securities offers accessible customer support through various channels, including hotlines and email. This demonstrates a commitment to providing responsive assistance to users.

Cons:

Complex Fee Structure:

The fee structure implemented by CMBC, while transparent, might be perceived as complex. Users will find it challenging to understand the intricacies of the fee system, potentially leading to confusion.

2. Exclusive Bank Transfers Only Deposit Method:

CMBC limits fund deposits to bank transfers only. This exclusive approach might inconvenience users who prefer alternative deposit methods, potentially limiting accessibility for certain individuals.

3. Potential Perception of Costliness:

While CMBC aims for transparency in its fee structure, some users might perceive the fees as relatively high compared to alternative platforms. This perception could impact the attractiveness of the platform for cost-conscious users.

Market Instruments

CMBC Capital, a subsidiary of China Minsheng Bank Group, offers a broad spectrum of financial services in Hong Kong and beyond.

Securities Business:

CMBC Capital engages in comprehensive securities brokerage services, encompassing a wide array of market securities. The offerings include Hong Kong stocks, exchange-traded funds (ETFs), warrants, callable bull/bear contracts (CBBC), exchange-traded bonds, exchange-traded real estate investment trusts (REITs), and other market securities. The company's strength lies in providing up to 90% IPO financing subscription services, facilitating clients in capturing investment opportunities for new listings. The securities brokerage business accomodate diverse client needs, enabling them to promptly seize investment opportunities in Mainland China, Hong Kong, and the global market.

Investment Banking:

CMBC Capital possesses qualifications for Hong Kong listing sponsoring and underwriting. The company provides a full range of investment banking services, including IPO sponsoring and underwriting, secondary market placement, rights issues, and issuance of convertible bonds. With a robust sales team, global sales channels, and various investor types, CMBC Capital actively opens capital market financing channels, optimizes enterprise structures, enhances market awareness, and maximizes market value for customers.

Structured Finance and Direct Investment:

CMBC Capital provides brokerage services for trading futures products in Hong Kong through its subsidiary, CMBC International Futures Company Limited. The subsidiary offers research reports, market commentary, and investment advice, emphasizing professional, meticulous, and personalized futures trading services. The team, comprising high-level professionals with extensive research-based understanding of the futures market, assists customers in developing suitable trading systems for stable and positive returns.

How to Open an Account?

Visit the Website:

Go to the official website of CMBC and click on “Online futures trading system.”

2. Access Free Trial:

Select the “FREE TRIAL” option to explore the online futures trading system, which includes a demonstration.

3. Open the Register Page:

Navigate to the “Register” page on the website to initiate the account creation process.

4. Complete the Declaration:

Fill in the required details in the registration form. This includes providing your email address, confirming it, selecting an appellation (Mr/Mrs/Miss), entering your name, age, contact phone, and contact address.

5. Verification Process:

Ensure the accuracy of the email address provided, as it will be used for the verification process. Confirm the email address to proceed with the account creation.

6. Submit Information:

Carefully submit all the required details. Upon submission, you will receive an email for verification. Please note that the demo account is strictly for demonstration purposes, with no actual involvement in real markets. The probationary period for the demo account is 60 days. If you encounter issues receiving the email within 24 hours, check your junk mail folder.

Trading Platform

Futures Trading Platform (SP Trader):

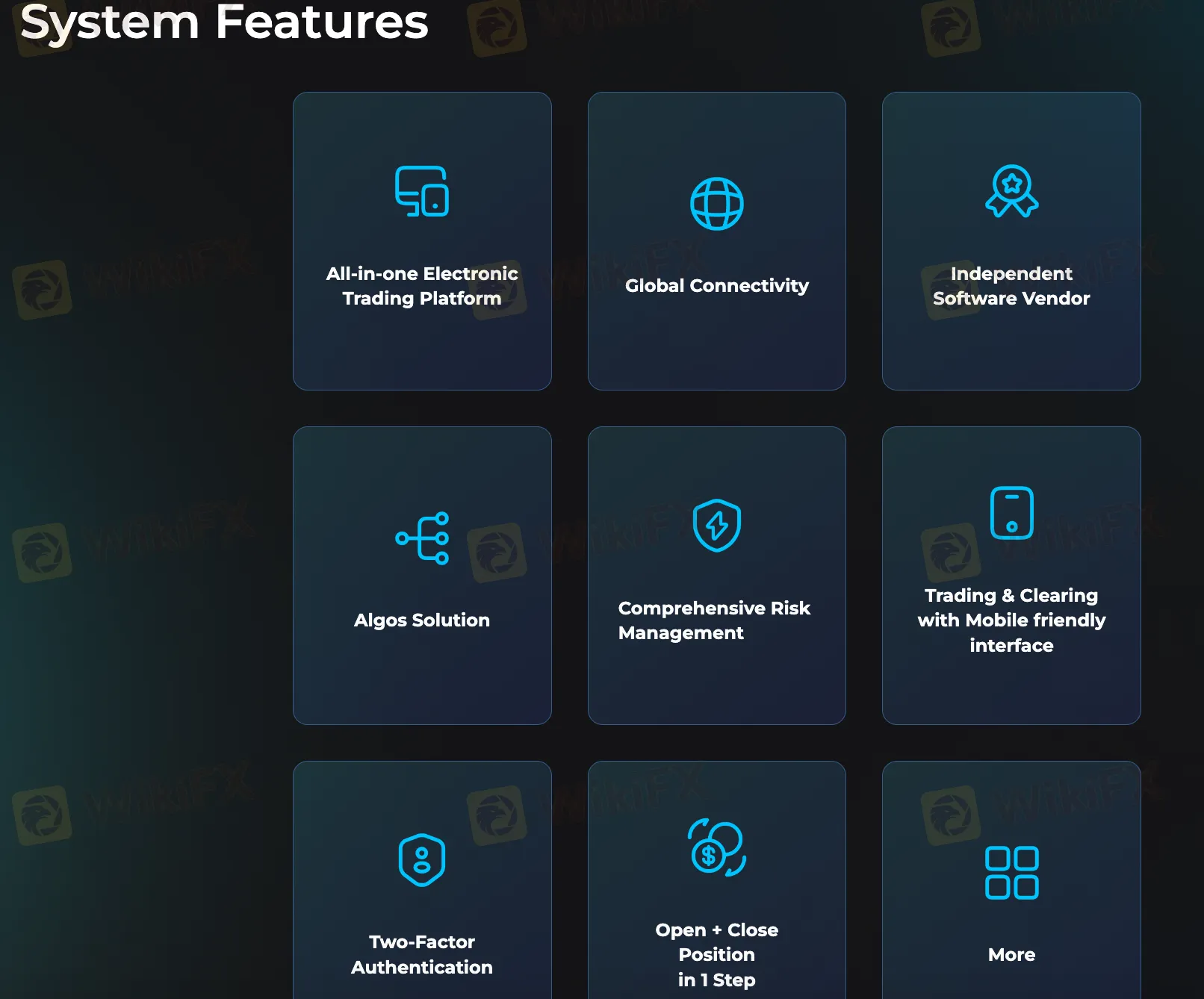

CMBC's trading platform, SP Trader, boasts over 20 years of FinTech experience and holds 40+ credentials across 9 regions worldwide.

The platform offers a range of services, including trading system development, algo-trading with DDE/API, and trading in stocks, futures, and stock options. Certified by multiple exchanges since 2002, SP Trader functions as an independent software vendor with global connectivity, supporting Windows PC, iOS, and Android platforms.

The system features encompass an all-in-one electronic trading platform, global connectivity with direct market access, and compatibility with multiple brokers, along with Bloomberg connectivity. It is certified by various financial institutions and exchanges globally, including HKFE, SEHK, CME, SGX, and LME. The platform provides algo solutions for arbitrage, hedging, ultra-low latency and high-frequency trading, as well as market-making. It emphasizes comprehensive risk management with support for dynamic SPAN risk management, multi-level risk control hierarchy, and real-time margin monitoring.

Notably, SP Trader offers a mobile-friendly interface for trading and clearing, covering computers, smartphones (iOS and Android), and tablets (iOS). It incorporates two-factor authentication for enhanced online trading security, along with biometric authentication readiness. The platform facilitates easy open and close position execution in a single step, presenting itself as a versatile solution for various global products, ensuring high-speed and stable response, and providing a trustworthy online trading experience.

Security Trading Platform (Brokerage Business):

CMBC Capital's securities brokerage services cover a diverse range of market securities, including Hong Kong stocks, ETFs, warrants, CBBC, bonds, and REITs. The brokerage business provides up to 90% IPO financing subscription services, aiding clients in capturing opportunities for new listings.

Diversified trading platforms, including online securities and futures trading systems, mobile trading systems, and fund-buying platforms, accommodate different customer requirements. The implementation of dual authentication enhances security, aligning with industry guidelines to reduce the risk of online fraud and protect customer interests in line with the Securities and Futures Commission's directives.

Transaction fees

CMBC implements a well-structured fee schedule, covering a wide array of financial instruments and services. The transparency in its fee structure is notable, allowing users to anticipate costs associated with their transactions. However, it's essential to acknowledge that the fee system, while comprehensive, may be perceived as intricate and relatively costly compared to some alternatives.

Hong Kong Stock Fee Schedule:

CMBC charges fees for Hong Kong stock transactions, including e-channel brokerage commission at 0.15% of the consideration, with no minimum charge. Telephone order commission is 0.25% of the consideration, with a minimum of HK$100. Stamp duty is 0.1% of the consideration, rounded up to the nearest dollar. The transaction levy by SFC is 0.0027% of the consideration, and the AFRC transaction levy is 0.00015% of the consideration, rounded to the nearest cent. HKEX trading fee is 0.00565% of the consideration, and CCASS settlement fee is 0.002% of the consideration, with a minimum of HK$2 and a maximum of HK$100.

Custody services involve HK$5 per transfer deed for depositing physical stocks. Withdrawal of physical stocks incurs HK$3.5 collected on behalf of CCASS, plus handling fees of HK$100 per stock and HK$1.5 per board lot (odd lots: HK$1.5), with a minimum of HK$100 and a maximum of HK$500. Compulsory share buyback is charged at 0.5% of the buy-in consideration, with a minimum of HK$100, applicable transaction charges, and CCASS penalty of 0.25% of the transaction amount calculated on T+2 closing price.

Nominee services encompass scrip fees at HK$1.8 per board lot. Collection of cash dividends incurs a handling fee of 0.22% of the gross dividend collected, with a minimum of HK$30 and a maximum of HK$15,000. Handling fees for bonus/rights/scrip dividends are HK$50. Corporate actions, such as subscription or exercise of rights/warrants, takeover, privatization, and other offers, cost HK$1 per board lot plus handling fees of HK$100 per event, and stamp duty when applicable, with a maximum of HK$5,000.

SZ-HK/SH-HK Stock Connect Fee Schedule:

For SZ-HK/SH-HK Stock Connect, CMBC charges brokerage commissions at 0.1% of the consideration, with a minimum of CNY100. Stamp duty, charged by SAT, is 0.05% of the consideration on the seller's side. Handling fees, charged by SSE/SZSE, are 0.00341% of the consideration per side. Management fees, charged by CSRC, are 0.002% of the consideration per side. Transfer fees, charged by HKSCC, are 0.002% of the consideration per side. Transfer fees, charged by ChinaClear-Shanghai/ChinaClear-Shenzhen, are 0.001% of the consideration per side. Portfolio fees, charged by CCASS, are based on the stock portfolio value at 0.008% per annum, accrued daily, and collected on a monthly basis.

Custody services for SZ-HK/SH-HK Stock Connect involve waived deposit fees, and withdrawal incurs CNY1.5 per board lot, with a minimum of CNY100. Nominee services include handling fees of 0.20% of gross dividends collected, with a minimum of CNY20 and a maximum of CNY5,000. Handling fees for bonus/rights/scrip dividends are CNY50. Corporate actions cost CNY3 per board lot, plus handling fees of CNY100 per event, and stamp duty when applicable, with a maximum of CNY5,000.

Bonds Fee Schedule:

For bonds, trading commissions are no more than 5% of the face value of the transaction, adjusted to the nearest percentage point. Custodian fees are calculated monthly at 0.02% per annum based on the value of the portfolio, with a minimum of HK$50/USD5/CNY40/EUR5. Transfer fees are HK$100 per transaction of USD2M or less and HK$200 per transaction above USD2M. Transfer fees are waived for deposits. Conversion fees are HK$500 per transaction.

Notes Fee Schedule:

Similar to bonds, notes trading incurs commission charges of no more than 5% of the face value of the transaction, adjusted to the nearest percentage point. Custodian fees are calculated monthly at 0.02% per annum based on the value of the portfolio, with a minimum of HK$50/USD5/CNY40/EUR5. Transfer fees are HK$100 per transaction of USD2M or less and HK$200 per transaction above USD2M. Transfer fees are waived for deposits. Stamp duty is 0.13% of the consideration, rounded up to the nearest dollar.

Funds/Alternative Investment Fee Schedule:

For funds and alternative investments, subscription, conversion, and redemption fees are subject to the terms and conditions of the fund. Nominee services involve transfer fees.

Interest and Other Services Fee Schedule:

Interest charges for cash account overdue at Standard Chartered Bank (HK) Limited are HKD prime rate +10% per annum. Margin account interest is HKD prime rate +4% per annum, and margin call overdue is HKD prime rate +9% per annum. Other services, such as returned cheques, stop cheque payments, remittance (CHATS to local account and telegraphic transfer to overseas account), account statement postage, re-issue of daily/monthly statements, and audit confirmation, incur specific charges.

While CMBC's transparent fee structure provides a comprehensive overview of charges associated with various financial instruments and services, some users might find it relatively complex and costly compared to alternative platforms.

Deposit & Withdrawal

CMBC Securities maintains an exclusive stance on fund deposits, allowing clients toutilize bank transfers as the sole method for injecting funds into their securities accounts.

The platform facilitates this process through three reputable banking partners: Industrial and Commercial Bank of China (Asia) Limited, China Minsheng Banking Corp., Ltd. Hong Kong Branch, and Bank of China (Hong Kong) Limited.

Clients can choose their preferred bank, and each bank provides specific account details for Hong Kong Dollar (HKD), United States Dollar (USD), and Chinese Yuan (CNY) transactions.

The emphasis on bank transfers underscores a commitment to security and reliability, aligning with traditional financial practices. While this approach ensures a straightforward and secure means of depositing funds, specific details about minimum deposit requirements and associated fees are not explicitly outlined in the provided information, warranting clients to seek precise details directly from CMBC Securities or consult the platform's terms and conditions.

Customer Support

CMBC Securities extends its customer support services from its prominent location at 45/F, One Exchange Square, 8 Connaught Place, Central, Hong Kong.

Clients can reach out through various contact channels, including the China hotline at 400 0038 000 and the Hong Kong hotline at (852) 3728-8066 or (852) 3728-8000.

For formal communications, the fax number is (852) 3753 3668.

In case of complaints, clients can utilize the dedicated Hong Kong hotline or connect via email at legal_compliance@cmbcint.com.

This multi-channel approach demonstrates the platform's commitment to accessible and responsive customer support.

Educational Resources

CMBC Securities enriches the trading experience for its users by providing comprehensive educational resources. Traders have access to a library of video tutorials, offering step-by-step guidance on trading processes and strategies. These tutorials are designed to assist both novice and experienced traders in navigating the platform effectively.

Moreover, CMBC Securities augments its educational offerings with insightful research reports. These reports provide in-depth analyses of market trends, stock performances, and economic indicators. By delivering a blend of visual learning through video tutorials and information-rich research reports, CMBC Securities demonstrates a commitment to empowering its users with the knowledge and tools necessary to make informed investment decisions. This educational support enhances the overall trading experience and fosters a more confident and informed user base.

Conclusion

In conclusion, CMBC stands as a prominent financial institution headquartered in Hong Kong, offering a diverse array of financial services.

Regulated by the SFC of Hong Kong, CMBC ensures a secure and monitored trading environment for its clients. The extensive range of market instruments, including securities brokerage, investment banking, and structured finance, meet varied financial needs. Moreover, the comprehensive SP Trader platform, enriched with video tutorials and research reports, positions CMBC as a facilitator of informed and empowered trading.

However, it's essential to note that the platform's fee structure, while transparent, is complex and relatively costly compared to alternative options. Additionally, the exclusive reliance on bank transfers for deposits limits convenience for some users. Despite these drawbacks, CMBC's commitment to regulatory compliance, diverse market offerings, and educational support solidify its position as a significant player in the financial services sector.

FAQs

Q: What trading instruments does CMBC offer?

A: CMBC provides a broad spectrum of financial instruments, including Hong Kong stocks, ETFs, warrants, CBBC, bonds, REITs, futures products, and alternative investments.

Q: How can I open an account with CMBC?

A: Visit the official CMBC website, click on “Online futures trading system,” access the free trial, open the register page, complete the declaration, undergo the verification process, and submit the required information.

Q: What is the minimum deposit at CMBC?

A: Specific details about the minimum deposit are not explicitly outlined; clients are advised to refer to CMBC Securities or the platform's terms and conditions for precise information.

Q: What are the fees associated with Hong Kong stock transactions on CMBC?

A: Fees include e-channel brokerage commission, telephone order commission, stamp duty, transaction levy, AFRC transaction levy, HKEX trading fee, and CCASS settlement fee, each with its own structure.

Q: How can I contact CMBC's customer support?

A: Reach CMBC's customer support through the China hotline at 400 0038 000, Hong Kong hotline at (852) 3728-8066 or (852) 3728-8000, fax at (852) 3753 3668, or email at legal_compliance@cmbcint.com.

Q: What educational resources does CMBC provide?

A: CMBC offers video tutorials for trading and research reports, providing users with step-by-step guidance and in-depth market analyses to enhance their trading knowledge.

Keywords

- 10-15 years

- Regulated in Hong Kong

- Dealing in futures contracts

- Dealing in securities

- Suspicious Scope of Business

- Suspicious Overrun

- Medium potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now