简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUD/USD Rate Outlook Mired by Risk of Bearish RSI Signal

Abstract:AUD/USD may face a more bearish fate over the coming days if the Relative Strength Index (RSI) fails to preserve the upward trend from earlier

Australian Dollar Talking Point

AUD/USD trades to fresh weekly lows as updates to the U.S. Gross Domestic Product (GDP) report undermine the recent shift in Fed rhetoric, and the exchange rate may face a more bearish fate over the coming days if the Relative Strength Index (RSI) fails to preserve the upward trend from earlier this year.

AUD/USD gives back the advance from earlier this month even though President Donald Trump delays the fresh round of tariffs targeting China, Australia‘s largest trading partner, and uncertainty surrounding the Asia/Pacific region may continue to drag on the aussie-dollar exchange rate as U.S. Trade Representative Robert Lighthizer warns that ’much still needs to be done before an agreement can be reached.

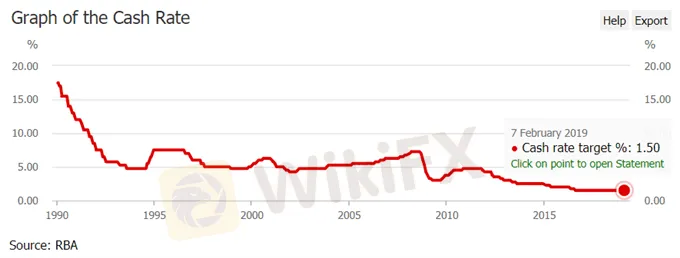

In response, the Reserve Bank of Australia (RBA) is likely to keep the official cash rate (OCR) on hold at its next meeting on March 5 as Governor Philp Lowe informs Parliament that ‘the probability that the next move is up and the probability that it is down are more evenly balanced than they were six months ago,’ and the weakening outlook for global growth may encourage the central bank to endorse a wait-and-see approach throughout the first-half of the year as Chinaendures‘the effects of the tensions with the United States and the squeezing of finance to the private sector as the authorities seek to rein in non-bank financing.’

As a result, the RBA may show a greater willingness to further support the economy as Governor Lowe states that ‘available data suggest that the underlying trend in consumption is softer than it earlier looked to be,’ and the Australian dollar stands at risk of facing headwinds over the coming days if the central bank shows a greater willingness to revive its easing-cycle. Keep in mind, the AUD/USD remains tilted to the downside as the flash-crash rebound stalls at the 200-Day SMA (0.7252), with the Relative Strength Index (RSI) at risk of highlighting a bearish trigger if the oscillator snaps the upward trend from earlier this year. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Daily Chart

Will keep a close eye on the RSI as it comes up against trendline support, with the near-term outlook for AUD/USD mired by the failed attempts to close above the 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) region.

In turn, a close below the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) area raises the risk for a move towards the monthly-low (0.7054), with the next region of interest coming in around 0.7020 (50% expansion).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUDUSD Range Vulnerable to Dovish RBA Forward Guidance

AUDUSD may face a more bearish fate over the coming days if the Reserve Bank of Australian (RBA) prepares Australian household and businesses for lower interest rates.

AUDUSD Monthly Range on Radar Ahead of Fed Economic Symposium

The monthly opening range sits on the radar for AUDUSD as attention turns to the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming.

AUDUSD Rate Outlook Clouded by Mixed RBA Rhetoric

AUDUSD struggles to hold its ground amid the threat of a US-China trade war, but there seems to be a rift within the RBA amid the recent batch of mixed comments.

AUD/USD: Australian Dollar at Risk Ahead of China Trade Balance

Spot AUDUSD remains at risk with looming China trade balance data due for release during Thursday's trading session.

WikiFX Broker

Latest News

Will Gold Prices Continue to Rise Due to Trump’s Tariffs?

Miami Firm Owner Pleads Guilty to $6M Ponzi Scheme Fraud

NBI Cebu Arrests Forex Trader for Illegal Investment Solicitation

PU Prime's "Feather Your Trades" Contest! Begin

eToro Files for IPO with $5 Billion Valuation on NASDAQ

Is FizmoFX a Scam? Fraud and Account Suspension of Traders

ALERT! Warning against Livaxxen

BOJ to Announce Policy Decision This Week, Market Bets on a Rate Hike

Crypto.com’s Dual Front Battle: European Progress and U.S. Regulation

SEC Charges Nova Labs for Crypto Fraud and Violations

Currency Calculator