Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Mr. Rolex

Portugal

False advertisement, after a week of trades all with huge slippage and execution time way over of the advertised! After contacting support with the issue, they answered that my account manager would contact me. Not only did they not reply to my issue also account manager was only interested in me depositing more. Not recommended!!

Exposure

2023-10-30

7058

Australia

It started off promising but has been disappointing lately. I've experienced issues with slippage and delayed execution times that weren't as advertised. While their platform looks modern and they offer advanced trading options, the actual trading experience needs improvement.

Neutral

2024-06-21

Happlaia

Malaysia

Honestly, I wouldn't recommend Advanced Markets. The slippage is just ridiculous, and don't even get me started on how slow the execution is. It's like trying to catch a train that left the station hours ago.

Neutral

2023-12-13

DHIEWJ

Netherlands

Went above and beyond in customer care. Very polite and understanding super helpful.

Positive

2024-07-04

Natsuki H., Hyogo

Colombia

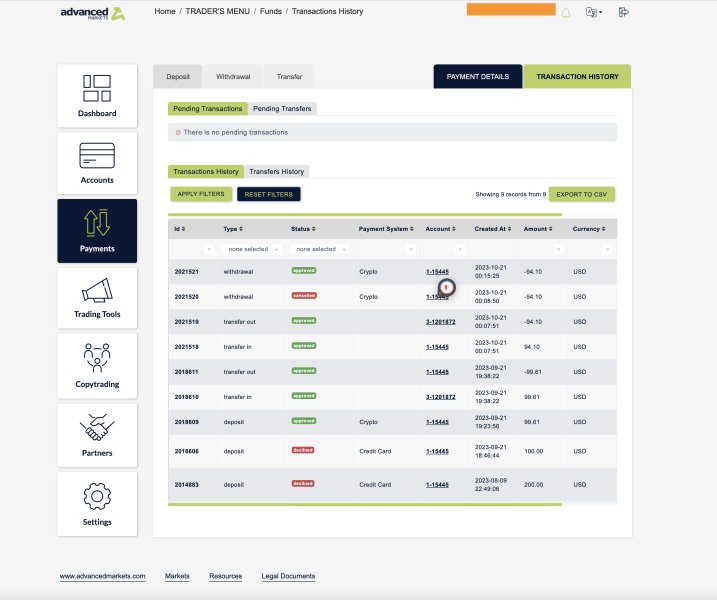

Advanced Markets is very transparent about all their fees, including deposit and withdrawal charges.

Positive

2024-06-27