US Dollar Rises on Non-Committal Fed, GBP & EUR Extends Losses - US Market Open

US Dollar Rises on Non-Committal Fed, GBP & EUR Extends Losses - US Market Open

USD: July Fed Meeting to Spark US Dollar Currency Volatility

A major move in USD following the Federal Reserves updated monetary policy stance on Wednesday risks sparking volatility across the currency market.

US Dollar Eyes 2019 High, GBPUSD Plummets Through 1.2300 - US Market Open

US Dollar Eyes 2019 High, GBPUSD Plummets Through 1.2300 - US Market Open

US Dollar Seems to be Biased Upward on FOMC Rate Decision

The US Dollar seems more likely to rise than fall after the FOMC monetary policy announcement even as an interest rate cut is overwhelmingly expected.

US Dollar May Gain if IMF Report, US GDP Data Fuels Haven Demand

The US Dollar may find itself propelled higher if the IMFs updated assessment of the world economy and an underwhelming US GDP data report stoke demand for liquidity.

US Dollar Pushes Higher, EURUSD and GBPUSD Suffers - US Market Open

US Dollar Pushes Higher, EURUSD and GBPUSD Suffers - US Market Open

US Dollar Outlook: GBPUSD, USDJPY, USDCAD Price Action Set-Ups

US Dollar Outlook: GBPUSD, USDJPY, USDCAD Price Action Set-Ups

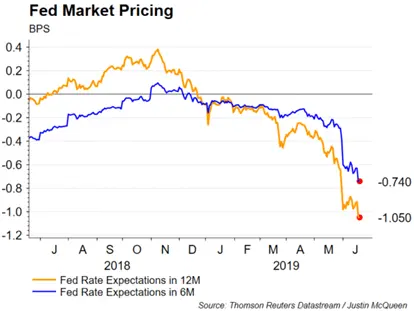

US Dollar Outlook Mired by Bets for Fed Rate Cut in July

Fresh data prints coming out of the US economy may do little to heighten the appeal of the Dollar as the Federal Reserve alters the forward guidance for monetary policy.

USD Price Analysis: Risk of Deeper Losses as Fed Confirms U-Turn

USD Price Analysis: Risk of Deeper Losses as Fed Confirms U-Turn

Weekly Trading Forecast: Fed Hopes Compete with Trade War Fears

A week ago, it seemed that some relief from trade wars would filter through to stimulate further relief rallies. As we move into the new trading week, it is clear that this persistent theme is once again firmly a concern – and reinforced by flagging economic growth. Will Fed support

USD Bounces Off 200DMA, MXN Rallies as Trump Suspends Tariffs - US Market Open

USD Bounces Off 200DMA, MXN Rallies as Trump Suspends Tariffs - US Market Open

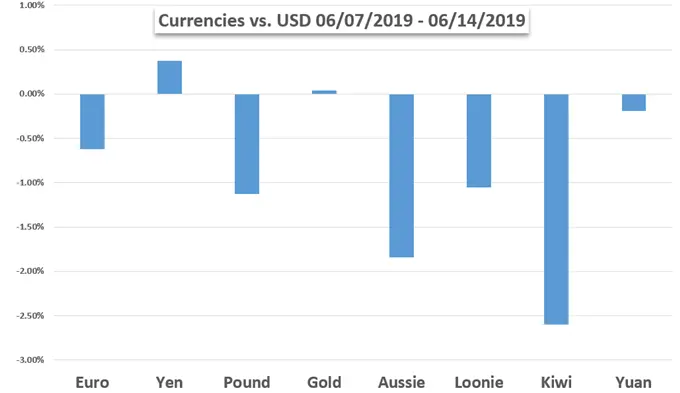

USD Drops on Weak NFP Report, Fed Rate Cut Bets Rising

USD Drops on Weak NFP Report, Fed Rate Cut Bets Rising

Japanese Yen Winning the Safe Haven Battle vs USD and Gold

Japanese Yen Winning the Safe Haven Battle vs USD and Gold

EURUSD Soft Despite Rising Inflation, USD Shrugs Off Mixed NFP - US Market Open

EURUSD Soft Despite Rising Inflation, USD Shrugs Off Mixed NFP - US Market Open

USD Whipsaws Despite Q1 GDP Smashing Expectations - US Market Open

USD Whipsaws Despite Q1 GDP Smashing Expectations - US Market Open

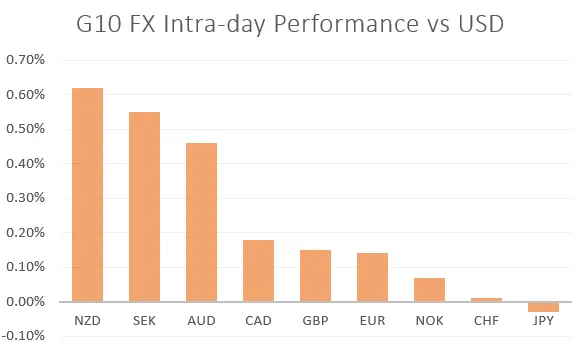

USD Gains Awakens Currency Volatility, EUR and GBP Pressured - US Market Open

USD Gains Awakens Currency Volatility, EUR and GBP Pressured - US Market Open

USD Back on the Throne, EUR Drops, GBP Bounces Off Support - US Market Open

USD Back on the Throne, EUR Drops, GBP Bounces Off Support - US Market Open

Weekly Fundamental Forecast:Trade Wars and Shutdown Fears Fade, Have We Entered a New Phase of Risk Appetite

Two of the most systemic fundamental threats facing the financial system have eased this past week in the avoidance of a second US government shutdown

FOMC Leaves Rate Range Unchanged, Dollar Dives Before Powell Presser

The US government shutdown will have a direct impact on how the Federal Reserve operates at the start of 2019.

Weekly Trading Forecast: Beware Volatility Between the Fed, NFPs, GDP and Trade Wars

The fundamental environment will grow increasingly tumultuous over the coming week. We wil continue to sort through general themes like the lifting of the US