简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trade With Caution: How Does FxCitizen Defraud Clients?

Abstract:The forex market is massive and involves trillions of dollars traded each day. Such a huge volume of transactions attracts scammers from every nook and corner of the world.

On top of that, increasing numbers of brokers make it even more challenging to find a legitimate broker. This piece discusses how shabby brokers like FxCitizen can scam you by luring you into unrealistic profitable deals. We'll also let you know how to avoid scam brokers.

Quick overview

Founded in 2010, FxCitizen(https://fxcitizen.com/) is an offshore broker based in Vanuatu. The broker provides trading services in forex, indices, and commodities. Other features include different account types, multiple payment options and a trading platform MT5 powered by MetaQuotes. The company entices clients with special bonus offers and cash rebates. Moreover, the broker hosts monthly lucky draws, trading contests and promises fake rewards.

Is FxCitizen regulated?

No, FxCitizen (https://fxcitizen.com/) is not regulated anywhere in the world. The company doesn't even hold registration with any well-known supervisory authority.

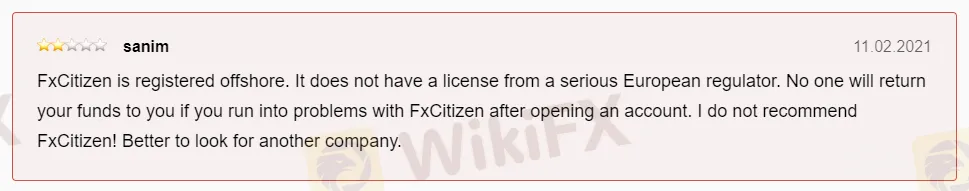

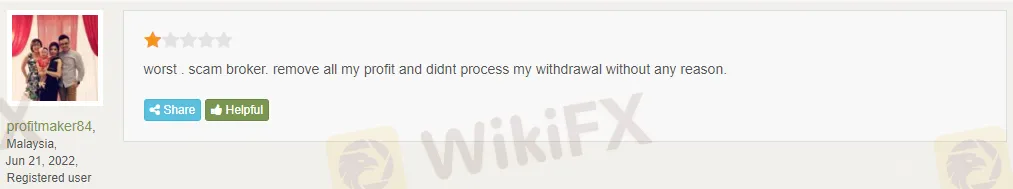

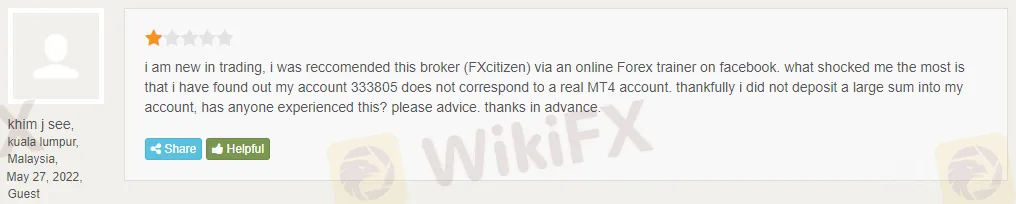

Clientele feedback

FxCitizen holds poor clientele feedback. The company has been accused of multiple issues, including price manipulation, account closures, withdrawal problems, customer support, etc. People have reported the broker's lousy code of conduct on several independent reviewers' portals, including BrokersView. Let us share some screenshots below.

How FxCitizen defraud clients?

FxCitizen marketing agents get connected with clients who attempt to register an account with the company. They pretend to be their account manager, ask them to fund their accounts and keep pushing them unless they do so. Usually, newbies who haven't been exposed to such tactics before become their prey.

Once clients add funds to their accounts, the company barely care about them anymore. It stops answering clients' phone calls and replying to their email messages. The firm doesn't process clients' withdrawal requests either. Clients have also reported that the company manipulates their trades and sometimes even blocks access to their trading accounts.

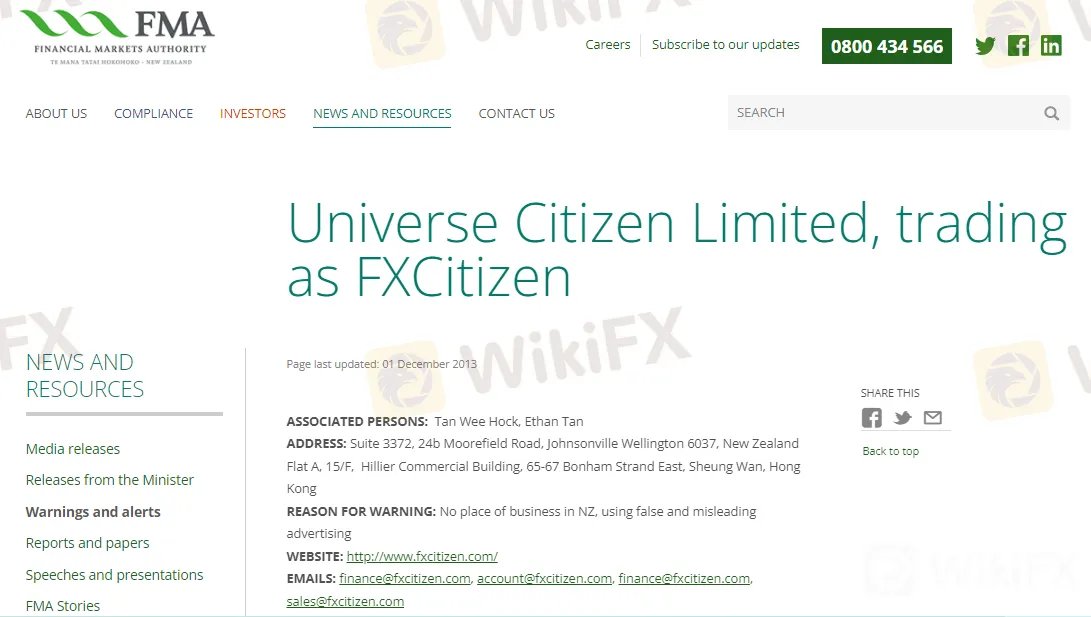

Notably, the broker has been warned by the Financial Markets Authority (FMA) New Zealand because of projecting misleading information.

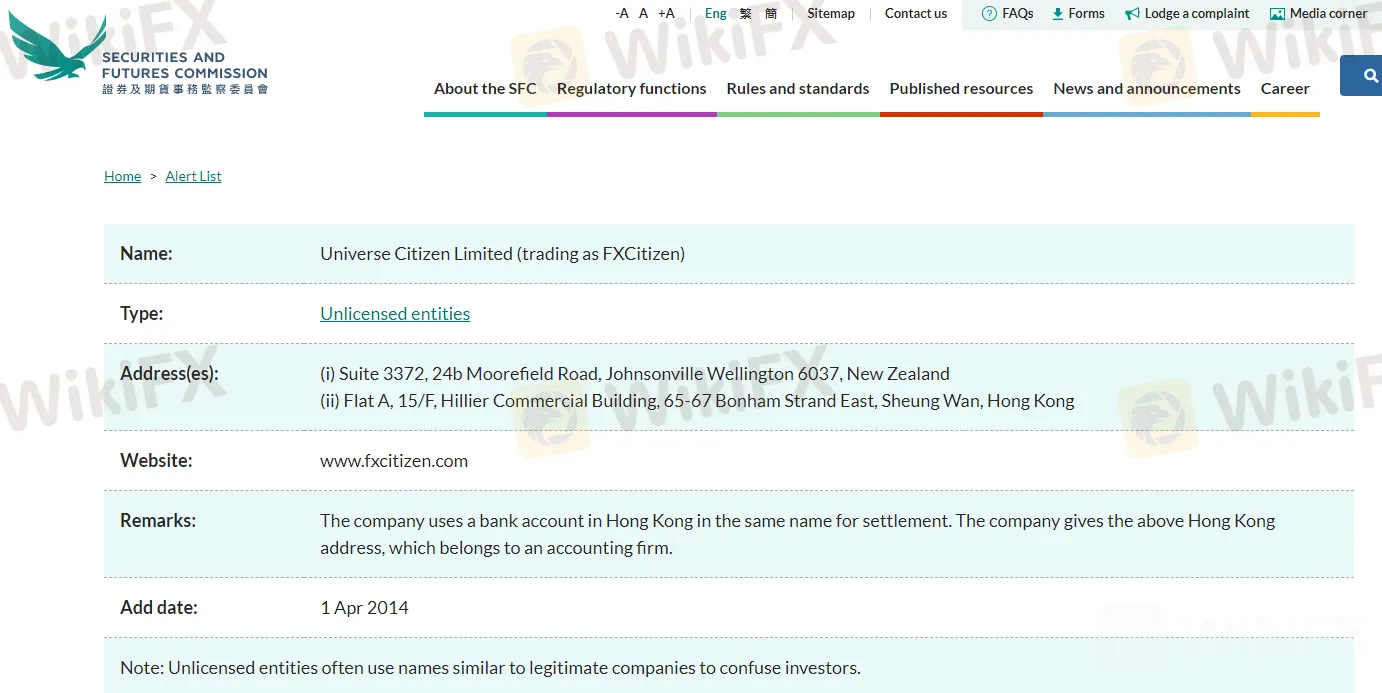

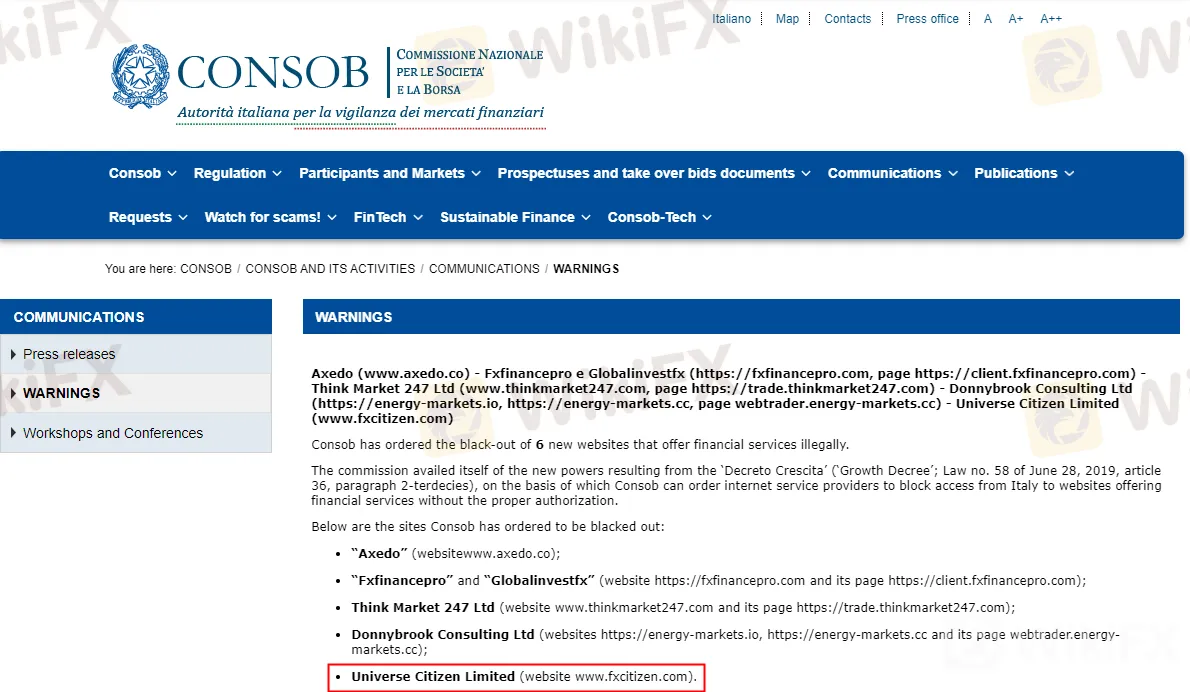

The Securities and Futures Commission in Hong Kong(SFC) also added the company to “Alert List” and the Italian Companies and Exchange Commission(CONSOB) also warned public that the broker offers financial services illegally.

What to do if I already have deposited funds with FxCitizen?

Being an existing client, you can only initiate a withdrawal request with the company. The broker is unlikely to process your withdrawals, not for big amounts at least. Therefore, try recovering your funds in small chunks. You might incur a higher withdrawal fee, but it is still worth it if you can get your funds back.

How to avoid signing up with scam brokers like FxCitizen?

First, make sure that you open an account with a regulated broker. Secondly, it should be a reputable entity. Remember, you can't start making thousands of dollars overnights in a highly volatile market like forex. Therefore, if someone promises unrealistic returns, believe it to be a scammer. Avoid paying any heed to such offers and refuse them straight away.

Bottom line

Although it is not always true for an unregulated broker to be a scam, precautions are still necessary. There is no use in crying over spilt milk, so better to proceed with care. A reputable regulated broker is always better than signing up with a non-regulated entity.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How Did the Dollar Become the "Dominant Currency"?

Since the fourth quarter of last year, the strong trend of the U.S. dollar has intensified, and as we enter 2025, investors face a contradictory situation.

How to Automate Forex and Crypto Trading for Better Profits

Find out how automating Forex and crypto trading is changing the game. Explore the tools, strategies, and steps traders use to save time and maximize profits.

Is Infinox a Safe Broker?

INFINOX, founded in 2009 in London, UK, is a regulated online broker under the UK FCA. It offers diverse trading instruments like forex, stocks, commodities, indices, and futures. Clients can choose between STP and ECN accounts and access educational resources. With 24/7 customer support, INFINOX aims to empower traders with reliable tools and guidance.

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

The idea that astrology could influence success in the stock market may seem improbable, yet many traders find value in examining personality traits linked to their zodiac signs. While it may not replace market analysis, understanding these tendencies might offer insights into trading behaviour.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Standard Chartered Secures EU Crypto License in Luxembourg

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator