Possible Introduction of Stimulus Bill Punishes USD But Fuels EUR

Headlines are stating that the US may introduce a coronavirus stimulus plan in recent days, which significantly lift risk-on tilts, spurring a USD selling, a EUR rise, and a EUR/USD close to 1.1800.

Buoyant USD on Fading Stimulus Deal Hopes

The DXY recently picked up a small risk-averse bid as the US presidential election is approaching.

USD May Encounter New Round of Depreciation

USDX has experienced a sharper volatility since this year. And it continues dropping despite of the temporary rally in US stock market stimulated by the hawkish fiscal and monetary policy.

This Week May See Bearish USD

Affected by the Fed decision, the US dollar, technically speaking, has showed an overall trend of weakness recently, with a high volatility.

Growing USD Ends at Punished AUZ, NZD & GBP

On Wednesday, U.S. stocks grew at the expense of the haven-associated USD, curbing its gains and punishing AUZ, NZD & GBP at the same time.

Gold Losing Shine on Soaring USD

On Tuesday, gold prices witnessed the biggest loss for seven years while USD embraced its biggest gain since early June. Driven by this, the markets of stocks, forex, oil and precious metals showed mixed performance.

Crash in USD: the Dollar Smile Turned into a Painful “Grin”

DXY has slid as more as 10% since this March and the losses have deepened in recent weeks amid the second wave of the pandemic. The theoretical dollar smile has flattened, sending a painful “grin” to investors instead.

Weekly Focus: USD Outlook Bearish

WikiFX News (3 Aug) - In the following week, USD may keep retreating under the pressure of stock markets and Fed rate decision.USD may decline if earnings reports from large-cap companies such as HSBC and Disney put a discount on haven-linked assets.

Experts Estimated an Inevitable Collapse in USD: a Decline of 35%

Stephen Roach, a senior researcher at Yale University, is anxious that the constantly changing global landscape and the huge budget deficit of the United States would lead to a collapse in USD.

US in Chaos, AUD and NZD Surged

After all three of the major US stock indices went up yesterday, the market’s risk appetite was also reflected in currencies, including AUD and NZD.

USD Net Shorts Rose to the Highest in Past 2 Years

According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week

The Further Step of U.S. Dollar's 'Weaponization', Based on Donald Trump's New Rule

A controversial new rule being implemented by Donald Trump will pave the way for the US to impose punitive tarrifs on the goods from countries with undervalued exchange rate, said the US department of commerce.

Rising Debts May Cause Depreciation of US Dollar

Jeffrey Gundlach, the CEO of DoubleLine Capital nicknamed “King of Bonds”, said he is expecting US dollar to go weak. He pointed out that due to US dollar’s relevance to the “twin deficits” of US in current account and budgets, the currency will likely drop in price.

US Dollar Outlook Hinges on Fed Rate Decision & Forward Guidance

The Federal Reserve meeting is likely to influence the near-term outlook for the US Dollar as the central bank is widely expected to deliver another 25bp rate cut.

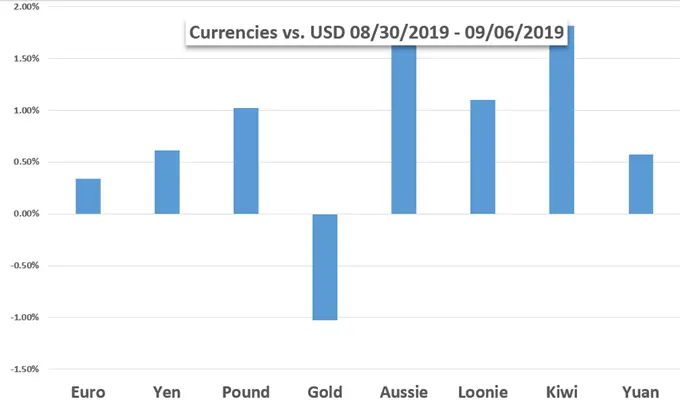

Dow Rises and Gold Falls on Trade War Enthusiasm, ECB Decision Top Event Ahead

Though tentative, market participants latched on to nascent signs that trade war conditions may improve and the threat of recession is not as imminent as many fear. This would be the perfect opportunity for monetary policy to further leverage the uneven swell in sentiment. The ECB will start a run

US Dollar Price Targets: USD Threatens Breakout of Uptrend Resistance

The US Dollar is probing fresh yearly highs into the to open of September trade, but is the rally sustainable? Here are the levels that matter on the DXY weekly chart.

Trading Forecast: EURUSD and Dow Bearings Rest on Jackson Hole, Trump

Scheduled event risk is starting to give way to sentiment and systemic fundamental concerns a prospect that threatens volatility at a time of year when quiet is supposed to prevail. Trade wars are finding guidance from headlines that President Trump regularly tops, while recession fears are tied more closely to

US Dollar May Rise if Fed Minutes and Jackson Hole Spook Markets

The US Dollar may rise if the Fed meeting minutes and commentary at the Jackson Hole symposium spooks markets and boost demand for liquidity.

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

Canadian Dollar Price Outlook: USD/CAD Four-Week Rally Vulnerable

Loonie was nearly unchanged against the US Dollar last weeks with price failing just pips from resistance. Here are the levels that matter on the USD/CAD weekly chart.