简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Price Forecast: DXY to Slide Lower Ahead of FOMC Rate Decision

Abstract:US DOLLAR INDEX, DXY, FOMC, US Q1 GDP, US 10-YEAR TREASURY YIELDS – TALKING POINTS: - Equity markets lost ground during APAC trade as investors look towards a series of US corporate earnings releases. - The FOMC’s dovish stance may limit the US Dollar’s upside against its major counterparts. - US Dollar Index (DXY) poised to slide lower as prices challenge key range support.

Equity markets slid lower during Asia-Pacific trade ahead of a slew of significant corporate earnings releases out of the US and the upcoming FOMC interest rate decision. Australia‘s ASX 200 (-0.21%), China’s CSI 300 (-0.82%) and Hong Kong‘s Hang Seng Index (-0.22%) all lost ground, while Japan’s Nikkei 225 crept marginally higher.

In FX markets, the cyclically-sensitive AUD and NOK largely outperformed alongside GBP, while the haven-linked USD, CHF and JPY fell against their major counterparts. Gold price drifted lower for the third consecutive day as yields on US 10-year Treasuries rose just under 2 basis points.

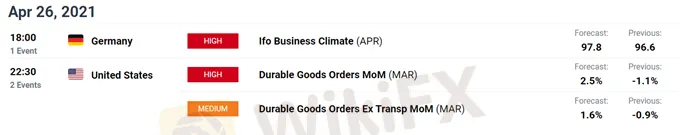

Looking ahead, US durable goods orders for March highlight the upcoming economic docket, alongside the release of Teslas much-anticipated earnings.

The US Dollar looks set to continue drifting lower in the week ahead, as investors turn their attention to the upcoming Federal Open Market Committees monetary policy meeting on Thursday.

Policymakers are unlikely to signal any changes to the central banks monetary policy stance and are expected to reiterate that there will be no tapering of measures until there is “substantial further progress” towards its mandated employment and inflation goals.

That being said, an extremely strong Q1 GDP print could push longer-term nominal yields higher in the near term, and underpin the Greenback against its major counterparts.

US 10-Year Treasury Yields with DXY Overlay

However, with rates markets winding back bets that the Fed will lift from the effective lower bound in 2022, it seems relatively unlikely that a stale data release will shift the needle and trigger a marked sell-off in Treasury markets.

With that in mind, the haven-associated US Dollar may continue to head south in the coming days, outside of a shift in market sentiment towards a risk-off environment.

US DOLLAR INDEX (DXY) DAILY CHART – RSI HINTS AT BUILDING BEARISH MOMENTUM

From a technical perspective, the US Dollar looks set to continue sinking lower against its major counterparts in the near term, as the DXY snaps back below all six moving averages and slices through key psychological support at 91.00.

With the RSI diving below 40 for the first time since January, and the MACD sliding into negative territory, the path of least resistance seems skewed to the downside.

A daily close below range support at 90.63 – 90.79 would probably intensify selling pressure and carve a path to challenge the yearly low (89.21).

However, if that stays intact a rebound back towards sentiment-defining 144-MA (91.55) could be on the cards.

US DOLLAR INDEX (DXY) 4-HOUR CHART – BULLISH RSI DIVERGENCE COULD INSPIRE REBOUND

Bullish RSI divergence on a 4-hour chart however, suggests that a short-term rebound could be on the cards.

Indeed, if prices fail to successfully hurdle 90.60, a topside push to retest the 8-EMA (90.90) may eventuate. Clearing that likely brings the trend-defining 55-EMA (91.38) into focus.

That being said, selling pressure would probably intensify quite significantly if support gives way, with the 90.00 handle highlighted as the next key area of support.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

Become a Full-Time FX Trader in 6 Simple Steps

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Currency Calculator