简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ThinkMarkets Going Public Via a Merger

Abstract:ThinkMarkets plans to merge with FG Acquisition Corp, aiming to become publicly traded, with a $160 million valuation.

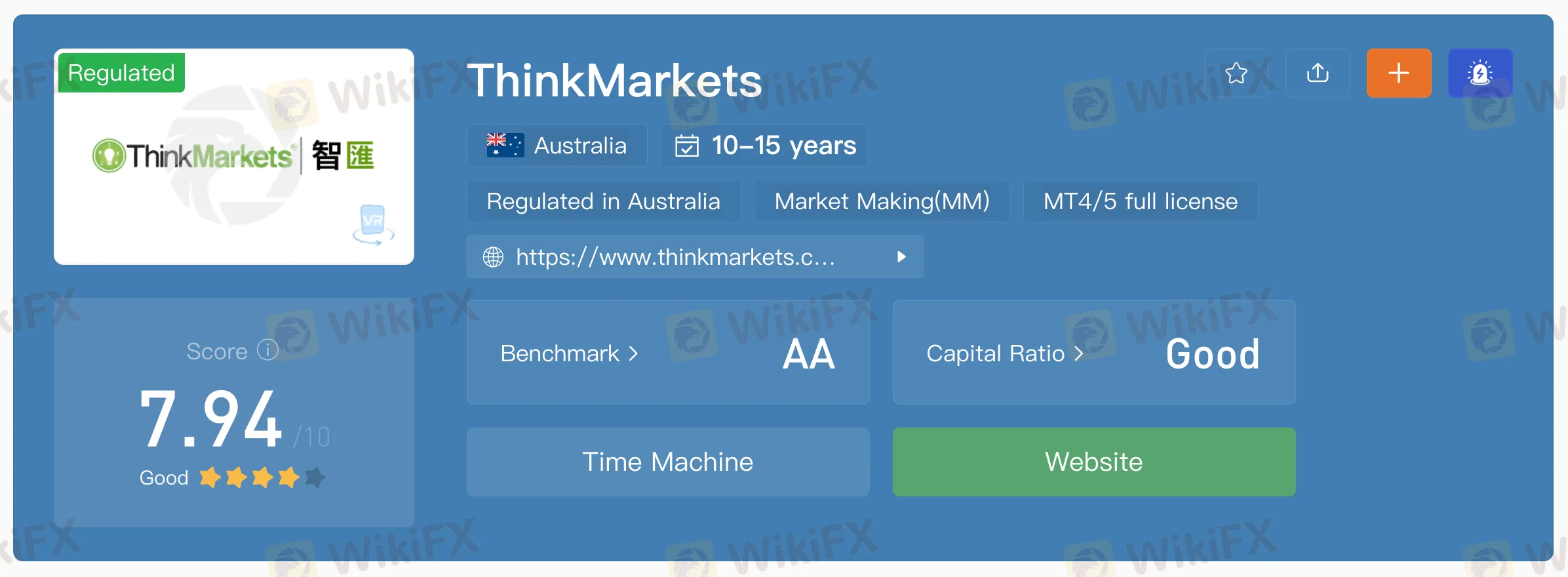

ThinkMarkets, an Australian-based broker operated by Think Financial Group Holdings Limited, has revealed its intention to undergo a merger with Canadian blank check company FG Acquisition Corp, with the aim of becoming a publicly traded entity. This move follows ThinkMarkets' expansion into the Asia Pacific region through acquiring a local forex company in Japan and obtaining a license in New Zealand earlier this year.

FG Acquisition Corp, listed on the Toronto Stock Exchange, is owned by Larry G. Swets Jr., a casualty insurance executive. The business will be known as ThinkMarkets Group Holdings Limited after the merger. The co-founders of ThinkMarkets, Nauman Anees and Faizan Anees, along with the existing management team, will assume the positions of Chief Executive Officer and President, respectively. The board of directors for the merged entity will consist of Symon Brewis-Weston, Julian Babarczy, Larry G. Swets Jr., Faizan Anees, Nauman Anees, and Faizan Anees.

The completion of the merger is anticipated in July 2023.

Since its establishment, ThinkMarkets has accumulated a substantial client base of 138,500 traders hailing from 165 countries. The company offers retail forex trading services and operates an institutional presence through a liquidity provisioning platform.

According to reports, ThinkMarkets' revenues experienced a notable increase, rising from USD 35 million in 2019 to over USD 62 million in 2022. As of March 2023, the user base of ThinkMarkets reached 138,500 approved clients, a significant growth from 17,200 at the end of 2015.

Based on its pre-money valuation, ThinkMarkets has been valued at $160 million in the reverse merger agreement, with an estimated pro forma enterprise value of approximately $190 million. As a result of the merger, ThinkMarkets will become a wholly-owned subsidiary of the Special Purpose Acquisition Company (SPAC) and hold the majority of the issued and outstanding Common Shares.

In addition, the SPAC intends to raise $20 million through a private placement of convertible debentures to support its expansion strategy, working capital, and general business needs.

The transaction will result in ThinkMarkets becoming a publicly traded company and receiving up to $125 million in net cash proceeds, which will be utilized to pursue the company's growth strategy in new markets and with new products. FG Acquisition Corp's IPO funds, currently held in escrow, amount to approximately $117 million. Furthermore, the parties have initiated a USD 20 million private placement of convertible debentures as part of the agreement, with investment bank Canaccord Genuity serving as the lead agent for the Private Placement.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator