简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Italian Stocks Can Now Be Traded By eToro Users

Abstract:eToro, Israeli social trading, and multi-asset brokerage firm, has extended its service offering and trading tools by embracing additional markets, including Italian equities traded on underlying exchanges.

The broker recently alerted its customers about the additional features in a statement. eToro users may now trade stock CFDs for certain Italian firms.

In recent years, the justification for adding new assets has grown as the company's customers from specific countries, such as fund managers, hedge funds, and commodities trading advisers, have shown a desire to actively trade local equities.

The new capabilities come on the heels of eToro enabling its US users to trade options for free, intensifying the brokers' battle to abolish trading costs. The Israeli corporation claims that the launch would broaden its offering to US customers, which is presently limited to equities, exchange-traded funds (ETFs), and cryptocurrencies.

eToro, which operates in a field dominated by both established businesses and high-flying applications, said that more of its key products would be accessible to American consumers in the near future.

Scaling eToro's US operations follow the firm's regulatory approval to purchase options trading platform Gatsby for about $50 million. Gatsby, co-founded in 2018 by Jeff Myers and Ryan Belanger-Saleh, is a commission-free option and stock-trading software geared towards younger traders.

Over the previous several months, eToro has witnessed key appointments and exits. Dylan Holmani, the broker's head of Global Sponsorships for over seven years, left the company in December. It had previously elevated Orel Assia to the position of head of growth for its eToro Money program.

Meron Shani was recently appointed as the broker's Chief Financial Officer. His appointment followed the departure of Shalom Berkovitz, the company's departing CFO and deputy CEO.

Meron joined eToro as vice president of finance in 2019. He was responsible for a variety of tasks within the organization, including financial, legal, compliance, and risk management. He comes into his new job with a strong history in the igaming business, where he has held numerous financial roles for over 19 years.

The executive changes occurred after eToro fired off 100 workers, half of whom were based in Israel. This figure reflects around 6% of the company's overall personnel.

Meanwhile,

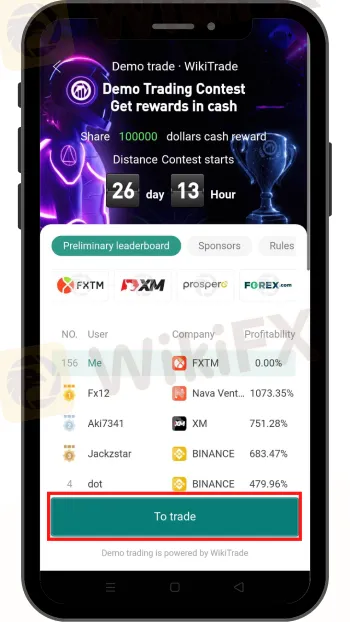

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

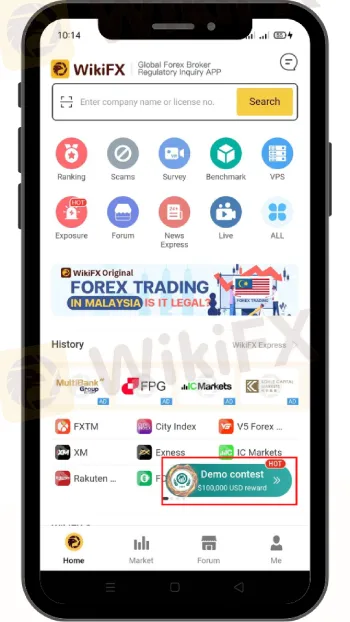

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Create an account by “Signing Up” or “Register”

Once all is done, click on the “Trade Button”

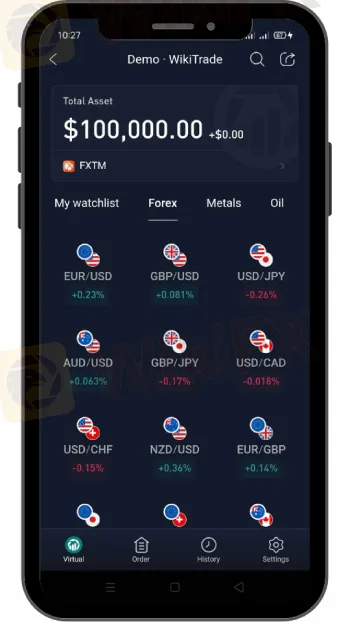

You should see the trading platform and may select the trading instruments you wanted to trade

Good luck and enjoy your trading experience!

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator