简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDIDR Eyes Indonesian General Election, China GDP, US Earnings

Abstract:USD/IDR eyes Indonesias General Election. Meanwhile, the Philippine Peso and Malaysian Ringgit may be torn between first quarter China GDP and the ongoing US earnings season.

ASEAN Fundamental Outlook

Malaysian Ringgit weakens with Palm Oil, USD/PHP brushes aside dovish BSP

Indonesian Rupiah eyeing general elections on the same day as China Q1 GDP

Market optimism to be driven by US earnings, retail sales which may disappoint

Trade all the major global economic data live and interactive at the DailyFX Webinars. Wed love to have you along.

US Dollar and ASEAN FX Recap

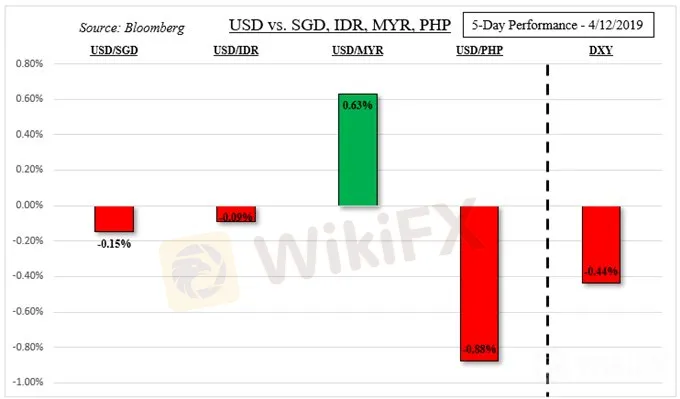

The US Dollar underperformed last week, aiming narrowly lower in rather choppy trade. A lot of the losses occurred during the first few days in the aftermath of a lackluster jobs report for the period of March. This resulted in overall mixed performance from some of its ASEAN currency counterparts. On Friday, the Singapore Dollar weakened following the MAS lowering growth and inflation forecasts.

While USD/SGD was more-or-less little changed by week-end, the Malaysian Ringgit largely underperformed. USD/MYR inversely tracked a decline in palm oil futures, Malaysia is the worlds second largest producer of the commodity. Meanwhile, USD/PHP fell, brushing aside increasingly dovish commentary from the Governor of the Philippine Central Bank on Friday as the Greenback weakened.

Indonesian Elections and Chinese GDP

USD/IDR is eyeing the upcoming Indonesia general election on April 17th. Incumbent President Joko Widodo, of the PDI-P party, has been leading in the polls against challenger Prabowo Subianto, of the Gerindra party. Albeit, recent surveys have been showing that the presidents lead has been somewhat narrowing. A status quo outcome may keep Rupiah volatility relatively stable.

On the flip side, a victory for Prabowo Subianto, based on opinion polls, may temporarily weigh against IDR as investors reassess their positioning. Mr Prabowo has promised tax cuts and if he wins, that may bolster the Rupiah down the road as it may lessen the urge for the Bank of Indonesia to cut rates. Regardless of the outcome, it still remains committed to upholding the value of IDR in close intervention.

Meanwhile, on the same day eyes will be on Chinese first quarter GDP data. According to the Citi Surprise Index, Chinese economic news flow has been tending to outperform relative to economists expectations. This suggests that perhaps models are being too pessimistic and an upside surprise may reduce global growth slowdown fears. That may boost equities and sentiment-linked ASEAN currencies.

US Earnings Season and Data

With concerns being raised by major central banks about the global growth environment, risk trends will be keeping a close eye on the US first quarter earnings seasons. So far, it has been a less-than-optimal start as Wall Street traded sideways. Signs of trouble ahead in the worlds largest economy could easily spark adverse knock-on effects that may spill into Asia Pacific equities.

In addition, keep an eye on US retail sales and PMI data which is another element in this equation. In stark contrast to China, data in the worlds largest economy has been tending to disappoint. The balance here will be how the US Dollar behaves as a liquid haven. You may follow me on twitter here @ddubrovskyFX for timely updates on how these impact financial markets and ASEAN FX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Economic : Key Highlights

Today's news highlights global economic and market developments, including Biden's call for calm, China's economic performance, the attempted assassination of Trump, major corporate acquisitions, and international financial markets. Significant updates also include geopolitical dynamics, cultural trends, and sports achievements.

Rupiah Gains as Jokowi Leads in Indonesian General Election

The Rupiah gained as unofficial results from the Indonesian General Election placed incumbent Jokowi in the lead. USD/IDR broke support in its dominant downtrend, eyeing 2019 lows.

Gold Prices May Extend Drop, AUD/USD At the Mercy of China Q1 GDP

Gold prices may extend drop as XAU/USD breached support on a stronger US Dollar and rising government bond yields. AUD/USD and risk trends are at the mercy of Q1 China GDP data.

Nikkei 225 Tests Resistance as Equities Await US Earnings Season

Equities traded mixed in Asia as the S&P 500 awaits the first quarter US earnings season. Upside momentum in the Nikkei 225 is fading, hinting that it may fall to support next week.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator