Score

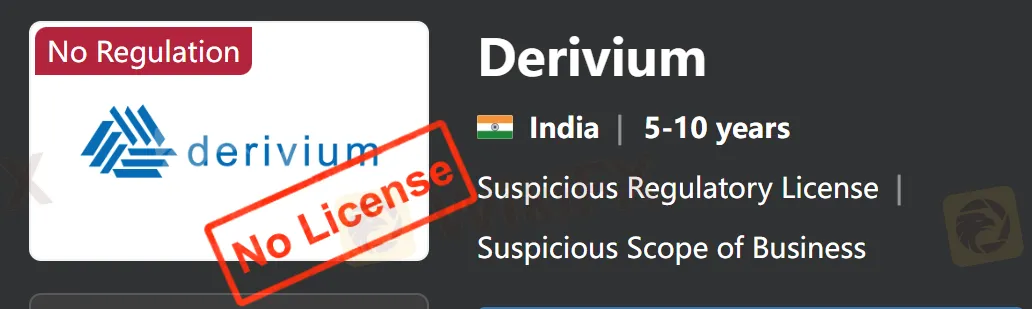

Derivium

India|5-10 years|

India|5-10 years| http://www.deriviumcap.com/Derivium/home

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

India

IndiaUsers who viewed Derivium also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

deriviumcap.com

Server Location

Singapore

Website Domain Name

deriviumcap.com

Server IP

54.251.133.87

Company Summary

| Aspect | Information |

| Registered Country/Area | India |

| Company Name | Derivium |

| Regulation | Unregulated broker, lacking oversight and compliance standards set by financial regulatory bodies |

| Services | Market making, institutional brokings, bond arranging, structured credit, wealth management, derivatives risk management solutions, investment advisory |

| Market Instruments | Government securities (G-Secs, SDLs, T-Bills), money market instruments, corporate bonds, structured bonds, other bonds and securities |

| Customer Support | Offices in New Delhi, Mumbai, Bengaluru, and Kolkata; contact numbers provided for each location; comprehensive support offered across these locations |

Overview

Derivium, an India-based financial services company, operates as an unregulated broker, which means it lacks oversight and compliance standards set by financial regulatory bodies. Despite this, Derivium offers a wide array of services including market making, institutional brokings, bond arranging, structured credit, wealth management, derivatives risk management solutions, and investment advisory. It provides access to various market instruments such as government securities, money market instruments, corporate bonds, structured bonds, and other securities. With offices in major cities like New Delhi, Mumbai, Bengaluru, and Kolkata, Derivium ensures comprehensive customer support, facilitating efficient assistance and communication for its clientele across these locations.

Regulation

Derivium operates as an unregulated broker, meaning it doesn't adhere to the oversight and compliance standards set by financial regulatory bodies. Clients should exercise caution when engaging with unregulated brokers as they may lack protections afforded by regulated entities, potentially exposing them to higher risks of fraud or malpractice. It's advisable for investors to opt for brokers regulated by reputable authorities to ensure transparency and accountability in their financial dealings.

Pros and Cons

Trading with Derivium offers a range of advantages and disadvantages that investors should consider. On the positive side, Derivium provides access to a diverse range of financial products and services, including government securities, corporate bonds, and derivatives. Additionally, its market-making and institutional brokings services offer liquidity and market access to institutional clients. However, it's important to note that Derivium operates as an unregulated broker, which may pose risks such as lack of investor protections and higher vulnerability to fraud or malpractice. Clients should carefully weigh these pros and cons before engaging with Derivium.

| Pros | Cons |

|

|

|

|

|

|

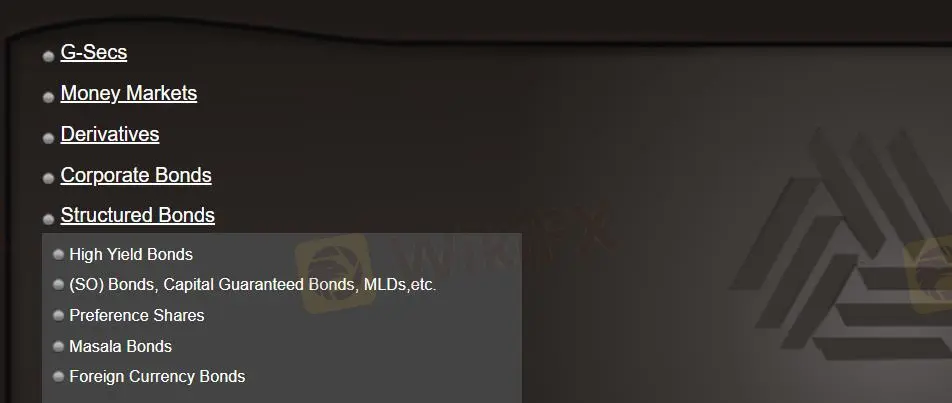

Market Instruments

Derivium offers a diverse range of trading products across various financial instruments. This includes government securities like G-Secs, State Development Loans (SDLs), and Treasury Bills (T-Bills), providing opportunities for fixed income investments.

Government Securities (G-Secs, SDLs, T-Bills): These are debt instruments issued by the government to raise funds. G-Secs are long-term bonds issued by the central government, SDLs are similar bonds issued by state governments, and T-Bills are short-term securities with maturities ranging from a few days to one year.

Money Market Instruments (Bank CDs, Corporate CPs, Credit Enhanced/SO Rated CPs): Money market instruments are short-term debt securities that typically have maturities of less than one year. Bank CDs are certificates of deposit issued by banks, while Corporate CPs are short-term promissory notes issued by corporations to raise funds. Credit Enhanced/SO Rated CPs are commercial papers with credit enhancements or issued by companies with strong credit ratings.

Derivatives (OIS, MIFOR Swaps, Interest Rate Futures): Derivatives are financial contracts whose value is derived from the performance of an underlying asset, index, or interest rate. Overnight Index Swaps (OIS) are contracts based on overnight interest rates, MIFOR Swaps involve the exchange of fixed and floating interest rates denominated in Indian rupees, and Interest Rate Futures are standardized contracts traded on exchanges that allow investors to speculate on or hedge against changes in interest rates.

Corporate Bonds (PSU Bonds, Corporate NCDs, High Yield Bonds): Corporate bonds are debt securities issued by corporations to raise capital. PSU Bonds are bonds issued by Public Sector Undertakings (PSUs), Corporate NCDs are non-convertible debentures issued by private corporations, and High Yield Bonds are bonds with lower credit ratings but higher yields to compensate for the increased risk.

Structured Bonds (SO Bonds, Capital Guaranteed Bonds, MLDs): Structured bonds are debt securities with customized features designed to meet specific investment objectives. SO Bonds (Structured Obligations Bonds) have tailored payment structures, Capital Guaranteed Bonds offer principal protection along with the potential for higher returns, and MLDs (Market Linked Debentures) provide returns linked to the performance of underlying assets or indices.

Other Bonds and Securities (Govt Guaranteed Bonds, Infra Annuity Bonds, Tier II / Perpetual Bonds, Preference Shares, Masala Bonds, Foreign Currency Bonds): These include various other debt instruments with specific characteristics. Govt Guaranteed Bonds are bonds backed by government guarantees, Infra Annuity Bonds finance infrastructure projects, Tier II / Perpetual Bonds are types of capital securities issued by banks, Preference Shares represent ownership in a company with preferential rights, Masala Bonds are rupee-denominated bonds issued overseas, and Foreign Currency Bonds are bonds issued in currencies other than the domestic currency.

These products provide investors with a wide range of options to diversify their portfolios, manage risk, and pursue their investment objectives.

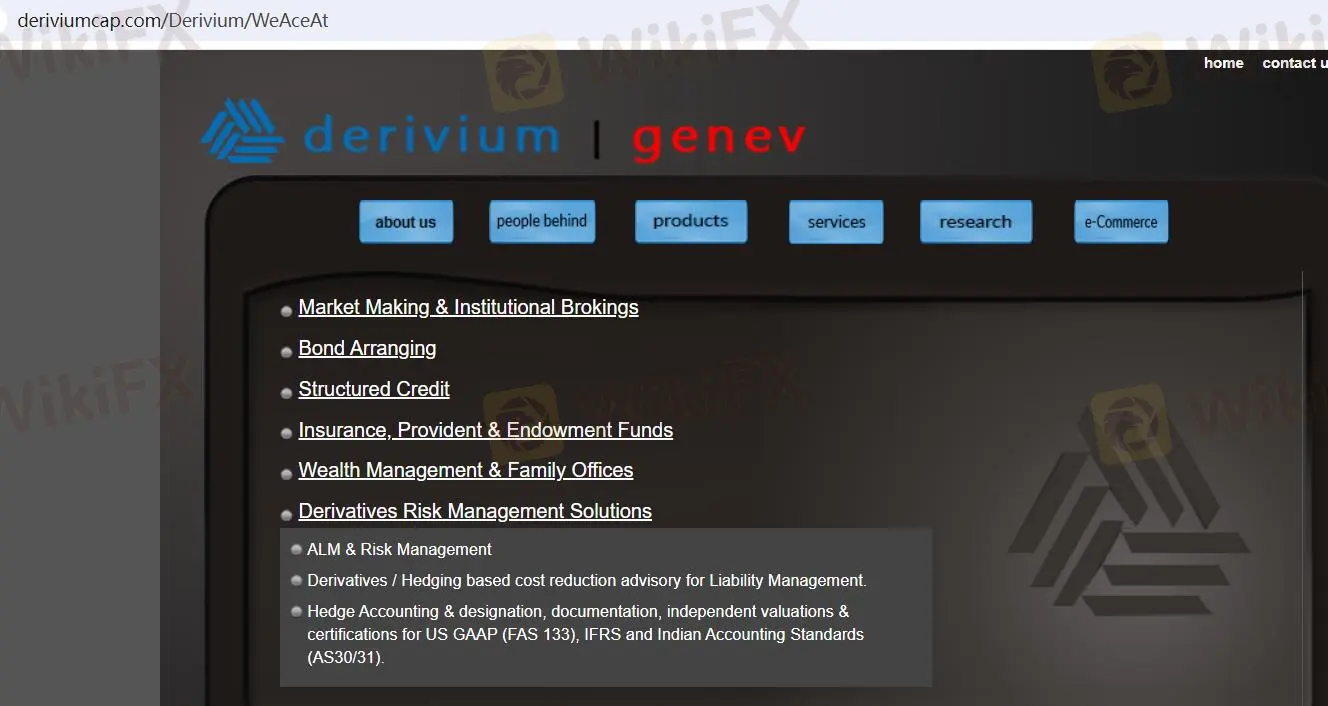

Services

Derivium offers a comprehensive range of financial services tailored to meet the diverse needs of its clients:

Market Making & Institutional Brokings:

As a #1 Corporate Bond Broker on both BSE (Bombay Stock Exchange) and NSE (National Stock Exchange), Derivium facilitates trading in corporate bonds, providing liquidity and market access to institutional clients.

It is accredited by FIMMDA (Fixed Income Money Market and Derivatives Association of India) as a broker for OIS (Overnight Index Swaps) and MIFOR Swaps, offering specialized services in interest rate derivatives.

Derivium assists clients in trading high-yield and long-term bonds issued by banks, corporations, and other entities, enabling them to optimize their fixed income portfolios.

Bond Arranging:

Derivium serves as a premier arranger for Commercial Papers (CPs), Bank Certificates of Deposit (CDs), and private corporate bonds, leveraging its expertise and network to facilitate debt issuances.

It arranges financing for non-banking financial companies (NBFCs), housing finance companies (HFCs), and other corporate entities, including the issuance of high-yield bonds and Tier II capital instruments.

Structured Credit:

Derivium offers structuring, advisory, and execution services for structured credit financing transactions, focusing on mid-tier corporates and delivering medium to high teen returns.

Its expertise includes hybrid debt structures and capital adequacy solutions tailored to the specific needs and risk profiles of its clients.

Insurance, Provident & Endowment Funds:

Derivium provides investment advisory services tailored to the regulatory requirements of insurance, provident, and endowment funds.

It designs long-term investment structures, including credit-enhanced infrastructure and housing bonds, partly paid bonds, and structured obligation bonds, ensuring compliance and optimizing returns for its clients.

Wealth Management & Family Offices:

Derivium offers wealth management services to high-net-worth individuals (HNIs) and investment advisory firms (IAFs), providing personalized investment strategies and portfolio management solutions.

Derivatives Risk Management Solutions:

Derivium assists clients in managing derivatives risk through ALM (Asset and Liability Management) and risk management advisory services.

It provides hedging solutions to reduce costs associated with liability management, along with hedge accounting services and independent valuations compliant with US GAAP (FAS 133), IFRS, and Indian Accounting Standards (AS30/31).

In summary, Derivium offers a wide spectrum of financial services encompassing trading, arranging, structuring, advisory, and risk management, catering to the needs of institutional investors, corporates, funds, wealth managers, and family offices.

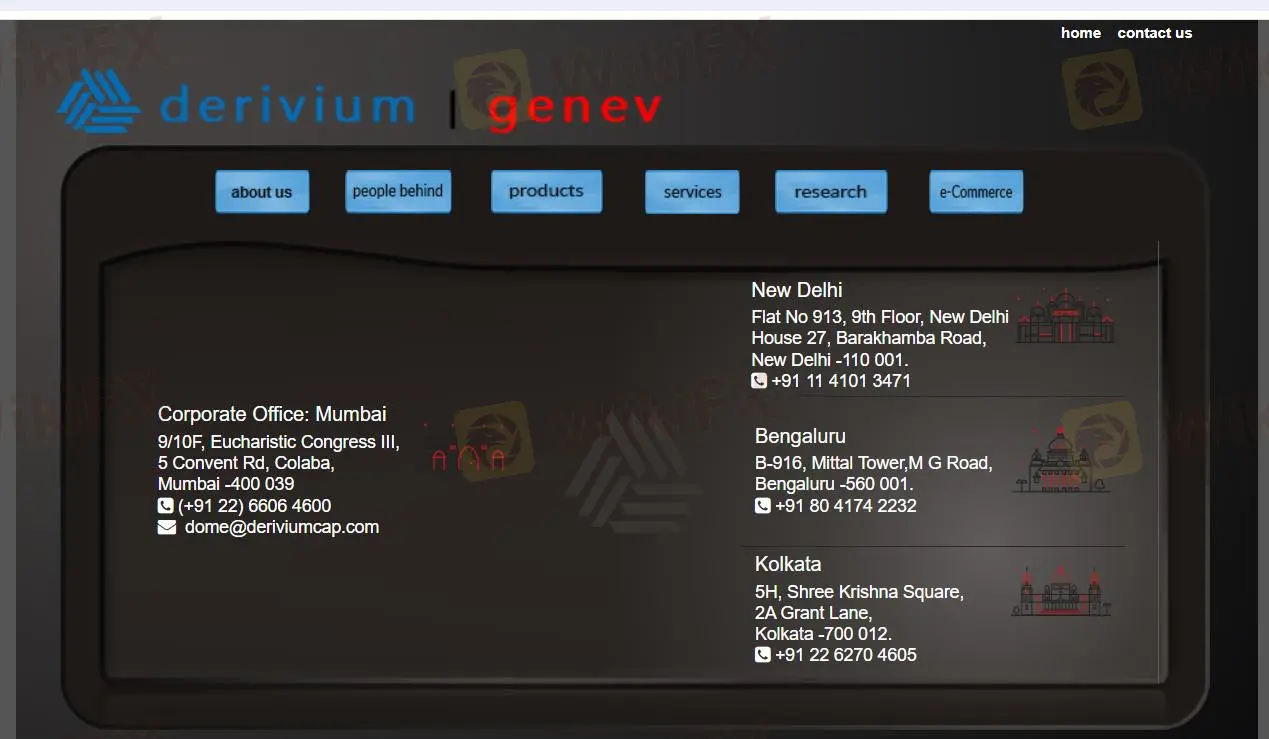

Customer Support

Derivium provides comprehensive customer support across multiple locations to ensure efficient assistance and seamless communication with its clients:

New Delhi:

Location: Flat No 913, 9th Floor, New Delhi House, 27 Barakhamba Road, New Delhi - 110 001.

Contact Number: +91 11 4101 3471

This office serves as a hub for client inquiries, support, and assistance in the New Delhi region.

Corporate Office: Mumbai:

Location: 9/10F, Eucharistic Congress III, 5 Convent Rd, Colaba, Mumbai - 400 039.

Contact Number: +91 22 6606 4600

As the corporate headquarters, this office oversees overall operations and supports clients with inquiries and assistance.

Bengaluru:

Location: B-916, Mittal Tower, M G Road, Bengaluru - 560 001.

Contact Number: +91 80 4174 2232

This office caters to clients in the Bengaluru region, providing support and assistance for their financial needs.

Kolkata:

Location: 5H, Shree Krishna Square, 2A Grant Lane, Kolkata - 700 012.

Contact Number: +91 22 6270 4605

The Kolkata office extends support and assistance to clients in the Kolkata region, ensuring their financial requirements are met effectively.

Derivium's customer support team is dedicated to addressing client queries, providing assistance with account management, offering guidance on financial products and services, and ensuring prompt resolution of any issues or concerns. With a presence in key cities across India, Derivium aims to deliver personalized and efficient customer support to its clientele.

Conclusion

In conclusion, while Derivium offers a comprehensive range of financial services and a diverse portfolio of trading products, it's crucial for potential clients to consider the implications of its unregulated status. While this offers flexibility, it also comes with inherent risks, as clients may lack the protections afforded by regulated entities. Therefore, investors should exercise caution and carefully weigh the pros and cons before engaging with Derivium. Additionally, given the limited information available on its website, clients may need to seek further clarification or conduct additional research to make informed decisions about their financial dealings with Derivium.

FAQs

Q1: Is Derivium regulated by financial authorities?

A1: No, Derivium operates as an unregulated broker, which means it doesn't adhere to oversight and compliance standards set by financial regulatory bodies.

Q2: What services does Derivium offer?

A2: Derivium offers a wide range of financial services including market making, institutional brokings, bond arranging, structured credit, wealth management, derivatives risk management solutions, and more.

Q3: What types of securities can I trade with Derivium?

A3: Derivium provides access to various securities including government securities (G-Secs, SDLs, T-Bills), corporate bonds (PSU Bonds, Corporate NCDs, High Yield Bonds), money market instruments, and derivatives such as OIS, MIFOR Swaps, and Interest Rate Futures.

Q4: Where are Derivium's main offices located?

A4: Derivium has offices in New Delhi, Mumbai, Bengaluru, and Kolkata, providing comprehensive customer support and assistance across these locations.

Q5: What risks should I be aware of when trading with Derivium?

A5: Clients should be aware of the risks associated with trading with an unregulated broker, including potential lack of investor protections, higher risks of fraud or malpractice, and limited recourse in case of disputes. It's essential to carefully consider these risks before engaging with Derivium.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now