Score

WGL

Vanuatu|5-10 years|

Vanuatu|5-10 years| https://en.wglforex.cn/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

China

ChinaContact

Licenses

Licenses

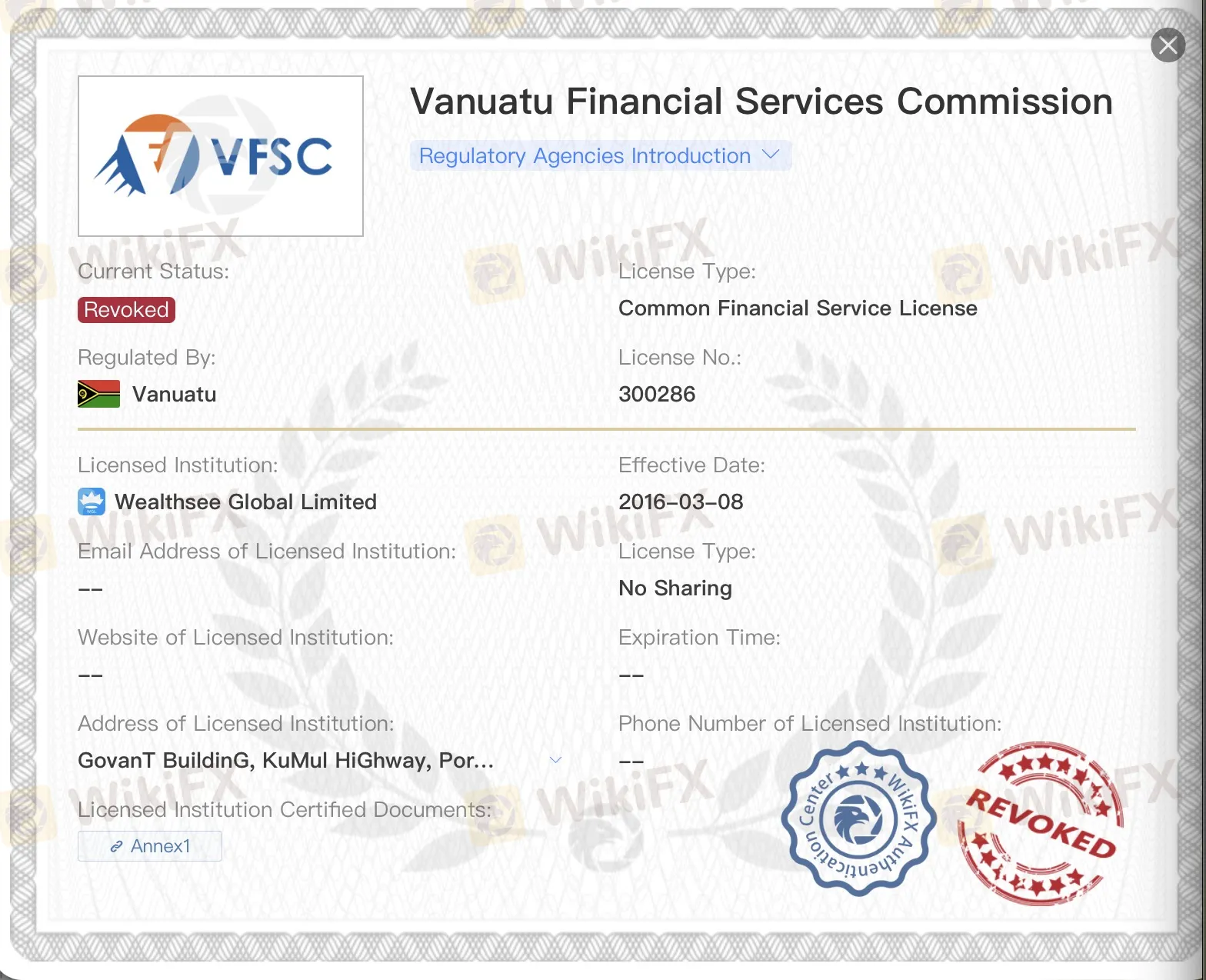

Licensed Entity:Wealthsee Global Limited

License No. 300286

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Vanuatu

Vanuatu

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed WGL also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Singapore Singapore | 869*** | EURUSD | 02-13 08:00:01 |

| 525*** | EURUSD | 02-13 08:00:01 | |

Dubai Dubai | 464*** | EURUSD | 02-13 08:00:01 |

Stop Out

1.30%

Stop Out Symbol Distribution

6 months

Website

wglforex.com

Server Location

United States

Website Domain Name

wglforex.com

Server IP

172.67.137.26

wglforex.cn

Server Location

United States

Website Domain Name

wglforex.cn

Server IP

104.21.112.1

wglforex.net

Server Location

Singapore

Website Domain Name

wglforex.net

Server IP

107.151.181.123

Company Summary

| WGL Review Summary | |

| Founded | 5-10 years |

| Registered Country/Region | Vanuatu |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Commodities, Cryptocurrencies |

| Demo Account | N/A |

| Leverage | Up to 1:500 |

| Spread | Starter Account: Starting from 1.0 pip, Advanced Account: Starting from 0.5 pips, Pro Elite Account: Starting from 0.1 pip |

| Trading Platform | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Min Deposit | $100 |

| Customer Support | Phone: +678 2246768 |

| Email: cs@wseeglobal.com | |

WGL Information

WGL is an online brokerage that facilitates trading in forex, indices, commodities and cryptocurrencies, offering leverage of up to 1:500 and a starting spread of 0.0. It is registered in Vanuatu and has been operating for more than 5 years.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unregulated Status |

| High Leverage | Website Inaccessibility |

| Outdated Trading Platforms | |

| Inefficient Customer Support |

Is WGL Legit?

WGLoperates without regulation of any regulatory institutions. It had been licensed by the Vanuatu Financial Services Commission (VFSC), but that has now been revoked.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| VFSC | Revoked | VATEE PTY LIMITED | Retail Forex License | 40097 |

What Can I Trade on WGL?

Clients get services of trading Forex, Indices (NASDAQ, S&P500, Dow Jones, DAX30, CAC40, FTSE100, and Nikkei225), Commodities (Gold, Silver, Oil, and Natural Gas), Cryptocurrencies (Bitcoin, Ethereum, and Litecoin) from WGL.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Crypto currencies | ✔ |

| Bonds | ❌ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

| Futures | ❌ |

Account Types

WGLoffers three live account types, namely Starter Account, Advanced Account, and Pro Elite Account.

Starter accounts require a minimum deposit of $100. The spread, starting at 1.0, leverages up to 1:200

Advanced Accounts require a minimum deposit of $1,000. It starts with a spread of 0.5 points and leverages up to 1:400.

Pro Elite accounts require a minimum deposit of $10,000. The spread, starting at 0.1 point, leverages up to 1:500.

| Minimum Deposit | Spread | Leverage | |

| Starter Account | $100 | start from 1 | 1:200 |

| Advanced Account | $1,000 | start from 0.5 | 1:400 |

| Pro Elite Account | $10,000 | start from 0.1 | 1:500 |

Leverage

WGL offers a maximum trading leverage of up to 1:500.

WGL Fees

The spread of the Starter Account, Advanced Account, and Pro Elite Account is 1, 0.5, 0.1 respectively.

Trading Platform

MetaTrader 4 (MT4), MetaTrader 5 (MT5) are the platforms chosen by WGL for clients.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MetaTrader 5 (MT5) | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

Deposit and Withdrawal

WGL offers a variety of methods of deposit and withdrawal, including Bank Wire Transfers, Credit/Debit Card, E-Wallet Services, Bank Wire Transfers, Credit/Debit Card Refunds, and E-Wallet Withdrawals.

Keywords

- 5-10 years

- Suspicious Regulatory License

- White label MT4

- Global Business

- Vanuatu Common Financial Service License Revoked

- Suspicious Overrun

- High potential risk

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

外惠唯权007

Hong Kong

I saw an article written by a man called Cheng and added his Wechat. He induced me to trade gold with him and promised me a 15% profit. I deposited $12500 on February 23th and traded entirely under his guidance. I lost a lot. Then he promoted me a middle class client and asked me to deposit 3071RMB. I lost again. I lost altogether over 81000 RMB. He asked me to deposit 39960RMB more to recover my loss. But I lost again. I’ve got only $511 now. This is a scam!

Exposure

2018-05-14

Samuel Harris

South Africa

WGL mt4 platform’s stability is impressive, seriously, even during peak hours. However, spreads can be crazy sometimes, or don't fill at the targeted price. I don't understand, and no one gives me reasons.

Neutral

2024-06-28

Genstin

Mexico

Good range of products. Good tight spreads. Customer service could improve. I requested an ISA transfer three weeks ago and I am still waiting.

Neutral

2024-05-17

Sarguna Raj

Netherlands

Generally, a quick withdrawal process. WGL processes my requests within 24 hours. 👍👍👍

Positive

2024-07-22